Today The Official Merchant Services Blog is going to get a bit personal, for me at least. I’m going to take a moment to talk about print media, and its withering industry. Or, think of it this way: I’ll be talking about the rise to power of E-Commerce — the industry that has helped deliver excruciating body blows to print media over the past decade, knocking it to the mat time and time again.

My history with print media goes back. Way back. All the way back to the beginning of my own career. I’ve worked for four different newspapers, the most high profile being the Asian Edition of the Wall Street Journal at the turn of the millennium. I’ve illustrated various comic strips and published my own comic book. I’ve worked for a printing company in Delaware. Along the way I’ve essentially learned how to make a printed publication from beginning to end; the only skill I lack is the ability to actually push the buttons on a printing press. But every other step, from concept to creation to pre-production to layout and design to editorial to post production I’ve done during my career.

And all of these skills are endangered because of E-Commerce. (Well not really; most the skills translate easily into the virtual media world which is why I’ve been able to transition my career; but everything involving production kind of gets tossed out the window, replaced with skills revolving around web safe colors, pixel sizes and screen ratios).

A really vast, somewhat oversimplified recap of the internet’s impact on newspapers, comic books and book publishing can be summed up by my own career. One of the companies I used to work for, Gannett (publisher of the USA Today), used to have an empire built on small to mid-size suburban community newspapers. They were everywhere. Including Lansdale, PA — where I worked for a time. Gannett was slow to embrace online news though. And the transition from the late 1990s to the aughts left Gannet in a position to streamline and essentially drop a lot of those small and mid-size papers from its stable.

At the same time, I was trying my best to get some traction going in my quest to be a freelance illustrator for comic books. Things didn’t quite work out. I never became the regular artist on The Flash or Spider-man like I dreamed of doing when I was younger. I did however get paid for doing a few projects and got quite a bit of my art published.

Still, steady work was hard to find. And the comic book industry appeared to be dying because of the problems that all of print media now faced.

The major publishers (DC Comics and Marvel Comics) were no longer selling millions of copies of their books. In fact, sales these days are horribly low, with top books barely cracking 100k in sales volume. This reduction in volume can be linked to its distribution channel. Comics stopped appearing in mainstream outlets because the sole distributor of the material, Diamond, only catered to specialized direct market hobby shops (comic book shops). You couldn’t find them at the local supermarket or the local 7-11 anymore. The comic book “rack” was gone. I’d go so far as to make the claim that today, in 2012, the two major comic book companies are really just stables for intellectual properties. Disney and Time Warner wanted Marvel and DC not so much for their ability to publish millions of paper periodicals every month. Instead they wanted the comic book companies for the properties that could at any moment be turned into $100 million blockbuster movie franchises.

So the comic book industry ended up being sold as a niche hobby, and stopped being made as a mass medium periodical. Big companies bought the two biggest publishers of those comics just to keep the ideas and licensing on ice for future movie potential. Print media, it is dying.

And then then there was the issue with comic strips. Newspapers shrunk the comics section over decades. When Action Comics first appeared in newspaper print in thge 1940s, the comic strip took up half a broadsheet, which back then was much larger than the broadsheet sizes for newspapers of today. But by the time Bill Watterson and Gary Larson gave up on two of the most popular comic strips of all-time (Calvin and Hobbes and The Far Side), the newspaper strip had shrunk to 3 tiny postage stamp sized panels shoved into the back end of the feautres/lifestyle sections of most papers.

Then the internet hit newspapers big time, as people went online for their news. They got the stories for free. And newspapers could no longer compete. Comic strips were a casualty of that shift in media.

So right now, survival instinct is kicking in for the comic art form. The internet allows both the strip and the comic book format room to breathe, and easier distribution. Penny Arcade is what I feel to be the best example of the modern comic strip, giving renewed life to the art that newspapers were choking out of their shrinking pulp empire. Penny Arcade can publish in color (because it’s online), can publish unorthodox sizes (because it’s online) and offer their content for free (online). They then make a killing selling collected editions (many sales being made … online) of the same content daily readers get for free. They adapted and brought the art form onto a new stage. Meanwhile … print media continues to not adapt.

Comic Books are starting to finally embrace the changing landscape. ComiXology offers Marvel, DC and independent publishers through their mobile application. You can purchase and download all of your favorite comic books directly to your iPhone, Android, iPad or Kindle. You no longer need to go to direct order hobby shops. Your comic books no longer need to take up physical space. They’re right there at your fingertips — your entire collection just a thumbtap away. While they may be a bit unwieldy and tiny on the smartphones, they look rather luxurious and eye-popping on a larger device like a Kindle (where, not so surprisingly, I’ve been reading my comic books in 2012).

That brings me to the Kindle — or more generally, the reader devices and THIS BLOG HERE from Michael Essany at Daily Deal Media. The article resonates with me. A number of my close friends used to work at Borders Books and Music in their twenties. Last year the local Borders closed up shop. And all we currently have in our local area is a Barnes and Noble located in the Christiana Mall.

The most striking thing about their store in the mall is when you walk in their front door you are immediately overwhelmed by their eBook section, with large signage telling you all about the Nook (their version of the Kindle).

That sight at my own local big box book store really drives home Essany’s second paragraph, when he writes, “Although many avid readers are mourning the noticeable loss of traditional big box and mom-and-pop book retailers, the economics of eCommerce and the popularity of eBooks are quickly dispatching publishing companies, paperback publications, and even print magazines to the trash receptacle of history.”

The point Essany is making was driven home even further when I attempted to make a quick trip to that Barnes and Noble for a book on a work-related topic: Web Design. I knew the right section of the store to go to, but couldn’t find the title I was looking for. I used their interface terminal in the store to look that title up. Apparently it was in stock as an eBook. And I could order a regular print version of it from there, but had to order it as an online purchase and have it delivered to my house days later. The entire point of my trip was to get the book that day, otherwise I’d have gone online when I got home from work instead. So I kept browsing, and found every single book they had under the topic of web design was only available either through an online purchase or as an eBook.

E-Commerce is winning

In terms of printed media E-Commerce is absolutely dominating. Essany cites a statistic to back up this outlook, writing that according to the Yankee Group (a research company we’ve cited ourselves when they made projections on The Future of Mobile Payments), consumers will purchase approximately 381 million eBooks next year with an average selling price of $7.

Most impressive

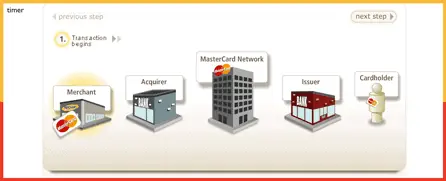

My own research for this very blog during last year’s holiday shopping season demonstrated what to me has become a very obvious aspect of the economy: shopping online is a common thing for people to do. That means E-Commerce is making buckets of money. Each one of those transactions are part of the payment processing industry. The foundation is there. People have found the convenience of shopping online so powerful that it outweighs the risk of fraud. So more and more people have taken to solving their shopping problems online. I know that I myself do this. It’s so much easier to look for a product online and know you’re getting what you want with a few clicks, than it is to go trudging out to a store that may or may not have the item you want.

Last year in a Blog Post about the upcoming holiday shopping season, I reported “A 2010 survey conducted by Google and OTX found that 35% of internet users start their holiday shopping prior to the end of summer, months ahead of Black Friday. This trend is only continuing to grow as consumers find online shopping convenient to their shopping habits, easy to do, and the wide selection lets them find great deals on price.”

This trend in shopper behavior combines with the rise of virtual media like eBooks like Voltron to form a very powerful lion-fisted, right-left combo to the solar plexus of Print Media’s crumbling empire.

And you know what? I’m OK with this.

I’m a voracious reader. But I’m also under the thrall of the convenience of online shopping. I truly do turn to the internet first for most products I’m interested in. This is heightened when I want to purchase a book, a magazine or a comic book. It’s just so much easier. The only time I’ve wanted to wander into a book store to buy a book was when I wanted it right then, with no wait on delivery. And I found the remnants of the only big chain bookstore in my local area to have already forced the decision upon me: If I wanted a book about web design, I needed to go directly to the web to get it.

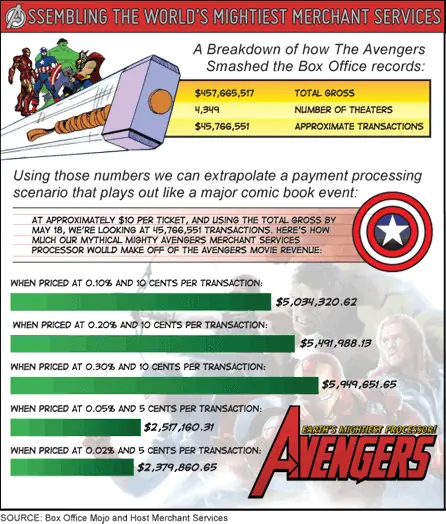

I’ve been using the ComiXology app this year. And when the company that I once worked for (Valiant Comics) as a production intern returned to the comic book industry after a long hiatus, publishing a comic book I once did post production work for (X-O Manowar), I immediately jumped onto my phone to purchase it. I find that I read more web comic strips than I ever read in a newspaper. I find I go to the web for my news. Or my phone. I’ve even found myself reading straight up only published electronically eBooks this year. I still prefer printed books, but for me they’ll be online purchases. I’ll buy the collected editions of comics I like, but do so online. I’ll buy printed books of titles I really just want to curl up with and turn the pages of, but I’ll make the purchase online. It’s gotten so pervasive in my life that I now buy tickets to sporting events online, brands of tea I can’t find at my local supermarket online, all of my roller derby referee equipment and rules books online. I even bought my ticket to The Avengers on my phone through Fandango and had it delivered to my phone as a mobile ticket.

E-Commerce is where it’s at. And publishers of the written word need to embrace this shift. Maybe it’s easier for me to do so because I work in the payment processing industry and get to see firsthand how big and booming E-Commerce is.