Certified Hosting, a leading web hosting services company, announced today a new partnership with Host Merchant Services that will enable webmasters to use merchant services with their web hosting plans. All Certified Hosting customers, including those on shared web hosting, virtual private servers (VPS hosting), and dedicated server hosting plans, are now able to apply for Payment Card Industry (PCI) compliant payment processing that is delivered to Certified Hosting’s high standards of customer service.

“Certified Hosting offers a range of ecommerce hosting services,” says Kacy Carlsen, co-founder and CEO of Certified Hosting. “We have made it easy for our customers to get up and running with an online store using the latest scripts and rock-solid hosting services. Quality merchant services are an essential part of a good ecommerce strategy for any business, and we are proud to announce Host Merchant Services as our chosen payment services partner. We are confident that Host Merchant Services will deliver the quality of service our customers have come to expect, at an affordable price.”

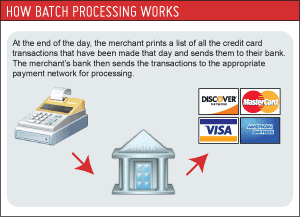

As a leading web hosting provider, Certified Hosting balances cost against quality of service. The company’s reliable web hosting services come with a 99.999% uptime, at a price that is affordable to new and growing businesses. Similarly, Host Merchant Services offers professional payment processing with fees that are clear, fair, and incredibly low. Typically, each type of credit or debit card transaction incurs a different fee, depending on the risk associated with it. Some merchant service providers charge merchants predetermined fees, meaning that merchants always pay the highest rate, regardless of which card has been used. Host Merchant Services charges merchants using a system known as Interchange Plus. Interchange Plus ensures that merchants only pay the fees that have actually been incurred, plus a small surcharge for administration. As a result, merchants using Host Merchant Services can reduce their payment processing expenses and more accurately project the cost of future transactions.

“There are no other industries where customers pay unnecessarily high charges,” says Carlsen. “Yet merchants routinely pay fixed fees for payment processing that do not reflect the actual transaction cost. At Certified Hosting, we provide fairly priced services thanks to Host Merchant Services. And now we can offer credit card processing to match. Even better, Host Merchant Services is – like Certified Hosting – an honest, upfront company that does not surprise merchants with hidden fees and charges.”

Another factor in Certified Hosting’s success is the company’s unlimited web hosting services, with no charges for customers who use a lot of disk space or bandwidth. The payment processing industry is full of complex terms and conditions, including additional charges buried deep in endless documentation. Host Merchant Services removes several common surcharges in the industry, with free applications, free setup, a free virtual terminal and an affordable payment gateway. Merchants are simply charged for the transactions they carry out, making accepting credit cards online more affordable and, crucially, more predictable.

“The most important thing about Host Merchant Services is that payment processing is made simple,” says Carlsen. “Host Merchant Services has no hidden charges, no expensive setup fees, and no unpredictable fees. With Host Merchant Services, our ecommerce hosting customers can quickly apply online, be approved in minutes, and begin taking payments in as little as 24 hours. We hope customers will take advantage of this new partnership so they can spend less on payment processing and maximize their profits.”

Certified Hosting has a proven record of excellent customer service, going the extra mile to help customers grow their online businesses. With this new partnership, Certified Hosting allows customers to get started right away with an affordable and efficient solution for payment processing.

Customers interested in merchant services from Certified Hosting and Host Merchant Services are encouraged to visit certifiedhosting.hostmerchantservices.com.