Near Field Communication or NFC technology has become one of the most popular features of mobile devices today. NFC technology helps run various contactless payment systems like Google Pay and Apple Pay. You can use an NFC payment system to make contactless transactions at various stores that accept these instant payments. Your business can also collect NFC payments if you have a processor that can read NFC signals.

NFC payments are convenient, but these instant transactions can be vulnerable to theft and other concerns. You can use a few measures to ensure these are safe at your workplace.

The Main Concept

An NFC payment entails two devices wirelessly interacting with each other. The two devices should be about four inches apart.

An NFC chip in one item will transfer data to a receiver. For payments, the NFC chip sending the data is the smartphone or other payment device. The receiver will collect the payment data and then provide confirmation to the phone or device. The device may trigger its digital wallet to start working to finish the transaction.

The process provides instant payment. A receiver can collect credit card data or other payment info from the NFC chip on the smartphone, tablet, or whatever else one is using.

NFC payments are available on most mobile devices. Android 4.4 or later devices and iPhone 6 or later iOS devices can support NFC payments.

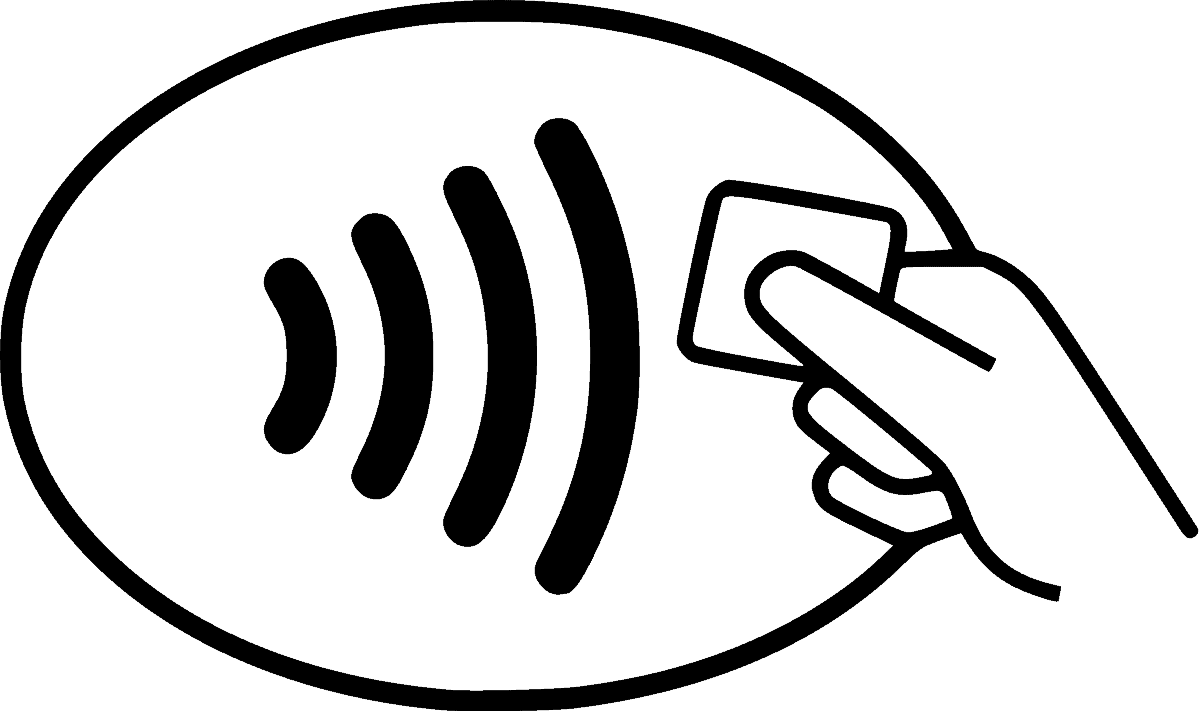

Some payment cards include NFC chips. You can tell there’s an NFC chip on a card if it has a signal showing a few waves coming from a card-shaped symbol.

The NFC payment process is popular for how people can complete a payment in less time. The fast scanning approach makes it easier for people to pay for things in moments. The contactless process is also useful, as it ensures a read without worrying about a card reader that might malfunction or a card that isn’t easy to read.

Close Distance Support

NFC payments require a close distance between the two objects. Since you need about four inches of space between the two items, it becomes hard for outside parties to try and steal data from a payment.

Some people may physically tap their devices on a sensor, but that is not necessary. It can take a second or two for the sensor to read the NFC signal.

Tokenization Is Critical

NFC payments are mostly secure thanks to tokenization. Apple Pay and Google Pay use tokenization technology to replace your real bank or card details with random numbers. The unique string of numbers is distinct to your transaction. Outside parties won’t be able to read your data and steal the content.

Two-Factor Authentication Is Necessary

Some NFC payments require two-factor authentication to work. You can supply the necessary second factor on whatever device you will use before making a payment. For Android devices, you can use biometric data or a PIN to confirm someone’s work. For iOS devices, you can use the Face ID or Touch ID system.

Common Risks and How They May Be Resolved

NFC transactions are secure and easy to process. But there are some risks to watch for as well. These issues are easy to correct if you use the right preventative measures:

- Data Corruption

Data corruption occurs when a criminal alters the data going to an NFC reader. The criminal adjusts the content to where it is corrupted and unable to be processed as necessary.

Any channels a business uses when processing NFC payments should be secure and encrypted to prevent data corruption. Check your data processor to see what you’re going to get out of a setup.

- Interceptions

An interception entails an outside part being a middleman when processing transactions between two NFC devices. The second party will collect the data and edit it before it moves to the intended recipient. The attack is tough to manage and not as common.

You’ll require an active-passive pairing to prevent interceptions. One device will receive the info, and the second will send the data. The process ensures data goes in one way between each party and not in both directions for each one.

- Theft

People can steal others’ mobile devices and use them to make NFC payments. The problem can be worse if a person doesn’t use a password protection system.

Customers must conduct their due diligence when planning their NFC payments. They can add passwords to their devices to prevent outside parties from accessing their data. They can also incorporate unique biometric details to add extra control.

Other Things You Can Do To Make Them Secure

You can also follow a few other ideas to help you make these NFC payments secure for everyone to follow:

- Use a program that confirms authentic NFC payment portals. You can use a platform that prevents jailbroken devices from being accepted. These devices may use altered or modified versions of NFC payment portals. These systems might be vulnerable.

- Keep all encryption keys you use in your workplace secure and private. These keys must be secure to prevent data from being stolen or incorrectly used.

- Keep the NFC receivers you use safe from tampering. They should only be accessible when someone is ready to complete an NFC payment. Keeping the receiver out of reach when it isn’t needed ensures no one can alter the receiver’s data.

- Provide instructions to your customers about how they can use NFC payments. Some customers might use their NFC payment devices wrong, making it harder for them to complete transactions. Customers will get used to what you provide after a while. The point especially encourages people who aren’t familiar with NFC payments to see what makes these so beneficial.

NFC technology is useful for many purposes, but it should work with care to ensure nothing wrong will happen in the work effort. Check on how your NFC system works and that you’ve got a system in hand to help you get something that works well.

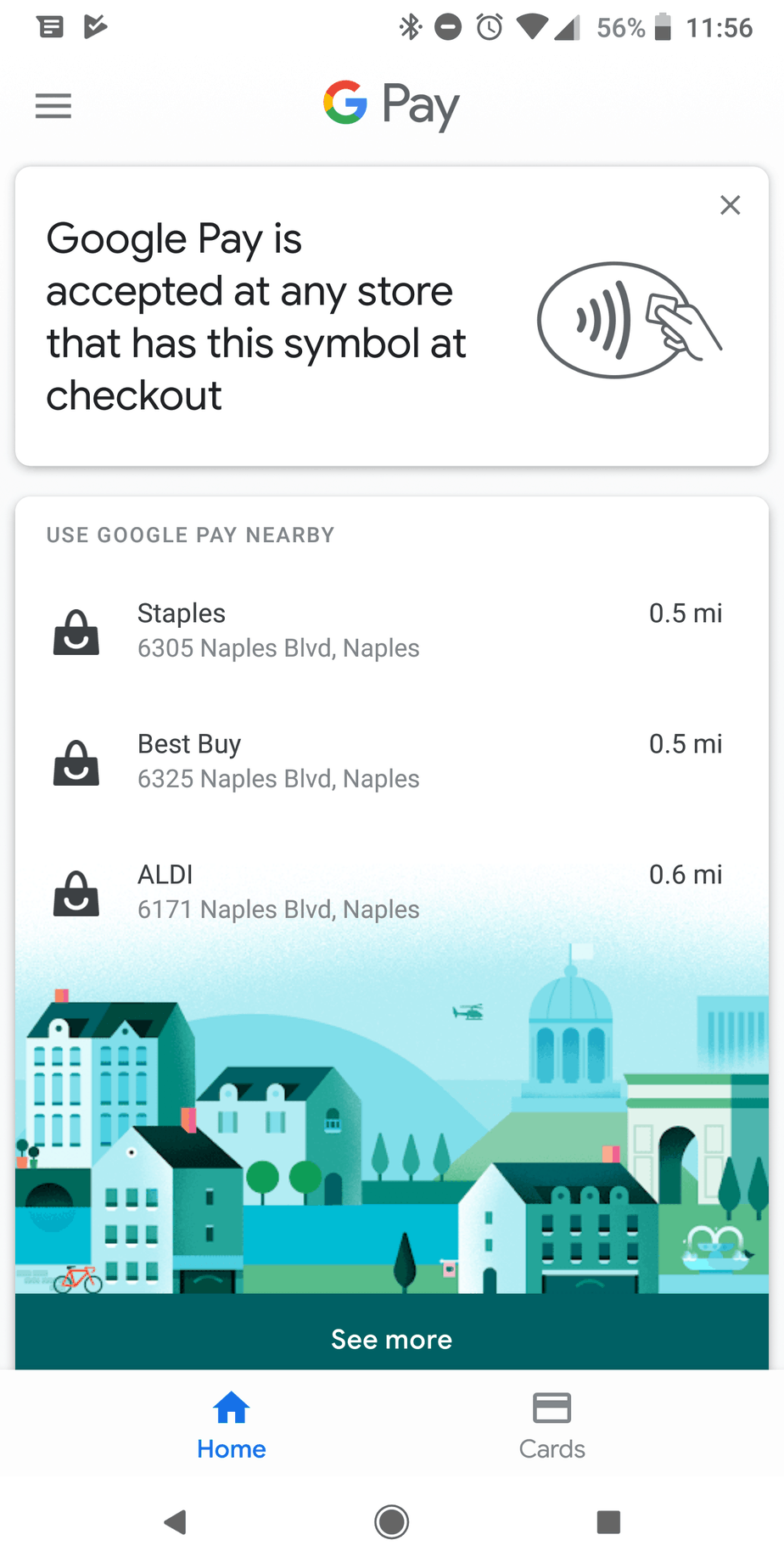

Finding Stores That Accept Google Pay

Finding Stores That Accept Google Pay Pay Nearby.” When you select this option, it will automatically show the three closest stores that accept the payment method. You can also choose “See More” for a longer list. The list will include everything from fast food chains and retailers to gas stations and grocery stores.

Pay Nearby.” When you select this option, it will automatically show the three closest stores that accept the payment method. You can also choose “See More” for a longer list. The list will include everything from fast food chains and retailers to gas stations and grocery stores.