Online payment processor Stripe announced on Friday, that the company is committing to transparency and user rights for its customers, following the lead of Google, Twitter, and Host Merchant Services. For today’s edition of the Official Merchant Services Blog, we will introduce Stripe, as well as discuss what these recent steps mean for the company, and the industry.

Stripe’s recent move is part of an effort to increase awareness of the effects of the legal process on their users. The company is an online payment processor geared toward developers. They offer to handle everything, including storing cards, subscriptions, and direct payouts to your bank account. Although some merchants may find that helpful, it may make refunds, voids, retrievals and chargebacks more difficult, since you do not have direct access to your customers’ payment information. The company also charges unusually high fees for acceptance, in an effort to simplify the process with rates starting at 2.9% and 30 cents for any card type.

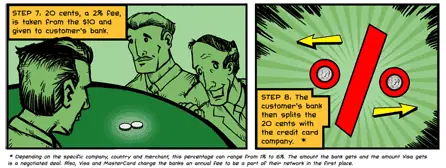

Stripe charges such a high rate, in an effort to simplify things for merchants. I would like to point out, however that a standard Debit card, using Durbin Debit rates would qualify for a rate of 0.05% and 22 cents under Interchange Plus pricing, the type of pricing offered here at Host Merchant Services. Since this rate of 5 basis points is so much lower, Stripe’s customers are overpaying by as much as 2.85%. For a transaction of $500, Stripe would charge a merchant $14.5 (2.9%) and an additional 30 cents on a transaction that actually costs them 25 cents (0.05%) and an additional 22 cents, or $0.47 total. In this case, the flat rate of 2.9% charged, is much greater than the Durbin Debit rate that could be applied, if the merchant was using Interchange Plus.

Stripe is moving towards more transparency, because they sometimes receive legal requests from third parties to stop doing business with certain users. Stripe is enlisting help from Chilling Effects, a joint project run by the Electronic Frontier Foundation, Harvard, Stanford, Berkeley, and other law schools that publish copyright takedown notices sent to web companies, and its most prominent contributors are Google, Twitter and GitHub.

It’s not clear how often the payment processor is asked to stop working with a site or on what grounds, however the best example of the lack of transparency by the net’s dominant payment intermediaries was demonstrated in the fall of 2010. Visa, MasterCard and PayPal all cut off WikiLeaks on the grounds it was engaged in illegal activities, after publishing a trove of U.S. diplomatic cables.

Stripe intends to provide transparency reports regularly about how many requests it gets, a practice that was pioneered by Google. Stripe, in regards to a subpoena notification policy also says it’s instituting the same policy as Twitter, committing to informing a user, when not barred from doing so, that someone is subpoenaing their record. This allows the targeted user to try to quash the subpoena in court. Twitter has spent significant resources fighting to allow its users to resist government subpoenas — including winning the right for WikiLeaks associates to try to quash a grand jury subpoena for their Twitter records.

In conclusion, it is a step in the right direction for large Internet companies to be on the side of transparency as well as advocate for the rights of their users. I hope more web companies step forward in the name of full disclosure in the future. Host Merchant Services has been committed to transparency from the start, and we maintain the promise of personal service and clarity for all customers.

The super-powered pairing of Discover and PayPal drove stock prices for each company, with Discover gaining 3.9% and eBay gaining 2.5% on the market the day the announcement was made. This arrangement will greatly accelerate PayPal’s in-store payment efforts. By riding on Discover’s network, PayPal can get into more locations and get there quickly. Best of all this movement doesn’t requiring any significant integration work by merchants. That potentially puts PayPal at a big advantage against rival mobile payment systems such as Google Wallet, Isis, and Square.

The super-powered pairing of Discover and PayPal drove stock prices for each company, with Discover gaining 3.9% and eBay gaining 2.5% on the market the day the announcement was made. This arrangement will greatly accelerate PayPal’s in-store payment efforts. By riding on Discover’s network, PayPal can get into more locations and get there quickly. Best of all this movement doesn’t requiring any significant integration work by merchants. That potentially puts PayPal at a big advantage against rival mobile payment systems such as Google Wallet, Isis, and Square.