If you have a New Year’s resolution to get your finances in order, that may include finding the right credit card. If you have a high-interest card that doesn’t provide you with any rewards or benefits, you could be missing out.

The Top Credit Card Offers for 2020 and 2021.

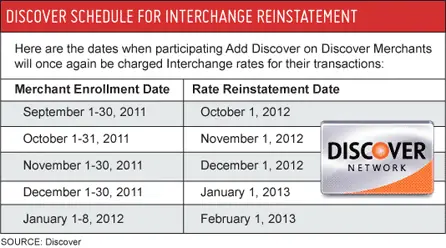

Discover-It Cash Back

If you want a simple credit card that pays you for your purchases, Discover-It is it. You earn 5% back on your purchases up to $1,500 each quarter. The reward categories change, but you always have options, and they are typically categories everyone spends in or specific stores everyone shops at (such as Amazon).

Discover also doubles the cashback you earn after your first year. In other words, you earn ‘free money’ if you keep your card in good standing for the year.

Citi Double Cash Card

Earn 1% back on all purchases and an additional 1% when you pay your bill. Even if you pay your balance over a few months, you still earn 1% of what you pay. So it totals out to 2% cashback as long as you don’t let interest charges take over your rewards.

The Citi Double Cash card doesn’t have a reward bonus like most cards, but it comes with a 0% balance transfer APR for 18 months. That’s a nice long period to pay off your balance before interest accrues.

Chase Freedom Unlimited

If you like tiered rewards, check out the Chase Freedom Unlimited card. There’s no annual fee, and you earn cashback year-round in a tiered manner.

It’s best for people who travel as you get the largest reward on travel purchases (5%). It also pays 3% back on restaurant purchases, 3% back at drugstores like CVS, and 1.5% back on all other purchases. So, no matter where you spend money, you’ll earn cashback.

Bank of America Cash Rewards Credit Card for Students

Students sometimes have a hard time finding a credit card that provides them any benefits besides a small credit line. The Bank of America card is a great place to start and it offers students rewards.

Students earn 3% cashback on a category that you choose, whether it’s groceries, dining out, or gas. Students can also earn 2% cashback on groceries, including Sam’s Club and Costco, and 1% back on everything else.

The 3% bonus category and 2% rewards can be used up to $2,500 per quarter, and then it falls to 1%, which is the perfect amount for students.

Look at the Credit Card Rewards you Need

Before you take just any credit card, determine your needs. What rewards will you use and what categories do you spend money in the most? Why not take advantage of what credit cards have to offer by finding the card that pays you back in ways you’ll use it and for purchases you already make?

If you aren’t sure which one is right for you, pull out your bank and credit card statements for the last year and total up your spending in each category to make the right choice.