Fiserv Inc., a prominent financial services and payments technology company, has grown substantially by adopting advanced technologies and implementing key strategies. It reported notable growth figures for the September quarter. Fiserv’s growth may hinge on its continued development and release of new services, including recent projects like Cash Flow Central and the SMB Bundle, targeted at crucial customer segments such as financial institutions and merchants.

Key Takeaways

- Strong Growth Driven by Digital Payment Innovations: Fiserv’s Q3 earnings report highlights significant growth in digital payment solutions, especially through the Clover platform, which saw a 15% increase in transaction volume and a 28% rise in revenue. This growth is helping Fiserv remain competitive in a rapidly expanding digital payment landscape.

- Clover and Carat Platforms as Key Revenue Contributors: Fiserv’s merchant services strategy has become critical following the 2019 acquisition of First Data Corp. and its Clover POS system. In addition, the Carat platform is gaining traction among large retail clients, solidifying Fiserv’s position in both small business and enterprise markets.

- New Financial Services Platform and Charter Expansion: Fiserv introduced Cash Flow Central to support digital payments and merchant acquiring for financial institutions, acquiring ten clients since its launch. Additionally, the company’s recent approval for a merchant-acquiring charter in Georgia positions it to expand its service offerings in the financial sector.

- Focus on Small Business and e-Commerce Solutions: Targeting small and medium-sized businesses, Fiserv launched the SMB Bundle, an integrated package for payment acceptance and analytics designed to streamline operations. This move, alongside a partnership with PayPal for QR code payments, emphasizes Fiserv’s commitment to supporting the growth of digital payment options for smaller businesses and adapting to e-commerce trends.

Fiserv’s Q3 Earnings Highlight Growth in Digital Payments and Point-of-Sale Solutions

Image source

The digital payment sector is changing dramatically, highlighted by recent earnings from Fiserv Inc., a top provider of payments and financial services technology. The company reported a third-quarter net income of $564 million in Milwaukee, with earnings per share exceeding analyst forecasts.

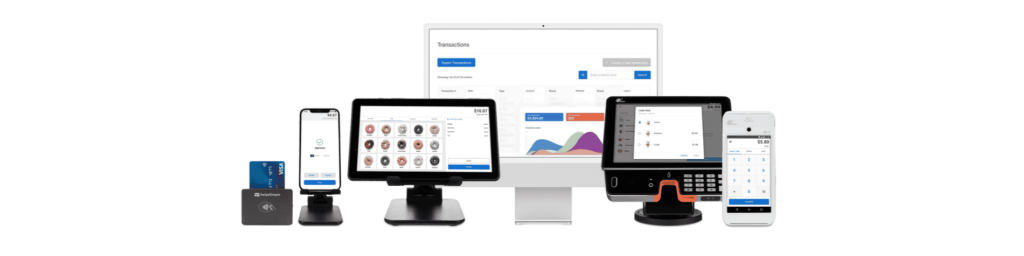

A critical development in Fiserv’s expansion was its 2019 purchase of First Data Corp. This $22 billion acquisition added the Clover point-of-sale (POS) system to Fiserv’s array of services, significantly enhancing Fiserv’s growth technology and boosting its merchant services offerings. Clover has become key to Fiserv’s strategy, offering businesses a flexible and expandable POS solution. In the third quarter of 2024, Clover processed $311 billion in transactions, marking a 15% increase from the previous year, according to Fiserv. Revenue from Clover rose by 28%. Additionally, the company repurchased $1.3 billion in shares.

Bob Hau, Fiserv’s Chief Financial Officer, mentioned that the company is witnessing solid revenue and volume increases from Clover. He stated that this progress is substantial enough for the company to aim for $4.5 billion in revenue next year. However, he noted that a slowdown in consumer spending has prompted management to temper expectations.

In the third quarter, Fiserv reported a 7% increase in adjusted revenue YOY, reaching $4.9 billion, with organic growth—excluding acquisitions—hitting 15%. The merchant solutions unit saw its revenue rise by 9% to $2.47 billion, driven primarily by small businesses, which accounted for $1.63 billion, also up by 9%.

The GAAP operating margin reached 30.7% in the third quarter and 27.7% for the first nine months of 2024, slightly changing from 30.8% and 25.2% in the same periods of 2023, respectively. In the Merchant Solutions segment, the GAAP operating margin improved to 37.7% in the third quarter and 36.2% over the first nine months of 2024, up from 34.8% and 32.9% in the corresponding periods of the previous year. For the Financial Solutions segment, the margin was 47.4% in the third quarter and 45.8% in the first nine months of 2024, an increase from 46.9% and 45.1% in 2023.

Net cash from operating activities increased 24%, totaling $4.41 billion in the first nine months of 2024, compared to $3.57 billion in the prior year.

Frank Bisignano expressed satisfaction with the third-quarter results, highlighting solid performances in both the Financial Solutions and Merchant Solutions segments and several significant new contracts. He noted that the company benefits from its critical role at the intersection of merchant and financial ecosystems, which are becoming more interconnected.

Apart from Clover, Fiserv has also developed the Carat platform to serve large enterprises with extensive digital payment and commerce solutions. Carat has become popular with significant retailers, including ten of the largest convenience store chains and nine of the top ten grocery chains in the U.S.

Building on these solid results, Fiserv continues broadening its offerings to align with shifting digital payments and e-commerce trends. The company’s partnerships and new product developments highlight its focus on innovation, particularly in enhancing payment flexibility and convenience for businesses of all sizes.

Digital Payments and E-commerce Driving Growth at Fiserv

Fiserv has broadened its e-commerce capabilities to adapt to the increase in digital payments. The company has collaborated with PayPal to launch QR code payment options, allowing merchants to take contactless payments easily. This move supports the rising consumer preference for digital and contactless payment methods.

The financial solutions division, covering banking, card issuing, ATM services, and Zelle peer-to-peer payments support, recorded revenues of $2.41 billion, a 4.3% increase. Digital payments were a significant driver within this segment, generating $987 million in revenue, marking a 5% growth.

Fiserv has also improved its digital payment solutions by integrating with platforms like Zelle, which supports peer-to-peer transactions. In the third quarter of 2024, Fiserv saw a 35% increase in the volume of Zelle payments processed, indicating a higher uptake of digital payment platforms.

Focusing on small and medium-sized businesses (SMBs), which play a crucial role in the economy, Fiserv introduced the SMB Bundle—a set of payment services specifically designed for small businesses. This package is available through Fiserv’s extensive distribution channels, including the Clover POS system, equipping SMBs with sophisticated payment solutions.

The SMB Bundle simplifies payment processing for small businesses by offering integrated payment acceptance, invoicing, and analytics features. Frank Bisignano mentioned that this bundle is expected to impact earnings next year positively. With these tools, Fiserv aims to enhance operational efficiency and market competitiveness for SMBs. However, Bisignano advised caution regarding these and other new initiatives. He pointed out that it is still early to make definitive judgments.

At the intersection of digital payment solutions and financial services, Fiserv’s ongoing advancements are designed to support businesses and financial institutions. Following the success of its e-commerce and SMB solutions, the company has continued to innovate in the financial services sector, expanding offerings that improve cash flow and merchant management for banks and credit unions. These recent developments set the stage for Fiserv’s next steps in enhancing its financial tools and strengthening the Clover brand.

Cash Flow Central and Merchant-Acquiring Charter Drive Growth in Fiserv’s Financial Services

Fiserv has been improving its financial services beyond just merchant solutions. The company introduced Cash Flow Central, a new platform that equips financial institutions with tools for digital payments and merchant acquisition. Since its launch a year ago, Cash Flow Central has acquired ten clients, including three additions in the third quarter of 2024.

The platform provides a range of tools that help financial institutions manage payments, cash flow, and merchant services, facilitating better customer service and more efficient operations for banks and credit unions.

During the quarterly analyst call, Bisignano announced that the company’s application for a merchant-acquiring charter in Georgia had been approved. The new financial services entity is slated to start operations next year, although Bisignano clarified that the company is not transitioning into a bank.

He also conveyed to analysts that the groundwork has been established for expanding into new services for new and existing clients, progressing toward the next generation of solutions. Bisignano emphasized that these developments are in place, although they are still in the initial phases.

Looking forward, Fiserv is focused on maintaining its growth by continuing to innovate and broaden its range of services. The company is set to introduce several new products under its Clover brand, including a new device expected to be released by mid-2024. These initiatives will likely bolster Fiserv’s standing in the merchant services sector.

Additionally, Fiserv has set a high revenue target of $4.5 billion for the Clover platform in the next year, underscoring its optimistic outlook for Clover’s growth and market share expansion.

About Fiserv

Fiserv, established in 1984 through the merger of First Data Processing and Sunshine State Systems, operates as a leading provider of financial services technology and payments, connecting a diverse range of businesses, financial institutions, and individuals globally. The company offers a broad spectrum of services, including digital banking solutions, account processing, network services, card issuer processing, payment, merchant acquiring, e-commerce, and payment processing solutions.

Fiserv supports thousands of financial institutions and millions of businesses across more than 100 countries. Among its notable products are CardHub, Carat, and Clover. Recognized for its industry impact, Fiserv holds memberships in prestigious indexes such as the Fortune® 500 and S&P 500®, and it has been listed as one of Fortune® World’s Most Admired Companies™. In a recent development, Lance Fritz was appointed to the Fiserv Board of Directors in February 2024.

Conclusion

Fiserv’s strategic investments in digital payment solutions and financial services have positioned the company as a versatile provider in a rapidly evolving industry. Through the successful expansion of platforms like Clover, partnerships with major payment networks, and initiatives like Cash Flow Central, Fiserv’s growth technology has enabled the company to consistently adapt to meet the changing needs of merchants, financial institutions, and consumers.

The company’s emphasis on innovation, from enhancing e-commerce capabilities to supporting small businesses, indicates a strong commitment to staying competitive. These ongoing developments highlight Fiserv’s potential for growth, particularly as it continues to bridge the gap between digital payments and traditional financial services.