As a restaurant owner or manager, you have a lot on your plate. From managing your team and serving delicious meals to keeping track of your financials, there is always something to be done. That’s where restaurant accounting software comes in. But with so many options available, how do you choose the best restaurant accounting software for 2023 that you need? That’s where we come in.

In today’s digital age, having a reliable and efficient system in place for managing your financial information is crucial for the success of your business. In this article, we will review some of the top restaurant accounting software options for 2023 and discuss the key features and benefits of each. We’ll cover everything from basic accounting functions like tracking sales and expenses to more advanced features like inventory management and real-time reporting.

Whether you’re running a small cafe or a large chain of restaurants, there is a software solution that can meet your needs. So, if you’re looking to improve the financial health of your business and streamline your operations, read on to learn more about the best restaurant accounting software for 2023.

What’s restaurant accounting software?

Restaurant accounting software is specifically designed for managing the financial aspects of a restaurant business. It includes the same types of modules as standard accounting systems but is optimized for the unique needs of the restaurant industry. Many programs integrate with other systems, such as POS, tax management, cost tracking, and payroll. These integrations help streamline various aspects of restaurant management and make it easier to track and analyze financial data.

How We Made The List?

When we compiled this list of the top bookkeeping software for restaurants, we considered many factors to ensure that we were recommending high-quality options that would meet the needs of our readers. Some of the key criteria we used in our evaluation included functionality, integrations, ease of use, and value.

Functionality

Functionality is an important consideration when choosing restaurant accounting software. We looked for software that offered a range of features specifically tailored to the requirements of the restaurant industry, including POS, payroll, payable accounts, and taxes. We also considered the overall level of functionality offered by each software program, looking for options that could handle a wide range of tasks and help streamline the financial management of a restaurant business.

Integrations

Integrations are another critical factor to consider when choosing restaurant accounting software. Many businesses use a range of different systems to manage different aspects of their operations, and it’s important to select software that can easily integrate with these other systems. We considered the number and popularity of integrations available for each software program, as well as the ease of setting up and using these integrations.

Ease of Use

Ease of use is also an important consideration when choosing restaurant accounting software. Automation and streamlining can make repetitive and time-consuming tasks faster and easier to accomplish, and we looked for software that was intuitive and simple to set up and use. This is especially important for small businesses needing more dedicated IT staff to handle technical issues.

Value

Finally, we considered value when evaluating our list of the best bookkeeping software for restaurants. We looked at the prices of each software program and compared them to the features and functionality offered. While getting what you pay for is important, we also wanted to recommend options that offered good value for money and didn’t break the bank.

Best Restaurant Accounting Software For 2023

We’ve compiled a list of the top five restaurant accounting programs for operating your restaurant business:

- QuickBooks Online

- Restaurant365

- MarginEdge

- Xero

- Davo

QuickBooks Online

QuickBooks Online is a powerful accounting software platform that is not specifically designed for the restaurant industry. However, its sophisticated reporting features, scalability, and portability make it an attractive option for restaurants, particularly when combined with POS systems and other tools.

QuickBooks Online can perform a variety of operations on its own, including issuing purchase orders, monitoring time and inventory, managing multiple locations, handling bill and invoice confirmations, and generating profit and loss statements.

It also allows you to construct reports based on up to 40 distinct tracking categories, including location and sales channel. The Advanced subscription includes limitless tag groups, which should be plenty for most small businesses.

While QuickBooks Online is an excellent accounting software platform, it does not provide a complete restaurant management solution. This implies that restaurant owners and managers may need to spend more time locating and configuring connections with other restaurant management solutions and determining how to personalize reports for their individual needs.

QuickBooks Online provides excellent reporting features, but tailoring them to the unique needs of a restaurant business may necessitate more effort.

Pros

- When opposed to other restaurant-specific software, it is highly affordable.

- Excellent catering project accounting

- Immediately share your records with an outside accountant.

- Separately track classes and places

Cons

- There is no support with staff scheduling.

- Custom print templates are difficult to produce

Restaurant365

Restaurant365 is a comprehensive restaurant management platform that offers virtually all of the functionalities a restaurant business could need to stay on top of its finances and manage its team effectively.

It is a popular choice among restaurant owners and managers due to its wide range of features and ease of use. One of the key advantages of Restaurant365 is its integration with the best POS systems, which helps to streamline operations and eliminate the need for double data entry. It means that your financial data is automatically recorded and updated in real-time, making it easy to get a clear picture of your business’s economic performance.

Whether you’re running a small cafe or a large chain of restaurants, Restaurant365 is a powerful tool that can help you manage your business more efficiently and effectively.

Pros

- Very complete, assisting in the expansion of sales, management of food prices, and labor optimization.

- Separately track revenue and spending by location.

- A restaurant-specific platform designed to address the issues of restaurant management.

Cons

- This system is expensive, with the basic accounting package beginning at $289 monthly. The most preferred package, which includes accounting, management, scheduling, and other features, costs $399 per month when paid annually.

MarginEdge

MarginEdge is a restaurant management system that strongly emphasizes invoicing, food expenses, and inventory control. It is a powerful tool that helps restaurant owners and managers track and manage these critical aspects of their business, ensuring they have the information they need to make informed decisions.

While MarginEdge is not a standalone accounting system, it integrates seamlessly with popular accounting software programs such as Sage and QuickBooks. This allows users to take advantage of the advanced financial management capabilities of these systems while also benefiting from the specialized features and functionality of MarginEdge. By integrating with these systems, MarginEdge helps to customize and optimize them for the unique needs of the restaurant industry, making it easier for users to track and analyze their financial data.

Pros

- Straightforward pricing

- Integration with other software

- Automatically recalculates the pricing of recipes based on the most recent invoice prices.

Cons

- There is no option for employee scheduling.

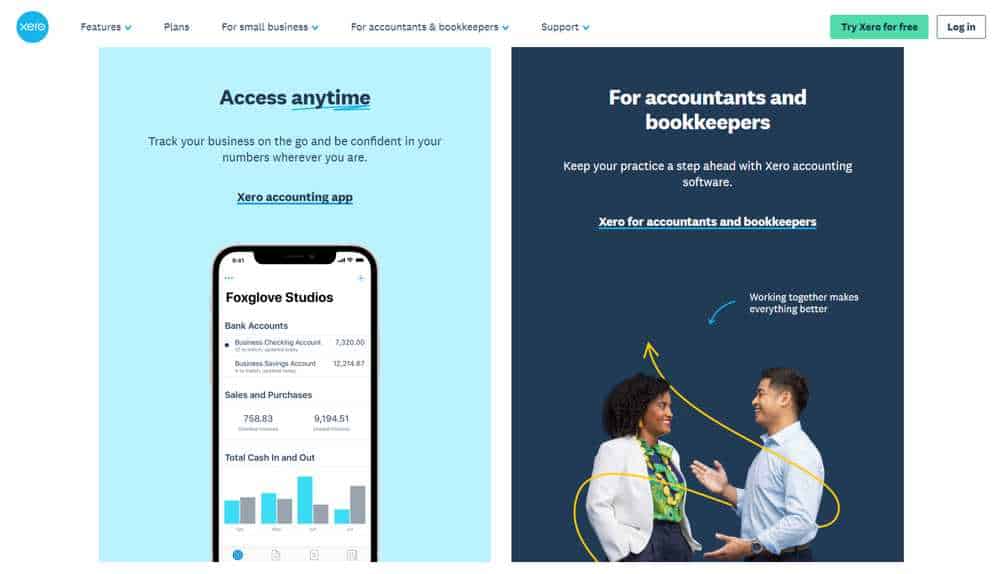

Xero

Xero is an excellent solution for small businesses because of its low cost and comprehensive feature set. This cloud-based system comes with a variety of features, including fixed asset management, which enables owners to determine depreciation, payrolls, revenue and expense monitoring, vendor bill payments, online bookkeeping, real-time money management, reconciliations, and invoicing. In addition to it, there is a smartphone app.

Xero has a low starting price of only $11 per month, and this price already includes 20 invoices, 5 bill entries, bill capture, and receipts, as well as bank reconciliation. The cost of the following step is $32 monthly, which is significantly more than the cost of the most comprehensive plan, which is $62 monthly. Because it can easily interact with hundreds of other applications, Xero is a wonderful choice for restaurant owners who are currently using different software to manage their establishments.

Pros

- The easy-to-use mobile app gives you access to all of your accounting tools no matter where you are.

- Maintain an accurate inventory count and use your collected data to generate invoices and orders.

- It allows you to create reports and communicate with your accountant on those reports.

Cons

- Since the system was not developed with restaurants in mind particularly, certain features may not meet your requirements and will require adjustment upon onboarding.

Davo

Restaurant operators will find Davo to be an invaluable tool for managing sales taxes. Even though it is not a full accounting program, it may be combined with your point of sale system or other accounting software to provide you with a more complete set of capabilities.

Davo pulls information from your POS and calculates your sales tax. Additionally, it can automatically submit and pay sales taxes, simply move sales tax to a protected holding account, and give daily reports. It is a data recovery technology hosted in the cloud and provides prompt service. Each location adds an additional $39.99 per month to the total cost.

Pros

- Compatible with all of the leading point-of-sale systems

- Put away the sales tax daily

Cons

- It’s not an entire accounting system by any means.

Conclusion

In conclusion, it is essential for restaurant owners and managers to have a reliable and efficient system in place for managing their financial information. Restaurant accounting software is specifically designed to meet the unique needs of the restaurant industry. It can help streamline various aspects of restaurant management, from tracking sales and expenses to generating reports and analyzing data.

When choosing the best restaurant accounting software for your business, it is essential to consider factors such as functionality, integrations, ease of use, and value. In this article, we reviewed some of the best restaurant accounting software options for 2023 and discussed the key features and benefits of each. Whether you’re running a small cafe or a large chain of restaurants, there is a software solution that can meet your needs and help improve the financial health of your business.