Today The Official Merchant Services Blog reacquaints itself with a very important topic: Security. Specifically we’re jumping back into the discussion about PCI Security standards. Consumers are using plastic, especially online, at record rates. But security is still a major concern. Credit card fraud, phishing scams, clickjacking and identity theft are all on the rise and transaction security is an increasing concern for more than just payment network providers — it’s a major issue for merchants as well.

Knowing is Half the Battle

Host Merchant Services provides extensive security resources in its article archive.

You can download a PCI Compliance FAQ here.

You can read a step-by-step guide on how to become PCI Compliant here.

As we’ve reported in past blogs, statistics show that merchants are still having trouble keeping up with PCI Compliance. Our October 7, 2011 Blog cited a study by Verizon that stated 79% of organizations were not fully PCI Compliant. Then our December 15, 2011 Blog cited a further study by Gartner Research that found 18% of merchants are not PCI Compliant at all.

Some Tips That Can Help

To help combat the issues these studies have raised, we’re going to offer five tips that can help merchants reassure customers that their credit card data is safe and secure. Following these tips can help build stronger customer loyalty and just generally promote the feeling of safety that comes with using your business among your consumers.

Start a Security Campaign

You can help assuage anxious customers through a marketing campaign that teaches them to protect their identities. Take the initiative and help them with their own private security. Host Merchant Services Article Archive provides a series of useful resources on combating identity theft here. You can point your customers to those resources, you can send regular emails, tweets and texts to customers that provide privacy tips and fraud-prevention tactics.

Remind Consumers Of Your Security Measures

Keep your own business’ fraud protection features prominent with a mailer or newsletter letting customers know the steps you have taken in the area of security. You can blend this with your security campaign, and keep your customers aware of the security features they have just by patronizing your business. Emphasize privacy rules you have in place and what steps you take to comply with standards like the PCI DSS.

Work With Card Companies

Beyond just PCI DSS, major credit card carriers like Visa offer fraud-prevention measures. Take advantage of these extra measures. And let your customers know you go this extra mile. Everything from regulations that prompt merchants to produce receipts with only partial card data to the use of special “codes” to hide card data on receipts. Every little bit helps.

Get Your Employees On Board

To ease consumer unrest over security issues, it will greatly help you to have your entire staff on board with your security measures and the marketing campaign that pushes those measures. Your employees are customer facing and so having them well versed in the steps you take to make transactions secure will make consumers feel a lot safer during the shopping experience.

Be Ever Vigilant

Just like in Batman or Superman adventures, the war on crime is a never-ending battle. To maintain your security measures and to consistently promote how well you maintain those standards, you need to be like Batman — ever vigilant. Always maintain good records. Keep those records secure. Keep credit card receipts away from the public. Make sure your data that you store is password protected. And always maintain your PCI Compliance.

That’s the basics of helping your customers feel safe about transactions. Go the extra mile, be ever vigilant, and let them know what you do for their benefit.

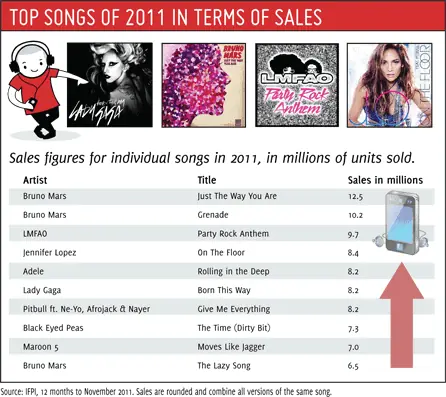

It just seems tiresome that after all that went down with SOPA, PIPA, the internet blackout, and the controversy, the music industry just reloads and reuses the same exact talking points that got the laws killed in the first place. SOPA died because the things being asked for weren’t going to work. Banking on payment processors to police the internet was a bad idea. It still is a bad idea. This whole wishlist smacks of some old sitcom gag where a child asks one parent for a cookie, is told no, then goes and asks the other parent. The answer’s still no.

It just seems tiresome that after all that went down with SOPA, PIPA, the internet blackout, and the controversy, the music industry just reloads and reuses the same exact talking points that got the laws killed in the first place. SOPA died because the things being asked for weren’t going to work. Banking on payment processors to police the internet was a bad idea. It still is a bad idea. This whole wishlist smacks of some old sitcom gag where a child asks one parent for a cookie, is told no, then goes and asks the other parent. The answer’s still no.