The Official Merchant Services Blog continues its epic masterpiece on the impact Customer Service can have on a business. In our previous blog we discussed anecdotal evidence and how it pertains to the perception of service and what can be learned from those anecdotes. The stories usually revolved around nightmarish tales of difficult customers and how those experiences can be applied to improving Customer Service and turning those customers into loyal return customers.

But anecdotes really only go so far. Numbers are required to help quantify the importance of customer service. Especially in the context of the things I’ve been reading lately around the internet in terms of video game companies, their development standards and some buzzwords about customer entitlement or gamer entitlement. You’ll remember the article that originally got me involved in a discussion about customer service came from The story of Jennifer Hepler found on The Mary Sue.

Add to that this Forbes article about The Myth of Gamer Entitlement. The trend I see happening is video game companies are taking part in a subtle marketing push through their web 2.0 tools to essentially justify letting their customer service lag. By furthering the Gamer Entitlement cause, they paint their own customers as villains, and themselves as victims of irrational customer whims.

Which as I said last time, baffles me. The goal of a business is to be successful and to nurture the development of healthy long-term business relationships. Quality customer service. A business wants happy customers. Loyal customers. Even difficult customers, the kind that complain a lot, the kind that prompt the Gamer Entitlement mythology I’ve been reading about, are valuable in your business. And I’ve found some data — some cold hard numbers — to help us analyze exactly how important customer service is. Hopefully these numbers will help even the victimized game development companies see how it is bad business to ignore customer service.

The Basics

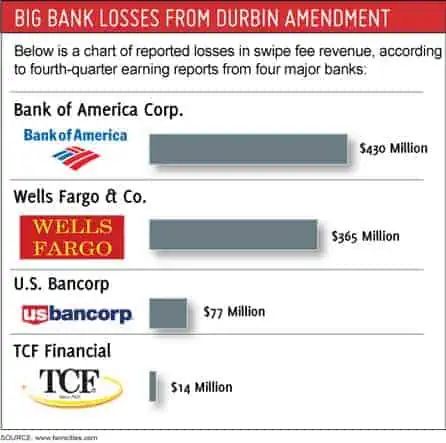

We start off with Customer Loyalty. Customer loyalty isn’t just satisfaction. Loyalty to your business, your brand, your services goes well beyond just satisfaction with a purchase. Customer Loyalty directly impacts business results. The Loyal Customer will continue to buy from your business and will promote it to others. This is the basic foundation for promoting and making sure you maintain quality customer service. This is why Host Merchant Services prioritizes its customer service so high — the motto being “You stay with us because you are happy with us.” It is the catalyst of customer loyalty. And reading what I have about Gamer Entitlement, I feel the most basic core of the concept has been lost. The companies that push this idea of gamer entitlement have forgotten how large an impact customer loyalty has on business. Here’s a graphic defining Customer Loyalty:

Now what to do with the concept of Customer Loyalty? Well Osman Khan delves into a fascinating look at the outcome that different states of customer loyalty can have on your business in this blog. Let’s look at the two charts:

The obvious contrast this chart shows is that the typical business has the smaller percentage of fiercely loyal customers at the top of their pyramid, while sports clubs and entertainers tend to have those zealous “fans.” These are the preferred loyal customers. These fans will stick with your business over the long haul and promote your business to anyone who listens the entire time. This chart may help explain some of my confusion over the gamer entitlement issue. I approach customer service with the typical state of customer loyalty in my mind. But video game companies are a bit more toward the entertainer part of the spectrum. Their pyramid has more rabid fans at the top than the norm. So they may be able to get away with poor customer service.

However, the Gamer Entitlement debate/issue still brings me back to the basic idea of customer loyalty. Video Game companies are not the Boston Red Sox or the New York Yankees. They’re not Bruce Springsteen. So they can’t get away with quite as much in terms of poor customer service. They do run the risk of angering those loyal customers. And losing them. To put it simply … Rockstar Games is not a Rock Star itself. Customer Service should still be a very key element of the business plan.

Marketing, Testimonials, Customers

The power of customer loyalty is typically harnessed in the form of Testimonials — happy customers rave about your business and endorse it. These are extremely effective marketing tools. Here’s a graphic from TechValidate demonstrating how effective Testimonials are compared to other forms of marketing:

This shows what a lot of people already say about testimonials: They work. People listen to other people when they recommend a business. This means that it is potentially a very bad move to alienate customers in the way developers are with the Gamer Entitlement tag. This is what really strikes me as the craziest part of what I’ve been reading about in terms of video game companies. They take a lot of liberties with their loyal customers — their rabid fans. But unlike diehard Yankees fans, video gamers don’t have a high tolerance for that type of action from their beloved video game company. And that’s why the internet is filled with negative word of mouth about the games that these loyal customers should instead be giving testimonials for.

Good Customer Service = More Sales

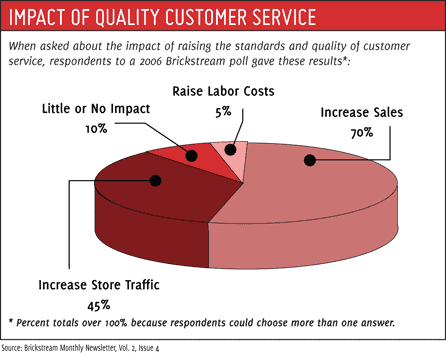

And the last graphic I offer today is from Brickstream, showing results from a survey they did about customer service. In it, their respondents demonstrate a distinct belief that improving or raising the quality and standards of customer service will directly increase sales and store traffic. The survey results:

That survey backs up what I’ve been thinking. Plain and simple — customer service enhances business. To recap, Customer Loyalty will give your business an edge and naturally increase marketing. Testimonials from loyal customers have a high impact in getting your business new customers and loyal customers stick with your business through the long haul. Loyal Customers are groomed and maintained by quality customer service. And businesses believe that quality customer service directly leads to more sales.

In our next installment on this epic saga of customer service and its impact in business, we’ll be looking at tips that are offered to consumers for dealing with bad customer service, as well as tips offered to businesses on how to improve customer service. Perhaps some of those video game companies will stop thinking their customers are too entitled, and use these tips to improve their sales and their word-of-mouth advertising?

width=”446″ height=”355″ />

width=”446″ height=”355″ />

Transaction Integrity Fee: Visa’s Transaction Integrity Fee is a new $0.10 fee that will apply to U.S. domestic regulated and non-regulated purchase transactions made with a Visa Debit card or Visa Prepaid card that fail or do not request Custom Payment Service (CPS) qualification. The CPS rates are Visa’s best rates and apply to both regulated and non-regulated transactions. This new fee can be viewed as a definite response from Visa to the Durbin Amendment’s interchange rate cap and finance reform/regulatory changes. This is part of the ninja-style set of moves The Official Merchant Services Blog

Transaction Integrity Fee: Visa’s Transaction Integrity Fee is a new $0.10 fee that will apply to U.S. domestic regulated and non-regulated purchase transactions made with a Visa Debit card or Visa Prepaid card that fail or do not request Custom Payment Service (CPS) qualification. The CPS rates are Visa’s best rates and apply to both regulated and non-regulated transactions. This new fee can be viewed as a definite response from Visa to the Durbin Amendment’s interchange rate cap and finance reform/regulatory changes. This is part of the ninja-style set of moves The Official Merchant Services Blog