This week, Visa unveiled seven new payment solutions, including one that could be seen as a “reimagining” of the conventional payment card. Visa, the credit card giant, is paving the way for a future where physical credit cards and card numbers may become obsolete. At the annual Visa Payments Forum in San Francisco, the company announced several new card innovations and digital products to transform the payment landscape.

Traditional features in the payment card industry, such as embedded chips, plastic cards, closed-loop systems, and the need to recall 16-digit numbers and CVVs, now seem outdated, reminiscent of 20th-century relics. The movement towards digital platforms and mobile devices and the swift growth of cutting-edge technologies like artificial intelligence are revolutionizing the design, issuance, personalization, and use of payment cards.

These innovations are part of Visa’s strategy to utilize generative AI to revolutionize payments, potentially eliminating the need to shuffle through multiple cards and enhancing user experience.

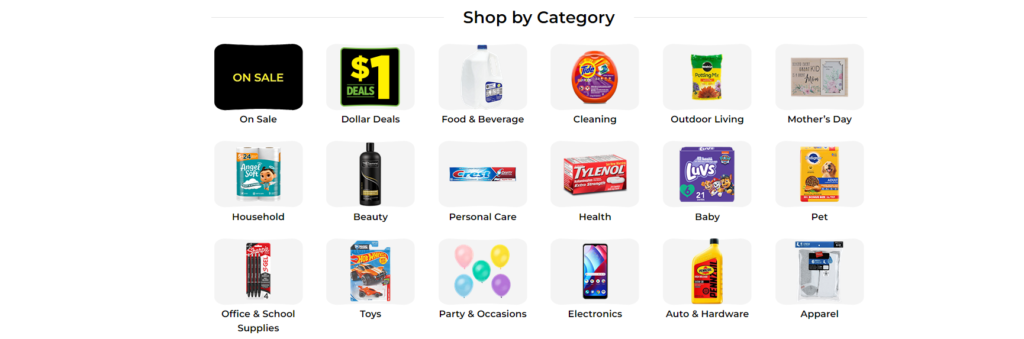

Key Takeaways of Visa New Card Innovations

- Visa Introduces Flexible Credential and Payment Passkey Service: Visa’s new digital products, including the Visa Flexible Credential and Payment Passkey Service, are designed to simplify and secure the payment process. The Flexible Credential allows consumers to switch between different payment methods using one card, while the Payment Passkey Service enables biometric authentication for online purchases.

- Enhanced Tap-to-Pay Features: Visa is upgrading its tap-to-pay technology with new functionalities like “tap to confirm,” “tap to add card,” and “tap to P2P payments.” These features aim to enhance the security and convenience of digital transactions, making it easier for users to authenticate their identity and manage their cards.

- Pay by Bank Service: Pay by Bank allows customers to make payments directly from their bank accounts through Visa’s secure network. This service is designed to streamline the checkout process by eliminating the need for card details and passwords, thereby reducing the risk of fraud.

- Visa Protect for A2A Payments and Data Tokens: Visa Protect for A2A Payments uses AI to enhance the security of account-to-account transactions by detecting and preventing fraud. Additionally, Visa’s introduction of data tokens enables consumers to manage and control their personal data sharing, providing more transparency and personalized shopping experiences.

Visa Unveils New Digital Payment Solutions, Paving the Way for a Cardless Future

Visa is at the forefront of a movement towards a future where physical credit cards and card numbers may become less necessary. At the annual Visa Payments Forum in San Francisco, the credit card giant revealed a range of digital products to revolutionize the payments industry.

Jack Forestell, the Chief Product Officer (CPO) and Chief Strategy Officer (CSO), highlighted the significant shift occurring in the industry, propelled by advancements in generative AI. These technologies are reshaping the way we shop and manage our finances, setting the stage for the introduction of digital-native payment card experiences. Visa announced new card features and digital innovations aimed at providing consumers with more personalized, convenient, and secure payment options. These products and services are set to begin rolling out later this year.

1. Visa Flexible Credential

The Visa Flexible Credential is an innovative technology that enables issuers to offer their clients the ability to access multiple funding sources through a single existing payment card. This new feature allows consumers to seamlessly switch between various funding options such as checking accounts, lines of credit, prepaid debit cards, loyalty points, or Buy Now, Pay Later (BNPL) plans.

Shoppers in Asia have already started experiencing this flexibility, and as more issuers adopt the technology, all consumers will soon enjoy the convenience of accessing diverse funding sources with just one card, marking a significant advancement in the future of payments.

2. Visa Payment Passkey Service

Visa has introduced passkeys as a new method for authorizing payments, allowing customers to make purchases online using a biometric scan on their smartphone or computer. This capability is provided through the Visa Payment Passkey Service, which is built on Visa’s own Fast Identity Online (FIDO) server. The service adopts a federated model, enabling merchants to easily integrate this biometric authentication feature into their checkout processes without the need to develop their own servers or undergo complex technical integrations.

This means consumers can utilize the same biometric authentication systems they already use to unlock their devices and securely make Visa payments online. Enrollment is simple and needs to be done only once during checkout. Visa also plans to enable enrollment through banking apps in the future, further simplifying the process.

Jack Forestell emphasized the widespread demand for uniformity, interoperability, and simplicity in online payments. Visa’s introduction of passkeys, specifically tailored for payment authentication, marks a significant shift in the industry. These passkeys streamline the checkout process by confirming identity without disruption. The Visa Payment Passkey Service enhances security while minimizing friction during online payments across any device or website worldwide.

In its initial deployment of passkeys, Visa has incorporated the Visa Payment Passkey Service into its Click to Pay feature, creating a more seamless and secure checkout experience on a large scale. Furthermore, Visa is collaborating with issuers in various global markets to integrate the Visa Payment Passkey Service and Click to Pay into new Visa cards. This integration will eliminate the need for manual card details and password entries when the card is first received, simplifying the payment process right from the start.

3. Tap-to-Pay

Visa is enhancing its tap-to-pay capabilities by offering several innovative features. Alongside the conventional method of tapping a smartphone to pay without needing specialized point-of-sale hardware, Visa is introducing several new functions. These include “tap to confirm,” which authenticates a user’s identity during online shopping, and “tap to add card,” which offers additional security when adding a card to a digital wallet or app. Visa also integrates “tap to P2P payments,” enabling consumers to send money to family and friends easily.

Furthermore, Visa has streamlined the transaction confirmation process. Now, transactions can be authenticated simply by tapping the card against a phone, removing the need for further input. This enhancement aims to make digital payments quicker and more secure for users.

4. Pay by Bank

Pay by Bank enhances the convenience and security of online payments by allowing customers to transact directly from their bank accounts over Visa’s secure network. Designed to simplify the checkout process, this service eliminates the need to enter card details or remember passwords, saving time and minimizing the risk of sharing sensitive information online.

Utilizing advanced security measures and technology, “Pay by Bank” ensures robust protection for transactions by integrating directly with bank accounts and leveraging Visa’s security protocols. This service simplifies account-to-account (A2A) payments, offering consumers various payment options, including loan applications, A2A transfers, or using other funding sources like credit cards. Visa is introducing this technology in the U.S., aiming to support its clients in delivering seamless and secure banking experiences.

5. Visa Protect for A2A Payments

Visa has introduced a new service called Visa Protect for A2A Payments to enhance the security of account-to-account (A2A) transactions. Using its extensive fraud prevention experience, Visa has integrated artificial intelligence (AI) to mitigate fraud risks across real-time payment (RTP) networks globally. This service scrutinizes a variety of transaction data to detect and thwart fraud. Already active in regions like Latin America and undergoing trials in the UK, it has effectively identified numerous RTP frauds and scams that were previously undetected.

With a significant investment of $10 billion in technology and innovation over the past five years, Visa continues to lead in securing digital transactions. These investments underscore its dedication to safeguarding all types of electronic payments.

6. Data Tokens

One of the key highlights from the Visa Payments Forum was the introduction of Visa data tokens. This innovative development utilizes Visa’s tokenization infrastructure and a network of partner banks to enhance consumer control over their personal data usage. These AI-powered tokens enable consumers whose banks participate in the program to actively manage how their data is shared with merchants and financial institutions, aiming to deliver personalized experiences.

Consumers can consent to share their data while shopping online, monitor where their data has been shared, and revoke access directly through their banking app. Additionally, when a consumer agrees to share their data, Visa generates a private data token for the merchant, which includes AI-generated insights from the consumer’s transaction data.

This token can be integrated into the merchant’s AI models to provide tailored real-time shopping recommendations. Furthermore, Visa ensures transparency by providing information to the consumer’s bank about where the data has been shared, enabling consumers to review and manage these settings conveniently through their mobile banking app.

About Visa

Visa Inc. is a global payment technology company based in the United States with international operations. The company manages VisaNet, a transaction processing network that handles the authorization, clearing, and settlement of payment transactions. Visa provides various products, including debit, credit, and prepaid cards; it also offers tokenization, tap-to-pay, and click-to-pay services. Additionally, Visa Direct enables the transfer of funds to eligible cards, digital wallets, and bank accounts; Visa B2B Connect serves as a business-to-business cross-border payment network; and Visa Cross-Border Solution facilitates cross-border consumer payments.

Visa DPS delivers value-added services like dispute resolution, fraud prevention, campaign management, data analytics, contact center support, and digital solutions. The company’s acceptance solutions feature Cybersource, which connects merchants to payment processing and offers risk management and identity solutions like Visa Advanced Authorization and Visa Secure. Furthermore, Visa Consulting and Analytics provides advisory services in payment consulting. Visa operates under various brand names including Visa Electron, Interlink, V PAY, and PLUS, serving merchants, financial institutions, and governmental entities. Founded in 1958, Visa is headquartered in San Francisco, California.

Conclusion

Visa’s recent announcements at the Visa Payments Forum highlight its dedication to evolving the digital payment landscape. By introducing the Visa Flexible Credential, Payment Passkey Service, and enhanced tap-to-pay features, Visa aims to provide more secure, convenient, and versatile payment options.

The Pay by Bank service and Visa Protect for A2A Payments focus on streamlining transactions and enhancing security, while data tokens offer greater control over personal data. These innovations signify Visa’s commitment to leveraging advanced technology, particularly generative AI, to improve the user experience and adapt to changing market needs. As these features roll out, they promise to redefine how consumers interact with payment systems, moving towards a more cardless and secure future.