American Express – the famous card issuing company for small businesses in the United States, has unveiled the fully digital form of Business Checking Account for SMBs.

The Business Checking Account by American Express will be offering small business enterprises a highly secure, low-fee, and top-yield experience of digital banking. The account is available with the APY or Annual Percentage Yield of 1.1 per cent on the overall balances that remain around $500,000. The all-new Business Checking Account is also responsible for connecting with the existing credit cards by American Express. Moreover, small businesses are also issued with a dedicated Business Debit Card.

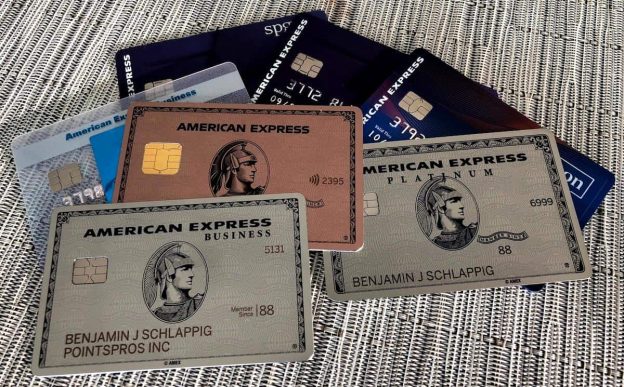

American Express Unveils Business Checking Account and Debit Cards for Small Businesses

Business accounts that are dedicated to small businesses with the help of the all-new Business Checking Account by American Express can help business enterprises (SMBs) look into as well as operate at a highly professional level. The digitization of such accounts only takes the process one step higher as it helps in streamlining as well as simplifying the overall process of cash management.

It is also quite profitable to earn interest rates of high yield at the moment when small business organizations are still going through the struggles of the pandemic.

Full-service, Customer-First Digital Business Account

Dean Henry –Executive Vice President (Global Commercial Services) at American Express, delivered comments on the launch of the all-new and fully digital Business Checking Account for small business enterprises in the United States of America.

We have come up with the revolutionary American Express Business Checking scenario from scratch. This is because small businesses revealed that they want to obtain more out of the existing business checking account services. The all-new version of Digital Business Account by American Express features a full-service, customer-first type of business checking account for ensuring the overall ease of cash management. Moreover, the account is also responsible for processing a wide range of payment types while earning high-yield interests upon balanced of the amount $500,000. Moreover, with this business account, customers will also be capable of earning and redeeming the exclusive membership reward points.

Henry added that it can be regarded as business checking with the best services of American Express. Businesses can look forward to receiving rewards, security, and high-end services while being capable of investing back into the respective businesses.

Membership Reward Points

During the start of 2022, customers of Business Checking accounts can easily earn points of Membership Rewards. They can easily redeem the same for ensuring deposits into the account of Business Checking.

Another major benefit that can be enjoyed by small businesses can enjoy the all-new account of Business Checking while earning the welcome deposit of amount $300 in the form of welcome bonus. Account holders are not expected to pay any amount of monthly fees. Moreover, there is no requirement of any minimum balance as well.

To top it all, small businesses having access to Business Checking accounts will also be capable of getting access to the network of as much as 37,000 ATMs that remain free of fees. This service is provided as American Express entered into the partnership with MoneyPass for providing such a service. Customers will also get access to one-stop and full-feature application that features the ability to ensure mobile-based check deposits.

When businesses have access to Business Checking accounts coming with a myriad of benefits along with reliable customer support services, it serves to be a valuable asset for small businesses. This also helps in freeing up the time of small businesses from banking-specific commitments such that they can continue with running their business seamlessly.

Features of Business Checking Accounts by American Express

Both small as well as mid-sized businesses in the United States of America can easily apply for the Business Checking account facility in a matter of 10 minutes. Once your application is approved, businesses can receive access to the following set of features:

- ATM Access Through MoneyPass: American Express has put forth its partnership with MoneyPass for offering access to an extensive network of as many as 37,000 ATMs that are fee-free to the customers of Business Checking accounts for balance enquiries and ATM cash withdrawals.

- Welcome Bonus: New customers of Business Checking accounts will be earning as much as $300 deposit amount in the form of welcome bonus for opening the account.

- No Monthly Fees: Businesses can enjoy $0 monthly maintenance fee without any requirement of maintaining a minimum balance.

- Competitive APY: Businesses can leverage the benefits of APY of a high yield of 1.1 per cent on the balances of around $500,000.

- Connected Membership Features: You can go through the American Express cards and the entire Business Checking account in a single place. With effect from 2022, customers of Business Checking accounts will also be earning points of Membership Rewards while redeeming the same for making deposits in to the account of Business Checking.

- Support for Multiple Transaction Types: Businesses can access a full spectrum of payment options for receiving as well as transferring funds –including Bill Pay, Debit Card, Check, Wire Transfers, and ACH.

- Intuitive and Simple App Functionality; You can easily manage the Business Checking accounts with the help of a one-stop, full-feature iOS application with the help of the mobile check deposit benefit.

- Faster Onboarding Process: Businesses can consider applying and getting a decision within a span of 10 minutes –without the requirement of stepping foot into the physical bank branch.

- Trusted Customer Service: You can get access to round-the-clock support services along with assistance from specialists of American Express –just a call or click away.

- View-based Access: The account is also known to provide members on the team with reliable access for viewing the account of Business Checking. Some additional role-based features will be available from 2022.

American Express is a leading integrated payment service provider across the globe. It helps customers with reliable access to its products, experiences, and insights for enriching the overall journey.