The Official Merchant Services Blog continues its far reaching and ongoing coverage of the Durbin Amendment and the aftermath of what this legislation brings. Just a quick recap of what the Durbin Amendment did: On October 1, the legislation put in place a cap on interchange fees from debit card usage. Prior to the legislation taking affect, the fee merchants were charged on the average transaction was around 44 cents. The cap put in place by this finance reform legislation put the ceiling for the fee at 21 cents, with provisions in place that allowed most banks to reach a maximum of 24 cents for the transaction. This cut into the profits that banks were essentially “banking on.”

Host Merchant Services provided an extensive and thorough analysis of the Durbin Amendment before it took affect. And our analysis predicted the same reaction from the banking industry that many other media sources predicted –– Banks would not want to lose those profits. Billions of dollars were at stake. The banking industry’s reaction is pretty straightforward: The burden of the fees would be shifted to other parts of the services they offer. The costs and fees would go from the merchants, to the consumer.

Bank of America Takes the Heat

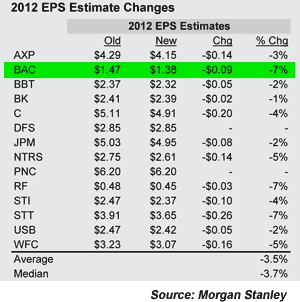

There was a very public media backlash over “Round 1” of this plan, as people slammed the banks for their plans to add monthly fees to debit card usage. The most notable reaction was against Bank of America, who announced they were going to charge customers a $5 monthly fee to use debit cards. This announcement polarized the Occupy Wall Street movement giving them a target for their ire and then was slammed in a wide variety of media outlets (including one Fox News Anchor who cut her debit card up on the air).

This very public display prompted all the banks considering this kind of fee to back off of the idea. With Bank of America itself being the last to relent.

The Burden of Billions

But that didn’t solve the problem. The big banks still have billions of dollars in losses from the hard cap on interchange fees that they need to make up for. And so the current plan is to spread them out through their other services. The customers are still going to shoulder the burden of these billions of dollars. It’s just now the burden is going to be much harder to spot. Which makes for less media coverage and more customer acceptance –– it’s just not as easy to slam banks for doing things like raising the cost of replacing a lost debit card or charging a fee for opening a basic checking account. The debit card usage fee was a sexy, easy to highlight news byte that could be latched onto. A news anchor could make their point with a pair of scissors. But what now? The billions of dollars are still there to be dropped onto bank customers. But now it’s tiny bits here for one service, tiny bits there for another service. It just can’t be wrapped up into one easy to characterize news angle.

Sneaking Fees Onto Consumers By Stealth

ABC News does its best to try, however, offering this article to explain that banks are now going ninja style with their plan of action. Sneaky fees hidden and peppered about their services. All combining to help make up the ground they were going to lose. But most of them deposited around their whole suite of services that it is much harder to latch on like a pit bull and berate them for doing this. The ABC Article states: “After an uproar of protests, the largest banks have said they are not going to charge customers for debit card purchases, but hidden overdraft, ATM and other fees are likely to rise, say consumer advocates.”

The New York Times also mentions that banks are trying to avoid the noise with this plan B of theirs: “Even as Bank of America and other major lenders back away from charging customers to use their debit cards, many banks have been quietly imposing other new fees. Need to replace a lost debit card? Bank of America now charges $5 — or $20 for rush delivery. Deposit money with a mobile phone? At U.S. Bancorp, it is now 50 cents a check. Want cash wired to your account? Starting in December, that will cost $15 for each incoming domestic payment at TD Bank. Facing a reaction from an angry public and heightened scrutiny from regulators, banks are turning to all sorts of fees that fly under the radar. Everything, it seems, has a price.”

A moneymorning.com article which recapped the New York Times article cites the Durbin Amendment as a direct catalyst for this strategy: “Banks blame increased regulations that limit fees and other charges for wiping out an estimated $12 billion in yearly income. Now it costs banks between $200 and $300 a year to maintain a retail checking account, but they only take in about $85 to $115 in fees per account per year. “

Durbin Not The Cause?

The ABC News Article offers a counter to Durbin being the easy scapegoat: “[Ed] Mierzwinski [consumer program director of U.S. Public Interest Research Group] said he believes banks are offering more a la carte services from what used to be one package offered to consumers. He said the trend is similar to what telephone companies have done over the years. ‘They’re un-bundling what used to be part of service and charging you more for it,’ he said. ‘Everybody blames Durbin. That’s hooey.’ “

Much of this was already predicted. Analysts that saw what Durbin was going to do knew the banks would have to scramble to recoup their perceived losses. Billions of dollars that they counted on couldn’t just disappear from their business plans and projections. That they would work added fees and rising costs of their other services was pretty much a no-brainer. These other areas of their service were not mentioned or affected by the finance reform legislation. Leaving banks open to make these kinds of adjustments. Occupy Wall Street is far more focused on house foreclosure practices than they are on the fee a bank charges you for using another bank’s card at their ATM.

The Bottom Line

And the bottom line is, the Dodd-Frank Act and its Durbin Amendment simply didn’t take enough of the variables into account to deal with this reaction. Even after all of this was predicted by the people on both sides of the debate. Yes, these changes are more stealthy than the straight up, in-your-face debit card usage fee. But no, they’re not that surprising. Just like a ninja in a boat full of pirates, these changes are standing on the deck as quiet as can be. But are very easy to see.