In 2024, several digitally native retailers are facing significant financial strain, raising concerns about the overall retail financial health of the sector. These businesses, which rely heavily on e-commerce and direct-to-consumer models, were once heralded as disruptors in the retail space. However, a combination of factors, including rising inflation, increased supply chain costs, and a challenging post-pandemic retail environment, has placed immense pressure on their business models, leading to more DTC bankruptcy risk.

Key Takeaways

- Post-Pandemic Market Shift: Many digitally native retailers, which thrived during the pandemic due to the surge in e-commerce, are now facing tough challenges. With the end of pandemic-driven demand, companies like Wayfair, Peloton, and others are seeing declining sales, exacerbated by inflation and high supply chain costs. These e-commerce challenges have revealed vulnerabilities in their business models, particularly regarding customer retention and profitability.

- Increased Bankruptcy Risks: The combination of operational inefficiencies, high debt loads, and unprofitable business models has led many companies into financial distress. Brands like SmileDirectClub and Rent the Runway are prime examples of companies filing for bankruptcy protection or undergoing severe restructuring to avoid it. Even larger entities like Qurate Retail Group and ASOS are struggling, with many expected to seek bankruptcy protection or further reorganization.

- Cost-Management Pressures: Rising operational costs, from inflation to shipping expenses, disproportionately affect smaller direct-to-consumer (DTC) brands. Without the leverage of sizeable physical store networks or capital reserves, companies such as Digital Brands Group and Beyond Meat find it increasingly challenging to manage profitability. These pressures heighten DTC bankruptcy risk as the market faces challenges in optimizing operations and cutting costs.

- Ongoing Industry Consolidation: Experts predict that the digital-first retail sector will likely see further consolidation through mergers, acquisitions, or private equity buyouts over the next two years. Companies that cannot demonstrate progress toward profitability while maintaining manageable debt levels will face continued financial strain. This consolidation trend is expected to reshape the DTC landscape as financially vulnerable brands merge or exit the market.

Financial Struggles of DTC Companies in 2024: A Challenging Terrain for Digital-First Brands

In 2023, several direct-to-consumer (DTC) companies, including prominent entities like Forma Brands (parent company of Morphe and others), SmileDirectClub, and Showfields, faced severe financial difficulties, resulting in bankruptcy filings.

Notably, SmileDirectClub ceased operations after filing for Chapter 11 bankruptcy protection, unable to secure the necessary capital despite extensive efforts. These companies encountered economic challenges marked by high debt levels and unprofitable operations, which were unsustainable amid the problematic market conditions following the pandemic.

By 2024, bankruptcies have decelerated, yet industry experts anticipate further challenges, particularly among digital-first brands. James Gellert, Executive Chairman of RapidRatings, highlighted that the retail sector is experiencing a “resettling” phase.

Gellert recently commented that this year will be an adjustment for numerous companies that have experienced disruptions in recent years. He noted that while many businesses emerged or expanded significantly during the pandemic, they have encountered more challenging conditions since its conclusion.

Companies that once thrived from the pandemic-driven boost in e-commerce are now grappling with tougher post-pandemic realities, such as heightened inflation and supply chain disruptions. For instance, Wayfair experienced a spike in demand during the pandemic but now faces dwindling sales and has initiated several layoffs. The retailer has seen e-commerce challenges, like a downturn in sales, with only a 3.7% increase in Q3 following nine consecutive quarters of decline, and it continues to report financial losses.

Gellert discussed Wayfair’s challenges in retaining customer loyalty, noting that it takes more work for the company to maintain a dedicated customer base when consumers can easily switch to competitors like Overstock or Target after an initial purchase. As a result, Wayfair must continually invest in marketing to remain visible to its customers.

Rent The Runway, another example has encountered difficulties in achieving profitability and operational efficiency despite various efforts to stabilize its operations. Peloton, too, benefited from increased demand during the pandemic but has since seen sales decline, legal issues, and costly recalls. The company has had to reduce its workforce and alter its strategies to remain viable.

Smaller DTC companies are particularly vulnerable to inflation and rising costs. Lacking the pricing influence and resources of larger competitors, these smaller entities find it difficult to exert pressure on suppliers or secure capital. To evade bankruptcy, these businesses must optimize operations, enhance profitability, and decrease debt.

Additionally, many of these brands have struggled to develop lasting customer loyalty, intensifying their financial challenges as customer acquisition costs increase.

The broader economic environment also plays a critical role. Inflation, supply chain interruptions, and escalating shipping expenses disproportionately impact digitally native retailers, as these businesses often lack physical store networks to mitigate some of these costs.

In the upcoming months, some of these brands will seek bankruptcy protection to reorganize their debts and restructure their operations, particularly those financially vulnerable before the pandemic but managed to survive the surge in online demand. As the market shifts to more regular shopping patterns and consumer behaviors, the weaknesses in their business models are becoming increasingly evident.

Operational turnaround and financial resilience themes will likely dominate the DTC sector in 2024. Without addressing these critical areas, the risk of additional bankruptcies, consolidations, or buyouts will remain significant.

Gellert predicts that over the next two years, the sector of digitally native retailers will likely experience more consolidation through mergers and acquisitions, private equity buyouts, or bankruptcies. To avoid bankruptcy, companies must achieve profitability or progress toward it while keeping their debt levels low.

He further explained that ongoing unprofitability combined with a high debt burden, which requires regular payments or refinancing, is a direct path to bankruptcy.

11 Online Retailers at the Risk of Bankruptcy in 2024

Several well-known companies are at a higher risk of bankruptcy, as indicated by their FRISK scores or other financial issues. FRISK score assesses the likelihood of bankruptcy.

A score of 1 suggests a 9.99% to 50% chance of bankruptcy within 12 months, while a score of 2 corresponds to a 4% to 9.99% chance. The scale goes up to 10, representing minimal risk.

Companies with a 9.99% to 50% chance of bankruptcy within 12 months include:

1. Sleep Number

Image source

Though Sleep Number’s FRISK score hasn’t been confirmed recently, the company faces challenges common to retailers under financial pressure. Shifts in consumer behavior and increased competition in the mattress market have impacted its revenue, putting it at risk as it manages these difficulties.

2. Rent the Runway

Image source

This fashion rental service is dealing with significant financial problems. In early 2024, it implemented a restructuring plan, cutting its workforce by 10% to reduce costs. Despite these efforts, Rent the Runway’s revenue dropped over 6% in the latest quarter, and it continues to operate with large losses.

3. Marley Spoon

Image source

Despite growing interest in its meal kit delivery service, Marley Spoon has faced financial challenges as demand for subscription-based food services has declined post-pandemic. The company struggles with high costs and lower-than-expected profitability, leaving its financial outlook uncertain.

4. Qurate Retail Group

Image source

The parent company of QVC and HSN is grappling with serious financial difficulties, including a high debt load and falling sales. By mid-2024, Qurate had accumulated more than $5.4 billion in debt and faced possible delisting from Nasdaq due to poor stock performance. Its ongoing restructuring efforts have yet to reverse its financial decline.

Apart from these, several companies, including well-known names like Beyond Meat, Peloton, Digital Brands Group, Express Inc., and Kirkland’s, currently carry FRISK scores of 2. This score indicates a 4% to 9.99% probability of these companies filing for bankruptcy in the next 12 months. Here’s a closer look at these businesses and their financial challenges:

5. Beyond Meat

Image source

This plant-based meat producer has been experiencing significant financial distress, largely due to shrinking demand, growing competition, and its inability to reach profitability. The company’s Q3 2023 revenue dropped by 8.7% year over year, while its cash burn has become a critical issue. In 2022, Beyond Meat used over $400 million in cash, and it is currently working to restructure its debt to manage overdue payments to vendors.

6. Peloton

Image source

Following a pandemic-era boom, Peloton has struggled with a sharp decline in demand for its fitness products. The company’s restructuring efforts to reduce costs and stabilize operations haven’t yet mitigated its financial challenges. Their FRISK score reflects the lingering risk of bankruptcy as it navigates restructuring plans.

7. Digital Brands Group

Image source

Known for its direct-to-consumer model, Digital Brands Group has been on the bankruptcy watchlist for several years. Despite increasing revenue by 22.5% in Q3 2023, the company faces operating losses, liquidity issues, and mounting debt. It has explored strategic alternatives, including potential store expansions to improve profitability.

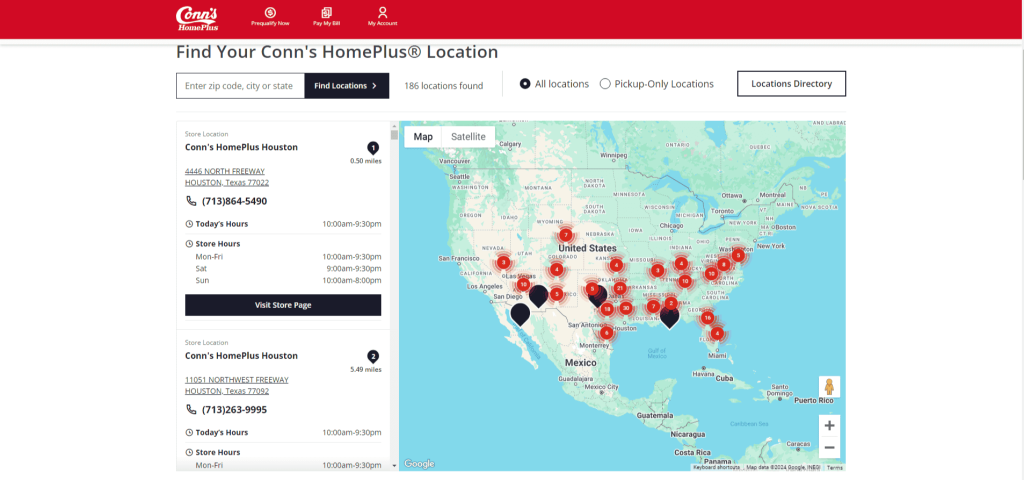

8. Express Inc.

Image source

The fashion retailer is facing severe financial difficulties, including a $275 million debt load. Recent missteps, including mismatches between product offerings and customer demand, have exacerbated the company’s fragile state. Express is currently restructuring, but due to continued revenue and profit margin declines, it remains at high risk of bankruptcy.

9. Kirkland’s

Image source

The home décor retailer has been hit hard by declining consumer spending and rising operational costs. These challenges and competitive pressure have placed Kirkland’s in a vulnerable financial position. The FRISK score suggests a real risk of bankruptcy if these headwinds persists.

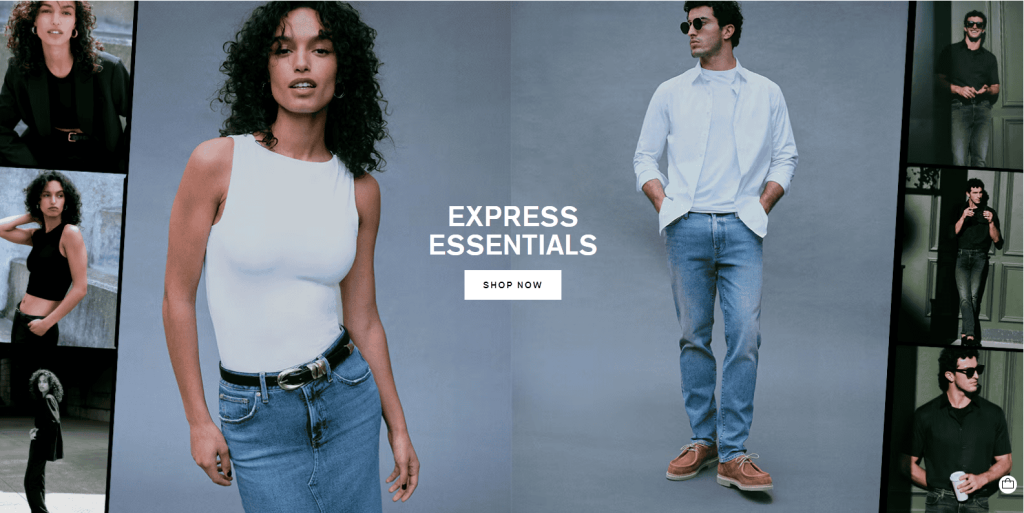

10. ASOS

Image source

The British fashion retailer has also encountered financial hurdles due to declining revenues and rising competition in e-commerce. Cost-saving initiatives are underway, but the uncertain consumer demand in a fluctuating retail environment doubts the company’s future stability.

11. Petco

Image source

In Q2 2024, Petco reported a steep 90% drop in operating income compared to the same period in 2023. Although net sales remained relatively flat, the company experienced a sharp increase in its net loss, raising concerns about its ability to manage financial headwinds. This has left Petco in a precarious position.

Conclusion

The financial circle for digitally native retailers in 2024 remains highly challenging, with many companies struggling to adapt to post-pandemic market conditions. Rising inflation, increased supply chain costs, and shifts in consumer behavior have exposed weaknesses in business models that once thrived on the surge in e-commerce. Companies like SmileDirectClub, Rent the Runway, and Peloton highlight the growing risk of bankruptcy as they contend with high debt loads and declining profitability.

To survive, these retailers must prioritize operational efficiency, reduce debt, and focus on profitability. As the industry reshapes itself in the coming years, many will likely face bankruptcy or consolidation without significant restructuring or mergers.