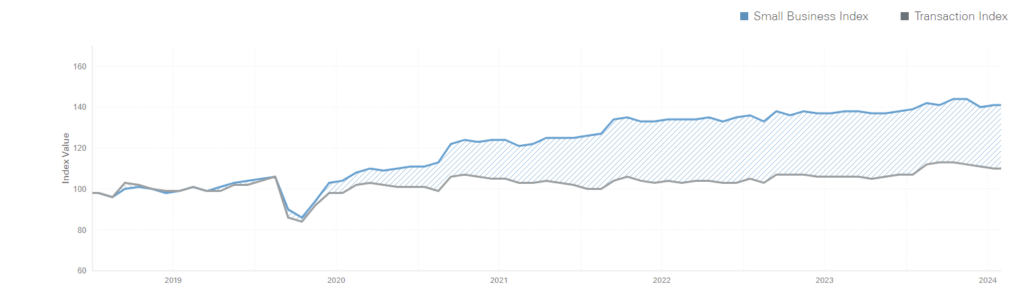

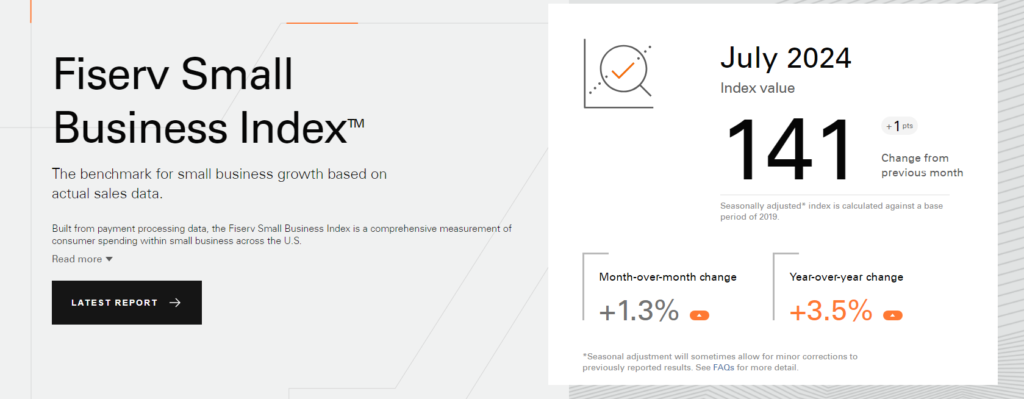

In 2024, marketing is dominated by digital channels, with email and social media marketing becoming more popular due to their convenience and wide reach. Startups and even big corporations are allocating high budgets just for online marketing. Yet, direct mail marketing always stands out from many “offline” marketing options. By incorporating direct mail ideas for marketing into your broader marketing strategy, you can offer your customers a distinct, personalized experience that differentiates your business from competitors. This discussion will cover the use of direct mail for business purposes and provide insights on developing an effective and memorable direct mail campaign.

What Is Direct Mail Marketing?

Before the internet was everywhere, we used to get many things in the mail—newspapers, coupons, bills, magazines, birthday cards, ads, and more. Now that many things have moved online, our digital spaces are getting crowded. Because of this, many people feel like they’re getting too much information online, especially since we spend so much time on social media. This is making it more expensive for businesses to advertise online, and people are starting to ignore those online ads more and more.

With email inboxes becoming increasingly crowded, direct mail is an appealing option for businesses. Daily, over 360 billion emails are sent, marking a nearly 20% increase since 2017. In this saturated digital environment, direct mail offers marketers a tangible way to stand out. Direct mail options include:

- Catalogs

- Postcards

- Checks

- Booklets

- Flyers

- Self-mailers

- Sales letters

- Coupons

- Free samples

In 2024, 61% of marketers increased their direct mail investments. The tangible nature of direct mailers adds a personal touch that can engage customers more effectively than the typical, often ignored email. Receiving a personalized piece of direct mail can make customers feel valued and recognized beyond just an email address in a database. This sense of appreciation can enhance customer loyalty and increase your returns. Additionally, a physical mail item can remain in view in a home for weeks, continuously reminding the recipient of your message.

Source: Forbes

Why Is Direct Mail Effective?

Direct mail marketing offers distinct advantages that enhance its effectiveness within a comprehensive marketing strategy. Below is an analysis of its benefits:

- High ROI:

Direct mail consistently shows high engagement rates, with an open rate of 80-90%, compared to email’s 20-30%. It achieves the highest return on investment (ROI) among marketing mediums, at 112%, outperforming SMS (102%), email (93%), and paid search (88%). The physical nature of direct mail, coupled with the option for personalized offers, significantly drives up engagement.

- Precise Targeting:

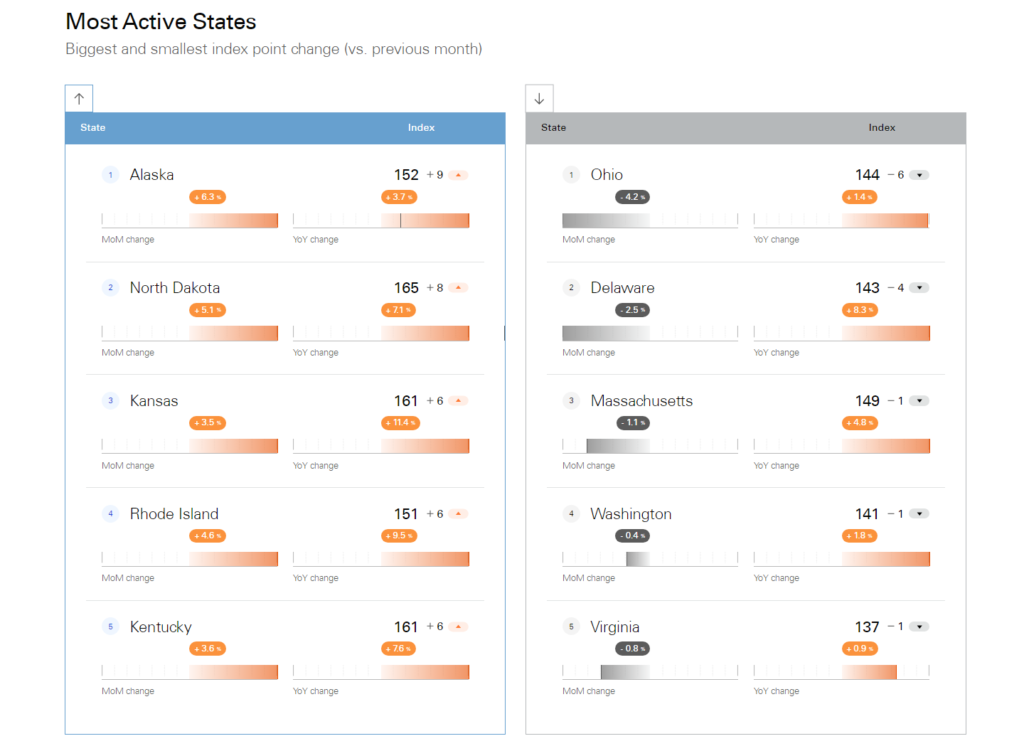

Tools like the Every Door Direct Mail (EDDM) (by USPS) enable targeting by geographic areas without requiring individual addresses. Utilizing the USPS database alleviates the need to gather personal address information independently. Additionally, businesses can employ their own mailing lists for further precision.

This method is exceptionally beneficial for local businesses aiming to connect with nearby customers. Demographic targeting by age, income, or household size helps ensure your message reaches the most appropriate recipients.

- Reliable Delivery:

Direct mail avoids the pitfalls of digital mail filters and is consistently delivered to a recipient’s physical mailbox, ensuring visibility among their daily mail. This reliability helps your message get noticed.

- Trackable Results:

The ability to monitor the impact of direct mail campaigns has significantly improved. Businesses can track responses directly by setting up unique contact details for each campaign—such as specific phone numbers, personalized URLs, or QR codes.

For instance, directing recipients to a specific website landing page or using unique tracking tags helps identify traffic originating from the mail. Including QR codes or shortened URLs simplifies the user experience, while unique phone numbers for calls can pinpoint the source of inquiries. This systematic approach allows for precise measurement of campaign success.

- No Prior Consent Needed:

Direct mail does not require recipients to opt in, which simplifies the process of reaching new potential customers. This avoids the complications associated with email marketing, such as users unsubscribing from mailing lists. However, there are no broad prohibitions against sending direct mail advertisements.

- Enhances Digital Efforts:

Direct mail can boost online engagement when combined with digital marketing strategies. Including QR codes, personalized URLs, and social media links in mailings can drive recipients to digital platforms, supporting a unified marketing approach.

- Building Brand Recognition:

Ongoing direct mail campaigns help enhance brand awareness, even if recipients don’t respond immediately. Regular exposure to your brand builds recognition and trust, which may encourage future interactions or purchases when a need arises for your products or services.

To capture attention, include appealing offers such as a discount coupon for a local eatery, a gift card for a florist, or an invite to a newly opened mall. These items often find a place on a fridge or a tabletop, keeping your brand visible until the recipient requires similar services, possibly giving your business an edge over competitors.

- Physical Presence:

Direct mail’s tangible aspect ensures it remains in homes for potentially longer periods, increasing the chances of interaction. Unlike quickly disappearing online ads, direct mail can be revisited, giving it a longer-lasting impact.

- A Unique Approach in Modern Marketing:

In an era where digital marketing dominates, direct mail offers a unique touch that can capture a consumer’s attention amidst the usual influx of emails and online ads. Personalized elements, like handwritten notes, can make communication even more striking, distinguishing it from commonplace digital messages.

17 of the Best Direct Mail Ideas to Market Your Small Business

Direct mail remains a powerful tool for small businesses to reach their target audience. Here are 17 of the best direct mail ideas to help you effectively market your business and stand out.

1. Send Postcards (With a Coupon)

Postcards remain an effective yet often underutilized tool in direct marketing. They offer a simple way to draw attention to your brand from your desired audience. Opt for a clean design on your postcards, incorporating essential details such as a call to action (CTA) (we will talk about this one later), contact information, and potentially your physical address.

Including an incentive, like a coupon, can prompt immediate action on your CTA–This is because

80% of consumers are more inclined to purchase from a new brand when offered a discount coupon, rising to 89% among millennials.

For an added touch, add a map of your location directly on the postcard to capture the recipient’s interest and guide them to your storefront. If your business operates online, adding a URL linked to the direct mail campaign allows you to track its success rate effectively.

Consider using oversized mailers to make your postcard more noticeable among daily mailers. While standard postcards measure 4 x 6 inches, oversized versions are 6 x 11 inches, making them more conspicuous. Additionally, leverage online design platforms that offer a variety of free templates to create visually appealing postcards that stand out.

2. Offer Anniversary/Birthday Discounts

Direct mail is an effective method for maintaining customer relationships by showing appreciation. A great example is sending discounts or promo codes for customer anniversaries and birthdays.

These discounts can enhance customer loyalty and keep your brand in their minds. This approach can be implemented with a simple postcard or included in a catalog, brochure, or mailing type. Although sending these offers via email is possible, studies show that direct mail typically receives a higher response rate.

Timing is crucial for these promotions; ideally, the postcard should arrive on or near the special day, particularly if the discount expires.

3. Focus on Bold (Yet Meaningful) Designs to Stand Out

To grab recipients’ attention in a full mailbox, creating a visually appealing design is crucial. This can be achieved using strong typography, high-quality images, and innovative layouts highlighting your main message. However, it’s crucial to maintain a balance between creativity and clarity. The design should catch the eye and convey the important aspects of your offer or message.

If you lack an in-house designer, consider hiring a freelancer from platforms like Fiverr to produce professional postcards, brochures, or catalogs representing your brand well. While loading your materials with extensive details about your business may be tempting, a more effective approach is to focus on the most pertinent information. A straightforward design with a single, clear CTA often yields better results than a cluttered one.

4. Giveaway Free Catalogs and Product Samples

Including free product catalogs and samples is a proven strategy to increase engagement in direct marketing campaigns. People appreciate receiving complimentary items, and incorporating small sample packs in your direct mail can effectively demonstrate your product’s value. Indeed, offering free samples has led to significant sales increases, sometimes by up to 2,000%.

Some instances, including an actual product sample, might need to be more practical due to the product’s characteristics. For example, Function of Beauty, which specializes in customizable hair care products, used scented paper strips to let customers experience the fragrance of their offerings. This creative solution allowed them to conduct a successful direct mail campaign using just an added piece of paper.

5. Add QR Codes and Links

Direct mail marketing can effectively initiate customer engagement by directing them to perform specific actions like visiting your website. A practical way to achieve this is by incorporating QR codes or concise, trackable URLs into your direct mail pieces, guiding customers to your website, store, or particular landing pages.

QR codes link your physical mail campaigns to your digital marketing initiatives. These simple barcodes are easily printed on mail items and can be scanned with any smartphone.

A single scan of a QR code can direct your customers to a designated landing page or other digital destinations. Given the widespread familiarity with QR codes, including them in your mail is straightforward and user-friendly.

6. Add Handwritten Notes

Sending handwritten messages can create a memorable impact, particularly for a smaller, more defined audience. This method demonstrates a strong commitment to personal service, which can enhance customer loyalty. Although unsuitable for large-scale campaigns, it effectively maintains relationships with high-value customers or clients in specialized markets.

7. Provide Detailed Information Through Brochures

While postcards are effective for quick communication about your business, they often need more space for more comprehensive details about your services. In such cases, brochures are an excellent alternative.

Brochures allow for an expanded presentation, including photographs, icons, illustrations, product descriptions, and menu options—typically too extensive for a postcard format.

For small businesses, brochures serve as a powerful marketing tool by offering ample space for detailed content, including product information and visual aids like images and infographics, enhancing both appeal and clarity. Additionally, distributing small batches of brochures to similar customer segments can help identify the most effective version for consistent results.

8. Enhance Your Mail with Embossed Envelopes

Embossed envelopes can significantly enhance your direct mail’s visual and tactile appeal, making it stand out. An embossed envelope introduces a tactile quality that can spark curiosity and motivate recipients to open your mail. This technique is handy when aiming for a sleek, minimalist design but still wanting to leave a strong impression.

9. Use Creativity in Mail Pieces

Not all businesses require detailed information about the product through catalogs or brochures; sometimes, you will require a little creativity to attract the audience. Invest effort into crafting mail that distinctly represents your brand. By adopting creative approaches, you can convey your product’s purpose more effectively with mail that stands out visually. This could involve unique designs such as fold-out letters, interactive cut-outs that become three-dimensional upon opening, or mail pieces that defy the conventional appearance of a letter.

For example, Papa John has utilized this strategy by sending out physical paper representations of their pizzas to customers, with each paper slice featuring a coupon for pizza deals. Employing creative and unusual mail designs can capture your target audience’s attention more quickly than traditional direct mail methods.

Nike set another great example with direct mail. Nike aimed to inspire young people to engage in sports. To this end, they distributed limited edition shoeboxes that featured a stadium print on the interior. Additionally, upon opening, these boxes would emit the sounds of a cheering crowd, aiming to motivate the recipient to get active.

10. Personalized Messages

Direct mail that acknowledges each customer’s unique preferences significantly boosts how valued they feel. By noting past purchases or particular interests, you deepen their connection to your brand.

For instance, HelloFresh enhances customer relations by sending personalized thank-you notes acknowledging customer loyalty and preferences. Adopting this method in your direct mail campaigns could make each recipient feel more recognized.

11. Promote Environmental Responsibility in Your Marketing

Consumers are increasingly aware of their purchases and the companies they support, particularly when these interactions are frequent. Brands must acknowledge the impact of their operations on the environment, especially when employing direct mail campaigns. Companies that demonstrate a real commitment to sustainability often gain a competitive edge.

You can opt for recycled paper or soy-based inks for your mailers. Make it a point to communicate these eco-friendly choices in your marketing materials, informing customers about your sustainable efforts. This transparency attracts consumers who prioritize environmental responsibility and boosts your brand’s image. Additionally, a note stating “Printed on 100% recycled paper” can positively impact your audience and possibly sway their preference towards your business instead of competitors who do not prioritize eco-friendly practices.

12. Focus on Solutions, Not Just Products

When crafting a direct mail marketing plan, it’s beneficial for companies to concentrate on how their services or products address specific customer problems rather than just listing features.

This shift in focus from merely selling a product to providing a solution makes your communication more effective and pertinent. For example, rather than detailing a water filter’s specifications, emphasize how it improves water quality and supports health. This method will likely increase engagement and response rates as customers perceive the tangible benefits of your offerings.

13. Distribute Branded Merchandise

Sending branded merchandise through direct mail effectively keeps your business prominent in customers’ minds. These items are physical reminders of your brand, leaving a lasting impact. The key is to select practical and relevant items for your business.

These gifts connect positively with your brand and prompt recipients to consider your business for related products or services first. This approach smartly blends the allure of a physical gift with ongoing brand reinforcement, ensuring your business remains memorable.

14. Enhance Engagement Through Storytelling

Incorporating storytelling into direct mail campaigns is an excellent strategy for emotionally engaging your audience and memorably delivering your message. Rather than just listing facts or promotions, sharing a story that connects with your audience can forge a stronger bond.

This tactic is equally effective for commercial enterprises. Sharing tales of customer successes or how your products or services have beneficially influenced someone’s life can incentivize recipients to trust and interact with your brand.

15. Use Infographics

Incorporating clear and informative infographics in your direct mail can help break down complex information and make it easier to understand.

This technique is useful in sectors like finance, where companies such as American Express use infographics to explain complicated subjects clearly and attractively. Infographics draw attention and improve the chances that your message will be understood and remembered.

16. Consider Implementing an EDDM Strategy

EDDM is a cost-effective way to reach a broad local audience without requiring a specific mailing list. With EDDM, you can target particular zip codes or neighborhoods, perfect for businesses aiming to grow their local customer base. This approach is beneficial for distributing postcards highlighting special deals, events, or new store openings.

For the best results in your EDDM campaign, select a dependable direct mail service that can assist with design and distribution.

17. Include a Clear CTA

The success of a direct mail campaign largely depends on a clear and motivating CTA. Your CTA should be noticeable and easy to understand, directing the recipient to the next steps. This can be enhanced by using contrasting colors, bold fonts, or design elements like arrows highlighting the CTA.

Your CTA language should be straightforward and prompt immediate action, such as “Call now for a free consultation” or “Visit our store today for exclusive discounts.” To prevent confusion, it’s crucial to direct your customers to a single destination, be it a website, a phone number, or a physical address.

Conclusion

Direct mail remains a potent tool for small businesses despite the dominance of digital marketing. Its tangible nature and personal touch offer advantages that online channels often need to improve. Integrating direct mail into your marketing strategy provides a unique customer experience that stands out in an era of digital overload. From postcards and catalogs to QR codes and personalized messages, direct mail allows for creative, targeted approaches that can significantly enhance customer engagement and brand recognition.

As businesses increasingly recognize the value of direct mail, those who leverage its benefits can effectively complement their digital efforts and foster deeper connections with their audience. With its ability to offer high ROI and reliable delivery, direct mail should be a key component in any comprehensive marketing plan, ensuring your business remains memorable and impactful in a crowded marketplace.