Today The Official Merchant Services Blog will take you through a quick roundup of the backlash over the Durbin Amendment. Host Merchant Services has kept its finger on the pulse of this legislation as it weaved its way through congress and into reality. The HMS article section gives you a comprehensive analysis of the legislation, which also very accurately predicted its impact on consumers, merchants and banks. The Official Merchant Services Blog also ran a 10-day series leading up to the October 1 start date for the legislation, titled Countdown to Durbin. That series selected relevant articles from around the internet and compared them to HMS’ detailed analysis of the legislation.

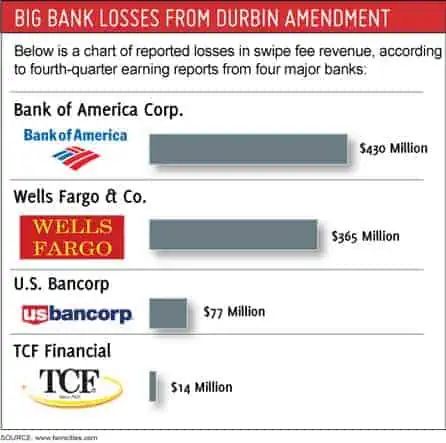

Since then, the story has continued to grow. It’s been spurred on by Bank of America, who announced in 2012 it would be charging its customers $5 per month to use debit cards. This move was clearly the bank’s response to the cap on swipe fees, and garnered quick and scathing negative reaction, as noted in this blog during the Durbin series. The bank was blasted for adding this fee after taking federal bailout money in the past. The bank was criticized for being the largest bank in terms of debit card transactions and thus one of the primary targets of the legislation. A Fox News anchor even cut up her debit card on the air to express her outrage over this news.

And then the protesters got involved.

Bank of America Gives Wall Street Protesters a Target

While initially the protesters on Wall Street were criticized for not having as much organization or specific goals as movements from decades prior, the Durbin Amendment and the Bank of America fees polarized enough people to fix that hole in the campaign right up. A Los Angeles Times article had this to say on it: “The announcement by Bank of America Corp. last week that it would charge customers $5 a month to use their debit cards has rung up animosity from coast to coast.

Coming amid growing anti-Wall Street protests, BofA’s new fee has become a focal point for anger and frustration about the flailing economy and Washington’s attempts to help the nation recover from the financial crisis.

Some banks are testing similar, though lower, debit card fees. But BofA was the first major player to take the plunge. And since it is the nation’s largest bank — as well as the beneficiary of one of the biggest taxpayer bailouts — the move has put a target on its red-white-and-blue logo.”

In our Countdown to Durbin blog series, The Official Merchant Services Blog cited reports that the first banks to put forth Debit card fees would indeed become a target and get negative reactions over their move. But the timing of the Wall Street protests that sorely needed something to latch onto, combined with Bank of America’s history with federal bailout money, and their foreclosure practices amplified the backlash. People began getting rowdy about it. And visiting Bank of America lobbies to be rowdy about it.

- This Boston Herald article describes arrests made in protest of Bank of America: “Two dozen trespassing protesters were happily hauled off from Bank of America’s downtown offices last night in a gesture of civil disobedience against what they say are the leading lender’s unfair foreclosure practices.”

- This Chicago Sun-Times article reports arrests were made at a Hyatt Regency and Bank of America in Chicago as part of the growing big bank/big business protest.

- This Huffington Post article has images from a Los Angeles protest where 500 people stormed the downtown, including 10 protesters that were arrested in a Bank of America lobby.

- And this Shore News Today article reports the protests spread to a Bank of America branch in Somers Point, New Jersey.

So What’s Next?

With all of the backlash and the protesting, one has to ask what the next step is? This ABC News 10 article suggests Online Banking: “According to financial website “Daily Finance”, many Americans are closing out their accounts and opting for online banks due to frustration over new debit card fees.”

E-commerce is booming and consequently this has created a much more viable niche for online banking. The article goes on to quote financial consultant Katrina Semmes: “Online banks are certainly worth looking into, but you need to do your homework to make sure they are reputable.” Semmes advised people to seek out the more recognized online banks.

“Semmes pointed out that some of the benefits of online banking include higher money market rates, 24/7 access to your account, and a reduction in one’s carbon footprint, meaning you don’t have to drive to the bank. She said some of the cons include a lack of ATMs with some online banks, no personal touch, and longer processing times for deposits and documents requiring signatures.”

But Online Banking isn’t the only reaction being touted. This Los Angeles Times article details how smaller banks and credit unions are primed to swoop in and grab disgruntled customers: “Regional and community banks such as L.A.’s City National Corp. and Chula Vista’s PacTrust Bank are lining up to take the anti-Bank of America pledge: no debit-card fees. For now, at least.

It’s an appealing come-on following BofA’s decision to charge customers $5 a month to swipe the cards — even for bankers who say new Federal Reserve regulations have unfairly capped what they can charge merchants for accepting the cards.”

Coming Full Circle

Although the most fascinating reaction to the Durbin Amendment can be found in this Huffington Post articlewhich details a call for a Justice Department Investigation: “House Democrats responding to the recent announcement of a new Bank of America debit card fee are calling for a Department of Justice investigation into Wall Street banks, charging that the timing of that announcement and the announcement of similar fees at other banks suggests possible collusion among the major players.

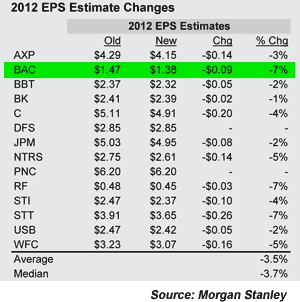

Bank of America, SunTrust, JPMorgan Chase and Wells Fargo have all recently announced new debit card fees. The banks cite a need to raise revenue to make up for diminished profits coming from merchant swipe fees as a result of recently passed reform legislation.”

A Short Opinion Break

So this is how things went with Durbin … It was introduced as an amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act. It’s goal was finance reform, specifically targeted at easing the burden of the consumer by putting a cap on debit card swipe fees. It was lobbied against in Congress by banks and credit card companies. Its debit card swipe fee cap was changed from the extreme 12 cent cap to a 21 cent cap with provisions that raise it to 24 cents. And then it was pushed back to October 1st, giving everyone time to prepare, and speculate what would happen. Most every report, story and analysis that came out about what would happen suggested that because the general scope of the reform legislation left all these other avenues there for banks to respond, that banks would do exactly what they did: Shift the fees to the consumer instead of the merchant.

All of that happens, like clockwork. And the government’s response? To push for the Department of Justice to investigate the banks for doing what many people, including the banks, said they would do.