Global eCommerce is a necessity in this digital age. The borderless business has gained immense popularity. Most of the credit goes to social media, search engine marketing, SEO, and other digital marketing campaigns. Not only does it benefit retailers, but the advent of online businesses has made it possible for customers to shop for products from any corner of the world and make payments online.

The mobile and internet are the main components that drive maximum sales for businesses running on a global scale. Even during the pandemic, global sales witnessed a growth of 25%, according to a report published by Statista. And, credit/debit cards and PayPal were considered the most sought-after options for payments. Here are a few common trends for global eCommerce success.

Global eCommerce –Mobile Shopping – A New Normal

With land-based stores shutting down overnight, customers were left with no other option than to buy things online. Technological advancements and M-commerce have made customers’ lives a whole lot easier, as they can purchase just about anything with simple clicks.

The product is delivered to their doorsteps and the payment is processed either online or through credit card machines. The Mobile e-commerce industry is expected to be worth $3.56 trillion in 2021, according to Oberlo. The pandemic has made mobile eCommerce an efficient way to shop for goods online, not only for customers but for B2B sectors and wholesalers as well.

This trend is expected to continue when the pandemic ends and everything goes back to normal. Considering its current popularity, it is safe to say that mobile shopping is not going out of trend anytime soon.

Shopping Overseas is Easier than You Think

Going global was a big step for any business before the digital era. However, the Internet has transformed the way businesses are executed. You do not need a global presence to go global with your brand. Nowadays, buyers are often looking for purchases outside their countries. So, setting up a borderless business is a breeze.

You don’t need to set up a warehouse or fulfillment center for international merchants or have a separate office in the countries you are covering. Cost-effective marketing combined with a broad range of advertising tools makes global business ideas a success for emerging businesses. Geographic targeting can help companies target the international audience and promote their brands to people based in different corners of the world effortlessly. As far as product delivery is concerned, many international courier delivery companies offer discounts on bulk shipping. So, you can have your products delivered to your international customers at a reasonable delivery cost and without any hassle.

Understanding the Product Market

Your product market is different for every region. For example, the demand for deodorant in China was always low because of biological reasons. Despite the solid marketing tactics, the product never gained popularity in this economy.

So, a product market should always be your first consideration when going global. Research the demand for your product in the particular region, along with potential revenues, and opportunities. There is no point in targeting a region where there is no market for your product or an area where customers are not interested in your services. Research the market thoroughly before promoting your brand.

Monitoring the Global Analytics

Analytics is the key to a successful global marketing campaign. Google insights tell you how your business is performing on a global scale and whether you are reaching your target audience. A global analysis gives you comprehensive details of your business’ performance in different regions.

Check out the traffic to your websites and social media by country data. Note down the countries with the highest traffic and also the regions where you are attracting a large audience but low conversions. This shows that the demand for your product and services is high in certain regions, but people don’t buy from you because of the onsite barriers, such as language, currency conversions, and more. Focus on addressing these issues to extend your reach and build audience engagement. These stats show you the data that will help you target countries with the best product-market fit.

Local Language is Important

Another trend in the global e-commerce business is the language. The language is often a communication barrier for your international audience, especially in regions where English is not the first language. Translating your content, including product descriptions, return & refund policies, terms & conditions, and blogs into your audiences’ first language is the easiest way to connect with your prospects. It also increases your chances of converting your prospects into loyal customers.

Posting content in your customers’ native language has a significant impact on your brand’s success in international countries. You can offer a native experience to your target audience by getting your website translated into their native language. According to research by CSA, 65% of customers want website content in their native languages. 40% of customers do not buy products from a company that doesn’t translate the website content into their native language.

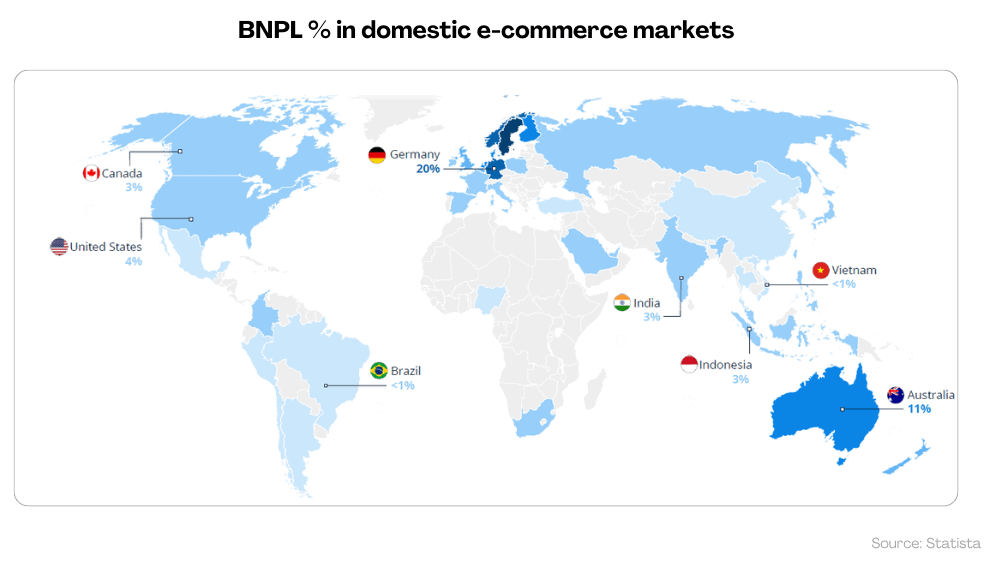

Customers Prefer Different Payment Methods

One of the common mistakes of startups and SMEs is choosing a payment method that works domestically for the international audience. The payment preferences of customers vary by country. In some areas, PayPal is the most suitable payment option, while buyers in other regions may use credit and debit cards for online shopping.

More and more customers are now adapting to digital wallet payment methods, such as Apple Pay, Google Pay, and PayPal for instant transactions. The online payment modes offer great perks. For starters, they transfer payments immediately. Moreover, they are easy to use.

Bottom Line

If there is one thing we have learned from these trends and stats, it is that global eCommerce is no longer a luxury, but a must for every business. The size of your business doesn’t matter, as it has nothing to do with your ability to go global. So, take advantage of these trends and expand your business on a global level.