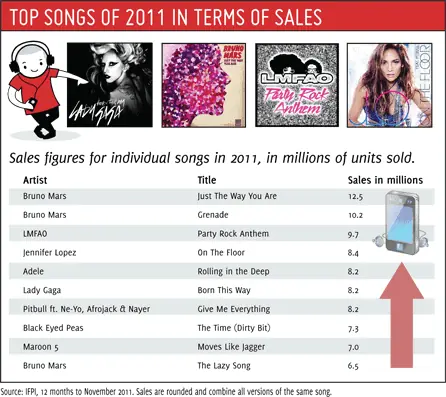

Today’s Official Merchant Services Blog post will wrap up our on-going series comparing Host Merchant Services and Square. In part 1 of our series, we reviewed how the two companies differ in how they set up merchant accounts. In part 2, the different pricing schemes offered were analyzed, as well as the time differences between fund dispersal. In Host Merchant Services Versus Square: Security and Conclusion we will offer a side-by-side comparison of the security and customer protection each company offers and wrap up the series with a final verdict on which offers superior merchant services.

Don’t be a ______

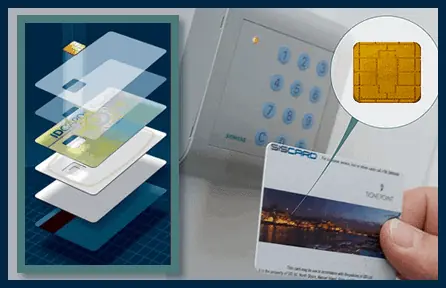

Everyone is concerned with credit card security these days. Merchants want to operate securely, and customers want to feel secure when they make purchases. The only way to be sure your credit card data is safe is to use devices that process credit card data in a secure manner. It may be cheap and easy to take the magnetic tape reader from a cassette player and attach a microphone input, but is it safe? Is it secure? Hackproof?

According to Verifone, and the hackers at Black Hat, the Square application is susceptible to audio hacking and the insertion of stolen credit card data via a TRRS cable (also known as an iPhone audio cable). Hackers have even created programs that can take credit card numbers and convert them into audio signals, which allow you to feed them into square through the audio port.

Many argue that this is no different than keying the card number in, the Square application doesn’t require CVV, why not just key them in? Here comes the scary scenario. With a simple cell phone application and this Square credit card reader, it makes skimming card data that much more easy for the malicious. Imagine leaving your credit card with the waiter/waitress and on the way to the POS terminal in the restaurant, and your server casually skims the card on the way. The hacker may be able to record the sound of your credit card and share the audio file with others or use it themselves to feed it back into Square.

Many people argue that this isn’t new nor is it the fault of Square that credit cards are so insecure. The problem is that since Square gives them out for free without any type of application, you have lots of potential card skimming devices in the market. Most consumers didn’t have access to a credit card reader in the past, but that has changed. The Square reader has been recently updated from the original design; you can see what the original Square looks like inside here.

Host Merchant Services differs from Square in many ways. HMS offers card readers through ID Tech, notably the UniMag II two-track mobile mag-stripe reader. This device works across Apple and Android platforms, being just as flexible as the Square reader. The ID Tech swipers that Host Merchant Services offers can work on the various iPhones, iPads and iPods, as well as a host of Android smart phones — a list can be found here.

These card readers are much more secure than the Square device as the Unimag swipers don’t work as input devices. This means you can’t upload a .txt file to get it to input, closing one of the holes in Square’s security.

Conclusion

Square is a viable and useful payment processing solution for a select group of merchants. Square’s marketing has always pushed that it is small business friendly. Digging through the details of what they offer however, it starts to become apparent that even a lot of small business owners can do better with other merchant services providers. If you’re going over the limits that Square sets in its fine print — especially if you find yourself having to be flexible and take card not present transactions on your mobile device — you’re losing out on the savings that you were promised. Those merchants are then paying fees at prices that are not all that competitive. Which means those merchants can find better savings and deals elsewhere.

I’ve always felt that Square is really a sign of the times, giving payment processing the same flexibility and potential that desktop publishing and online printers have given the vanity publishing industry. Desktop publishing has been opened up enough by computer software like Gimp and online printing and online distribution options to allow everyone to easily upload, produce and then publish books, brochures and other printed media — giving rise to micropublishers. And much like that shift in the publishing industry, Square has created viability in the payment processing industry that wasn’t there before. That is to say, Square works best with micromerchants — the kind of merchants you’d find on Etsy.com.

Square offers a payment-processing plan to merchants hawking their individual goods from place to place, giving them the ability to take plastic in what was once just a cash only endeavor. The people I think of in that plan are merchants constantly on the go, selling one or two items — maybe some concert t-shirts out of the back of their car, or their own sketches at a comic book convention. These are the merchants that could potentially save with Square.

Host Merchant Services offers a plan that can be customized to work with any size merchant. Specialized pricing with individual statement analyses mean that merchants come out on top with the most savings possible. HMS also keeps merchants compliant with the PCI Compliance Initiative, and keeps customers card data safe by offering the latest and most secure equipment, even for mobile payments.

Square has its shortcomings in terms of how merchants may grow and expand. By setting limits on card not present transactions, and setting up flat fees, Square is simple and straightforward. But it is also locked into a pricing structure where the fees cease to be competitive as a business begins to function on a more consistent basis. This is where a payment processor like Host Merchant Services begins to shine. Their pricing structure is flexible enough that it can offer competitive rates that save even Square merchants money if they switched. Host Merchant Services can also guarantee stable payment of funds; the merchant has their own merchant account, and helps the merchant seamlessly transition into transactions beyond just mobile with no change in rates or pricing.

Once you step up to the next tier of merchants, a small business merchant doing regular monthly transactions on their mobile device — a merchant with even just a tiny but steady stream of business through the device — HMS gets a clear edge when stacked up against Square. After comparing the two processors in terms of merchant account set up, pricing, disbursal of funds, and security in this series, the final verdict is that Host Merchant Services offers the most complete and straightforward merchant services, while still saving merchants money on fees.