The concept of buy-now-pay-later transactions sounds convenient for many people. The idea allows a person to purchase a product on credit and then pay for it after an interest-free period. The customer can also pay for the item in installments. Online retailers have been using BNPL schemes for a while. They have also become available at some physical sites as of late.

While BNPL systems are appealing, there are many risks to consider. Sometimes a person might have less power over one’s purchase than what someone might expect. It is also tough for many people to fully understand some of the things they’ll get out of their schemes.

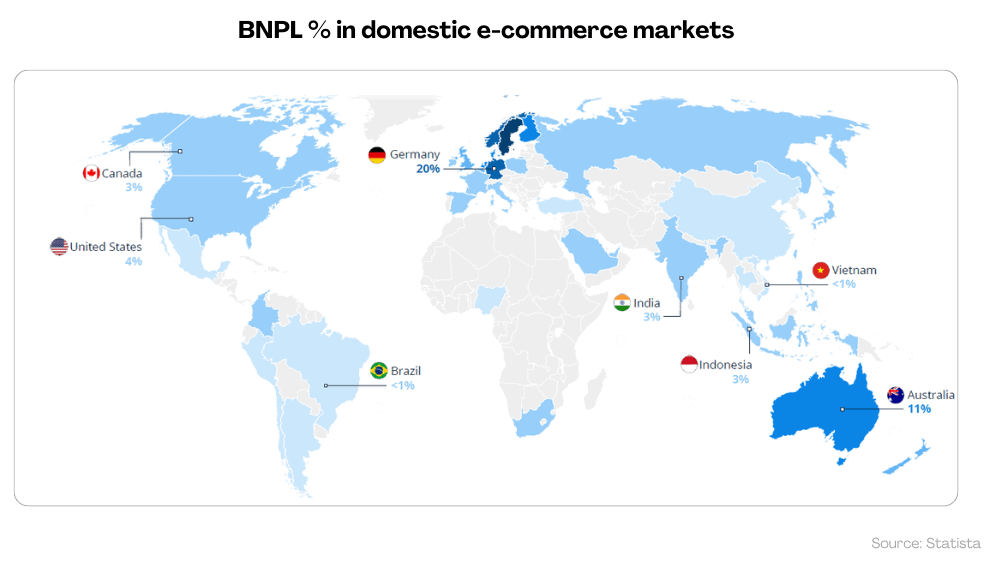

Sour: Statista

A BNPL provider could also help reduce the risks associated with these schemes by being more transparent and easy to understand. A BNPL team can work with security systems to protect everyone’s data, plus it could provide clear terms and conditions that people will want to read and understand. It will still be up to the customer to watch for the risks that come with whatever one wishes to manage.

BNPL Schemes – Different Limits

A BNPL scheme will often subject customers to lower transaction limits than what their credit cards might support. A BNPL website or service will require a customer to provide personal data before completing a transaction. A customer might need to allow access to websites or services that can review someone’s credit risk.

Alternative credit scoring may also work in some cases. The effort entails non-traditional methods for reviewing someone’s credit risk. Instead of focusing on what credit bureaus say, an alternative credit scoring process can entail looking at things like these:

- Bill payments for various entities

- What someone does on social media

- Employment history

- Property records

- Any transactions someone makes with a government

These points are radically different from whatever traditional credit bureaus can review. The review efforts make it that someone might have less purchasing power than if someone used a traditional credit card. The review process may also be invasive to where more of one’s data is being used in ways that someone might not prefer or expect.

Extensive Fees

Most people who use BNPL services don’t think about the fees they would pay if they don’t handle their work well. The costs can be significant at times:

- Some BNPL fees can be several percentage points of the value of a purchase. These fees will keep the BNPL system operational while ensuring it can maintain a profit. The charge is also reflective of the convenience the system provides to its customers.

- Late fees can be more than 50 percent of the value of one’s outstanding balance in some cases.

- Some services may not have caps on how high the late fees can get.

- A service could suspend an account if someone doesn’t complete a payment on time.

But a BNPL service won’t charge interest on outstanding payment amounts like what a credit card company would do. BPNL will gain its revenue from merchant fees instead of through annual fees or interest debt.

Payment Data Storage Is Necessary

A BNPL system will require a customer to store one’s payment data in a network. The customer’s security risk will be higher due to one’s data being open in a new platform. There’s no guarantee that a BNPL setup will always be secure for regular use either, producing a significant worry surrounding what someone can get out of the work.

Customers will put their data at risk of being lost when they deal with these transactions. But this doesn’t have to be as much of a concern if a BNPL provider manages things right. A BNPL solution should utilize the proper security features to ensure its safe operation. A BNPL system can work with many things, including:

- Password protection, including two-way verification processes

- Firewalls, including hardware and software-based ones that the BNPL service operates

- Encryption support, especially for credit card data

- Tokenization of transactions to replace personally identifiable information on a network

BNPL solutions will increase how many transactions a business can offer, as BNPL efforts can make a business more accessible and useful. But a BNPL service will not be as effective if one isn’t aware of everything that can work.

Complex Terms and Conditions

The terms and conditions surrounding BNPL schemes can be too convoluted for people to figure out. People who don’t understand these terms might fall victim to some of the risks associated with a BNPL deal. The BNPL app Klarna has an extensive terms and conditions listing that takes close to an hour for a person to read, for example.

The greatest worry is that most people don’t think to read the terms and conditions. The computer game retail site Gamestation had an April Fools’ Day gag this year where it said in its terms and conditions that anyone who didn’t click on a specific link that day when making a purchase would forfeit their souls to the website.

The prank showcased how people never read these terms before making purchases. It shows that people are often willing to skip these details when trying to complete a transaction. They want to pay for items right now and aren’t willing to wade through complex terms.

BNPL services are traditionally transparent when discussing their fees. They want to prevent their customers from collecting more rollover debt than what they can afford. But the terms and conditions sections can be complex and thorough to where it might be tough for people to afford certain things that they think they could purchase right away.

Caution Is Critical

BNPL schemes can be useful when ensuring people can get more access to different items they want to purchase. But a BNPL solution needs the right planning. Every customer must be capable of recognizing the risks associated with such a transaction. Failing to understand the concerns of a BNPL deal can be dangerous, especially considering how one’s financial data is being made open to everyone in the process.