Get the payment processing solution that fits your business

Merchant

Services You'll Love

- Reliability

- Scalability

- Low Cost

- Great Service

About Host Merchant Services

Merchant Services and Credit Card Processing Done Right

Merchant Services and Credit Card Processing Done Right

Get the payment processing solution that fits your business

Backed by years of experience, we offer industry-leading support, transparent and lowest pricing possible, and a commitment to lowering your processing costs, Host Merchant Services gives you a long-term payments partner you can trust. Explore our processing solutions or connect with a payments specialist today to get a custom proposal built around your exact needs.

Explore Other Industries and Business Types

Fitness Studios

Contractors

Nonprofits

Restaurants

Retail Stores

Ecommerce

Mobile Payments

Merchant Services Made for You

We provide merchants of all types with payment processing and point of sale systems. We use straightforward pricing, no cancellation fees, and fantastic customer service making us the last merchant services company you will ever want.

24x7x365 Customer Service

No Cancellation Fees

Lifetime Rates

Experience the freedom of

locked-in credit card processing rates that won’t increase over time.

No Up-Front or Hidden Fees

No setup fees and no hidden charges. Just the lowest merchant services rates available.

What our customers are saying

Our merchants love us and it shows. We are top-rated in the Better Business Bureau, Consumer Affairs, and Card Payment Options. Our #1 priority is merchant satisfaction! Find out why we are the top rated credit card processor in the world!

Host Merchant Services has been an excellent partner for enabling credit card processing services in our gym software. They are a great fit because, in addition to providing technical support for our software integration, they match our focus of providing excellent customer service and cost savings for the gyms that use our software.

Mike Spencer, RX Gym Software

Host's rep, Don, was excellent at explaining all the information in detail. He did a cost analysis and took one of our spreadsheets and compared it to who we had which was CardConnect. He went above and beyond, and in the long run, Host has saved us a little bit of money. We had a good rate to begin with and it went a little lower. A...

Karen of Boothwyn, PA

Businesses Save 27% on Average with Host Merchant Services

- In-person

- Keyed & Online

- Total

Average costs to expect

Based on the weighted average cost of popular cards and a transaction size of: $Monthly sales volume:

| In-person rate | Monthly credit card volume | Discount tier |

|---|---|---|

| Interchange+ 0.40% + $.08 | $0 - $50K | 1 |

| Interchange+ 0.35% + $.07 | $50 - $100K | 2 |

| Interchange+ 0.25% + $.07 | $100 - $500K | 3 |

| Interchange+ 0.20% + $.06 | $500 - $1M | 4 |

| Interchange+ 0.15% + $.06 | $1M+ | 5 |

Founded on Fantastic Service

Host Merchant Services was founded in 2010 and was structured around a strong backbone of customer service. 11 years and thousands of happy merchants later, customer service is still our number one priority. In fact, our merchant support team is 4x larger than our sales team! We don’t believe in hold queues either, so you’ll never have to wait in line. When you’re with Host you’ll get first-class treatment!

Featured Terminals

Host Merchant Services offers a wide variety of credit card machines for businesses throughout the United States and Canada. We offer the latest credit card machines including Pax, Dejavoo, Ingenico, Valor PayTech, Verifone, and more.

VL100 Pro

Fast, Reliable Countertop EMV Terminal

VP100

Versatile Countertop Terminal With Printer

VP350

Modern Android PIN Pad Terminal

VP550C

Powerful Android Countertop POS Terminal

Dejavoo Z8

Compact, Secure EMV Countertop Machine

Ingenico Desk/3500

Secure, Durable EMV Terminal

PAX A80

Dependable Android Countertop Terminal

Ingenico Move 5000

Flexible, Full-Featured Mobile POS

PAX A920

Premium Mobile Android POS Device

VL300

Secure, Standalone Customer PIN Pad

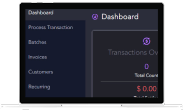

Integrate Payment Processing Into Your Software

Merchant Services and Credit Card Processing News

SEO Agency Payment Processing: High-Risk Solutions

US-based SEO and digital marketing agencies often ...

Restaurant Payment Processing: QSR vs Full-Service Guide

Choosing the right payment processing system is no...

Frequently Asked Questions

What kinds of payments can I accept with Host Merchant Services?

How is your pricing structured, and what makes it different?

How quickly will I receive my funds?

Do I need to change banks to work with you?

How do you protect my customers’ card data?

Do you support my industry?

Can you work with high-risk or hard-to-place businesses?

Can you help lower my processing costs beyond the rate itself?

What happens if I get a chargeback? Can you help me fight it?

- You’ll be notified promptly through your reporting tools.

- Our team will walk you through what’s being disputed and what documentation can help.

- We help you respond with receipts, signed invoices, order logs, or other evidence as needed.

I have a software platform. How does payment integration and revenue sharing work?

- Direct API integration or hosted payment pages

- Support for in-app, in-person, and online payments under one relationship

- Co-branded or white-label options in some cases

- Custom commercial terms that can include revenue sharing, depending on volume and structure