Mobile payments have never been more popular. People are using mobile payments these days to complete quick transactions through their mobile devices. You’ll notice a few distinct differences when looking at mobile payments vs. credit card payments. Many of these entail the technologies used and how people may find mobile payments to be more useful for their needs.

The Concept of Mobile Payments

A mobile payment entails a transaction made through a mobile device. The customer can use a smartphone, smartwatch, or even a wristband.

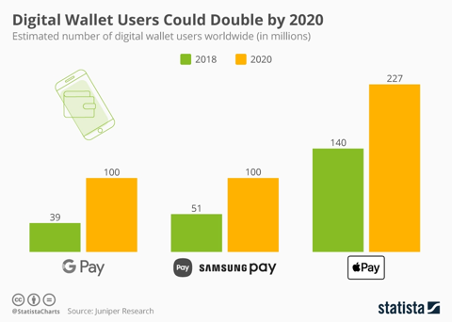

The user will pay for something with a mobile payment solution like Apple Pay or Google Pay. The system incorporates credit card or bank data in one platform. The user will transmit one’s payment information from that account to the retailer to complete the purchase.

Each mobile payment comes from a digital wallet. The wallet will link to an appropriate interface or platform. The wallet will include the bank or card info. The mobile payment system takes the payment info from the digital wallet and uses it to cover the transaction. Some digital wallets, like what PayPal uses, can include specific amounts of money someone withdraws from a bank or credit line before spending that total.

The system simplifies how people can pay for their purchases. Customers don’t have to get a physical credit card out to complete a transaction. The buyer will have more control over the purchase experience, especially as that person can handle the payment in less time. The customer may also feel more comfortable with the transaction process when using a mobile payment system.

Mobile Payments vs. Credit Card Payments – A Safer Solution

One difference between mobile payments and credit card deals is that mobile transactions are safer. A mobile payment can help the customer send data from a digital wallet to the retailer, completing the transaction without providing any cards. The mobile payment system ensures full security over a deal.

You won’t see that same security with a credit card. Although credit cards have evolved to feature a chip-based system that is harder to hack, there is always the potential for someone to steal a card. A person can always steal a card or its identifying numbers and use it to commit fraud.

But with a mobile transaction, the thief would have to use a thumbprint scan or other system to confirm one’s identity. It would be tough for that person to try and duplicate that thumbprint in this process. Many mobile devices are also locked through PINs or other biometric features, so that adds extra security to the deal.

How People Get These Systems

People will apply for credit cards by filling out the proper forms to get them ready. People will submit credit info to highlight their ability to pay their balances. Some people may be rejected for cards if they have poor credit ratings. The ones that do get accepted may be subject to high-interest rates and restrictive charges.

A mobile payment is different, as a customer will require a suitable payment app on one’s device. Google Pay and Apple Pay are the most prominent apps, although Samsung Pay is available on many Samsung devices. The user will link one’s existing bank or card info to the app. The system is simple and gives the customer more power over how one will pay for items.

Since people don’t need credit to get a mobile payment account, you can expect these payments to be more common. People prefer payment choices that don’t require lots of effort or risk. Some of these payments will entail direct bank transfers, making the transaction process easier to follow.

Convenience For the Customer

Customers also use mobile transactions because they are more convenient:

- There’s no need for the customer to keep lots of cards on hand. The customer’s payment info is all on the same mobile payment app.

- It takes less time to complete a mobile payment than it does to run a credit card.

- It is easier to track a phone or other smart device if it gets lost than if one’s credit card is lost.

- Mobile payment platforms can inform customers of whatever coupons or other discounts they have stored with them. They will not forget about these like they would if they had traditional coupons they would use with a credit card.

What Systems Accept These?

One difference between mobile payments and credit cards entails the point of sale or POS systems that can accept these choices. Most POS setups can accept credit cards, with the technology being so common.

However, not all platforms can accept mobile payments. A POS system must support a system like Google Pay or Apple Pay to complete mobile payments. A POS setup can also work with different integrations with systems like PayPal, Venmo, or anything else a customer wants to use.

The extra effort necessary to accept mobile payments makes it tough for some retailers to support them. As more people start using mobile payments and the technology becomes more commonplace, you can expect to find more POS solutions that can support mobile deals.

Will Mobile Payments Take Over?

Mobile payments may become more popular than credit cards after a while. It will take a long time before anyone can figure out what will happen.

The problem with mobile payments is that many people are uncertain about how they work. They also might not have the mobile devices necessary to complete these payments. Some are also comfortable with credit cards, especially since chip-based ones are more secure than older magstripe models.

You can expect mobile payments to become more prominent, especially as mobile devices become more accessible. Potential advances in payment technology will also help increase the chances for these payments to be popular and useful among people. Whatever happens, it will be exciting for people to see as they look at how payment trends change, and people start to see what’s more efficient and effective.