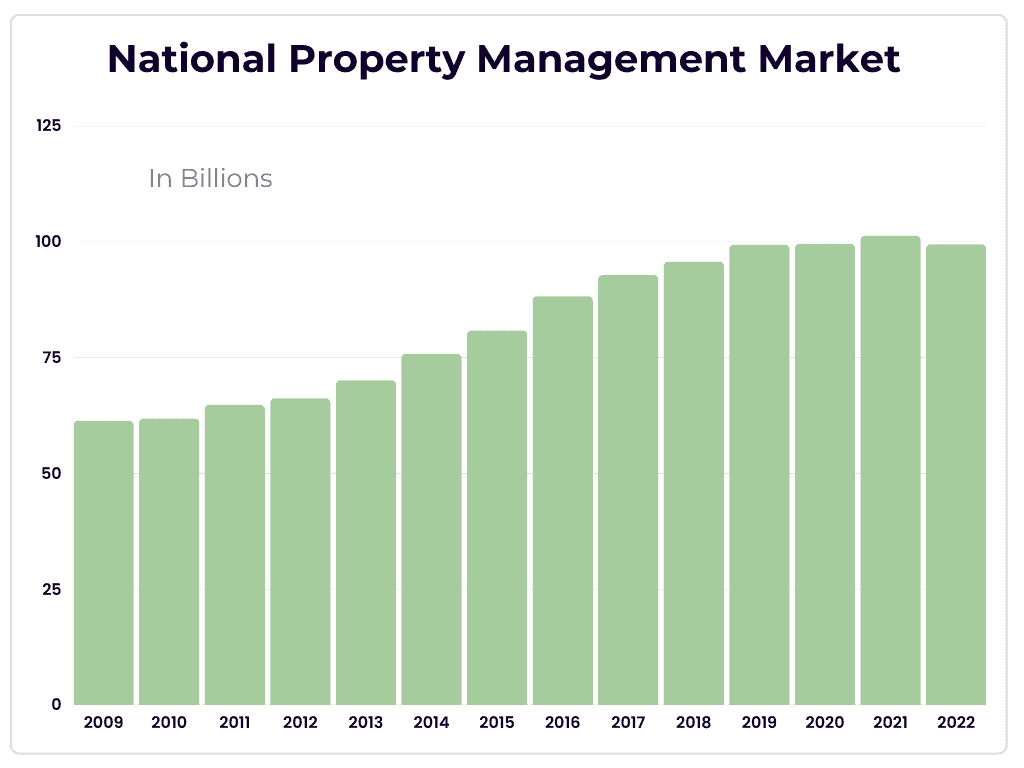

In the United States, the property management industry is in continuous growth and generates 16% of the country’s GDP. While this is a field that’s ripe with profitable opportunities, it can be difficult for a property manager to fulfill the multiple duties required of them, especially as their list of properties grows.

That’s where property management systems come in. These software solutions allow landlords, investors, and property managers to stay organized, communicate with their tenants, and generally manage all the properties they have. If you are looking to learn which one works best for your real estate business, you’ve come to the right place.

In this article, you’ll learn about the ten best property management systems available now, what makes them great, and what their drawbacks are.

10 Top Property Management Systems

From mobile oriented solutions to software that can fit both small- and large-scale property managers, here are the best property management systems available today:

- Buildium

The Buildium property management software solution is one of the most comprehensive options on the market today. No matter what you need, this software can handle it all.

The software offers a wide range of options for managing rental properties in all their aspects. The interface lets you manage vacancies, maintenance, and accounting, while the accounting package offers automatic rent reminders, a full ledger, and the option to generate reports on demand. Rent can even be paid online through a tenant portal.

Buildium’s basic bundle covers up to 150 units for $50 per month, and there are larger packages available with maximum support for 5,000 units. The best value will be found in the higher tiers, since the unit prices are lower. However, $50 per month for 150 units works out to $0.33 per unit, making it an affordable expense. You can also try Buildium for 15 days for free before purchasing a subscription to see if it is right for your company.

One downside to this software is that the company uses a ticket-based customer service system, and responses can take several hours. It is important to note, however, that the team is highly knowledgeable and can easily guide you through the majority of common issues.

As well as its native functionality, Buildium is compatible with many well-known third-party systems. Among them are Apartment List, Apartments.com, Zillow, HappyCo, Forte, Happy Inspector, MSI, HotPads, Lovely, Nelco, RevSpring, PayNearMe, TransUnion, Tenant Turner, Trulia, and Zumper.

Pros

- Built by property managers.

- Rent is automatically collected via a tenant portal.

- Online ticket help is available during business hours.

- There are numerous training materials available.

- Easy to use.

Cons

- Long response times on customer service tickets

- Not suitable for sole property managers

- TurboTenant

There are plenty of rental property management software platforms offering free trials, but they are usually limited to a few units or for a short period of time. However, unlike other rental management software, TurboTenant is completely free regardless of how many units you manage. Its easy-to-use interface and straightforward setup make TurboTenant an excellent free option for rental property management software.

TuroTenant provides landlords with a number of features aimed at making tenant administration easier, such as handling applications online, screening tenants, and sending bulk tenant messages.

Some optional services are available for a one-time fee, such as state-specific lease agreements for $39, unlimited electronic signatures for $9, and 32 landlord forms for $145.

Using rental listing sites like Realtor.com, Apartment List, Rent.com, or even Facebook Marketplace, landlords can market vacant homes across several platforms with a single click. A tenant’s credit report can be checked using TransUnion, any documents can be sent and signed online, and maintenance requests can be made. Payments by ACH are free, but payments by credit card have a fee of 3.49%.

However, Turbotenant is only free for landlords because it passes the costs to the tenants. Tenants must pay an application and screening fee ($55) and a fee for rent payments made with credit cards (3.49%). There’s also renter’s insurance at $8 per month.

Pros

- Fully free property management solution.

- Excellent for DIY landlords.

- Customer service is available 24 hours a day, seven days a week via phone and online.

Cons

- Tenants bear the burden of the software costs.

- Limited features.

- AppFolio

AppFolio is primarily designed for landlords with a large number of properties, but it can also be used by landlords seeking to expand their business. A variety of units can be accommodated, including single-family homes as well as large apartment complexes, and the services can be customized. Instead of paying an all-in-one fee, you pay a predetermined fee per unit. Manage as many units as you like with no tiered pricing or other restrictions. In addition, you pay separately for advanced features, so you only pay for what you use.

In order to sign up, you must first pay a $400 onboarding fee. In addition, the following unit fees apply on a per-unit basis:

- Residential rentals: $1.40 per month

- Commercial rates: $1.50 per month

- Student accommodation: $1.40 per month

- HOAs: $0.80 per month

There is also a minimum monthly cost of $280 for residential landlords, and to receive the greatest price on residential units, you’ll need at least 200 units.

The software includes a number of useful property management features, such as the ability to build professional-looking websites for your properties, purchase sales leads, screen tenants, and purchase renters’ and landlord’s insurance. The software also allows you to track maintenance requests, pay invoices, collect debts, and accept online payments. As previously mentioned, some of these services are extra-cost, but you only pay for what you use.

Pros

- Multiple plan options including residential landlord plans, community association plans, and commercial real estate landlord plans

- Supports all unit types

- Mobile app available

Cons

- Monthly minimum fees make it ill-suited for property managers with a small number of units

- Propertyware

In general, Propertyware is intended for landlords of single-family homes. Although it lacks some features other software suites have, this is a feature, not a defect. Due to the fact that there are no commercial renting capabilities, the user interface is significantly simpler than most comparable applications. Whether you rent out a single property or hundreds, it works equally well regardless of how many units you have.

This software comes in three price tiers: Basic, Plus, and Premium, which cost $1, $1.50, and $2.00 per unit, respectively. A minimum payment is also required for each tier, which is $250 per month for Basic, $350 for Plus, and $450 for Premium.

With the Basic package, you can generate financial reports, market vacant homes, schedule maintenance, collect rent payments, and screen prospective renters. In addition to these features, the Plus plan offers two-way text messaging, digital signatures, and inspection scheduling. In addition to the previously mentioned features, there is a maintenance management portal and a supply vendor portal included in the Premium plan.

One limitation of Propertyware is its lack of third-party support. Other than Mail Merge and DocuSign, third-party support is not available. You won’t need to worry about this if you’re searching for a complete management solution. However, using products or services such as Apartments.com is not possible if you with this software.

Pros

- Great option for large portfolio management

- Mobile app available

- Simple interface

Cons

- Limited features

- Pricing is more suitable for large portfolios

- Intended for single family property management

- SimplifyEm

SimplifyEm was created by real estate professionals for real estate professionals. Although it can support up to 2,000 units, it is best suited to landlords with fewer units. In the case of fewer than ten units, your monthly payment will be only $20. The price increases by $10 per month for every additional 10 units purchased, so your monthly fee would be $60 if you have 50 units. Billing is then done in 25-unit increments, but the base rate remains at $1 per unit. A 15-day free trial is also available to see how it works before committing.

SimplifyEm’s key selling point is its simplicity, hence the name. This tool is designed to be simple for even first-time landlords to use, and the company offers live phone and email support for that purpose.

Renters can purchase renters’ insurance through the tenant site, and the software tracks income and expenses. Landlords can generate financial reports, log maintenance requests, screen tenants, and perform other critical tasks. Also available are integrations with Zillow, TransUnion, Fidelity, ACH.com, NARPM, and Trulia.

Pros

- One to 2,000 units are supported.

- Real estate professionals created it.

- Has sophisticated features

- Great option for first-time landlords with a small portfolio

Cons

- The platform can limit your growth as it doesn’t support more than 2,000 units

- MRI Software

Commercial properties such as large apartment buildings typically use MRI software. Many of these properties are held by groups of investors rather than by a single landlord, which means you need a system with features suited for multi-landlord properties. Thus, this program offers a variety of features that are not found in similar products. Aside from basic rental management, it offers a multitude of planning capabilities. Asset management, space management, strategic planning, and compliance with public housing regulations are all made easier with MRI Software. Additionally, it is available as a cloud-based service or as an installed program.

One downside of MRI Software is that the pricing for this service is a bit more ambiguous than for other property management services. MRI Software does not offer a free trial, and the price can only be obtained by contacting them directly. In spite of that, it has received generally positive reviews on various landlord websites, with investors praising its value. For you to know whether they are a good match for you, you will need to receive a quote.

Pros

- Several advanced features are included.

- Reliable business with a long history

- Simple to use

Cons

- Pricing is not available online, and you’ll need to contact the company for a quote.

- Yardi Breeze

The Yardi Breeze cloud-based property management system is among the earliest of its kind, and it continues to be a top-notch service. The company has been in the industry for a long time, even before the cloud came along.

Pricing for Yardi Breeze is transparent, which is a plus. The company charges a monthly fee of $1 per property instead of tiers. The cost of the program is very low, and it makes it very competitive in the current market. There is however a $100 minimum charge per month for residential homes and $200 for commercial properties, which means you will have to pay more to maintain properties with fewer than 100 units. A Breeze Plus upgrade package is also available. It costs $2 per unit, with a minimum monthly charge of $400, for both residential and commercial establishments. The first 30 days of training are free, and customer support is available 24/7.

With Yardi Breeze you can manage applications, automate marketing, and collect rent online. However, a feature that’s unique to Yardi Breeze is the ability for tenants to submit repair requests along with smartphone images.

Pros

- Characteristics that are unique, such as the ability for tenants to upload pictures for repair requests

- Customer service and training are provided at no cost.

Cons

- Lack of a mobile app

- Rent Manager

A versatile property management platform, Rent Manager can handle any number of units. Additionally, it’s convenient to use on the go. Through the cloud, you can access it from any computer, but you can also download an app for your smartphone. Receive payments, enter work orders, schedule maintenance, and enter work orders from your phone’s screen. In addition, you can snap images and save them to the cloud, which is important for maintenance.

On the portal, you can generate financial reports, manage work orders, and rent unoccupied units. You can also create a very professional-looking website for your property with Rent Manager’s website-building tool. Furthermore, maintenance requests can be tracked from beginning to end.

While pricing is only available as a quote that must be requested by phone, there is a free trial version if you want to give it a try.

Tenants also benefit from using Rent Manager. Online lease signing eliminates the need for mail and postage, and rent can be paid online from any device and payment history can be viewed. As a result, landlords and tenants are on the same page.

Pros

- Simple to set up

- Built-in website builder

- Gets tenants and landlords on the same page with online contract signing and payments.

Cons

- Pricing is only available upon request.

- Re-Leased

Whether it’s a commercial property, residential property, or an office or industrial space, Re-Leased is designed for all types of properties. The customer service department is available 24/7 and there is no limit to the number of units you can have. You won’t have to worry about switching providers as your company grows.

Various monotonous tasks can be automated with the software. Using it, you can send out automatic rent reminders and automate your property listings. Repair projects are greatly simplified with an integrated communications center that links you, your maintenance workers, and your tenants. Additionally, Google Calendar, Outlook, and Microsoft 365 can be connected to sync all of your calendars.

However, pricing information is not publicly available. To find out how much the software will cost, you’ll need to contact the company and request a quote for your property.

Pros

- Appropriate for a variety of properties

- Microsoft 365 integration

- Xero support

- Enterprise-level protection

Cons

- You need to contact the company to get a price quote.

- Avail

Avail is one of the most popular property management programs in the world. Because it’s aimed primarily at small landlords and DIYers, it lacks several capabilities that you’d expect from more robust commercial hardware. However, it does have the advantages of making the software easier to use and understand. As a result, it’s a convenient way to supplement your income by renting out one or two apartments.

It does, however, have a number of beneficial features. You can use it to screen tenants and to create digital leasing contracts that your tenants can sign online. The software generates state-specific leases that comply with local laws and regulations. Online rent payments can be made from any device, but a small fee will apply.

Avail’s biggest advantage is its low cost: it’s totally free. It can be used for an unlimited number of units without cost. However, the paid edition offers additional features such as personalized leases, no-fee rent payments, and next-day payments. The price is not competitive for larger properties, but it’s an excellent value for small landlords.

Pros

- Simpleness of use

- Excellent customer service

- Great pricing for small time landlords

Cons

- Limited tutorials

- The reporting module is not particularly reliable.

- Pricing is not competitive for landlords with larger portfolios

Final Word

The best property management system for your real estate business will largely depend on the size of your portfolio, and the features you need. For instance, options like Avail and SimplifyEm are great for landlords with a small number of units, while Buildium and AppFolio are a better fit for those that manage a large number of properties.

If you are looking for free software, Avail and TurboTenant are completely free, but their features are more limited compared to other options on the list. Before you decide on one option over the other, make sure you take the time to consider your needs and what the companies offer.