In the fragmented world of mobile payments, one company is taking advantage of unifying existing technologies for the benefit of shoppers.

FitPay is a California company that was envisioned by veterans of the mobile payments industry. This innovative tech firm has paid close attention to shoppers who have been largely underwhelmed by “contactless” mobile payments powered by the near-field connectivity (NFC) chips found in select smartphones.

Tech giants from Apple to Google to PayPal have attempted to disrupt the mobile payments scene through various methods. Digital wallets, NFC smartphones, and even key chain fobs have not become ubiquitous, and one of the reasons for the lack of widespread adoption is that major tech firms are trying to establish a new standard of payment instead of leveraging existing technology.

FitPay sees a problem with coming up with a new payment standard. When it comes to transactions at the cash register, the United States has proven to be averse to change. One clear example of this aversion is the implementation of the Europay MasterCard and Visa (EMV), which is not moving along as swiftly as industry analysts expected.

FitPay: Taking Advantage Of The Emerging Technology

Instead of coming up with yet another new payment system, FitPay is taking advantage of two technologies on the rise: wearable smart devices and EMV terminals. The company has developed an API with a corresponding SDK that can marry credit and debit cards to wearable devices such as smartwatches. Part of the strategy is to give shoppers a functional enticement to wear their smartwatches by allowing them to make payments at EMV terminals.

The idea behind being able to pay with smartwatches and other wearable devices is that many shoppers do not feel comfortable taking out their smartphones at the checkout lines. With smartwatches, however, they are already wearing the device loaded with a credit or debit card that they can use anywhere an EMV system has been implemented. This new and exciting contactless payment platform is scheduled to launch in November, just in time for the busy holiday shopping season.

What Are Wearable Payment Options

Well, it’s pretty straightforward. A wearable payment option refers to using devices that you wear on your body to make payments without needing cash or cards. These devices can come in forms like smartwatches, fitness trackers, bracelets, or embedded chips in clothes or accessories.

The way these wearable payment options function is through a technology called near-field communication (NFC). By connecting your device to your bank account or credit card information you can securely transfer money with a tap or wave of your wrist. This removes the hassle of rummaging through wallets and purses to find the card while waiting in line at a store.

One of the key benefits of using wearable payments is their convenience and ease of use. With this technology strapped to your wrist or attached to your clothing, making a purchase becomes as effortless as lifting an arm or touching a button. There’s no need to carry around bulky wallets filled with cards that could potentially be lost or stolen.

When it comes to security concerns about adopting this payment method, rest assured that wearable payments come with security features that safeguard against fraud and unauthorized transactions. Many devices nowadays require authentication, such, as fingerprint scans or facial recognition before processing any payments.

Like any technology wearables also have limitations and drawbacks. Some retailers haven’t upgraded their point-of-sale systems to accept NFC payments which limits the places where wearable payment options can be used for purchases.

However, we shouldn’t forget that these technologies offer exciting possibilities for developments in transaction methods. There might be some limitations as compared to cards and wallets that are common today, but the future is promising.

How Does It Work?

Wearable payment devices such as smartwatches or fitness bands allow individuals to link their bank accounts or credit cards through an app. This integration enables transactions with a tap or a swipe, on these devices. This feature enables individuals to make payments by tapping their device on a compatible point-of-sale terminal.

When you make a purchase the device uses Near Field Communication (NFC) technology to send encrypted payment data to the merchant’s terminal. The transaction is then processed instantly deducting the specified amount from your linked account.

This seamless integration eliminates the need to carry wallets or search for cards at checkout counters. With a tap of your wrist, you can effortlessly breeze through payments without dealing with cash or swiping cards.

In addition, many wearable devices offer features like transaction history tracking and budget management tools that help users stay organized and effortlessly keep track of their spending habits.

In terms of functionality wearable payment options are designed with user-friendliness and intuitiveness in mind. They utilize existing technologies such as NFC and biometrics to ensure transactions while providing convenience at every step.

Benefits Of Using Wearable Payment Options

The advantages of using payments are all about convenience and ease. Of fumbling through your wallet or bag to find your credit card you simply need to tap your wrist or wave your hand over a payment terminal. It’s quick and seamless. It removes the hassle of carrying cards.

Another great thing about wearable payments is how they simplify transactions in places. Especially during festivals when the shops are crowded, this payment option comes as a blessing.

Wearable payments also offer a layer of security compared to traditional methods. With features like authentication and tokenization, it becomes much harder for unauthorized individuals to access your information. This gives you peace of mind knowing that even if you misplace your device it would be challenging for someone to carry out fraudulent transactions.

Moreover, wearing smart devices that integrate payment capabilities means fewer items to carry around or potentially lose. By consolidating functions into one compact accessory – such as a smartwatch or fitness tracker – you have everything conveniently accessible on your wrist without the need for bulky wallets.

The advantages of utilizing wearable payments are centered around convenience, speed, enhanced security features, reduced clutter, from cards, and increased opportunities for integrating loyalty rewards programs.

Limitations Of Using Wearable Payments

However, it is important to acknowledge that wearable payment options also have their limitations and drawbacks. It is crucial to consider these factors before embracing this technology.

A key limitation is the issue of compatibility. Not all devices or merchants support wearable payment options, which means there may be situations where you cannot use your device for transactions. Additionally, different wearables may have varying levels of compatibility with payment platforms making it challenging to switch between devices without facing obstacles.

Another drawback is the reliance on technology and battery life. Wearable devices require a power source to function hence it becomes necessary to ensure that your device remains charged at all times. If your device runs out of battery while you’re, on the go you will be unable to make any payments until it is recharged.

There are concerns, about the security of payments. Even though encryption and authentication methods have improved there is always a risk of data breaches or hacking attempts. Storing information on a device that could potentially be lost or stolen raises understandable security concerns.

The cost can also be a barrier for some people considering payments. These devices often come with a high price tag compared to traditional payment methods like credit cards or cash. Additionally, there might be fees associated with using wearable payment platforms or services tied to wearables.

The Future Of Wearable Payment Options

Undoubtedly the future of payments looks promising. With technology advancing and a growing demand for convenience wearable devices are becoming a part of our daily lives. They seamlessly integrate into our routines. Enhance how we carry out transactions.

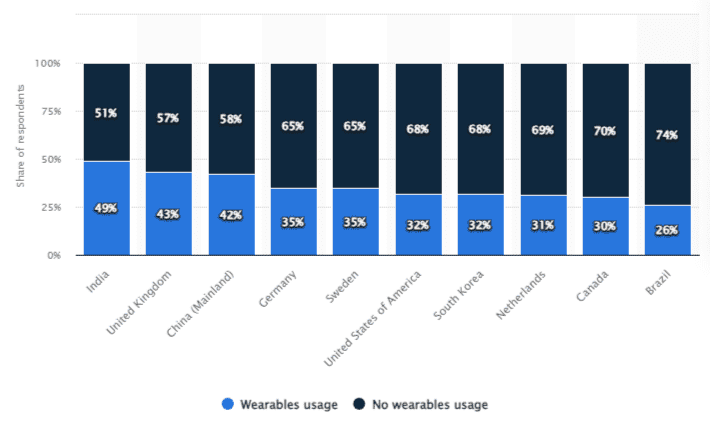

Source: Statista – Wearable devices usage in selected countries as of September 2023

One captivating aspect of the future of payments is the potential for convenience. Just imagine a world where you can effortlessly pay for your morning coffee or groceries by tapping your smartwatch or bracelet eliminating the need to rummage through your wallet or purse. Wearables can make transactions faster and more efficient than before.

Furthermore, as technology continues to evolve, so do security measures surrounding wearable payments. Biometric authentication such as fingerprint scanning or facial recognition can provide an extra layer of protection against fraud and unauthorized access to personal information.

We can anticipate innovations, in payment options as we move forward. There will likely be a range of wearables that cater to individual preferences and styles. The range of possibilities is vast, from fitness trackers that also function as payment devices to clothing that has payment capabilities built in.

Acquirer – a bank, which is often a 3rd party provider, who processes and settles merchant credit card payments. This can be a bank providing your merchant account or a service that provides it to your processing company. The acquirer works with the credit card issuer.

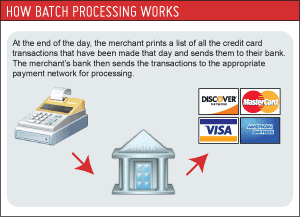

Acquirer – a bank, which is often a 3rd party provider, who processes and settles merchant credit card payments. This can be a bank providing your merchant account or a service that provides it to your processing company. The acquirer works with the credit card issuer. Batching – is the review process done by a merchant on all credit card transactions for the business day. The review process involves ensuring all credit card transactions are authorized and signed by the cardholder. After the review process, the merchant sends the information as a batch to the acquirer to receive clearing for payment.

Batching – is the review process done by a merchant on all credit card transactions for the business day. The review process involves ensuring all credit card transactions are authorized and signed by the cardholder. After the review process, the merchant sends the information as a batch to the acquirer to receive clearing for payment. Clearing – the third step in the payment process which happens after the acquirer sends the batch information through the card network to the issuing bank. The card network acts as a router depending on the credit card issuer found on the purchase detail. This process permits revenues for both the issuing bank and the card network called the interchange fee. After deduction of interchange fees, the issuing bank sends the information back to the acquirer through the same card network used.

Clearing – the third step in the payment process which happens after the acquirer sends the batch information through the card network to the issuing bank. The card network acts as a router depending on the credit card issuer found on the purchase detail. This process permits revenues for both the issuing bank and the card network called the interchange fee. After deduction of interchange fees, the issuing bank sends the information back to the acquirer through the same card network used. Funding – the fourth step in the credit card payment process. This involves the acquirer sending back the transaction information to the merchant less the discount fee. The merchant receives the remainder of the payment and is now considered paid. This generates the cardholder’s billing statement and accounts are funded appropriately.

Funding – the fourth step in the credit card payment process. This involves the acquirer sending back the transaction information to the merchant less the discount fee. The merchant receives the remainder of the payment and is now considered paid. This generates the cardholder’s billing statement and accounts are funded appropriately.