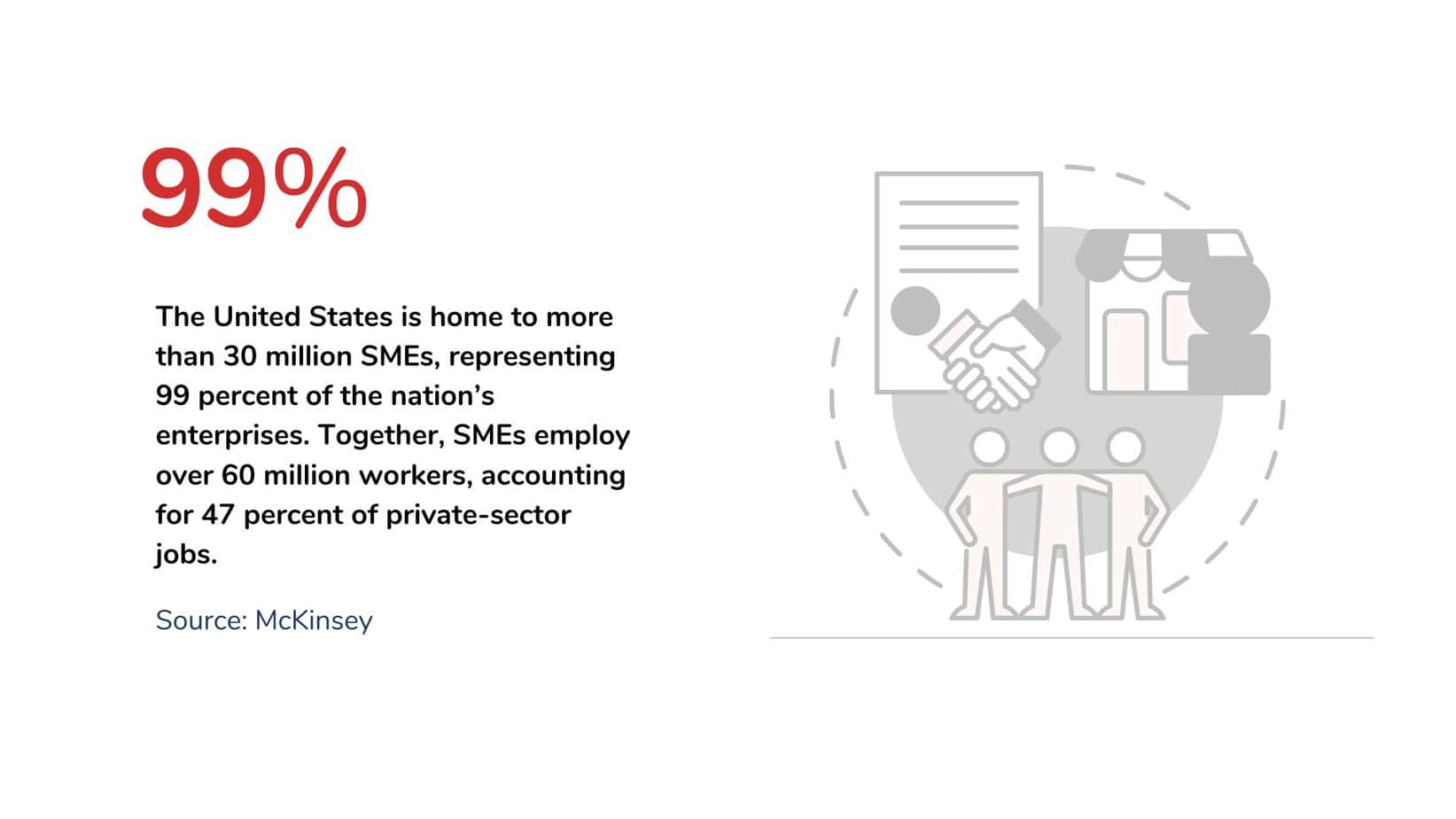

The emergence of online lending platforms has transformed how SMBs can secure support. Today we will understand the advantages that online lending brings to SMBs and how it effectively addresses the obstacles they encounter when pursuing loans. We will also understand how SMBs and online lending is fast evolving and benefiting the merchants in the US and globally.

Why More Strict Financial Regulations are Pushing Community Banks to Offer Online Lending for SMBs?

Originally, all banks were local. There were even strict regulations prohibiting banking across state lines after the Great Depression. The fear was that if national banks failed, it could destroy the entire financial system. Of course, that was the same fear articulated during the 2008 Sub-Prime Mortgage Crisis.

Local banks have an advantage with respect to their community focus. They can shake the hands of the local barber, farmer or plumber and discuss their needs for raising money. This community focus allows for small business loans that are beneficial for the lender, borrower and community.

Gradually, local banks began to expand with the relaxation of regulations during the 1990s. The community focus has not been lost, the majority of small business loans are still provided by the local banks. After the Sub-Prime Mortgage Crisis, tighter financial regulations were established which are now pinching the profit margins of many local banks.

Now, paperwork can be so costly at local brick-and-mortar banks that small business loans are simply not profitable.

What is the Answer?

Perhaps, online lending can be used to kill two birds with one stone.

By making a more affordable streamlined process, the community banks can create a cheaper online lending format that might be up to 75% lower. This allows for SMBs to continue receiving funding while improving their technological accessibility.

Many SMBs are owned by single proprietors. They can now complete the online loan process faster and receive cash infusions to keep their business growing more rapidly. As small businesses hire more workers – the entire nation benefits.

The World Wide Web continues to change how businesses are run. Affordable, accessible, and simple online loan application forms are a key benefit. Most individuals are simply sick and tired of filling out the same long, tedious applications in triplicate. SMB online finance is a win-win for all parties.

SMBs and Online Lending

The emergence of online lending has had an impact, on small and medium-sized businesses (SMBs). These innovative platforms have disrupted the lending landscape providing SMBs with access to much-needed capital. The days of complicated loan applications that often lead to disappointment are now a thing of the past.

Through lending, SMBs can now apply for loans conveniently from their office or home with a few clicks. The process is. Efficient, saving business owners time and effort. No longer do they have to wait weeks or even months for a decision. Many online lenders offer approval within hours or days.

One notable advantage of online lending is its flexibility. Traditional banks often have criteria for loan approval putting SMBs at a disadvantage. Online lenders recognize that each business is unique and consider factors beyond credit scores. Such as cash flow, sales history, and industry trends. When making decisions.

Additionally, online lending presents opportunities for businesses, with collateral or those who may not meet stringent requirements imposed by banks. This inclusiveness allows medium businesses (SMBs), in various industries to access the finances they need to expand their operations invest in new equipment or technology launch marketing campaigns, and hire more staff members. The possibilities are endless!

In addition to being accessible and flexible another notable advantage of lending is its transparency. Unlike banks that may surprise borrowers with fees and complex terms, reputable online lenders provide upfront information about interest rates and repayment schedules. This ensures that you know what you’re getting into before accepting any offer.

As more SMB owners discover the benefits offered by lending platforms it’s no surprise that this industry continues to thrive! Whether you’re starting your dream business or aiming to take your existing venture to heights consider exploring the world of lending—a modern solution designed specifically for small businesses like yours.

Benefits of Online Lending for SMBs

One of the significant advantages of online lending for small and medium-sized businesses (SMBs) is the speed and convenience it offers. Traditional loan applications can be a process involving paperwork and taking weeks or even months for approval. However with lending platforms SMBs can quickly and easily complete their applications, from their offices.

In addition, to saving time online lending also offers medium businesses (SMBs) a wider range of lenders to choose from. Of being restricted to banks or credit unions SMBs can connect with lenders from all over the country or even internationally. This increased competition among lenders often leads to terms and competitive interest rates.

Another advantage of lending is that it allows SMBs to secure funding even if they don’t have credit scores. Traditional lenders usually have requirements when it comes to creditworthiness, which makes it challenging for SMBs to qualify for loans. On the other hand, online lenders take a comprehensive approach considering factors like cash flow and business performance in addition to credit history.

Moreover, numerous online lending platforms provide repayment options specifically tailored for SMBs. These options can include extended repayment terms or adjustable payment schedules that account for fluctuations in revenue.

Online lending has transformed how SMBs access financing by offering approval times, a selection of lenders with improved accessibility regardless of credit score limitations, and flexible repayment options customized for their unique needs.

Obstacles faced by SMBs in obtaining loans

Small and medium-sized businesses (SMBs) often encounter difficulties when trying to secure traditional loans, from banks and financial institutions. These challenges can impede their growth potential. Restrict their opportunities.

SMBs often face a hurdle when it comes to getting financial support from lenders. Banks usually have requirements, such, as a track record of profitability, collateral, and excellent credit scores. Unfortunately, these are not always attainable for businesses.

In addition to these standards, the application process for loans can be quite burdensome for SMBs. It involves submitting paperwork and financial statements that provide information about their business operations. This can be time-consuming. Take away resources that could be better utilized in running and expanding their business.

Another challenge arises from the repayment terms offered by banks. These terms may not align with the cash flow patterns of SMBs. Small businesses often experience fluctuations in revenue streams, which makes it difficult to meet fixed payments.

Furthermore, it is worth noting that traditional lenders tend to adopt an approach when evaluating loan applications from SMBs. They might prioritize corporations or industries perceived as risky compared to smaller ventures or innovative startups.

Given these difficulties faced by SMBs when seeking financing through channels online lending platforms specifically tailored to their needs have emerged as a solution.

Stay tuned for our blog section where we will delve into how online lending has revolutionized access to capital, for medium-sized businesses!

Addressing the Challenges: How Online Lending Helps SMBs

Online lending has revolutionized the financing landscape for medium businesses (SMBs) in need of financial support. SMBs often face obstacles when it comes to obtaining loans but fortunately, online lending platforms have emerged as a solution, to these challenges.

One of the difficulties that SMBs encounter with loans is the arduous and time-consuming application process. Banks typically demand paperwork, financial statements, and collateral which can overwhelm business owners who are already juggling multiple responsibilities.

However online lending platforms offer an application process that’s both speedy and convenient. Business owners can complete an application form with a few clicks and submit their documents electronically. This streamlined approach saves them time and energy allowing them to focus on running their businesses of drowning in paperwork.

Another significant challenge posed by loans is the eligibility criteria imposed by banks. Many SMBs struggle to meet these requirements due to credit history or insufficient collateral. Recognizing that each business is unique online lenders take into account factors such, as cash flow analysis or social media presence when evaluating loan applications.

Moreover, online lenders offer flexibility in terms of loan amounts as compared to banks. They specifically cater to the capital requirements of small and medium businesses (SMBs) by providing smaller loan sizes that align with their needs. This enables businesses to access funding without burdening themselves with debt or borrowing more, than necessary.

Furthermore what sets lenders apart from institutions is the speed at which they evaluate loan applications. While decision-making processes at banks can take weeks or even months online lenders often provide funding within days of approval. This quick turnaround time ensures that SMBs have access to the working capital they need promptly allowing them to seize opportunities or address expenses without delay.

Additionally one of the advantages of lending is that it opens up opportunities for businesses in all industries regardless of their geographic location. Transactions occur digitally through platforms that can be accessed from, around the world.