How the Chargeback Process Works & How to Win a Chargeback?

Let’s admit it! Almost every merchant has faced chargeback disputes from consumers at some point, and we know how painful it is! The situation worsens if you are unable to win the chargeback dispute even after trying hard.

Currently Host Merchant Services is seeking qualified applicants for the following positions:

Being the merchant, you can challenge the chargeback case and complete each and every stage of the entire process within tight timeframes. Don’t worry; we will guide you through the entire process.

In this article, we have discussed in detail how the chargeback process works and what you can do to win it. So, the next time a customer files a chargeback, you can contest the dispute by participating in a few steps that the card associations have created together with the acquiring and issuing banks.

Stages in a Chargeback Process

After a customer files a chargeback case and you decide to challenge it, you can initiate the following three dispute cycles:

2. The Second Chargeback

3. Arbitration

Let’s discuss each of these dispute types in detail.

1. First Chargeback

This is the initial chargeback dispute stage, which takes place in the following flow:

a) The cardholder files a chargeback to the issuing bank. Depending on the card association, the customer will have around 45-180 days to raise the dispute. In exceptional circumstances like family emergencies or natural calamities, they can even dispute a year-old chargeback.

b) The issuing bank then reviews the claim and may take up to 2-6 weeks to check the dispute’s validity. For example, Visa offers the issuing banks up to 30 days to review the claim raised by the customer.

c) After reviewing, the chargeback claim is taken forward to your acquiring bank or your payment processor, who then notifies you regarding the dispute. You will also get a notification from your cardholder regarding the claim.

d) Next, the money gets debited from your merchant account, and the cardholder is reimbursed, and it remains a temporary credit for the customer. This means the amount can be transferred back later to your merchant account if you win the dispute.

e) Once you receive the chargeback, you can either accept the claim raised or contest it. If you accept it, you will lose the chargeback as well as the fees. The acquiring bank will give you a tight deadline of around 7-10 days to explain the matter and defend yourself.

f) If you contest the chargeback, you can send relevant evidence to the acquiring bank to prove that you have fulfilled the customer’s order, who then sends it to the issuing bank. You will also need to submit some documents such as:

- Proof of shipping (typically through shipping receipt, tracking number, etc.)

- Matching billing and shipping addresses

- Transaction or sales receipt

- Positive AVS response

- Proof of delivery (for example, in the form of a confirmation email, a delivery receipt from the delivery service provider, etc.)

- Any details or proof of conversations with the customer, or any other evidence, which proves that you have fulfilled the order.

g) On receiving the evidence, the chargeback amount will get credited to your merchant account, again temporarily.

h) After receiving the evidence, the issuing bank reviews them. After review, it will then rule in favor of either you or the cardholder. Alternatively, depending on the reviewing results, the issuing bank can even file a second chargeback or pre-arbitration.

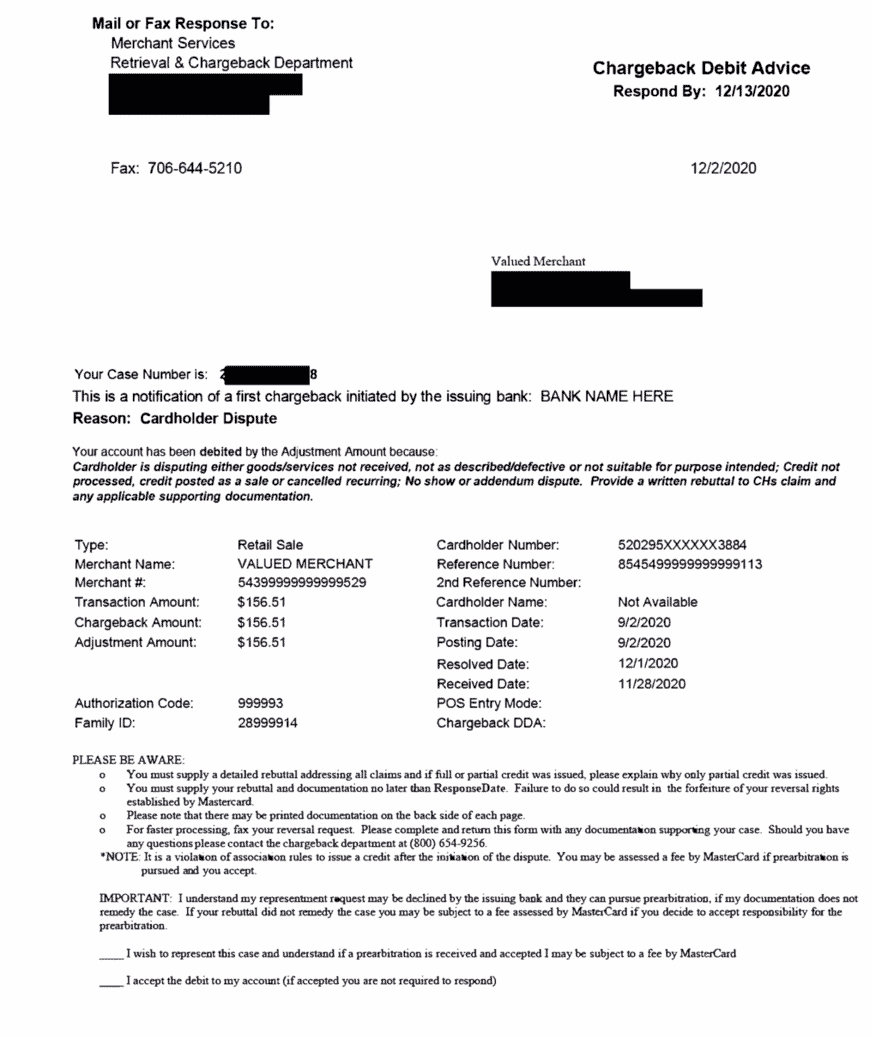

Sample Chargeback

2. Second Chargeback or Pre-Arbitration

It is the second round of fighting and is not applicable for Visa. The process takes place in the following steps:

a) The cardholder changes the chargeback code or submits new evidence.

b) The issuing bank then sends the claim to the acquiring bank with this additional evidence.

c) On revealing the claim, the acquiring bank further sends the chargeback to the merchant, that’s you, along with the additional details and evidence submitted by the cardholder.

d) Agin after receiving the chargeback, you can either accept or contest the claim. The same process follows – if you accept the chargeback, you will lose it along with the associated fees.

e) If you choose to challenge the chargeback and fight back, you can send more evidence to the acquiring bank to prove you have fulfilled the order.

f) On revealing the evidence, the issuing bank again rules in favor of the customer or the merchant. Alternatively, it can also call for arbitration.

g) If the issuing bank rules against you, you and the acquiring bank can either accept the chargeback or call for an arbitration yourselves.

3. Arbitration

This is your last chance to prove that you weren’t guilty and you have fulfilled all the order requests successfully, thus winning the chargeback dispute. The process involves the following steps:

a) The relevant bank would ask for arbitration to the applicable card.

b) The relevant bank would ask for arbitration to the applicable card.

c) The card association would review the submitted pieces of evidence from the issuing and acquiring banks, after which it will issue the final decision.

d) Then, the card association would charge the required fees to the losing bank.

e) Then, the card association would charge the required fees to the losing bank.

f) However, if the acquiring bank wins, the money is returned to your account permanently, and the issuing bank will repost the transaction to the cardholder. The fees associated with the arbitration process will be charged from the issuing bank.

To maximize your chances of winning a chargeback, you need to:

- Maintain accurate records and evidence of your order and payment details.

- Understand the entire chargeback process.

- Avoid second chargebacks by getting it right at the first go!

- Learn about the regulations and documentation requirements.

- Admit whenever you are wrong and never hide. It will only turn costly for you if you do.

- If you want to contest the chargeback, do so carefully and set your best foot forward. Because once the dispute is closed, you cannot petition the matter further, and you lose it forever!

Yes, it’s not going to be very easy to win a chargeback, but it’s not impossible. Having the right knowledge about the matter and submitting the right evidence and documents, you can definitely win it!