Contactless payments have been there since the 1990s, but the COVID-19 pandemic has brought it to the limelight. Moreover, the trend is here to stay for a more extended period, given the circumstances.

Recently, the global beverage brand, Coca-Cola, is all set to add a variant by launching a contactless option for its consumers’ feasibility regarding pouring their beverages. A touchscreen-operated dispenser would deliver around 200 drink options with a simple tap on the smartphone.

According to Chris Hellmann, Coca-Cola Freestyle’s vice president, “All Coca-Cola beverage dispensers are safe with recommended care and cleaning. However, given these uncertain times, people may prefer a touchless fountain experience.”

Speaking of this, this newly launched contactless solution makes selecting and pouring a drink just a few clicks away for consumers.

How Pour By Phone Works

All it takes for the customer is to scan the QR code on display, leading them to the cloud, bringing the Coca-Cola Freestyle user interface to the phones. Following this, they can feel free to select their favorite drink and flavor from the menu. Before making its way to the Coca-Cola, the idea was run through initial testing at Firehouse Subs, Five Guys, and Wendy’s locations in Atlanta.

We intentionally designed this so anyone with a smart device could pour a drink,” Michael Connor, chief architect of the Coca-Cola Freestyle, said in a statement. “When you have a tray or a sandwich in one hand, you don’t want to deal with downloading an app.” He also added that they have invested time and effort and went the extra mile to ensure necessary steps have been taken to make the solution easy and fast and the experience super-reliable.

The Need of the Contactless Technology

By this summer, the software will be available at around 10,000 Coca-Cola Freestyle dispensers. Also, all of the dispensers will be compatible with contactless technology by the year-end.

As per a study from Civic Science, about 65 percent of people going to a restaurant choose to pour drinks on their own than having a waiter do it for them.

It is pertinent to mention that QR code now making waves once enjoyed a maligned status. However, it has managed to come up as the enabler of contactless commerce. This development came in when China-based Alipay and rival Tencent’s started making use of QR code and went to fulfill their endeavor of standardizing it.

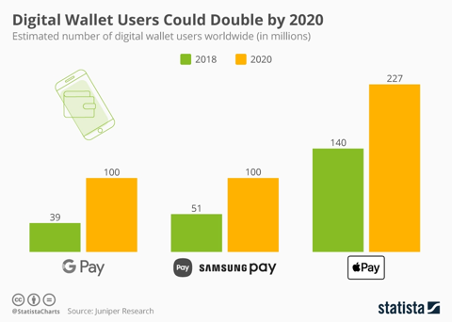

Subsequently, a consortium of platforms has emerged normalizing the use of QR codes to process transactions. Walgreens now accepts payment through the platform of Alipay while Apple is upping its game via Apple Pay. In addition to this, even Walmart has also altered its Walmart Pay app to incorporate QR codes and adopt the new touchless technology.

Final Thoughts

Ever since the COVID-19 crises erupted, many experts suggested contactless payments to curb the spread of the virus through cash, debit, or credit cards.

The news of contactless dispensers is another addition as going contactless became the new normal amidst the COVID-19 global crisis considering that many businesses resorted to the contactless payment option. All eyes are now on how these touchless dispensers by Coca-Cola would fair in the coming future.