Endpoint security systems detect malicious software and security incidents, issue warnings, automate investigative processes, and execute corrective actions. CrowdStrike stands out as a prominent figure in global cybersecurity, offering a flexible and extensive platform designed to address significant security challenges businesses face. This comprehensive guide will discuss and analyze some other effective CrowdStrike alternatives.

What Is Endpoint Security?

Endpoint security safeguards devices like smartphones, laptops, tablets, and desktop computers from cyber threats. Businesses use endpoint security systems to secure devices that employees use for work, whether these devices are connected to the cloud or to the company’s own network.

Each device that connects to a company’s network or cloud services can be a point of vulnerability, possibly allowing unauthorized access. Cybercriminals can exploit these points by deploying malware to access and steal sensitive information.

To counter these threats, organizations implement tools that manage cyber risks on these devices by detecting, analyzing, and blocking them. Current endpoint security solutions are often available as an Endpoint Protection Platform (EPP), incorporating various security measures such as advanced antivirus software, firewalls, and endpoint detection and response (EDR) systems.

Why Is Endpoint Security Essential?

Endpoint security is crucial for every organization to manage the risks associated with both local and remote devices. Each device that connects to the network may serve as a potential entry point for attacks, a risk that has grown with the increase in remote working and the expanding number of endpoint devices.

Attacks that exploit human errors, like phishing, are on the rise, while servers remain primary targets for attackers due to their critical role in operations. Data breaches can be costly, often resulting in millions of dollars in losses, primarily due to the revenue impact from disrupted business activities.

Robust endpoint security protects against such social engineering tactics and significantly narrows the possible points of attack. It establishes multiple protective barriers to ward off frequent attacks. Crucially, it equips security teams with the necessary tools to detect and address threats that evade initial defenses, thereby mitigating the consequences of security breaches.

An Overview of CrowdStrike

CrowdStrike is a global cybersecurity firm that provides antivirus and endpoint security solutions that are widely adopted by various international companies and organizations. Additionally, CrowdStrike offers services in threat intelligence and responses to cyber-attacks. Through its software platform, it offers cloud-based endpoint security. This platform is designed to prevent, detect, and respond to cyber threats. At the heart of CrowdStrike’s offerings is the Falcon platform, a unified, lightweight agent that is native to the cloud and enhances threat visibility.

The platform includes real-time monitoring and recording features that increase an organization’s awareness of its threat environment, facilitating easier identification and management of potential vulnerabilities.

Why Look for CrowdStrike Alternatives?

Recently, CrowdStrike was implicated in a significant incident linked to a Microsoft outage on 19th July 2024, impacting banks, airlines, and other businesses globally.

The disruption led to the widespread return of the infamous blue screen of death, traced to a flaw in a content update for Windows hosts associated with CrowdStrike’s Falcon Sensor software. This update introduced a file that altered the logic used to detect malicious actors, but unfortunately, it triggered problems exclusively within the Microsoft ecosystem due to a specific bug.

Despite this incident, several other factors might lead businesses to reassess their relationship with CrowdStrike:

- Deployment Challenges

Setting up and configuring the CrowdStrike platform requires substantial technical know-how, which can be a significant hurdle for companies lacking a specialized IT team or those with minimal technical staff. Also, even though CrowdStrike is a cloud solution, it necessitates installing an agent on each device it protects. This requirement can lead to a labor-intensive and complex deployment process, particularly for large organizations with many endpoints.

- Cost Concerns

CrowdStrike’s pricing is notably high, which can be a barrier for some businesses, particularly minimal-to-medium-sized enterprises, that may find the costs daunting. The company employs a subscription-based pricing strategy, which, while offering flexibility, may become costly over time compared to one-time purchase licenses. This model might not align well with organizations operating on limited budgets.

- Incompatibility with Older Systems

Another limitation is CrowdStrike’s inadequate support for older legacy systems. Businesses that depend on such systems for essential operations might encounter compatibility issues with CrowdStrike’s technology. This incompatibility can prevent these organizations from fully integrating or benefiting from CrowdStrike’s security solutions.

- Issue of False Positives

CrowdStrike occasionally misidentifies harmless activities as threats, resulting in false alarms. These erroneous alerts disrupt operations and consume valuable time and resources as staff investigate non-existent threats. A high frequency of false positives may also lead to alert fatigue, where real threats could be ignored due to frequent false alarms.

Essential Features to Look Out for in an Endpoint Security System

When selecting any endpoint security system, these features are essential for safeguarding sensitive information and maintaining transparency in cyber security efforts:

- Firewalls and Access Management

The primary component of an endpoint protection strategy is the firewall. Today’s firewalls handle more specific responsibilities than older versions, particularly in distributed networks. As employees increasingly work outside the traditional office setting, the effectiveness of a centralized hardware firewall diminishes. However, this shift does not eliminate the need for firewalls to secure endpoint devices. These devices can be safeguarded through tailored access controls that govern device usage based on custom policies.

Additionally, the increasing variety in network endpoints necessitates a unique approach to protection. Like firewalls, ring-fencing restricts network access to specific applications, effectively isolating them to prevent the misuse of known and potential vulnerabilities. This approach leverages detailed policies tailored to individual users and devices to manage network access meticulously.

- Threat Intelligence

Your security platform should integrate with external providers to enhance threat intelligence capabilities. The system should be able to collect and analyze data on current or developing threats from various sources, transforming it into actionable insights. Such intelligence offers real-time alerts and supports the development of anticipatory security measures to reduce risks.

- Endpoint Device Tracking

Effective endpoint protection systems usually feature device tracking capabilities to address the risk of data breaches from lost or stolen devices. This feature is crucial not only for portable devices like laptops but also for others less prone to theft, such as printers and cameras.

Security tools need to monitor the status of these devices, even tracking them across different locations globally, and provide options for remote actions like wiping data if the device remains connected.

- Cloud Storage and USB Protection

Endpoints frequently connect to cloud storage solutions, from local servers to major cloud platforms. Alternately, when cloud services aren’t used, USB devices become common for data storage and are also vulnerable to cyber threats. Security measures for cloud storage should guard against phishing, malware, and other attacks aimed at cloud infrastructure.

For USB devices, security protocols might include enabling or disabling connections, potentially prohibiting USB storage across networks, and extending to other types of USB-connected equipment. Implementing endpoint security that manages both cloud and USB interactions is advisable to ensure comprehensive protection.

- Adaptive Protection

Adaptive protection in endpoint security dynamically adjusts to the evolving threat landscape. This type of protection leverages machine learning and artificial intelligence to analyze behaviors and identify anomalies that could indicate threats.

This proactive stance allows the system to detect and respond more effectively to advanced threats like zero-day attacks and ransomware. The technology continuously learns from new data, improving its predictive capabilities and thus fortifying the organization’s security posture against known and unknown threats.

- Data Loss Protection (DLP)

Data Loss Protection is an integral aspect of advanced endpoint security systems. It ensures that sensitive information does not leave the secure confines of the network without authorization. DLP tools monitor and regulate data transfer across various channels through removable media, network exchanges, or applications.

By implementing stringent policies, DLP systems can prevent unauthorized file transfers, including through emails and collaborative platforms, and restrict access to sensitive data. This layer of protection is crucial for preventing data breaches and ensuring that critical information remains protected within the organizational network.

- Content Control

The system you choose must have content control, as endpoint security systems allow for the granular management of web access across an organization. This can include blocking or allowing access to specific websites and managing the categories of content that can be accessed.

For example, categories such as adult content, gambling, and sites promoting violence can be specifically blocked to maintain compliance and protect network integrity. These systems ensure that organizational policies on internet use are enforced without requiring manual oversight for every decision, which helps mitigate potential legal liabilities and enhance productivity.

- Reports and Alerts

Effective endpoint security solutions must include robust reporting and alert mechanisms to provide administrators with timely and accurate insights into the security health of their network endpoints.

These tools deliver detailed alerts and prioritized notifications about potential vulnerabilities, aiding in promptly identifying and mitigating threats. The availability of comprehensive dashboards and reports enhances visibility into the business’s security, allowing for quick responses and minimizing the risk of widespread damage from security breaches. Rapidly detecting threats is essential, as the longer a threat remains undetected, the greater the potential for extensive harm to the system.

Top 9 Alternatives to CrowdStrike Currently Available in the Market

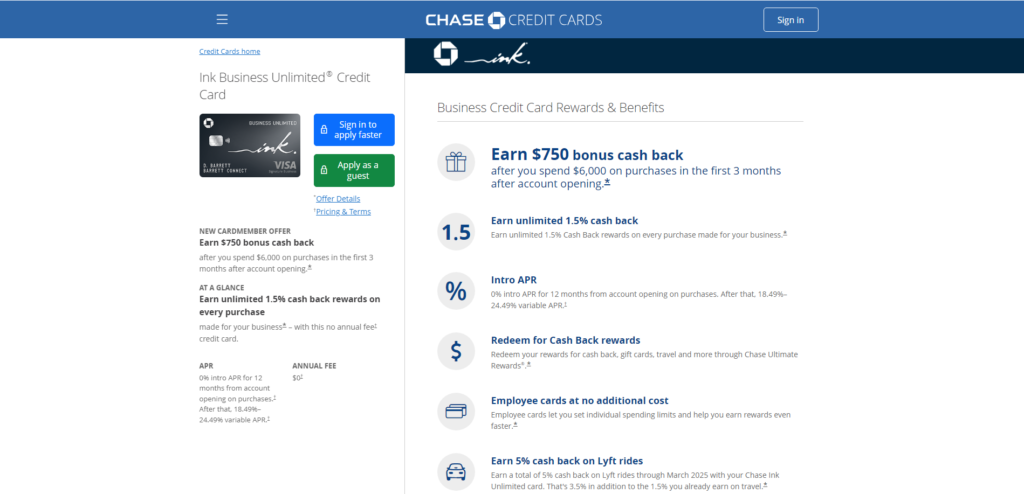

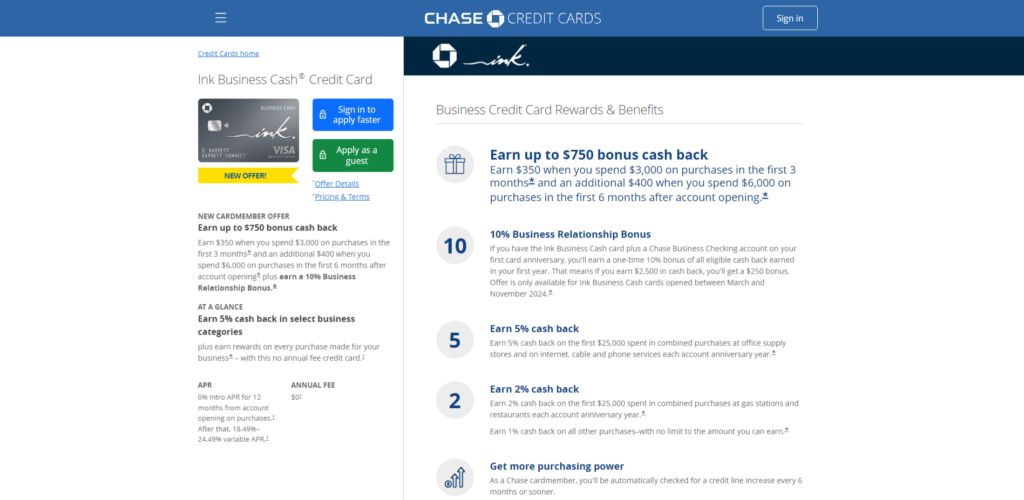

1. Heimdal

Heimdal Endpoint Security offers extensive security features to protect devices from cyber threats. It includes advanced tools such as Next-Generation Antivirus, Endpoint Detection and Response, Application Control, Firewall, and Mobile Device Management. Heimdal provides a robust defense against malware, unusual activities, and unapproved applications.

Image source

Key advantages of using Heimdal include increased operational efficiency through automation, centralized control for easier management, and early threat detection. Additionally, it offers specialized security options for mobile devices. Heimdal Endpoint Security is designed for businesses and organizations of all sizes, addressing the complex cybersecurity challenges today’s enterprises face with effective and comprehensive protection.

Key Features of Heimdal

- Content Control: Organizations can regulate web traffic using the Content Control feature, which blocks access to harmful or undesired websites through DNS filtering. This method intercepts harmful domains, reducing the risk of phishing and malware infections.

- Custom Block Pages: When users try to visit blocked sites, they are greeted with custom block pages. These pages can be tailored with the organization’s branding and specific messages explaining access restrictions.

- Application Control: This functionality allows for the management of application usage on endpoint devices by either approving (whitelisting) or denying (blacklisting) specific applications. This helps curb the use of unauthorized software, mitigates the risk of shadow IT, and ensures adherence to security protocols.

- Patch Management: Integrated with Heimdal’s patch management system, Content Control ensures that all software and operating systems on network devices are regularly updated. This feature automatically installs patches and updates, minimizing vulnerabilities.

- Proactive Threat Detection: Heimdal employs a proactive stance and offers detection capabilities through Indicators of Compromise (IOC) and Indicators of Attack (IOA) at the traffic layer. This preemptively identifies threats at the network level before they escalate to endpoint processes, thwarting potential attacks early.

- Remote Device Management: Heimdal’s platform also facilitates remote management of devices, enabling administrators to locate, lock, or erase devices that are lost or stolen. This feature is essential for effective mobile device management (MDM), enhancing security for devices operating beyond the corporate network.

Heimdal Pricing

Heimdal Endpoint Security pricing details can be obtained by contacting their sales team. The licensing cost differs based on the subscription length, including monthly, yearly, three-year, and five-year options. Additionally, Heimdal offers a free demo that can be signed up for on their website.

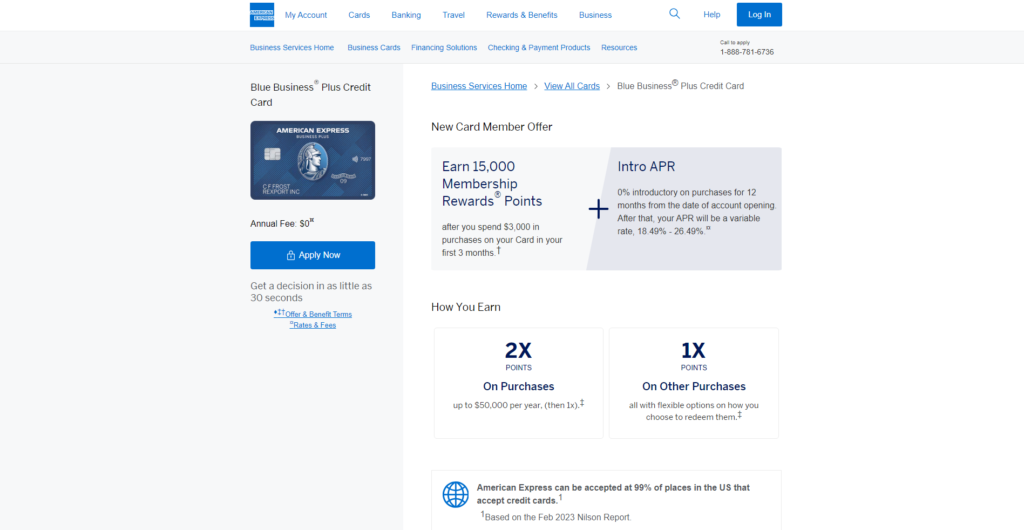

2. Cynet

Cynet offers a comprehensive security package that safeguards against threats targeting endpoints and extends across your entire network. This system enables centralized control of endpoint security throughout your organization. With Cynet, proactive monitoring of your entire internal environment is possible, encompassing endpoints, networks, files, and hosts. This approach helps to minimize potential attack surfaces and reduce the chances of simultaneous attacks.

Image source

Key Features of Cynet

- Next-Generation Antivirus (NGAV): Cynet’s NGAV offers enhanced threat protection by scrutinizing both static files and active processes. It effectively identifies and halts new malware types that bypass traditional antivirus tools by altering their binary signatures.

- Endpoint Detection and Response (EDR): Cynet’s EDR system consistently monitors endpoints, delivering sophisticated threat detection and response. It anticipates potential attacker actions through ongoing monitoring and behavioral analysis, facilitating quick threat resolution and mitigation.

- Automated Response and Orchestration: The Cynet platform features automated mechanisms for threat investigation and resolution, rapidly addressing all aspects of an attack throughout the network. This automation lightens the load on security personnel and accelerates the resolution of security incidents.

- Deception Technology: Cynet employs deception to divert attackers from real assets to decoy setups. This strategy isolates the attackers, gathers intelligence on their tactics, and promptly notifies the security team.

- Centralized Log Management: Cynet’s centralized log management automatically collects and analyzes essential log data, aiding in quickly and precisely detecting threats across the network.

- User and Entity Behavior Analytics (UEBA): Utilizing artificial intelligence, Cynet’s UEBA identifies advanced threats, including file-less attacks and advanced persistent threats (APTs), by examining unusual patterns and suspicious behaviors in user and entity activities.

Cynet Pricing

Cynet offers two main cybersecurity packages with clear pricing. The Elite package includes an industry-leading XDR platform supported by 24/7 MDR, costing $7 per month per endpoint. Their All-in-one package provides a comprehensive Enterprise Security Platform backed by 24/7 MDR support, priced at $9 per month per endpoint.

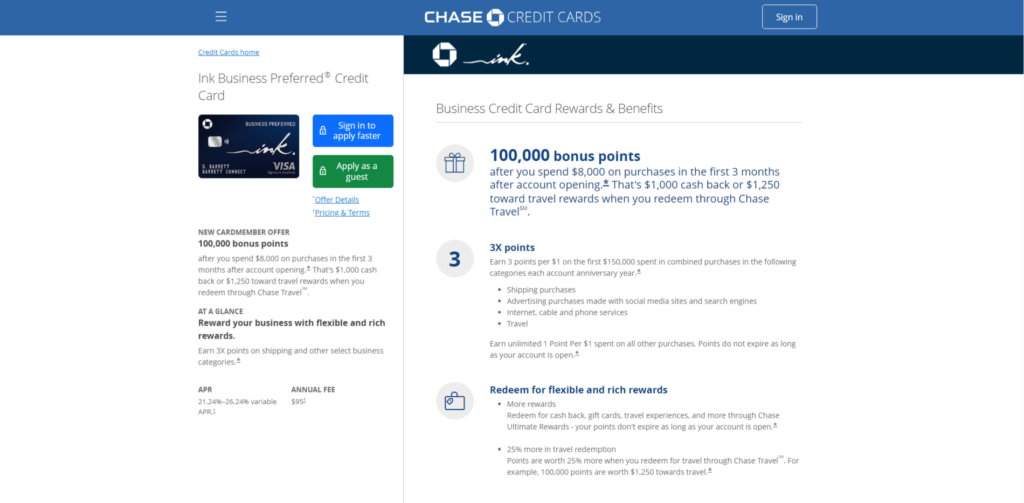

3. SentinelOne

Unlike CrowdStrike, having the SentinelOne platform may prove quite challenging and time-intensive. It integrates Unified Endpoint Protection (EPP), Next-Generation Antivirus (NGAV), Extended Detection and Response (XDR), and Endpoint Detection and Response (EDR) with AI-driven automation, enhancing security across endpoints, cloud environments, and Active Directory identities.

Image source

Achieving full functionality requires installing several substantial agents, undergoing system reboots during setup, and manually configuring exclusions to address software compatibility issues. Furthermore, the lack of an automatic sensor update feature necessitates additional maintenance efforts.

While the platform employs AI and automation, these technologies are primarily utilized at the sensor level, similar to conventional antivirus systems. Overall, the system is crafted to identify sophisticated threats, serve as a firewall, and support Security Operations (SecOps) teams with incident response capabilities.

Key Features of SentinelOne

- Proactive Threat Hunting with SentinelOne Active EDR: This feature empowers security analysts to actively seek out and mitigate potential threats within their network environment before they escalate. SentinelOne’s advanced search functions and extensive endpoint visibility facilitate the swift discovery of compromise indicators and enable thorough forensic analyses.

- EDR Customization with STAR: The STAR module allows for tailored adjustments to EDR configurations and policies. It provides security teams with the tools to devise bespoke detection rules, set up response protocols, and handle exceptions, enhancing an organization’s security measures while reducing the likelihood of false alerts.

- Rapid Incident Investigations with SentinelOne Active EDR: Designed for swift investigative and responsive actions, SentinelOne provides detailed insights into each threat, including processes, network connections, and file changes. These insights allow analysts to quickly evaluate threat severity, identify impacted systems, and determine necessary actions. The platform’s targeted search capabilities also aid analysts in focusing on specific investigative interests.

- High-Velocity Threat Detection with Storyline Technology: SentinelOne Active EDR utilizes Storyline technology to enhance the speed of threat detection. It synthesizes data from diverse sources into a coherent narrative, simplifying the task for analysts to grasp the full extent of a threat. This automated event correlation expedites detection, minimizes manual analysis time, and quickens incident response.

- Cloud Upload with Binary Vault: Integrating with Binary Vault, SentinelOne Active EDR offers a secure cloud space to store and analyze suspicious files for 30 days. This facilitates automatic cloud-based threat analysis to assess the risk of executable files, enhancing the ability to recognize threats and gather preemptively intelligence on evolving attack strategies.

- End-to-End Attack Remediation: SentinelOne Active EDR employs AI technology for autonomous containment and remediation of threats. Its capabilities include isolating compromised files, severing harmful network connections, and restoring systems to their state before the attack occurred.

SentinelOne Pricing

SentinelOne provides various cybersecurity solutions at different pricing levels depending on the package selected. The prices per endpoint for each package are as follows: Singularity Core is priced at $69.99, Singularity Control at $79.99, Singularity Complete at $159.99, and Singularity Commercial at $209.99. For the Singularity Enterprise package, the price is available upon inquiry.

These pricing structures apply to environments with 5 to 100 workstations. Each package offers different features and services, catering to a spectrum of basic and advanced business security needs.

4. Microsoft Defender

If you use a Microsoft-based operating system, you should know about Microsoft Defender for Endpoint, their security platform. This system utilizes advanced AI, featuring “Copilot for Security” as a key feature. It processes 78 trillion daily signals from various sources, enabling it to detect new threats effectively.

Image source

This is one of the safest options available. Although Microsoft has had its share of subpar software releases, these have generally not caused significant issues. As one of the largest software companies globally, Microsoft has robust capabilities for developing fixes. Additionally, using Microsoft’s own security services can simplify aspects like customer support. Therefore, if consistent and reliable customer support is a priority for you, Microsoft Defender for Endpoint might be the optimal choice.

Key Features of Microsoft Defender

- Endpoint Behavioral Sensors: Integrated within Windows 10, these sensors collect and analyze behavioral data from the operating system. The gathered information is then transmitted to a cloud-hosted, private version of Microsoft Defender for Endpoint.

- Automatic Attack Disruption: This feature proactively disrupts ransomware attacks by blocking their ability to move laterally and encrypt remotely across decentralized devices.

- Cloud Security Analytics: This capability leverages data from Microsoft’s extensive ecosystem, including online resources and enterprise cloud services like Office 365. Utilizing advanced big-data analytics and machine learning, it interprets behavioral signals to provide threat detections, insights, and recommended actions for mitigating risks.

- Threat Intelligence: Contributed by third-party partners and Microsoft’s security experts and hunters, this intelligence is crucial for Defender for Endpoint. It enables the identification of specific attacker methodologies, techniques, and tools, generating alerts when these indicators are detected in the sensor data.

Microsoft Defender Pricing

Microsoft provides its Defender for Endpoint solution in two tiers: P1 and P2. The P1 plan emphasizes preventive measures and includes unified security tools under centralized management, such as advanced antimalware, device controls, and an endpoint firewall. The P2 plan encompasses all features of P1 along with additional capabilities like automated investigation and remediation, threat intelligence, and sandboxing. For pricing details, please reach out to Microsoft directly.

5. Symantec

Symantec provides various cybersecurity services, such as endpoint protection, cloud security, and threat intelligence. A key advantage of Symantec is its extensive threat intelligence network. This allows the company to collect and analyze data from diverse sources worldwide, offering businesses critical insights into potential threats. These insights help shape effective security strategies to address emerging risks.

Image source

The endpoint protection offered by Symantec employs a comprehensive strategy to guard against various threats, including malware, ransomware, and zero-day attacks. It features an automated threat response capability, enabling the system to respond to threats promptly.

Key Features of Symantec

- Anti-malware and Antivirus Protection: Symantec Endpoint Protection employs multiple detection engines and behavioral analysis to identify and neutralize familiar and emerging threats. This proactive defense mechanism is effective against various types of malware, such as viruses, ransomware, and fileless attacks.

- Intrusion Prevention System (IPS): The IPS feature actively monitors and analyzes network traffic to intercept and block malicious activities before they compromise your device. It plays a crucial role in thwarting unauthorized access and mitigating the risk of cyber attacks by detecting and neutralizing threats instantaneously.

- Firewall Protection: Symantec’s integrated firewall oversees incoming and outgoing network traffic, blocking unauthorized access attempts. It enhances security by enforcing traffic rules based on established security protocols.

- Application Control: This functionality enables organizations to manage application usage by authorizing (whitelisting) or prohibiting (blacklisting) certain applications. This control helps prevent malware infections and enforces compliance with internal software policies.

- Data Loss Prevention (DLP): Included in Symantec Endpoint Protection, the DLP feature monitors and controls the movement of sensitive data to prevent unauthorized disclosure. This capability is essential for safeguarding intellectual property and adhering to data protection laws.

- Endpoint Detection and Response (EDR): Symantec Endpoint Protection’s EDR capability provides comprehensive visibility into endpoint behaviors, facilitating swift responses to detected threats. It allows for quick identification, investigation, and resolution of security incidents, reducing the impact and downtime caused by such events.

Symantec Pricing

Symantec Endpoint Security does not offer a free version; the paid version costs $39 per year.

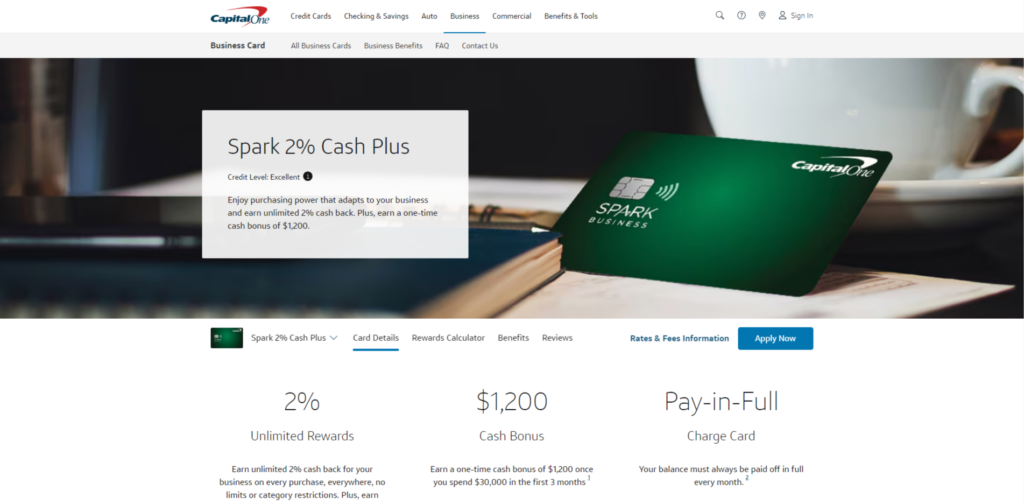

6. Palo Alto Networks

Palo Alto Networks stands as a significant competitor to CrowdStrike, particularly in the area of endpoint security. This company is recognized as a leader in the field and provides extensive solutions that can fulfill the requirements of almost any business. Like many contemporary cybersecurity firms, Palo Alto Networks incorporates artificial intelligence. Its “Precision AI” is designed to mitigate AI-driven threats from external entities, offering protection against bots that might scan networks for vulnerabilities. Palo Alto also includes all the standard features expected from a top-tier cybersecurity provider.

Image source

Palo Alto Networks boasts a notable list of high-profile clients, including Caesars Entertainment, Michelin, the Formula E racing team Envision Racing, and Autodesk. It is widely regarded as one of the major players in the industry and serves as a direct alternative to CrowdStrike for businesses considering a change.

Key Features of Palo Alto Networks

- Next-Generation Firewalls (NGFWs): Palo Alto Networks equips its NGFWs with machine learning to tackle and avert elusive threats. These firewalls feature inline deep learning and are supported by the insights of the Unit 42 Threat Research team, enabling them to halt a wide array of threats, including zero-day and previously unknown threats, more effectively than traditional methods. This advanced technology not only decreases the number of security incidents but also enhances operational efficiency, providing a substantial return on investment.

- Cortex XSIAM: Utilizing AI, the Cortex XSIAM platform augments the capabilities of Security Operations Centers (SOCs). It provides enhanced visibility into cloud assets and incidents through its Cloud Detection and Response (CDR) feature and is integrated with Prisma Cloud to streamline incident management. With support for over 1,000 integrations, the platform facilitates extensive threat detection and responsive actions across diverse environments.

- Precision AI: Embedded within its various platforms, Palo Alto Networks’ Precision AI delivers self-reliant security solutions. This technology focuses on context-driven, actionable, and proactive security interventions that enhance operational efficiency and user experiences. Its AI-driven functions are critical in spotting vulnerabilities, securing AI applications, and ensuring comprehensive threat prevention.

- Prisma Cloud: Prisma Cloud ensures the security of applications, data, and the broader cloud infrastructure. It incorporates AI Security Posture Management (AI-SPM) and runtime security to safeguard AI-driven applications against threats. This helps maintain data integrity and compliance throughout the application lifecycle, from development to deployment.

- Private 5G Security: Palo Alto Networks offers robust security solutions tailored for private 5G networks, collaborating with partners such as Celona, Druid, and NVIDIA. These solutions provide critical visibility, enforce policies, and facilitate threat detection across enterprise devices utilizing 5G networks, ensuring that these networks are both secure and efficient.

Palo Alto Networks Pricing

Palo Alto Networks offers a range of cybersecurity solutions priced to accommodate businesses of various sizes and budgets. Prices start at around $3,000 for an entry-level package suitable for small companies or startups and scale up to between $50,000 and $100,000 for mid-sized companies.

Large enterprises requiring advanced security measures can expect to invest around $1,000,000 for the most comprehensive packages. These prices reflect the sophisticated technology and capabilities provided by Palo Alto Networks, representing a significant investment for prospective buyers.

7. ESET

ESET is a leading provider of endpoint security and antivirus solutions, known for its robust yet efficient products that cater to the security demands of organizations across more than 200 countries. Their flagship product, ESET Endpoint Security, is a cloud-based solution offering comprehensive protection capabilities to address existing and emerging threats. This platform utilizes ESET’s advanced machine learning technology, expert human insights, and a wide-reaching global threat detection network to deliver layered security protection.

Image source

ESET Endpoint Security includes several key components: a proactive anti-phishing module, threat detection mechanisms, a cloud-based scanning tool, an exploit blocker, and a bidirectional firewall. These elements are designed to meet general cybersecurity standards and the specific needs of various industries. The software is available in multiple versions, each with unique features tailored to enhance security for different operating systems and device types.

Key Features of ESET

- Antivirus and Antispyware Protection: ESET provides comprehensive antivirus coverage, defending against online and offline threats. It effectively prevents the spread of malware within the network, safeguarding other devices and users.

- Full Disk Encryption: ESET’s full disk encryption feature secures entire disks or specific partitions, protecting sensitive data. This is critical for businesses needing to adhere to data protection regulations and is available in the Protect Advanced, Protect Complete, and Protect Enterprise editions.

- Cloud Sandbox: ESET utilizes a cloud sandbox environment to analyze suspicious files in a contained setting, protecting your network from zero-day threats and ransomware by preventing these potential threats from penetrating your system.

- Endpoint Detection and Response (EDR): In the Protect Enterprise edition, ESET’s EDR capabilities offer real-time surveillance and response to security incidents and anomalies, equipping organizations with sophisticated threat detection and response tools.

- Multi-Factor Authentication (MFA): To bolster security, ESET incorporates MFA, which requires additional verification methods before allowing access to systems, significantly reducing the risk of unauthorized entry.

- Advanced Machine Learning: ESET leverages machine learning techniques both locally and in the cloud to efficiently identify and combat sophisticated threats, minimizing the impact on system performance and aiding in controlling advanced persistent threats.

- Firewall and Botnet Protection: ESET’s firewall safeguards your network from unauthorized access, and its botnet protection halts malicious communications. Together, these features protect your network from the disruptions caused by large-scale botnet threats.

ESET Endpoint Pricing

ESET Endpoint Security offers three pricing plans. There is no free version, although a free trial option does not require a credit card. Discounts are provided and can vary depending on the number of seats and the frequency of the plan. The ESET PROTECT Entry is priced at $304 per year and includes file server security, modern endpoint protection, and a console for management.

The ESET PROTECT Advanced plan adds mobile threat defense, full disk encryption, and advanced threat defense for $396 per year. The most comprehensive package, ESET PROTECT Complete, costs $414 annually and encompasses cloud app protection, mail server security, and vulnerability and patch management. Each of these plans is billed annually.

8. VMware Carbon Black

VMware Carbon Black Endpoint Security is an all-encompassing endpoint protection platform (EPP) crafted to shield organizations from complex cyber threats like malware, ransomware, and other harmful attacks. Utilizing a cloud-native framework, it offers a comprehensive suite of tools for detecting, preventing, investigating, and reacting to environmental cybersecurity events. Its standout features include advanced behavioral analytics, real-time threat hunting, and flexible policy customization, making it an optimal solution for companies aiming to enhance their defenses amidst the evolving cyber threat landscape.

Image source

The platform utilizes Predictive Security Cloud (PSC) technology, a sophisticated big data and analytics cloud platform that processes customers’ raw data to identify potential threats. Carbon Black Cloud delivers SaaS-based services for threat mitigation and automated attack detection. This system employs a Zero-Trust approach, supporting risk-based security protocols and providing immediate insight into endpoint activities, establishing a strong endpoint defense record.

Key Features of VMware Carbon Black

- Advanced Threat Detection and Response: VMware Carbon Black combines next-generation antivirus (NGAV) with behavioral endpoint detection and response (EDR) to tackle cyber threats. By leveraging behavioral analytics, it identifies and mitigates malicious activities before they inflict significant harm. This includes protection against sophisticated threats like fileless and malwareless attacks that traditional antivirus programs often overlook.

- Consolidated Security Management: The platform merges multiple security functions into a single agent and console. This streamlines management reduces downtime and enhances the efficiency of overseeing security operations. Administrators benefit from a simplified process for monitoring and responding to incidents, improving overall threat detection and remediation efforts.

- Adaptable Security Policies: VMware Carbon Black allows users to implement and tailor security policies to their specific requirements. While the platform provides predefined policies, users can also create, modify, and manage their own. This adaptability allows organizations to fine-tune their defenses to address evolving threats better.

- Optional Managed Detection and Response (MDR): VMware Carbon Black provides optional managed detection services for organizations seeking additional support. These services offer ongoing monitoring and triaging security alerts, enhancing threat identification and mitigation. This is especially beneficial for organizations with limited internal security resources.

- Advanced EDR and Threat Hunting: Enterprise EDR delivers advanced threat hunting and incident response capabilities. It offers continuous visibility into endpoint activities, enabling security teams to detect, investigate, and respond to threats in real time. This feature also supports comprehensive threat hunting by allowing analysts to search for compromise indicators across the network.

- Vulnerability Management and Real-Time Assessment: VMware Carbon Black includes features for assessing vulnerabilities and managing endpoint risks. It performs real-time assessments and offers remediation tools to address vulnerabilities promptly. This proactive approach helps to minimize the attack surface and prevent potential exploits, enhancing overall security resilience.

VMware Carbon Black Pricing

VMware keeps the pricing for Carbon Black confidential. However, Carbon Black Endpoint partners offer it at various rates – $52.99 per endpoint per year for a one-year plan, and $38.40 per endpoint per year for a five-year plan.

A three-year subscription to Carbon Black MDR costs $32.99 per endpoint per year. Costs vary from $36 per endpoint per year for a 36-month commitment to Cloud Endpoint Standard to $90 per year for a 12-month subscription to Cloud Endpoint Enterprise.

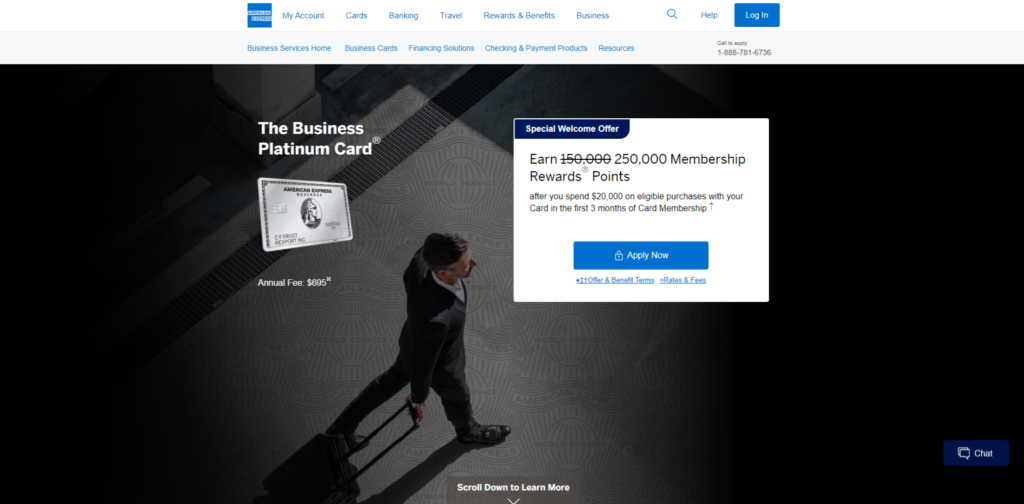

9. Cisco Secure

Cisco Secure Endpoint is an all-inclusive endpoint security solution with built-in extended detection and response (XDR) and advanced endpoint detection and response (EDR) capabilities. Using cloud-native technology, this product effectively enhances the detection, prevention, investigation, and response to cybersecurity threats across various environments. It safeguards your hybrid workforce by delivering robust endpoint security powered by insights from 300,000 security customers and extensive visibility from a leading network provider.

Image source

Additionally, Cisco Secure Endpoint includes XDR functionalities, offering a cohesive view and simplified incident management through automated playbooks. This is critical for managing today’s dispersed and dynamic IT environments.

On the administrative side, Cisco Secure Endpoint provides centralized management tools that ease the control of security protocols and aid in efficiently implementing and administering cybersecurity measures. This includes USB device control and built-in rules management to better protect against threats from physical devices. The solution includes Talos Threat Hunting and integrated risk-based vulnerability management, which help proactively identify threats and swiftly respond to prevent potential breaches from developing.

Key Features of Cisco Secure

- Zero Trust Security Model: Cisco Secure Endpoint supports the Zero Trust security model, which operates on the principle of “never trust, always verify.” It consistently checks the security status of endpoints, assisting organizations in shifting from traditional perimeter-based security to a dynamic, adaptive approach.

- Endpoint Visibility and Control: Cisco Secure Endpoint provides detailed insights into endpoint activities, helping organizations understand their device security status. This increased visibility improves the management of endpoints, facilitating the enforcement of security policies and compliance across the network.

- Response Automation and Orchestration: The solution incorporates automation and orchestration capabilities, enabling security teams to streamline routine tasks and responses. This efficiency boosts incident response times and lightens the load on security analysts, freeing them to tackle more complex security challenges.

- Threat Hunting Capabilities: Cisco Secure Endpoint also allows security teams to search for threats proactively. Analysts can leverage its features for threat-hunting exercises to uncover and address potential threats that automated tools might miss.

- Cross-Platform Protection: Cisco Secure Endpoint protects multiple operating systems, including Windows, macOS, Linux, and mobile platforms. This broad compatibility ensures a uniform security strategy, accommodating an organization’s diverse devices and operating systems.

- Secure Access Service Edge (SASE) Integration: The solution integrates with the Secure Access Service Edge (SASE) framework, merging network security functions with WAN capabilities to enhance secure access for dynamic organizational needs. This integration boosts overall network security by extending protections to include remote and branch office locations.

- Scalability for Large Enterprises: Cisco Secure Endpoint is built to scale, making it ideal for large enterprises with complex and broad network infrastructures. It manages many endpoints efficiently, maintaining strong performance and effective threat detection.

Cisco Secure Pricing

Pricing details are not disclosed publicly.

Conclusion

Reviewing the current landscape of endpoint security, it becomes clear that while CrowdStrike remains a notable player, alternatives must be considered. This necessity arises from various factors, including high costs, deployment complexities, and occasional inaccuracies in threat detection, which could lead to disruption and unnecessary alarms. As organizations increasingly rely on digital infrastructure, the demand for robust, versatile, and efficient endpoint security solutions escalates.

The alternatives highlighted offer a range of features tailored to meet these needs, from advanced threat detection to comprehensive management tools, ensuring that businesses can choose solutions that align well with their specific operational requirements and budget constraints. Selecting the right endpoint security system is crucial for safeguarding sensitive information and maintaining operational integrity in an ever-evolving threat landscape. Therefore, businesses need to assess their specific needs, consider the strengths and limitations of each option, and select a solution that not only meets their security requirements but also integrates seamlessly with their existing systems and processes.