Amazon has decided to discontinue the option of using Venmo as a payment method starting from January 10, 2024. This change comes over a year after Venmo was initially introduced as a means to cater to the payment preferences of Amazon customers. Although Amazon will still accept Venmo credit and debit cards, it will no longer be possible to link Venmo accounts for payments on Amazon. However, those who have already integrated Venmo into their Amazon wallets will still have a limited time window to continue using this payment method.

The decision to discontinue Venmo came after an announcement made in October 2022 where both Amazon and Venmo highlighted their collaboration as an option for users looking to streamline their purchases on the e-commerce platform. With this change, Amazon is now shifting its focus towards viable payment methods while gradually phasing out the direct use of Venmo accounts. As Amazon excludes Venmo as a payment option let us understand its implication for Amazon users.

Key Takeaways

- Amazon’s Decision: Amazon is discontinuing the direct use of Venmo accounts for payments on its platform starting January 10, 2024. This change follows a partnership announced just 14 months ago and indicates a strategic shift in Amazon’s payment methods.

- Impact on Users: Current Amazon users who have already linked Venmo to their accounts will have a limited window to continue using this payment option until the specified date. Amazon advises users to update their payment methods to avoid disruptions in one-time and recurring payments, including Prime memberships and subscriptions.

- PayPal’s Response: While PayPal, Venmo’s parent company, acknowledged the change, they emphasized their ongoing collaboration with Amazon and reassured customers that other Venmo-related payment methods, such as Venmo credit and debit cards, will still be accepted on the platform. PayPal’s stock saw a slight decline following the announcement.

- End Note: The decision comes at a challenging time for PayPal, with its stock value dropping by 16% over the past year. This move by Amazon adds to the competitive pressures PayPal faces, particularly with Stripe strengthening its relationship with Amazon and progressing towards an IPO.

Amazon Excludes Venmo: Understanding The Reason Behind This Decision

Amazon has informed its users that they will no longer be able to use Venmo as a payment option. The company clarified that while direct Venmo payments will cease, they will continue to accept Venmo debit and credit cards. This change aligns with a separate announcement from Venmo itself, indicating a shift in their partnership dynamics. According to Amazon, recent updates have led to the decision that Venmo can no longer be added as a new payment method. However, for users who already have Venmo linked to their Amazon accounts, this payment option will remain accessible until the specified date of January 10, 2024.

Source: Amazon

The decision to remove Venmo as a payment option on Amazon has caught many by surprise, especially since the exact reason behind it hasn’t been disclosed. While some speculate it might be due to slower-than-expected adoption, it’s puzzling given Amazon’s initial enthusiasm in introducing Venmo as a checkout option last October. Venmo, known for its quick money transfers between users, seemed like a fitting addition to Amazon’s various payment choices at that time.

And despite PayPal’s efforts over the past ten years to incorporate Venmo into its overall business strategy after acquiring it, this move by Amazon is a setback after just 14 months of partnership. For Venmo, this partnership was a step toward diversifying beyond P2P transactions, potentially increasing its revenue through transaction fees from retail sales. While the collaboration was announced in 2021, it wasn’t until October 2022 that the integration became active.

Earlier attempts as well by PayPal to boost Venmo’s popularity among teenagers didn’t pan out as hoped. Now, with Amazon dropping Venmo as a payment choice, PayPal faces another challenge in its growth plan. They reassured customers that numerous other payment methods remain available for convenience.

PayPal’s spokesperson, Joshua Criscoe, in a recent interaction, said that Venmo and Amazon have decided to deactivate Venmo as a payment method on Amazon for now. However, customers can still link Venmo cards to Venmo accounts for Amazon payments. Criscoe emphasized PayPal’s strong relationship with Amazon and expressed optimism about its future growth. Following this announcement, PayPal’s stock experienced a slight decline, too.

Steps For Subscribers To Avoid Disruptions

Amazon’s changes will affect one-time purchases and recurring payments like Prime memberships and other subscriptions. If you’ve set up Venmo as your go-to method for these payments, Amazon cautions there could be hitches.

To avoid any issues, switching your payment details before the mentioned date is a good idea. Simply log into your Amazon account, head to the “Memberships and Subscriptions” section, and make the necessary updates.

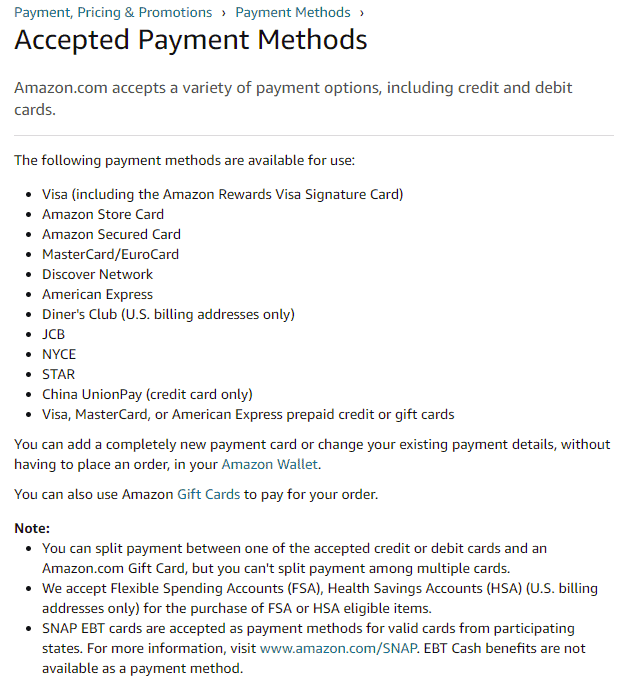

While Venmo, along with PayPal, will no longer be a payment option on Amazon, the platform continues to offer a diverse array of payment methods to accommodate its users. Customers can conveniently make purchases using various gift cards, including Visa, Amazon, American Express, and MasterCard. Additionally, payments can be processed directly through checking accounts.

Amazon’s range of accepted payment methods extends to major credit card options such as Prime Visa, Visa, Amazon Secured Card, Amazon Store Card, Discover, MasterCard/EuroCard, JCB, China UnionPay, and American Express. It’s important to note that specific payment options may be applicable only for certain types of purchases. For customers with a US billing address, Amazon offers the flexibility to utilize FSA or HSA for eligible items. Moreover, in select states, the platform also accepts SNAP EBT cards, allowing users to purchase groceries seamlessly.

PayPal Facing Troubles From All Sides

PayPal has been facing challenges recently, reflected in a 16% drop in its stock value over the past year. Adding to the pressure, Stripe, another payment processor, has been strengthening its ties with Amazon and is moving forward with plans for an IPO.

In an effort to face these challenges, PayPal appointed a new CEO, Alex Chriss, in September. Chriss has been actively working to strengthen partnerships within the tech and finance industries. One notable achievement under his leadership was a collaboration with Apple. In October, PayPal announced that customers could link their PayPal or Venmo cards to Apple Wallet. Additionally, PayPal ventured into the realm of stablecoins earlier in the year, a move that caught the attention of the SEC, resulting in a subpoena.

About Amazon

Amazon.com, Inc. is a prominent player in the industry selling a wide range of consumer products and subscriptions both online and in physical stores worldwide. The company operates across three segments – International, AWS, and North America. Amazon offers a selection of products from both its inventory and third-party sellers. They sell devices like Fire tablets, Kindle e-readers, Rings, Fire TVs, and Echo smart speakers. Additionally, Amazon creates media content and provides platforms for creators such as musicians, authors, and Twitch streamers to showcase their work and make sales.

In addition to their presence, Amazon offers a suite of services through AWS, including cloud storage, computing capabilities, analytics tools, and machine learning solutions. They also handle product fulfillment services for sellers while providing content subscriptions and advertising services. Amazon Prime’s membership program offers benefits to subscribers. Established in 1994 with its headquarters located in Seattle, Washington; Amazon caters to a clientele comprising sellers, consumers, enterprise developers, advertisers, and content creators.

About Venmo

Venmo was established in 2009 as a straightforward solution for sending money through text messages. By the end of 2010, they introduced an app to make transactions even easier. Initially, Venmo mainly focused on person-to-person (P2P) payments and simple transactions like paying for food trucks. However, they have since expanded their services to allow users to make in-person payments to various merchants. Users have the flexibility to fund their Venmo accounts and link them to bank accounts, debit cards, or credit cards. At present, more than 2 million merchants accept Venmo payments. Venmo employs the most advanced security measures and specialized algorithms to prioritize user safety to protect information and prevent unauthorized activities.

The user-friendly Venmo mobile app is available on both iOS and Android platforms, enabling users to transfer funds from their Venmo balance into their bank accounts. In terms of ownership history, Braintree acquired Venmo for $26.2 million in 2012 before being acquired by PayPal in December 2013. Today, Venmo operates as part of the PayPal family.

Conclusion

The decision made by Amazon to remove Venmo as a payment option reflects the changing interest in e-commerce partnerships and the strategies they employ. Although the exact reasons behind this move have not been disclosed, it highlights how online retail is an environment where alliances can shift based on factors like user adoption rates and strategic business decisions. While this transition may cause some inconvenience for Amazon users, they have a range of alternative payment methods available to ensure minimal disruption. It also serves as a reminder of the importance of reviewing and updating payment settings, especially when changes are announced.

On the other hand, for PayPal, the Venmo situation adds to a series of challenges highlighting the highly competitive nature of the payment processing industry. As both Amazon and PayPal steer through these shifts, they continue exploring opportunities for growth and innovation to provide consumers with secure payment options. Overall, this development demonstrates how fluid the digital payment ecosystem is, emphasizing adaptability and foresight as qualities. Moving forward, it will be fascinating to observe how these industry players continue to evolve and shape the future of transactions.