Chargebacks are disputed everyday at every business, sometimes they can be difficult but have you ever looked back and analyzed the true cause for the chargeback? Chargebacks are a common problem for businesses and especially for high-risk businesses. Chargebacks protect the consumer from fraudulent transactions as well as rectify errors from simple miscommunication. It’s not just small businesses that are subject to chargebacks; large, established retail enterprises fall prey to chargebacks as well. As such, it is essential to analyze the root causes of chargebacks carefully. Such analysis may uncover genuine problems with specific areas of operations of a business that may need to be rectified to wrest control over chargebacks.

Below, we explore what chargebacks are, why they are essential to dispute effectively, the root causes of chargebacks, how to analyze these root causes, and what preventive measures to take to prevent chargebacks from occurring.

What are Chargebacks?

Chargebacks are payment disputes the customer raises about a particular charge to their credit card. When a chargeback arises, the issuing bank withholds the funds from the merchant until it decides the accuracy of the transaction. If the bank rules for the business, the funds are released to the merchant. However, if the bank rules in favor of the customer, it reverses the charge on the customer’s credit card. The chargeback process is often a lengthy and cumbersome process that requires a significant amount of documentation and recordkeeping.

Importance of chargeback disputes

Disputing chargebacks is a crucial facet of running a business. There are specific cash flows associated with transactions involved in chargebacks that are suddenly on hold and may not possibly arrive. This becomes even more pronounced because the business has already incurred the costs of manufacturing the product, shipping it out and may now be assessed chargeback fees if the dispute is unsuccessful.

As businesses go through the motions of the dispute, they simultaneously need to get to the root cause of why the chargeback transpired. Everything from fraudulent activities to genuine issues the client raises, analyzing chargebacks’ root causes is vital to tackle recurring problems effectively.

Analyzing chargebacks root causes

Merchants often revert to focusing on the disputing chargebacks and the revenue lost and how to adjust budgets for the cash flow that will not be coming in. Those are necessary steps for a business to carry out but only the first steps in a series of actions they must take.

There is a lot of information available in the chargeback merchants receive. For starters, merchants can analyze the cause of the transactions being disputed. Reviewing these causes can help merchants get to the root causes of chargebacks in their business. This root cause analysis may uncover that specific changes may be needed in any one of the following areas:

Customer Support – Evaluate whether the customer made any effort to reach out to the support team to rectify any qualms about the product before filing a chargeback complaint with the bank. It is essential to understand the consumer journey and identify any friction that can lead to miscommunication or a lack of communication that manifests into chargebacks unnecessarily.

Delivery – What are the merchant’s processes around the delivery of goods. It may be a bit hard to successfully dispute a chargeback when a child’s Christmas gift ordered a week in advance is received on Easter. Preferred delivery vendor relations may be offering your charge rates but costing you much more in lost revenue and negative customer feedback.

Sales Staff – Having a professional and well-trained sales staff is vital to a robust revenue pipeline and happy clients. If your sales team is overpromising and hyping up expectations of customers that don’t pan out upon delivery, it may be time to revisit your company’s sales tactics. You want to ensure overzealous sales staff aren’t being too aggressive in closing sales that customers end up regretting shortly after purchasing the product, let alone receiving it.

Product – This is a critical facet to consider. There may be a shortcoming with the product that the client doesn’t value as much. Is it a manufacturing or quality flaw? Are there durability issues? Lower quality goods can lead to client dissatisfaction and chargebacks. Furthermore, word of mouth in today’s hyper-social environment can further alienate clients from your company’s products if quality issues lead to chargebacks.

Card Related issues – Was the card valid? Was all the credit card information collected to process the payment? Merchants should carefully review the process in place of collection, verifying, and storing card data to ensure that there aren’t any inefficiencies in that operation leading to chargebacks.

Safeguards around chargebacks

Once businesses understand the true nature of the problems that give rise to chargebacks, they can successfully place safeguards to avoid them going forward. Some examples of safeguards can include:

Appropriate training levels for sales staff to work with clients by partnering with them as trusted advisors instead of looking to close a quick sale and moving on. It may not work all the time and may require changes from the top-down. However, it can reap significant benefits from both a revenue and branding perspective.

Emphasize stellar customer support. This will also require an investment of time and money in training and upskilling your support staff to set the appropriate tone of empathy towards current and future clients.

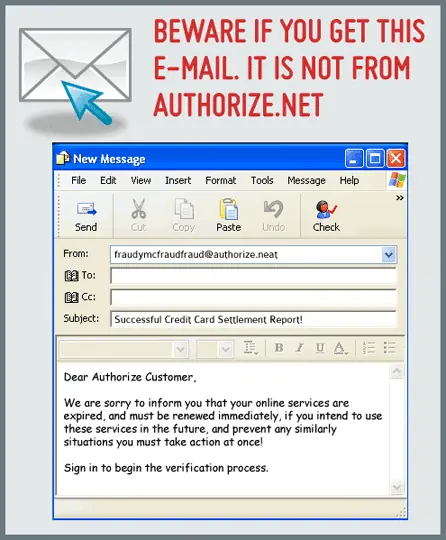

There are specific technologies merchants can invest in to avoid the chances of fraudulent transactions. These include:

- 3-D Secure – an online authentication protocol for card not present transactions.

- Tokenization – a storage mechanism of securing card data being used to process a payment.

- BIN checkers – used by merchants to ensure the card details used in transactions are legitimate before they process the payments

Understandably, chargebacks are not an easy issue to tackle for businesses. Chargebacks cost real money. Merchants end up paying for chargebacks in many ways; through lost sales, shipping and handling costs borne by them, and chargeback fees by the merchant account provider. The merchant account provider may also start evaluating the merchant as a high-risk business leading to higher payment processing rates.

Sometimes it isn’t in a merchant’s control how a chargeback dispute is settled. However, there is hope and reason to be optimistic and take action on the matter. Merchants have a lot of control over chargebacks arising. By being deliberately proactive and using the steps in tackling chargebacks it will become easier to dispute them.

Last month, a bank in Rhode Island bank was given an application for a $144,050 loan through the Paycheck Protection Program (PPP). PPP is an enormous federal effort that is designated to assist many small businesses that are severely affected by the Coronavirus pandemic. This PPP

Last month, a bank in Rhode Island bank was given an application for a $144,050 loan through the Paycheck Protection Program (PPP). PPP is an enormous federal effort that is designated to assist many small businesses that are severely affected by the Coronavirus pandemic. This PPP