What is an SS4 Form?

Posted: October 11, 2023 | Updated:

Ensuring compliance in payroll management and the proper withholding of employment taxes is important for all types of businesses. If you fail to ensure complaince it can lead to legal and financial risks. When a business have employees that are globally or nationally dispersed it becomes even more important to manage the payrols and taxes properly. In such cases, tax withholding must align with the employee’s location rather than the employer’s headquarters.

In any case the most important document that you should know about is SS4 form. It plays a vital role in the employee taxes. The SS4 form serves as a tax document used by organizations seeking to obtain their Employer Identification Number (EIN). While not every business type requires this form, it is mandatory for some. Without an EIN, certain businesses are legally barred from paying employees or filing taxes. And this clearly shows the importance of SS4 form.

What Is SS4 Form, And Who Needs It?

For prospective business owners and aspiring side hustlers, understanding Form SS4 is essential. This IRS form plays a pivotal role in establishing a business’s identity through the allocation of a unique business identifying number.

Form SS4 serves as the formal request for EIN from the IRS. An EIN is a vital identifier assigned to businesses, serving various purposes such as tax reporting and filing. The eligibility to apply for this EIN extends to a diverse range of entities, including:

- Employers, like big corporations, sole proprietors and partnerships.

- Estates.

- Trusts.

- Government agencies.

- Nonprofit organizations.

- Specific individuals, like sole proprietors and other entities listed on Form SS4.

Upon approval, the EIN assigned to your entity will consist of nine digits, with a hyphen positioned between the second and third digits. This unique identifier is a fundamental cornerstone for regulatory compliance and financial transactions in the business realm.

Form SS4 – Basic Structure and Key Components

Form SS4 is organized into three primary information categories, and it is crucial to complete all the required details accurately. Omitting essential fields or providing incorrect or unclear information can lead to the rejection of your application and delays in acquiring your Employer Identification Number (EIN).

- Common Information

The initial section includes fundamental information related to your business, such as its name and complete contact information. Within this segment, you’ll also designate a responsible party to serve as the primary contact for communication with the IRS. This designated individual should ideally be the business owner or an LLC member who holds significant control over the organization’s assets and financial matters.

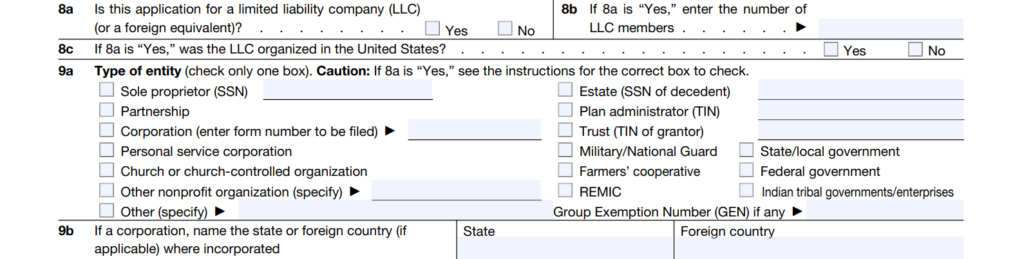

- Business Classification

The second segment of Form SS4 is dedicated to specifying your business’s legal classification. It is important to note that, depending on your business type, not all the fields in this section may be applicable to your situation.

- Additional Details

In this final category, you’ll be asked to provide information regarding the purpose behind your application, as well as details concerning employees and wages involved. If you already possess an Employer Identification Number (EIN), it is important to verify whether obtaining another one is necessary. Typically, if you’re merely expanding or altering business locations or initiating employee hiring, you can often utilize your existing EIN for the same business.

![]() Check the full form here

Check the full form here

Fill Out The SS4 Form In These 6 Easy Steps

The IRS mandates the use of Form SS4 for businesses and various entities to acquire a unique identification number necessary for tax-related purposes. Here’s a simple, six-step guide on how to complete the Form SS4 effectively:

Step 1: Gather Essential Information

Begin by collecting common formalities about your business. The following list outlines the information you’ll need to have at your fingertips before filling out the SS4 form.

Step 2: Starting With The General Details

In this section, you’ll fill out the following fields:

- Line 1: Fill in the legal or documented name of your entity or the company.

- Line 2: If your business operates under a trade name (DBA), provide it here, especially if it differs from the actual name of your company.

- Line 3: This line is exclusively for those looking to apply for EIN under a Trust. If this applies to you, enter the trustee’s name for a trust. If there’s a designated individual who will receive this particular tax information, list their name under “care of.”

- Line 4a–b: Specify the business’s mailing address. If you filled in line number 3, use the mail address of the person you wrote off under “care of.”

- Line 5a–b: Include the actual address if it differs from the address you provided in section 4a–b.

- Line 6: Fill in the details regarding the entity’s main address.

- Line 7a–b: Fill in the complete name and either the Social Security or the taxpayer’s ID number of all the entity’s responsible party(s). A responsible party is an individual who sees over or handles the business, the finances, and the assets.

Step 3: Filling Out The Details About The Business

In Lines 8 and 9 of the form, you will need to indicate the nature of your work. Depending on your business type:

- If you are a single owner LLC, mark the corresponding checkbox and provide your Social Security Number (SSN).

- For multiple owner LLCs, select the Partnership checkbox.

- Suppose your LLC has opted for taxation as an S-corporation or corporation before submitting Form SS4. In that case, you may need to choose the Corporation checkbox (it is recomended to confirm this detail with a licensed tax professional before submitting your EIN application).

Suppose your business doesn’t fall into any of the established categories mentioned in Section 9a (type of entity). In that case, you should tick the box at the end of that section labeled as “other” and provide any information about your specific type of business. Furthermore, if it applies to you, make sure to fill out the section for “Group Exemption Number (GEN).”

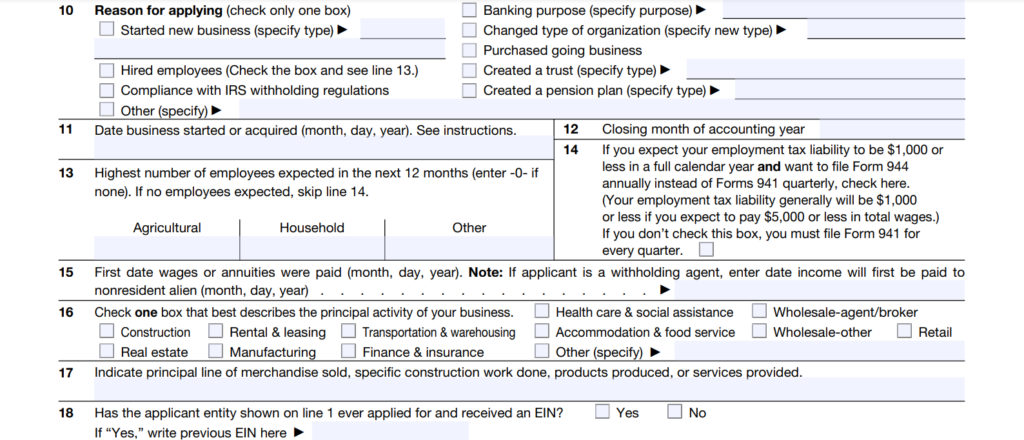

Step 4: Going Over the Additional Business Information

- Line 10: Tick the box that corresponds to the reason why you applied for the EIN. Common reasons include starting a new venture, hiring some employees, or other bank related things.

- Line 11: Enter the specific date on which your business was officially started.

- Line 12: Indicate the month of closing of your company’s accounting or FY (fiscal year). Many companies follow the calendar year; here, December month is the closing. However, if your FY differs from the standard, specify the month when your FY concludes.

- Line 13: Write the projected maximum amount of working employees you think you may be hiring in the coming year. If you hold a sole proprietorship with zero employees, you could simply type in “0” in the column.

- Line 14: State whether you intend to file Form 994 by the IRS, designed for SMEs expecting to pay up to $1,000 in taxes for employment.

- Line 15: State the date when your business first disbursed annuities or any wages.

- Line 16: Describe the primary focus of your company. There will be many options to select from, like manufacturing, real estate, retail, or healthcare. If your business focus isn’t mentioned, you can choose “other.”

- Line 17: Fill in any additional details about the primary focus of your company here.

- Line 18: State if the applicant who is filing has already applied for the EIN or not.

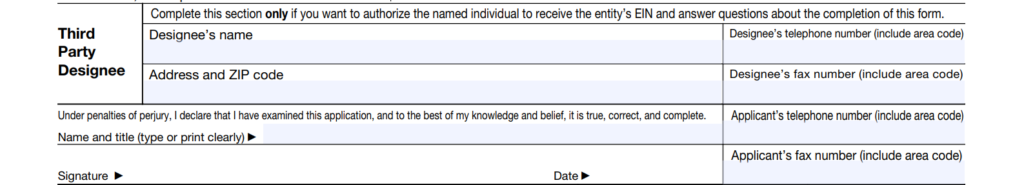

The signing of Form SS4 varies depending on the entity type:

- If the SS4 form applicant is an individual, the signatory also must be a sole person.

- If the SS4 form applicant is Corporate, the applicant must hold the position of Vice President, President, or any Principal Officer.

- Suppose the SS4 form application is from a Government entity, Partnership, or any other organization. In that case, the signatory must be an authorized employee or member who knows the said entity’s affairs.

- And If the Trust or Estate submits the SS4 form application, the signatory must be the executor.

Step 6: Submitting Your Completed SS4 Form for Processing

Once you’ve meticulously completed and verified your SS4 form, it is time to initiate the submission process. You have the option to submit your application online, through fax, or traditional mail. The method you choose will dictate the duration it takes to receive your Employer Identification Number (EIN).

- Online Application: When applying online, you must complete the form within a 15 minute timeframe to avoid a timeout. Therefore, it is crucial to have all the necessary information ready beforehand. Typically, you’ll get your EIN on the same day via email.

- Fax Application: Fax submissions usually take approximately four working days to process.

- Mail Application: If you opt for mailing, please be aware that it may take a minimum of four weeks for processing, assuming all information is accurately and correctly submitted.

Frequently Asked Questions

Is an EIN required for sole proprietor?

If the proprietor doesn’t have any employees or doesn’t pay any excise taxes, having an EIN is not mandatory. However, if you choose to acquire one, you can apply for it by completing a Form SS4 and using your Social Security as your identification number.

What is the cost of filing Form SS4?

Filing a Form SS4 is completely free. However, you may need to cover postage or international call fees if you choose to apply by mail or phone.

How can I obtain a Form SS4?

The Form SS4 is available online on the IRS’s official website; you can simply download it. After completing the form, you can print it and either mail it or fax the document to IRS.

Is it necessary for me to file Form SS4?

While filing Form SS4 can be advantageous in various situations, it is legally mandated only for businesses falling under the following categories: -Non-profit organizations -Estates -Partnerships -Corporations