Today The Official Merchant Services Blog wants to review the details of VISA’s new Fixed Acquirer Network Fee (FANF). On April 1, 2012, Visa began charging this new fee. But it has taken about this long for it to catch up to merchants and their statements. The process sort of knocked its way down like dominoes falling — The fees went in effect in April, but were based on May’s activity, so didn’t show up until June’s statements, that many merchants are now noticing here in July.

These fees are new, and start to show up on statements where they hadn’t appeared before and they have the appearance of being hidden fees. This development goes against the Host Merchant Services policy of no hidden fees. Which is why we’ve attacked this story so vigorously in our blog, trying to keep our readership up to date on these new card association fees affecting the credit card processing industry.

The HMS Guarantee

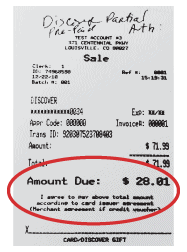

Host Merchant Services wants to assure its customers that it sticks by its guarantee. HMS will never increase their fees for their customers. HMS continues to offer the guaranteed lowest rate. And that rate is frozen. Unfortunately, Card Association Fees are new, and are not part of any current pricing model. They are also mandated and initiated by the credit card companies themselves — Visa, MasterCard and Discover. All processors everywhere will be adding them to their pricing structure. So your statement will start showing new fees moving forward. But we here at Host Merchant Services will help explain what they are, where they come from and why they’re just now appearing on your statement. So please feel free to contact us if you have any questions about your statement.

Now About Those Fees

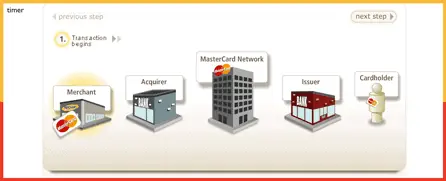

FANF is the most high profile of the new fees. But it’s name is a bit misapplied, as the fee itself is not “fixed” in any sense of the word. The FANF is a monthly fee that will affect all merchants to a varying degree. For card present businesses like retailers, the amount of the Fixed Acquirer Network Fee will be based on the number of locations a business has. For card not present businesses like e-commerce operations, the FANF will be based on gross Visa processing volume. So the “Fixed” fee’s actual amount varies based on multiple factors. Those variables are:

-

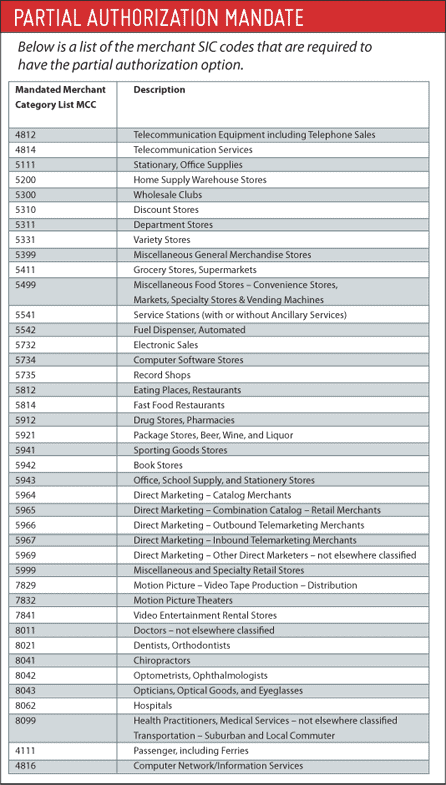

Merchant Category Code (MCC)

The merchant category code used to classify a business plays a role in the amount of the FANF charged each month. However, the impact of the MCC is very minimal, amounting to a difference of $0.90 – $1.10 for most businesses (less than fifty locations). -

Acceptance Method

The main factor in determining the amount of the FANF is whether a business processes the majority of its transactions in a card present or card not present environment. -

Card Present Businesses

(Excluding Fast Food Restaurants / MCC 5814)

The amount of the Fixed Acquirer Network Fee for card present businesses will be based number of locations. Businesses with one location will be charged $2 – $2.90 a month, up to $85 a month for businesses with 4,000 or more locations. -

Card-Not-Present Businesses

(As well as Fast Food Restaurants / MCC 5814)

For card-not-present businesses, the amount of the FANF will be based on gross Visa processing volume. Card-not-present businesses will see a greater impact from the FANF than card-present businesses due to the fee being determined by volume.

For example: card-not-present business processing between $8,000 and $39,999 will be hit with a Fixed Acquirer Network Fee of $15 a month opposed to just $2 for a card present business with similar volume and one location.

Other Fees

Besides FANF, Visa also is implementing a Transaction Integrity Fee and making revisions to its Network Acquirer Processing Fee. Visa’s Transaction Integrity Fee is a new $0.10 fee that will apply to U.S. domestic regulated and non-regulated purchase transactions made with a Visa Debit card or Visa Prepaid card that fail or do not request Custom Payment Service (CPS) qualification. On the other hand, the Network Acquirer Processing Fee on Visa-branded signature debit will be reduced — going from $0.0195 per authorization to $0.0155 per authorization. The fee for credit card authorization will remain $0.0195 per authorization.

Visa and MasterCard issued new alerts on May 15 suggesting the breach dated back to January 2011 — an exposure window significantly longer than what was originally reported by Global when news of the breach surfaced in late March. Visa’s alerts in March, which Brian Krebs used to

Visa and MasterCard issued new alerts on May 15 suggesting the breach dated back to January 2011 — an exposure window significantly longer than what was originally reported by Global when news of the breach surfaced in late March. Visa’s alerts in March, which Brian Krebs used to