SaaS companies are changing the way businesses operate. With the rise of cloud computing, these companies offer software solutions that can be accessed from anywhere, anytime. This has led to increased flexibility, scalability, and cost-effectiveness for businesses of all sizes. In 2023, we can expect to see more SaaS companies emerge and existing ones continue to innovate. Let us look at the top SaaS companies in 2023 to watch closely.

Top SaaS Companies in 2023

Zoom

Company Overview

Zoom Video Communications, Inc. is a publicly-traded company headquartered in San Jose, California. It was founded by Eric Yuan, a former Cisco WebEx engineer, who wanted to create a video conferencing platform that was easy to use and reliable. Zoom’s mission is to make video communications frictionless.

Products and Services

Zoom offers a variety of products and services to meet the needs of individuals, businesses, and organizations of all sizes. Some of their main products include:

Zoom Meetings: a video conferencing solution for virtual meetings, webinars, and conference calls.

Zoom Rooms: a software-based conference room solution that enables users to join Zoom meetings from conference rooms.

Zoom Phone: a cloud-based phone system that enables users to make and receive calls over the internet.

Zoom Video Webinars: a solution for hosting virtual events such as webinars, virtual conferences, and town hall meetings.

In addition to these products, Zoom also offers various features and add-ons such as recording, virtual backgrounds, and integrations with other software applications.

Target Market

Zoom’s target market includes individuals, businesses, and organizations of all sizes who are in need of a reliable and user-friendly video conferencing solution. Zoom’s platform is suitable for a wide range of industries, including education, healthcare, finance, government, and more. With the COVID-19 pandemic causing a massive shift towards remote work and virtual meetings, Zoom has seen a significant increase in demand for its services.

Business Model

Zoom’s business model is based on a freemium pricing model, which means that they offer a basic version of their platform for free and charge a fee for additional features and add-ons. The free version of Zoom includes features such as unlimited one-on-one meetings and group meetings of up to 100 participants with a 40-minute time limit. Paid plans start at $14.99 per month per host and include features such as longer meeting durations, more participants, and additional administrative controls.

Funding

Zoom has raised over $1 billion in funding since its founding in 2011. In April 2019, Zoom went public on the NASDAQ stock exchange with an initial public offering (IPO) price of $36 per share. Since then, Zoom’s stock price has soared, and as of March 2023, it is trading at over $300 per share.

Interesting Points about the Brand

Zoom’s founder and CEO, Eric Yuan, was once a Cisco WebEx engineer who quit his job to start Zoom after being frustrated with the limitations of existing video conferencing solutions.

Zoom was initially launched as a B2B solution but has since expanded to include B2C offerings such as the free version of Zoom and Zoom for Home.

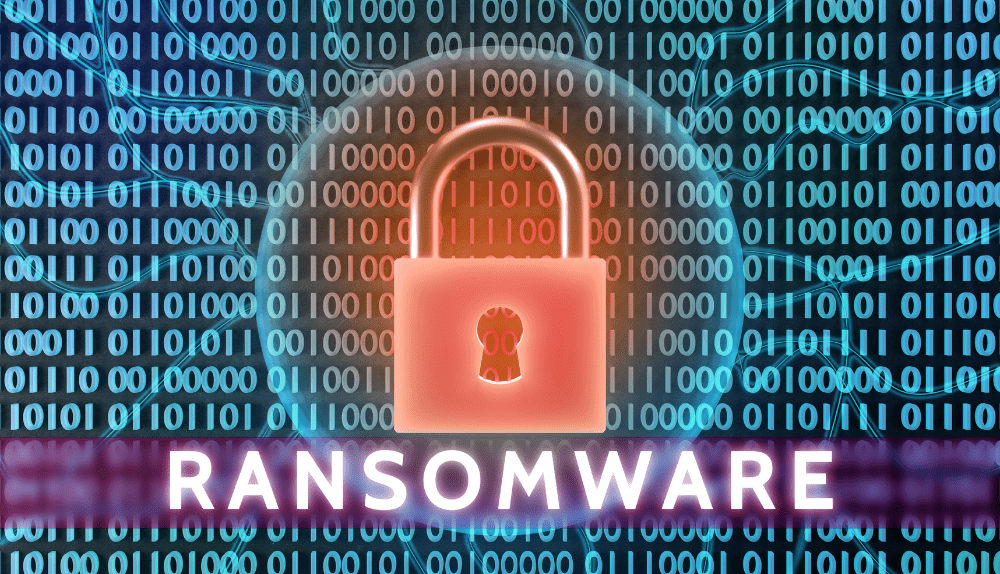

Zoom has faced some criticism for privacy and security concerns, particularly in 2020 when the platform experienced a surge in usage due to the COVID-19 pandemic. However, the company has taken steps to address these concerns and improve its security features.

Zoom has been recognized as one of the best places to work in the Bay Area, and it has won numerous awards for its culture and employee satisfaction

Wrike

Company Overview

Wrike is a software-as-a-service (SaaS) company that was founded in 2006 by Andrew Filev. The company is headquartered in San Jose, California, and has offices in several countries, including Ireland, Ukraine, and Russia. Since its inception, Wrike has grown rapidly, and today it has more than 20,000 customers worldwide. The company’s mission is to help teams work smarter, not harder, by providing them with a single platform to manage their projects, collaborate, and communicate.

Products and Services

Wrike’s flagship product is its project management and collaboration software. The software is cloud-based and is designed to help teams of all sizes manage their projects more efficiently. Some of the key features of Wrike’s software include task management, team collaboration, time tracking, customizable workflows, and project reporting. The software is also highly customizable and can be tailored to meet the specific needs of individual teams and organizations.

In addition to its project management software, Wrike also offers a range of other products and services, including:

Wrike for Marketers: A tailored solution designed specifically for marketing teams, which includes features like digital asset management, request forms, and proofing and approval workflows.

Wrike for Professional Services: A solution designed for service-based businesses, which includes features like resource management, project accounting, and billing and invoicing.

Wrike Analyze: A business intelligence tool that provides insights into project performance, team productivity, and resource utilization.

Target Market

Wrike’s software is designed to meet the needs of teams and organizations of all sizes and across a range of industries. The company’s target market includes:

Small and medium-sized businesses (SMBs) looking for a cost-effective project management solution.

Large enterprises that need a scalable, customizable project management solution.

Marketing teams that need a solution tailored to their specific needs.

Service-based businesses that need a solution for managing projects and resources.

Business Model

Wrike operates on a subscription-based business model, where customers pay a monthly or annual fee for access to its software. The company offers a range of pricing plans to suit the needs of different teams and organizations. Wrike’s pricing plans are based on the number of users and the features included in the plan. The company also offers a free trial of its software, which allows customers to test the software before making a purchase.

Funding

Since its inception, Wrike has raised over $25 million in funding. The company’s most recent funding round was in 2018, where it raised $10 million in a series D funding round led by Bain Capital Ventures. The funding was used to expand the company’s product offerings and accelerate its growth.

Interesting Points about the Brand

Here are some interesting points about Wrike that make it stand out from other SaaS companies:

Wrike was named one of the fastest-growing companies in North America by Deloitte in 2019.

The company has won several awards for its software, including the 2019 SaaS Award for Best Project Management Software and the 2020 Trust Radius Award for Best Customer Support.

Wrike has a strong focus on security and privacy. The company is SOC 2 compliant and has multiple security certifications, including ISO 27001 and GDPR.

The company has a strong commitment to sustainability and has implemented several initiatives to reduce its carbon footprint. These include using renewable energy sources, reducing waste, and promoting eco-friendly practices.

Wrike is a top SaaS company to watch out for in 2023. With its innovative software solutions, strong focus on customer satisfaction, and commitment to sustainability, Wrike is poised for continued success in the years to come.

Stripe

Company Overview

Stripe was founded in 2010 by brothers John and Patrick Collison, who grew up in rural Ireland and taught themselves to code at a young age. After selling their first company, Auctomatic, in 2008, they decided to start Stripe to solve the problem of online payments. Since then, Stripe has grown into one of the largest and most successful fintech companies in the world. The company is headquartered in San Francisco, California, and has offices in several other countries, including the UK, Ireland, Singapore, and Australia.

Products and Services

Stripe offers a range of online payment solutions for businesses, including:

Payments

Stripe’s Payments product allows businesses to accept payments from customers anywhere in the world, in more than 135 different currencies. Payments can be made using credit and debit cards, Apple Pay, Google Pay, and other popular payment methods.

Billing

Stripe’s Billing product allows businesses to create and manage subscriptions, send invoices, and handle other billing-related tasks in a streamlined and automated way.

Connect

Stripe’s Connect product allows businesses to build and manage online marketplaces, where buyers and sellers can transact securely and easily. Connect handles all of the complicated payment and regulatory issues that come with building a marketplace, so businesses can focus on building their product and growing their user base.

Radar

Stripe’s Radar product uses machine learning to help businesses detect and prevent fraud. Radar analyzes billions of data points to identify fraudulent activity, and can be customized to suit the specific needs of each business.

Target Market

Stripe’s target market is primarily small to medium-sized businesses that sell goods or services online. The company’s easy-to-use payment solutions, flexible APIs, and robust developer tools make it an attractive option for businesses of all sizes, from independent freelancers to large enterprise companies.

Business Model

Stripe’s business model is based on taking a small percentage of each transaction processed through its platform. The company charges a standard fee of 2.9% + 30¢ per successful transaction, with no additional monthly or setup fees. This pricing model makes Stripe an affordable option for businesses of all sizes, while still allowing the company to generate significant revenue.

Funding

Stripe has raised more than $2 billion in funding since its founding, from some of the world’s most prominent venture capital firms, including Sequoia Capital, Andreessen Horowitz, and General Catalyst. In March 2021, Stripe raised $600 million in a funding round that valued the company at $95 billion, making it one of the most valuable startups in the world.

Interesting Points about the Brand

Here are a few interesting points that make Stripe stand out as a top Saas company to watch out for in 2023:

Developer-friendly

Stripe is known for its developer-friendly APIs and robust set of tools for building custom payment solutions. This has made the company a favorite among developers and has helped to fuel its rapid growth.

Global reach

Stripe’s platform supports payments in more than 135 different currencies, making it an attractive option for businesses that operate globally. The company also has offices in several countries, including the UK, Ireland, and Australia.

Slack

Company Overview

Slack was founded in 2013 by Stewart Butterfield, who previously co-founded Flickr. The company is headquartered in San Francisco, California, and has additional offices in New York, Dublin, Vancouver, Tokyo, and Melbourne. Slack’s mission is to make people’s working lives simpler, more pleasant, and more productive.

Slack’s platform allows teams to collaborate and communicate through channels, direct messaging, and integrations with other tools. The platform offers features such as file sharing, video and voice calls, and custom app integrations. Slack has over 12 million daily active users as of 2023, and the company has been valued at over $23 billion.

Products and Services

Slack’s main product is its messaging platform, which allows teams to communicate and collaborate effectively. The platform offers features such as channels, direct messaging, video and voice calls, and file sharing. Slack also offers a variety of integrations with other tools, such as Google Drive, Trello, and Salesforce.

In addition to its messaging platform, Slack also offers a range of enterprise-level features for larger organizations, such as enterprise mobility management, security and compliance features, and enterprise grid for larger deployments.

Target Market

Slack’s target market is primarily teams and organizations of all sizes that require an efficient way to communicate and collaborate. The company has a strong presence in the technology industry, with customers such as Airbnb, Lyft, and Shopify. However, Slack has also gained popularity in other industries, such as finance, healthcare, and education.

Business Model

Slack operates on a freemium business model, which allows users to use the platform for free with limited features. The company generates revenue through its paid plans, which offer additional features such as unlimited message history, group voice and video calls, and priority support.

Slack’s paid plans are priced per user per month, with pricing ranging from $6.67 per user per month for the standard plan, to $15 per user per month for the plus plan. The company also offers enterprise-level features, which are priced on a case-by-case basis.

Funding

Slack has raised over $1.4 billion in funding to date. The company’s most recent funding round was in 2019, where it raised $427 million at a valuation of $7.1 billion. Notable investors in Slack include SoftBank, Accel, and Andreessen Horowitz.

Interesting Points about the Brand

Slack was originally developed as an internal tool for Stewart Butterfield’s game development company, Tiny Speck.

The name “Slack” is an acronym for “Searchable Log of All Conversation and Knowledge”.

Slack’s logo features a hashtag symbol, which has become synonymous with the company.

Slack has a strong culture of remote work, with over 70% of its employees working remotely.

In 2020, Slack was acquired by Salesforce for $27.7 billion, marking one of the largest tech acquisitions in history.

Atlassian

Company Overview

Atlassian was founded in 2002 in Sydney, Australia by Mike Cannon-Brookes and Scott Farquhar. The company started as a small software consulting business, but it has grown into a global leader in the software industry. Atlassian’s mission is to unleash the potential of every team, and its products and services are designed to help teams work better together.

Products and Services

Atlassian offers a wide range of products and services, including:

Jira Software

Jira Software is a project management tool that helps teams plan, track, and release software.

Confluence

Confluence is a team collaboration tool that helps teams create, organize, and share knowledge.

Trello

Trello is a visual collaboration tool that helps teams organize and prioritize their work.

Bitbucket

Bitbucket is a code collaboration tool that helps teams build, test, and deploy their code.

Jira Service Desk

Jira Service Desk is a service management tool that helps teams provide great service to their customers.

Target Market

Atlassian’s products and services are designed for teams of all sizes and industries. Its customers range from small startups to large enterprises. Atlassian’s focus is on helping teams work better together, regardless of their industry or size.

Business Model

Atlassian’s business model is based on a subscription-based model. Customers pay a monthly or annual fee to use Atlassian’s products and services. Atlassian also offers a free trial of its products and services, which allows customers to try them out before committing to a subscription.

Funding

Atlassian is a publicly traded company on the NASDAQ stock exchange under the ticker symbol TEAM. The company went public in 2015 and raised $462 million in its initial public offering (IPO).

Interesting Points about the Brand

Here are some interesting points about the Atlassian brand:

Work Culture

Atlassian is known for its unique work culture. The company has a “no bullshit” policy, which encourages employees to speak their minds and be honest with each other.

Collaboration

Atlassian’s products and services are designed to promote collaboration among teams. The company also promotes collaboration internally, with its employees working in open-plan offices and using tools like HipChat to communicate with each other.

Corporate Social Responsibility

Atlassian is committed to being a socially responsible company. The company has a program called “Atlassian Foundation,” which supports nonprofit organizations around the world.

Innovation

Atlassian is constantly innovating and releasing new products and services. The company is also known for its innovation in the workplace, with its “ShipIt Days” allowing employees to work on innovative projects outside of their usual work.

Customer Satisfaction

Atlassian is committed to providing great customer service. The company has a Net Promoter Score (NPS) of 71, which is considered to be excellent.

HubSpot

Company Overview

Hubspot was founded in 2006 by Brian Halligan and Dharmesh Shah, and it’s headquartered in Cambridge, Massachusetts. The company’s mission is to help businesses grow better, and they do this by providing a suite of software tools that enable companies to attract, engage, and delight customers.

Products and Services

Hubspot’s product suite is divided into four main categories: marketing, sales, service, and CRM. In the marketing category, Hubspot offers tools for content management, social media, SEO, email marketing, advertising, and analytics. The sales category includes tools for sales automation, pipeline management, and contact management. The service category provides tools for customer service and support, including a help desk and knowledge base. The CRM category ties everything together, providing a unified view of customer interactions across all channels.

Target Market

Hubspot’s target market is primarily small to medium-sized businesses (SMBs) that are looking for an all-in-one software solution to manage their marketing, sales, and customer service. However, the company has been expanding its offerings to include larger enterprises as well.

Business Model

Hubspot’s business model is subscription-based, with customers paying a monthly fee for access to the software. The company also offers add-on services, such as consulting and training, which generate additional revenue.

Funding

Hubspot has raised over $1 billion in funding since its inception, with its most recent funding round in 2021 raising $175 million. The company went public in 2014 and is traded on the New York Stock Exchange under the symbol HUBS.

Interesting Points about the Brand

Hubspot has a strong focus on inbound marketing, which emphasizes attracting customers through content and experiences rather than interruptive advertising.

The company has a robust community of users and partners, with over 100,000 customers and 3,000 agency partners worldwide.

Hubspot has a strong commitment to sustainability, with initiatives such as carbon neutrality and a focus on reducing waste.

Hubspot is a top Saas company to watch out for in 2023 due to its innovative product suite, commitment to customer success, and strong financial backing. As businesses continue to seek all-in-one solutions to manage their operations, Hubspot is well-positioned to meet this demand and continue its growth trajectory.

Asana

Company Overview

Asana is a privately held company that provides a cloud-based project management software platform for individuals and teams to track and manage their work. The platform offers various features, including task management, project tracking, team collaboration, and reporting. Asana’s platform can be accessed through a web application or a mobile app, and it offers integrations with various third-party apps, including Google Drive, Slack, and Dropbox.

Products and Services

Asana offers a range of products and services to help individuals and teams manage their work efficiently. Some of its notable products and services include:

Asana Work Graph

Asana’s Work Graph is a proprietary technology that powers its platform, allowing individuals and teams to track and manage their work effectively. It is a data architecture that organizes and connects all the work that happens within an organization, including tasks, projects, people, and data.

Asana Premium

Asana Premium is a paid version of the platform that offers advanced features such as custom fields, project portfolios, and admin controls. The Premium version is designed for larger teams or organizations that require more complex project management capabilities.

Asana Business

Asana Business is a higher-tier subscription service that offers advanced security features and priority support. The Business version is designed for organizations that require a higher level of security and compliance.

Target Market

Asana targets a broad market of individuals and teams who need to manage their work effectively. Its platform is suitable for a range of industries, including marketing, design, engineering, and project management. Asana’s target market includes small enterprises that require a scalable and flexible project management solution.

Business Model

Asana’s business model is based on a subscription-based SaaS model. The company offers a free version of its platform, which includes basic project management features. It also offers paid versions of its platform with more advanced features, such as Asana Premium and Asana Business. Asana’s revenue is generated primarily from its paid subscription services.

Funding

Since its founding in 2008, Asana has raised over $200 million in funding. Its investors include some of the leading venture capital firms, including Benchmark Capital, Founders Fund, and 8VC. In 2018, Asana raised $75 million in a funding round led by Generation Investment Management, bringing the company’s valuation to over $1.5 billion.

Interesting Points about the Brand

Asana has several interesting points that make it stand out in the SaaS industry. Here are a few notable points:

Dustin Moskovitz, one of Asana’s co-founders, was also a co-founder of Facebook. He left Facebook in 2008 to start Asana.

Asana’s Work Graph is a proprietary technology that sets it apart from other project management software providers. It offers a unique approach to managing work by connecting all aspects of a project in one place.

Asana’s platform is highly customizable, allowing teams to create custom workflows, fields, and templates. This makes it a flexible solution for teams with unique project management needs.

Asana’s platform integrates with over 100 third-party apps, making it a versatile tool for managing work across various platforms and applications.

Top SaaS Companies to Watch in 2023

SaaS companies are changing the way businesses operate. With the rise of cloud computing, these companies offer software solutions that can be accessed from anywhere, anytime. This has led to increased flexibility, scalability, and cost-effectiveness for businesses of all sizes. In 2023, we can expect to see more SaaS companies emerge and existing ones continue to innovate. Let’s take a look at 10 SaaS companies that are making moves in 2023.

Top SaaS Companies to Watch in 2023

============================

Zoom

Zoom is a cloud-based video conferencing platform that enables users to host virtual meetings, webinars, and conference calls. Founded in 2011, Zoom has become one of the most popular video conferencing software in the world, with over 300 million daily meeting participants in 2020. Zoom’s success can be attributed to its user-friendly interface, reliability, and scalability. In this article, we will dive into the details of Zoom’s company overview, products and services, target market, business model, funding, and interesting points about the brand.

Company Overview

Zoom Video Communications, Inc. is a publicly-traded company headquartered in San Jose, California. It was founded by Eric Yuan, a former Cisco WebEx engineer, who wanted to create a video conferencing platform that was easy to use and reliable. Zoom’s mission is to make video communications frictionless.

Products and Services

Zoom offers a variety of products and services to meet the needs of individuals, businesses, and organizations of all sizes. Some of their main products include:

Zoom Meetings: a video conferencing solution for virtual meetings, webinars, and conference calls.

Zoom Rooms: a software-based conference room solution that enables users to join Zoom meetings from conference rooms.

Zoom Phone: a cloud-based phone system that enables users to make and receive calls over the internet.

Zoom Video Webinars: a solution for hosting virtual events such as webinars, virtual conferences, and town hall meetings.

In addition to these products, Zoom also offers various features and add-ons such as recording, virtual backgrounds, and integrations with other software applications.

Target Market

Zoom’s target market includes individuals, businesses, and organizations of all sizes who are in need of a reliable and user-friendly video conferencing solution. Zoom’s platform is suitable for a wide range of industries, including education, healthcare, finance, government, and more. With the COVID-19 pandemic causing a massive shift towards remote work and virtual meetings, Zoom has seen a significant increase in demand for its services.

Business Model

Zoom’s business model is based on a freemium pricing model, which means that they offer a basic version of their platform for free and charge a fee for additional features and add-ons. The free version of Zoom includes features such as unlimited one-on-one meetings and group meetings of up to 100 participants with a 40-minute time limit. Paid plans start at $14.99 per month per host and include features such as longer meeting durations, more participants, and additional administrative controls.

Funding

Zoom has raised over $1 billion in funding since its founding in 2011. In April 2019, Zoom went public on the NASDAQ stock exchange with an initial public offering (IPO) price of $36 per share. Since then, Zoom’s stock price has soared, and as of March 2023, it is trading at over $300 per share.

Interesting Points about the Brand

Zoom’s founder and CEO, Eric Yuan, was once a Cisco WebEx engineer who quit his job to start Zoom after being frustrated with the limitations of existing video conferencing solutions.

Zoom was initially launched as a B2B solution but has since expanded to include B2C offerings such as the free version of Zoom and Zoom for Home.

Zoom has faced some criticism for privacy and security concerns, particularly in 2020 when the platform experienced a surge in usage due to the COVID-19 pandemic. However, the company has taken steps to address these concerns and improve its security features.

Zoom has been recognized as one of the best places to work in the Bay Area, and it has won numerous awards for its culture and employee satisfaction

==============================

Wrike

In today’s fast-paced business world, SaaS companies are quickly becoming the go-to choice for many organizations. These companies offer software solutions that are cost-effective, easy to use, and scalable. Among the top SaaS companies to watch out for in 2023 is Wrike. Wrike is a cloud-based project management and collaboration software that helps businesses streamline their operations and improve productivity. In this article, we will take a closer look at Wrike, including its company overview, products and services, target market, business model, funding, and some interesting points about the brand.

Company Overview

Wrike is a software-as-a-service (SaaS) company that was founded in 2006 by Andrew Filev. The company is headquartered in San Jose, California, and has offices in several countries, including Ireland, Ukraine, and Russia. Since its inception, Wrike has grown rapidly, and today it has more than 20,000 customers worldwide. The company’s mission is to help teams work smarter, not harder, by providing them with a single platform to manage their projects, collaborate, and communicate.

Products and Services

Wrike’s flagship product is its project management and collaboration software. The software is cloud-based and is designed to help teams of all sizes manage their projects more efficiently. Some of the key features of Wrike’s software include task management, team collaboration, time tracking, customizable workflows, and project reporting. The software is also highly customizable and can be tailored to meet the specific needs of individual teams and organizations.

In addition to its project management software, Wrike also offers a range of other products and services, including:

Wrike for Marketers: A tailored solution designed specifically for marketing teams, which includes features like digital asset management, request forms, and proofing and approval workflows.

Wrike for Professional Services: A solution designed for service-based businesses, which includes features like resource management, project accounting, and billing and invoicing.

Wrike Analyze: A business intelligence tool that provides insights into project performance, team productivity, and resource utilization.

Target Market

Wrike’s software is designed to meet the needs of teams and organizations of all sizes and across a range of industries. The company’s target market includes:

Small and medium-sized businesses (SMBs) looking for a cost-effective project management solution.

Large enterprises that need a scalable, customizable project management solution.

Marketing teams that need a solution tailored to their specific needs.

Service-based businesses that need a solution for managing projects and resources.

Business Model

Wrike operates on a subscription-based business model, where customers pay a monthly or annual fee for access to its software. The company offers a range of pricing plans to suit the needs of different teams and organizations. Wrike’s pricing plans are based on the number of users and the features included in the plan. The company also offers a free trial of its software, which allows customers to test the software before making a purchase.

Funding

Since its inception, Wrike has raised over $25 million in funding. The company’s most recent funding round was in 2018, where it raised $10 million in a series D funding round led by Bain Capital Ventures. The funding was used to expand the company’s product offerings and accelerate its growth.

Interesting Points about the Brand

Here are some interesting points about Wrike that make it stand out from other SaaS companies:

Wrike was named one of the fastest-growing companies in North America by Deloitte in 2019.

The company has won several awards for its software, including the 2019 SaaS Award for Best Project Management Software and the 2020 Trust Radius Award for Best Customer Support.

Wrike has a strong focus on security and privacy. The company is SOC 2 compliant and has multiple security certifications, including ISO 27001 and GDPR.

The company has a strong commitment to sustainability and has implemented several initiatives to reduce its carbon footprint. These include using renewable energy sources, reducing waste, and promoting eco-friendly practices.

Overall, Wrike is a top SaaS company to watch out for in 2023. With its innovative software solutions, strong focus on customer satisfaction, and commitment to sustainability, Wrike is poised for continued success in the years to come.

==========================

Stripe

Stripe is a Silicon Valley-based financial technology company founded in 2010 that offers a variety of online payment solutions for businesses of all sizes. The company has rapidly become one of the most successful startups in the world, with a valuation of over $95 billion as of 2022. In this article, we’ll delve deeper into Stripe’s products and services, target market, business model, funding, and other interesting points about the brand that make it a top Saas company to watch out for in 2023.

Company Overview

Stripe was founded in 2010 by brothers John and Patrick Collison, who grew up in rural Ireland and taught themselves to code at a young age. After selling their first company, Auctomatic, in 2008, they decided to start Stripe to solve the problem of online payments. Since then, Stripe has grown into one of the largest and most successful fintech companies in the world. The company is headquartered in San Francisco, California, and has offices in several other countries, including the UK, Ireland, Singapore, and Australia.

Products and Services

Stripe offers a range of online payment solutions for businesses, including:

Payments

Stripe’s Payments product allows businesses to accept payments from customers anywhere in the world, in more than 135 different currencies. Payments can be made using credit and debit cards, Apple Pay, Google Pay, and other popular payment methods.

Billing

Stripe’s Billing product allows businesses to create and manage subscriptions, send invoices, and handle other billing-related tasks in a streamlined and automated way.

Connect

Stripe’s Connect product allows businesses to build and manage online marketplaces, where buyers and sellers can transact securely and easily. Connect handles all of the complicated payment and regulatory issues that come with building a marketplace, so businesses can focus on building their product and growing their user base.

Radar

Stripe’s Radar product uses machine learning to help businesses detect and prevent fraud. Radar analyzes billions of data points to identify fraudulent activity, and can be customized to suit the specific needs of each business.

Target Market

Stripe’s target market is primarily small to medium-sized businesses that sell goods or services online. The company’s easy-to-use payment solutions, flexible APIs, and robust developer tools make it an attractive option for businesses of all sizes, from independent freelancers to large enterprise companies.

Business Model

Stripe’s business model is based on taking a small percentage of each transaction processed through its platform. The company charges a standard fee of 2.9% + 30¢ per successful transaction, with no additional monthly or setup fees. This pricing model makes Stripe an affordable option for businesses of all sizes, while still allowing the company to generate significant revenue.

Funding

Stripe has raised more than $2 billion in funding since its founding, from some of the world’s most prominent venture capital firms, including Sequoia Capital, Andreessen Horowitz, and General Catalyst. In March 2021, Stripe raised $600 million in a funding round that valued the company at $95 billion, making it one of the most valuable startups in the world.

Interesting Points about the Brand

Here are a few interesting points that make Stripe stand out as a top Saas company to watch out for in 2023:

Developer-friendly

Stripe is known for its developer-friendly APIs and robust set of tools for building custom payment solutions. This has made the company a favorite among developers and has helped to fuel its rapid growth.

Global reach

Stripe’s platform supports payments in more than 135 different currencies, making it an attractive option for businesses that operate globally. The company also has offices in several countries, including the UK, Ireland, and Australia.

——————————————–

Slack

Slack is a software-as-a-service (SaaS) company that provides a messaging platform for teams to collaborate and communicate effectively. The company has gained significant popularity in recent years, and as we move into 2023, it remains one of the top SaaS companies to watch out for. In this article, we will explore Slack’s company overview, products and services, target market, business model, funding, and interesting points about the brand.

Company Overview

Slack was founded in 2013 by Stewart Butterfield, who previously co-founded Flickr. The company is headquartered in San Francisco, California, and has additional offices in New York, Dublin, Vancouver, Tokyo, and Melbourne. Slack’s mission is to make people’s working lives simpler, more pleasant, and more productive.

Slack’s platform allows teams to collaborate and communicate through channels, direct messaging, and integrations with other tools. The platform offers features such as file sharing, video and voice calls, and custom app integrations. Slack has over 12 million daily active users as of 2023, and the company has been valued at over $23 billion.

Products and Services

Slack’s main product is its messaging platform, which allows teams to communicate and collaborate effectively. The platform offers features such as channels, direct messaging, video and voice calls, and file sharing. Slack also offers a variety of integrations with other tools, such as Google Drive, Trello, and Salesforce.

In addition to its messaging platform, Slack also offers a range of enterprise-level features for larger organizations, such as enterprise mobility management, security and compliance features, and enterprise grid for larger deployments.

Target Market

Slack’s target market is primarily teams and organizations of all sizes that require an efficient way to communicate and collaborate. The company has a strong presence in the technology industry, with customers such as Airbnb, Lyft, and Shopify. However, Slack has also gained popularity in other industries, such as finance, healthcare, and education.

Business Model

Slack operates on a freemium business model, which allows users to use the platform for free with limited features. The company generates revenue through its paid plans, which offer additional features such as unlimited message history, group voice and video calls, and priority support.

Slack’s paid plans are priced per user per month, with pricing ranging from $6.67 per user per month for the standard plan, to $15 per user per month for the plus plan. The company also offers enterprise-level features, which are priced on a case-by-case basis.

Funding

Slack has raised over $1.4 billion in funding to date. The company’s most recent funding round was in 2019, where it raised $427 million at a valuation of $7.1 billion. Notable investors in Slack include SoftBank, Accel, and Andreessen Horowitz.

Interesting Points about the Brand

Slack was originally developed as an internal tool for Stewart Butterfield’s game development company, Tiny Speck.

The name “Slack” is an acronym for “Searchable Log of All Conversation and Knowledge”.

Slack’s logo features a hashtag symbol, which has become synonymous with the company.

Slack has a strong culture of remote work, with over 70% of its employees working remotely.

In 2020, Slack was acquired by Salesforce for $27.7 billion, marking one of the largest tech acquisitions in history.

——————————–

Atlassian

In the world of technology, software as a service (SaaS) has become a popular delivery model for software applications. One of the top SaaS companies to watch out for in 2023 is Atlassian. This article will provide an overview of Atlassian, its products and services, target market, business model, funding, and interesting points about the brand.

Company Overview

Atlassian was founded in 2002 in Sydney, Australia by Mike Cannon-Brookes and Scott Farquhar. The company started as a small software consulting business, but it has grown into a global leader in the software industry. Atlassian’s mission is to unleash the potential of every team, and its products and services are designed to help teams work better together.

Products and Services

Atlassian offers a wide range of products and services, including:

Jira Software

Jira Software is a project management tool that helps teams plan, track, and release software.

Confluence

Confluence is a team collaboration tool that helps teams create, organize, and share knowledge.

Trello

Trello is a visual collaboration tool that helps teams organize and prioritize their work.

Bitbucket

Bitbucket is a code collaboration tool that helps teams build, test, and deploy their code.

Jira Service Desk

Jira Service Desk is a service management tool that helps teams provide great service to their customers.

Target Market

Atlassian’s products and services are designed for teams of all sizes and industries. Its customers range from small startups to large enterprises. Atlassian’s focus is on helping teams work better together, regardless of their industry or size.

Business Model

Atlassian’s business model is based on a subscription-based model. Customers pay a monthly or annual fee to use Atlassian’s products and services. Atlassian also offers a free trial of its products and services, which allows customers to try them out before committing to a subscription.

Funding

Atlassian is a publicly traded company on the NASDAQ stock exchange under the ticker symbol TEAM. The company went public in 2015 and raised $462 million in its initial public offering (IPO).

Interesting Points about the Brand

Here are some interesting points about the Atlassian brand:

Work Culture

Atlassian is known for its unique work culture. The company has a “no bullshit” policy, which encourages employees to speak their minds and be honest with each other.

Collaboration

Atlassian’s products and services are designed to promote collaboration among teams. The company also promotes collaboration internally, with its employees working in open-plan offices and using tools like HipChat to communicate with each other.

Corporate Social Responsibility

Atlassian is committed to being a socially responsible company. The company has a program called “Atlassian Foundation,” which supports nonprofit organizations around the world.

Innovation

Atlassian is constantly innovating and releasing new products and services. The company is also known for its innovation in the workplace, with its “ShipIt Days” allowing employees to work on innovative projects outside of their usual work.

Customer Satisfaction

Atlassian is committed to providing great customer service. The company has a Net Promoter Score (NPS) of 71, which is considered to be excellent.

==============================

HubSpot

As we step into 2023, the world of software as a service (SaaS) is rapidly expanding, and there is a lot of buzz around Hubspot. Hubspot is a leading CRM, marketing, sales, and customer service software provider, and there are many reasons why it’s a top company to watch out for in 2023. In this article, we’ll dive into Hubspot’s company overview, products and services, target market, business model, funding, and interesting points about the brand.

Company Overview

Hubspot was founded in 2006 by Brian Halligan and Dharmesh Shah, and it’s headquartered in Cambridge, Massachusetts. The company’s mission is to help businesses grow better, and they do this by providing a suite of software tools that enable companies to attract, engage, and delight customers.

Products and Services

Hubspot’s product suite is divided into four main categories: marketing, sales, service, and CRM. In the marketing category, Hubspot offers tools for content management, social media, SEO, email marketing, advertising, and analytics. The sales category includes tools for sales automation, pipeline management, and contact management. The service category provides tools for customer service and support, including a help desk and knowledge base. The CRM category ties everything together, providing a unified view of customer interactions across all channels.

Target Market

Hubspot’s target market is primarily small to medium-sized businesses (SMBs) that are looking for an all-in-one software solution to manage their marketing, sales, and customer service. However, the company has been expanding its offerings to include larger enterprises as well.

Business Model

Hubspot’s business model is subscription-based, with customers paying a monthly fee for access to the software. The company also offers add-on services, such as consulting and training, which generate additional revenue.

Funding

Hubspot has raised over $1 billion in funding since its inception, with its most recent funding round in 2021 raising $175 million. The company went public in 2014 and is traded on the New York Stock Exchange under the symbol HUBS.

Interesting Points about the Brand

Hubspot has a strong focus on inbound marketing, which emphasizes attracting customers through content and experiences rather than interruptive advertising.

The company has a robust community of users and partners, with over 100,000 customers and 3,000 agency partners worldwide.

Hubspot has a strong commitment to sustainability, with initiatives such as carbon neutrality and a focus on reducing waste.

In conclusion, Hubspot is a top Saas company to watch out for in 2023 due to its innovative product suite, commitment to customer success, and strong financial backing. As businesses continue to seek all-in-one solutions to manage their operations, Hubspot is well-positioned to meet this demand and continue its growth trajectory.

——————————————

Asana is a cloud-based project management software company founded in 2008 by Dustin Moskovitz and Justin Rosenstein. The company has been growing rapidly and has become a popular SaaS (Software as a Service) provider in the project management industry. In this article, we will discuss the various aspects of Asana, including its company overview, products and services, target market, business model, funding, and interesting points about the brand.

Company Overview

Asana is a privately held company that provides a cloud-based project management software platform for individuals and teams to track and manage their work. The platform offers various features, including task management, project tracking, team collaboration, and reporting. Asana’s platform can be accessed through a web application or a mobile app, and it offers integrations with various third-party apps, including Google Drive, Slack, and Dropbox.

Products and Services

Asana offers a range of products and services to help individuals and teams manage their work efficiently. Some of its notable products and services include:

Asana Work Graph

Asana’s Work Graph is a proprietary technology that powers its platform, allowing individuals and teams to track and manage their work effectively. It is a data architecture that organizes and connects all the work that happens within an organization, including tasks, projects, people, and data.

Asana Premium

Asana Premium is a paid version of the platform that offers advanced features such as custom fields, project portfolios, and admin controls. The Premium version is designed for larger teams or organizations that require more complex project management capabilities.

Asana Business

Asana Business is a higher-tier subscription service that offers advanced security features and priority support. The Business version is designed for organizations that require a higher level of security and compliance.

Target Market

Asana targets a broad market of individuals and teams who need to manage their work effectively. Its platform is suitable for a range of industries, including marketing, design, engineering, and project management. Asana’s target market includes small enterprises that require a scalable and flexible project management solution.

Business Model

Asana’s business model is based on a subscription-based SaaS model. The company offers a free version of its platform, which includes basic project management features. It also offers paid versions of its platform with more advanced features, such as Asana Premium and Asana Business. Asana’s revenue is generated primarily from its paid subscription services.

Funding

Since its founding in 2008, Asana has raised over $200 million in funding. Its investors include some of the leading venture capital firms, including Benchmark Capital, Founders Fund, and 8VC. In 2018, Asana raised $75 million in a funding round led by Generation Investment Management, bringing the company’s valuation to over $1.5 billion.

Interesting Points about the Brand

Asana has several interesting points that make it stand out in the SaaS industry. Here are a few notable points:

1. Co-Founder Dustin Moskovitz was also a Facebook Co-Founder

Dustin Moskovitz, one of Asana’s co-founders, was also a co-founder of Facebook. He left Facebook in 2008 to start Asana.

2. Asana’s Work Graph is a Unique Approach to Project Management

Asana’s Work Graph is a proprietary technology that sets it apart from other project management software providers. It offers a unique approach to managing work by connecting all aspects of a project in one place.

3. Asana’s Platform is Highly Customizable

Asana’s platform is highly customizable, allowing teams to create custom workflows, fields, and templates. This makes it a flexible solution for teams with unique project management needs.

4. Asana’s Platform Integrates with Over 100 Apps

Asana’s platform integrates with over 100 third-party apps, making it a versatile tool for managing work across various platforms and applications.

=======================

DocuSign

DocuSign is one of the most innovative SaaS companies that provide a complete suite of digital signature and transaction management solutions for businesses. The company is known for its secure, reliable, and easy-to-use platform that enables businesses to sign, send, and manage documents online, anytime, and anywhere. In this article, we will explore DocuSign’s company overview, products and services, target market, business model, funding, and interesting points about the brand.

Company Overview

DocuSign was founded in 2003 by Tom Gonser, Court Lorenzini, and Eric Ranft in Seattle, Washington. The company started as a digital signature service and has grown into a leading global SaaS platform for managing electronic agreements. As of 2023, DocuSign has more than 1,800 employees and offices in over 12 countries worldwide. The company has been recognized as one of the fastest-growing SaaS companies in the world, with a 42% year-over-year growth rate.

Products and Services

DocuSign offers a wide range of products and services that help businesses of all sizes to streamline their workflow and increase productivity. Some of the most popular products and services offered by DocuSign include:

eSignature: A secure and legally binding way to sign documents electronically.

DocuSign Rooms: A virtual workspace for real estate transactions that enables agents to share, collaborate, and manage documents online.

DocuSign Gen: A tool that automates the creation and distribution of customized documents such as contracts, agreements, and invoices.

DocuSign Identify: A digital identity verification solution that helps businesses verify the identity of signers remotely.

Target Market

DocuSign’s target market includes businesses of all sizes and industries that need to sign and manage documents online securely. The company’s customers include real estate agents, healthcare providers, financial services firms, legal professionals, and government agencies. DocuSign’s solutions are especially useful for businesses that require secure and legally binding signatures for compliance reasons.

Business Model

DocuSign’s business model is based on a subscription-based software as a service (SaaS) model. The company offers various pricing plans that allow customers to choose the features and services that meet their specific needs. DocuSign’s pricing plans are based on the number of users, the number of documents, and the level of support required.

Funding

DocuSign has raised over $600 million in funding from leading investors, including Salesforce Ventures, Google Ventures, and Visa. The company went public in 2018 and is listed on the NASDAQ under the ticker symbol DOCU.

Interesting Points about the Brand

Here are some interesting points about the DocuSign brand:

DocuSign was named one of the world’s most innovative companies by Forbes in 2021.

The company has over 750,000 customers worldwide, including more than 800 of the Fortune 1000 companies.

DocuSign has processed over 1.5 billion electronic signatures since its inception.

The company’s CEO, Dan Springer, was named Glassdoor’s Highest Rated CEO in 2018 and 2019.

DocuSign has been recognized as one of the best places to work by Glassdoor and Fortune magazine.

Twilio

Company Overview

Founded by Jeff Lawson, Evan Cooke, and John Wolthuis in 2008, Twilio is one of the most well known companies in the world. Twilio , cloud communications platform, is headquartered in San Francisco, California. It provides APIs for developers messaging, videos and voice to be easily integrated into their applications. With many offices in different countries of the world Twilio has been expanding ever since its inception.

Twilio offers a wide range of products and services that enable developers to build and integrate communication functionalities into their applications. Some of Twilio’s popular products and services include:

Twilio Allows developers to add SMS, MMS, and WhatsApp messaging to their applications. It also enables developers to add voice through VoIP, SIP, and other voice protocols. Programmable video feature provides APIs for developers to add real-time video and group chat with their application

Twilio has a super network that provides a global carrier hat connects to over 5 billion mobile devices and 3.5 billion landlines worldwide.

Target Market

Twilio’s products and services are designed to meet the communication needs of businesses of all sizes, from startups to enterprise-level organizations. Twilio serves customers across a range of industries, including healthcare, finance, retail, and more.

Business Model

Twilio has a pay-as-you-go pricing system, where you only pay for what you use. The company’s pricing is based on usage, such as the number of messages or minutes used, and varies depending on the country and region.

Twilio raised more than $1.4 billion funding since its inception. The company went public in 2016 and is listed on the New York Stock Exchange (NYSE) under the ticker symbol TWLO.

Some Lesser Known Facts About Twilio

Twilio is known for its strong developer community and support. The company offers extensive documentation, tutorials, and community forums to help developers integrate Twilio’s products and services into their applications.

Twilio has a strong commitment to diversity and inclusion. Twilio implemented several initiatives to increase diversity in its workforce and support underrepresented groups in technology.

Twilio is identified and valued for its innovative products and services. It won several awards, including the 2020 CODiE Award for Best Communication Platform as a Service and the 2020 DevOps Excellence Award for Best Innovation in DevOps Tooling.

Twilio is a top SaaS company to watch out for in 2023. With its innovative cloud communications platform, extensive range of products and services, and commitment to diversity and inclusion, Twilio is poised for continued success in the years to come.

DocuSign

Company Overview

DocuSign was founded in 2003 by Tom Gonser, Court Lorenzini, and Eric Ranft in Seattle, Washington. The company started as a digital signature service and has grown into a leading global SaaS platform for managing electronic agreements. As of 2023, DocuSign has more than 1,800 employees and offices in over 12 countries worldwide. The company has been recognized as one of the fastest-growing SaaS companies in the world, with a 42% year-over-year growth rate.

Products and Services

DocuSign offers a wide range of products and services that help businesses of all sizes to streamline their workflow and increase productivity. Some of the most popular products and services offered by DocuSign include:

eSignature: A secure and legally binding way to sign documents electronically.

DocuSign Rooms: A virtual workspace for real estate transactions that enables agents to share, collaborate, and manage documents online.

DocuSign Gen: A tool that automates the creation and distribution of customized documents such as contracts, agreements, and invoices.

DocuSign Identify: A digital identity verification solution that helps businesses verify the identity of signers remotely.

Target Market

DocuSign’s target market includes businesses of all sizes and industries that need to sign and manage documents online securely. The company’s customers include real estate agents, healthcare providers, financial services firms, legal professionals, and government agencies. DocuSign’s solutions are especially useful for businesses that require secure and legally binding signatures for compliance reasons.

Business Model

DocuSign’s business model is based on a subscription-based software as a service (SaaS) model. The company offers various pricing plans that allow customers to choose the features and services that meet their specific needs. DocuSign’s pricing plans are based on the number of users, the number of documents, and the level of support required.

Funding

DocuSign has raised over $600 million in funding from leading investors, including Salesforce Ventures, Google Ventures, and Visa. The company went public in 2018 and is listed on the NASDAQ under the ticker symbol DOCU.

Interesting Points about the Brand

Here are some interesting points about the DocuSign brand:

DocuSign was named one of the world’s most innovative companies by Forbes in 2021.

The company has over 750,000 customers worldwide, including more than 800 of the Fortune 1000 companies.

DocuSign has processed over 1.5 billion electronic signatures since its inception.

The company’s CEO, Dan Springer, was named Glassdoor’s Highest Rated CEO in 2018 and 2019.

DocuSign has been recognized as one of the best places to work by Glassdoor and Fortune magazine.

Conclusion

The SaaS industry is rapidly growing and evolving, with new players entering the market every year. However, certain companies stand out as ones to watch in 2023 based on their innovative products and services, strong financials, and commitment to customer success. Companies like Wrike and Asana are leading the way in their respective industries and are poised for continued growth and success in the years to come. As businesses continue to rely more on cloud-based software solutions, it is important to keep an eye on these top SaaS companies and their developments. By staying informed about the latest trends and innovations, businesses can stay ahead of the curve and maintain their competitive edge.