On January 21, 2025, Crypto.com, a Singapore-based cryptocurrency exchange, announced the launch of its institutional-grade Crypto.com Exchange in the United States. With this strategic move, Crypto.com will expand into the US market by offering institutional and advanced traders a technologically advanced cryptocurrency trading platform featuring deep liquidity and ultra-low latency.

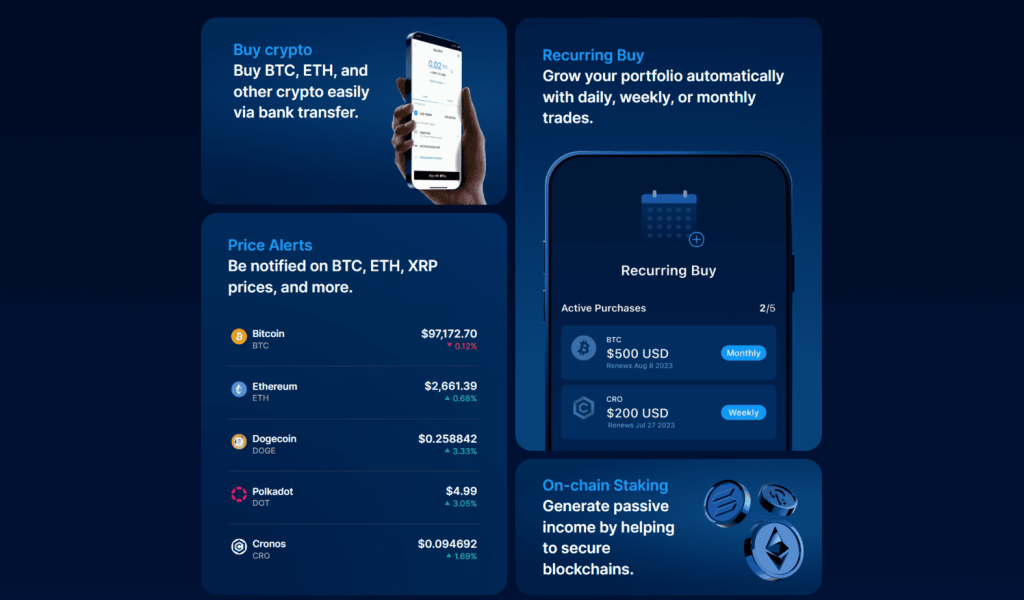

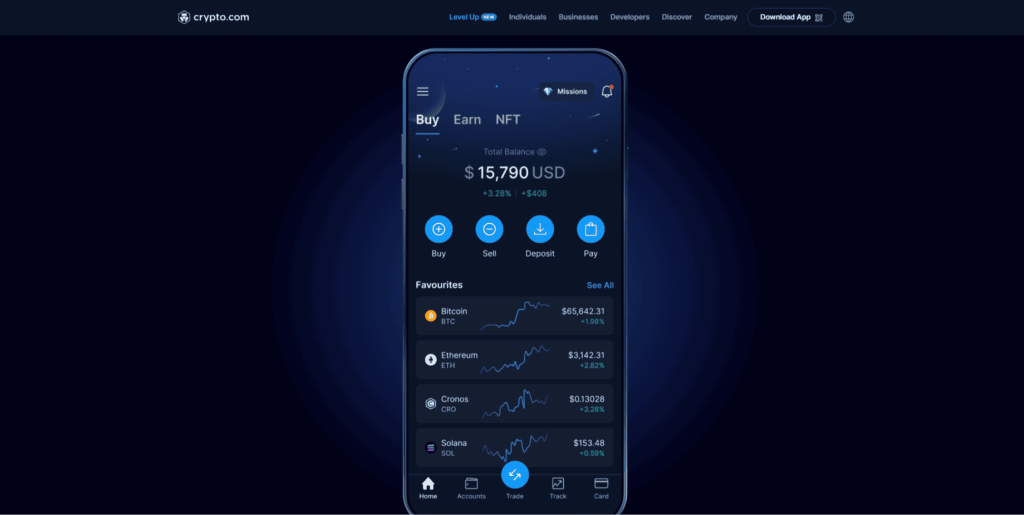

Crypto.com allows users to trade 480 trading pairs and 300 cryptocurrencies in ultra-low latency. The platform, optimized for responsiveness and speed, has industry-leading compliance and security features and offers a personalized experience with a customizable widget-based design, which lets users drag and drop components like order books and charts.

Key Takeaways

- Crypto.com has launched its new US Institutional Exchange. It offers advanced trading with deep liquidity and ultra-low latency.

- The platform supports 480 trading pairs and 300 cryptocurrencies and features a customizable, widget-based interface for a tailored experience.

- Institutional traders benefit from advanced order types, efficient fiat funding, and robust API integrations – all of which ensure smooth, high-frequency trading.

- The relaunch comes amid a cleaner and more supportive US regulatory environment. This positions Crypto.com as a strong competitor in the institutional crypto market.

Crypto.com Expands Institutional Offerings with New US Exchange Relaunch

Image source

Since cryptocurrencies became a mainstream topic over the past decade, institutional investors – including hedge funds, asset managers, family offices, and pension funds – have acknowledged their potential as portfolio diversifiers. Unlike retail investors, the institutions often require advanced trading systems, deep liquidity, advanced order types, and rigorous security measures. Over the past few years, the institutional segment has seen an influx of players and capital.

This demand has driven exchanges to innovate and offer tailored solutions that address the specific needs of these high-stakes investors. As policymakers work to provide a framework that ensures market integrity while fostering innovation, institutional players have become more confident in committing significant capital to crypto markets. Crypto.com’s new platform is a timely response to market conditions, offering features designed with the institutional investor in mind.

Crypto.com has long been a major player in the digital asset ecosystem, catering to millions of retail users across the globe. However, the company has steadily evolved its offerings to meet the more sophisticated demands of institutional traders. The new US Institutional Exchange is the culmination of years of testing, iteration, and technological investment – first piloted in an early version in 2022 and later suspended in 2023 due to “limited demand.” With renewed regulatory optimism and better product capabilities, the platform is making a grand re-entrance into the US market.

Kris Marszalek, CEO of Crypto.com, highlighted the company’s focus on technological innovation, highlighting that significant investments have been made in improving the technological infrastructure and banking connections of the Crypto.com Exchange since its preliminary testing in the US in 2022. He noted that the company devoted considerable time to developing the right product globally for institutional and sophisticated users. Marszalek voiced great enthusiasm about the complete rollout of the exchange in a market that remains a focal point of their optimism – the US.

One of the cornerstones of any institutional trading platform is liquidity. Crypto.com has leveraged its global presence to deliver “deep liquidity” across more than 300 cryptocurrencies and 480 trading pairs. For institutions, deep liquidity ensures that large orders can be executed without significant market impact. In addition, the platform offers ultra-low latency. Ultra-low latency is essential for high-frequency trading thanks to a cutting-edge matching engine that can scale to support up to 64 million transactions per second with an impressive 370-nanosecond matching latency. This level of performance ensures that traders can execute orders quickly.

Beyond liquidity, the new exchange offers advanced order types, enabling traders to implement complex strategies. The platform accommodates every trading style, from limit and market orders to more sophisticated options like stop-loss, GRID, DCA (dollar cost averaging), and TWAP (time-weighted average price) orders. The user interface is highly customizable. It features a widget-based design, allowing traders to tailor their trading dashboard by dragging and dropping elements such as charts, order books, and market data streams.

For institutional traders, the ease of funding accounts and moving capital in and out of the exchange is paramount. Crypto.com’s new platform simplifies this process by allowing direct Fedwire transfers from local US bank accounts. Plus, users can fund their accounts using a “USD Bundle” that supports flexible withdrawals in both US Dollars and USDC at a strict 1:1 ratio without incurring additional conversion fees or spreads. These features are designed to lower the friction often associated with large-scale fiat-to-crypto conversions, thus streamlining the trading process.

Institutional clients frequently rely on advanced technological integrations to automate and optimize trading. In recognition, Crypto.com has equipped its platform with robust API support (including FIX 4.4, WebSockets, and REST APIs) that can handle the demanding needs of high-frequency traders. The exchange also offers premium services such as tailored OTC trading, exclusive fee incentives through Market Maker and VIP Programmes, and 24/7 dedicated client support. These white-glove services ensure institutional users receive the same professional support level as in traditional financial markets.

The institutional exchange relaunch is happening when the United States regulatory environment shows signs of transformation. With President Donald Trump’s recent inauguration and new signals from agencies such as the SEC – most notably, creating a dedicated crypto task force – the future for digital asset regulation appears to be looking good.

The cryptocurrency industry has faced ambiguous regulatory scrutiny for years, and companies have faced uncertainty regarding compliance and legal interpretations. Crypto.com had a turbulent relationship with US regulators, even filing a lawsuit against the SEC after receiving a Wells notice. However, recent developments (including Trump’s 2025 win) suggest a paradigm shift. Institutions are now more confident in entering the digital asset market, and the new administration is signaling a willingness to work with industry stakeholders to develop clear, comprehensive regulations.

A representative from Crypto.com expressed confidence that the incoming administration will collaborate with the sector to establish transparent regulations aimed at consumer protection and leveraging industry advancements. This anticipation of more transparent regulatory frameworks is a crucial driver for the exchange’s relaunch, as it is anticipated to increase institutional involvement in the cryptocurrency market.

Recognized as one of the top three global spot trading platforms, Crypto.com Exchange emerged last summer as the leading USD-based crypto exchange, offering some of the most competitive BTC and ETH spreads. It also has an attractive fee structure with maker fees starting at 0%, and users can unlock additional rewards through various activities – making it a cost-effective and competitive option compared to other US-based exchanges.

The US is regarded as North America’s largest and most influential cryptocurrency market. With approximately 70% of crypto activity in the region involving transfers of over $1 million, the need for a robust, secure, and compliant institutional exchange has never been greater. The new Crypto.com Exchange is set to compete head-to-head with other prominent institutional platforms offered by companies like Kraken, Coinbase, and Gemini.

US users eligible for Crypto.com Exchange can start onboarding by visiting Crypto.com/Exchange or using the Crypto.com Exchange app. Meanwhile, retail investors in supported US regions will continue to access services through the Crypto.com App.

About Crypto.com

Founded in 2016 by Bobby Bao, Gary Or, Kris Marszalek, and Rafael Melo, Crypto.com is a prominent cryptocurrency platform based in Singapore. It has quickly diversified its services, offering a dynamic mobile app, an extensive crypto exchange, a DeFi wallet that users control, an NFT marketplace, and a prepaid Visa card. The company’s vision, “Cryptocurrency in Every Wallet™,” has propelled its growth from 10 million early users to over 100 million globally, underpinning its commitment to security, regulatory adherence, and privacy.

Crypto.com also stands out for its extensive marketing and high-profile partnerships, including acquiring naming rights to the Crypto.com Arena and collaborating with top sports teams and entertainment events. This strategy has helped to elevate the profile of digital currencies. The company continues to evolve, adding institutional trading platforms and crypto derivative products to its offerings, thus further merging traditional financial services with blockchain technology.

Conclusion

The launch of Crypto.com’s US Institutional Exchange reflects the growing demand for advanced cryptocurrency trading platforms tailored to institutional investors. With features such as deep liquidity, ultra-low latency, and customizable trading interfaces, the platform is designed to meet the needs of high-frequency traders and large-scale investors. Including direct fiat funding, advanced API integrations, and premium client services further strengthens its appeal in a competitive market.

This expansion comes when regulatory clarity in the United States is improving, making it a strategic move for Crypto.com to establish itself as a key player in institutional crypto trading. As competition intensifies among major exchanges, Crypto.com’s technological advancements and regulatory alignment position it well for long-term growth in the US market.