As a business owner, it is important that you understand how to properly process payments to other businesses you work with. Failure to do so often results in negative and damaging consequences. Here are some tips for processing payments accurately in a B2B environment.

Online shopping carts are a valuable tool that you should never overlook. Using them results in the creation of an automated payment processing which often leads to a significant rise in revenues. With so many options at your fingertips for online shopping carts, you can choose the type that suits your business the best. Researching each type will help you choose the shopping carts that are the most suitable.

Using payment card industry compliance absolves your business of liability when it comes to the data gained from each of your customers’ credit card accounts. It then becomes the responsibility of your business’s payment processor, freeing you up to focus on other matters at hand. Your merchant services will be much more reliable and trustworthy when using a PCI.

It is also important to use a payment processing solution that has been integrated into your business. This allows you to directly process payments your customers make using their credit cards. It results in less work for your business and ensures that your ledger is always balanced and that any invoices found in your system are labeled as having been paid.

You will also find that credit card processing is made much easier by using mobile apps to get the job done. This is the best way to ensure your payments are completed in a timely manner. It can also boost your business as it allows your salespersons to make instant sales to customers.

Conclusion

B2B payment processing is a task that must be taken seriously for any business to be successful. PCI compliance is an important part of the process and one you shouldn’t neglect. Your credit card processing and merchant services can go a long way in helping your business appeal to a wide customer base. Following the tips discussed above means that your business will be able to thrive.

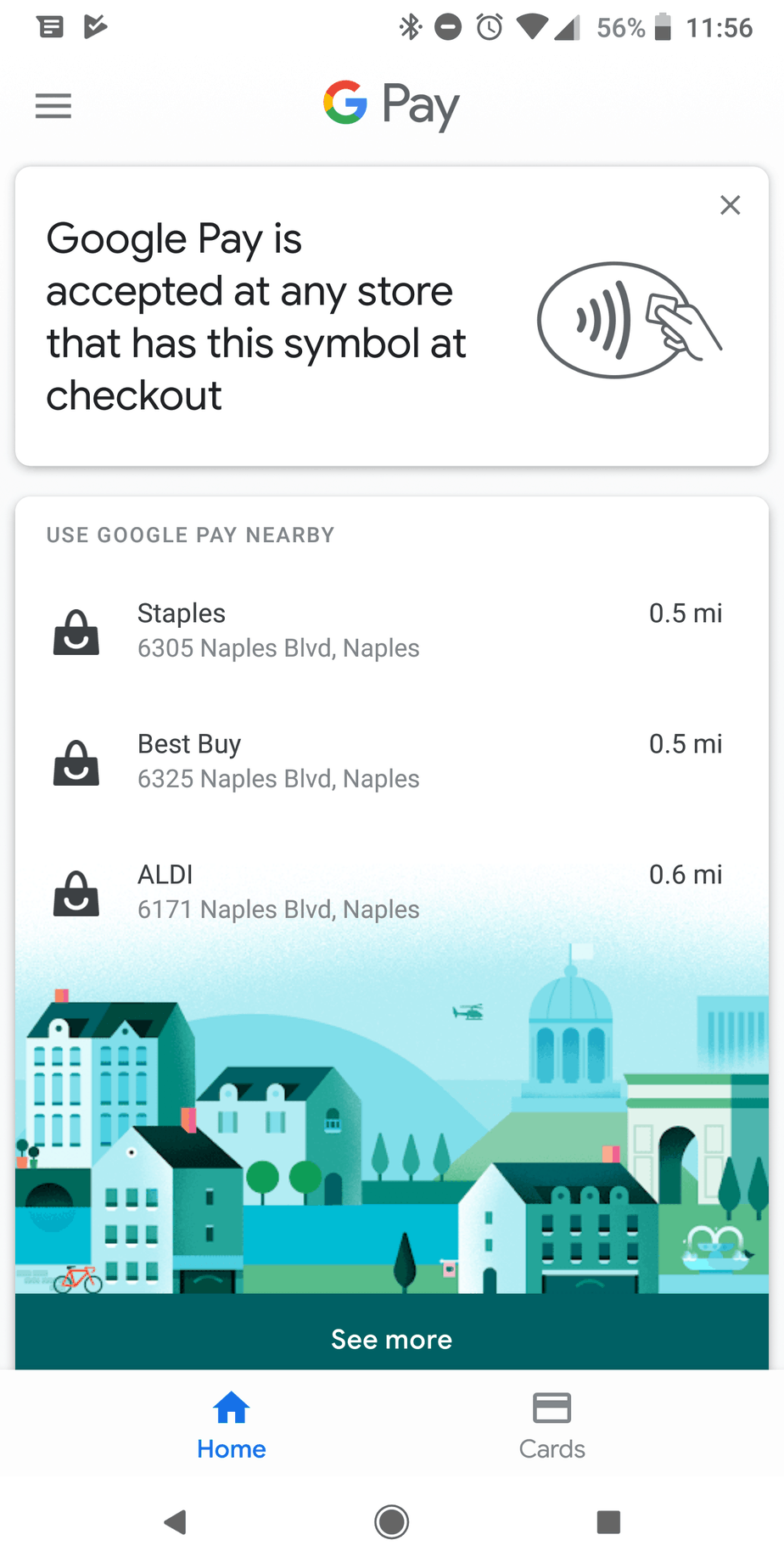

Finding Stores That Accept Google Pay

Finding Stores That Accept Google Pay Pay Nearby.” When you select this option, it will automatically show the three closest stores that accept the payment method. You can also choose “See More” for a longer list. The list will include everything from fast food chains and retailers to gas stations and grocery stores.

Pay Nearby.” When you select this option, it will automatically show the three closest stores that accept the payment method. You can also choose “See More” for a longer list. The list will include everything from fast food chains and retailers to gas stations and grocery stores.