A Review of Valor PayTech for 2025

Posted: August 01, 2024 | Updated:

Valor PayTech, a rapidly expanding fintech company, offers a wide range of processor-independent, omnichannel payment solutions. The company provides merchants and reseller partners with advanced, comprehensive tools and the adaptability needed to thrive in the fast-paced business climate. Valor PayTech has shown significant expansion in the retail and restaurant sectors.

If you are considering using any of their mobile, in-person, or e-commerce solutions or hardware options. This Valor PayTech review will help you by analyzing their services, features, and other relevant details.

An Overview of Valor PayTech

Image source

Valor PayTech, founded in 2019, is a fintech company that provides secure and comprehensive payment technology solutions. The company offers various services for diverse business needs, including point-of-sale (POS) systems, mobile and virtual terminals, e-commerce solutions, and recurring billing services.

Their product range includes countertop POS systems, wireless and Android-based POS devices, and mobile applications, which facilitate the management of transactions across multiple platforms. Valor PayTech’s solutions are compatible with various payment processors, allowing their clients flexibility and choice.

By 2023, Valor PayTech had increased its presence with over 100,000 devices, demonstrating its commitment to innovation and customer satisfaction. The fintech industry recognizes the company for its versatile and secure payment solutions, dedicated customer service, and continued technological development.

Solutions Offered by Valor PayTech

Valor Paytech delivers a suite of tools and services for various payment settings, including e-commerce, in-person, and mobile transactions, along with additional value-added services.

- E-Commerce Solutions:

Valor PayTech provides comprehensive e-commerce solutions designed to facilitate smooth online transactions. Their platform supports a variety of payment methods and integrates seamlessly with various shopping cart systems. Key features include robust SDKs and APIs that enable easy integration of payment functionalities into websites and mobile applications.

Additionally, Valor PayTech offers hosted payment pages and embedded payment options that ensure secure, PCI-compliant processing of sensitive payment information. The platform also supports real-time transaction data access, allowing merchants to stay updated on their business operations anytime.

- In-Person Payment Solutions:

Valor PayTech’s in-person payment solutions cater to businesses requiring reliable and flexible point-of-sale (POS) systems, including models like the VL100, VL300, and wireless. Their offerings include countertop POS systems, wireless POS systems, and Android-based terminals such as the VL110 and VL500. These devices are designed for easy integration and support various transaction types, such as returns, sales, tip adjustments, and voids.

Valor’s cloud-based technology, Valor Connect, enables remote setup and management, reducing the need for on-site technical support. The systems also sync inventory in real-time across all connected devices, ensuring accurate stock levels and smooth operations.

- Mobile Payment Solutions:

Valor PayTech provides mobile payment solutions for businesses on the move through its ValorPay application. This app allows merchants to process transactions via a virtual terminal, scan cards, capture signatures, and send invoices via email or SMS. The app supports real-time transaction monitoring and batch notifications.

Additionally, ValorPay facilitates QR code payments, enabling quick and contactless transactions. The mobile solutions are compatible with both Android and iOS devices and are designed to offer a next-generation payment experience for merchants and their customers.

- Value-Added Services:

Valor PayTech also offers several value-added services to enhance the overall payment experience for merchants and their customers. These services include real-time updates for recurring billing information to minimize declined transactions, fraud prevention tools, and detailed analytics for better business insights. It also consists of an online portal for real-time payment management and transaction monitoring, as well as marketing tools like Engage My Customer™, which assists in creating loyalty programs and targeted marketing campaigns.

Valor’s platform is designed to be scalable, allowing businesses to grow and adapt their payment processing needs over time. The company also provides extensive support and resources for ISOs and ISVs, ensuring that partners can maximize the benefits of Valor’s technology.

Features of Valor Paytech

Valor Paytech provides a diverse range of POS solutions tailored to various business needs, including countertop, wireless, and Android POS options and a mobile app that enhances merchant capabilities.

- Wireless POS: The VL110 represents Valor Paytech’s wireless POS solution. It is designed for businesses that require mobility and flexibility in payment processing. This system supports multiple payment methods and is noted for its portability and ease of use in dynamic business environments.

- Countertop POS: The VL100 and VP100 are part of Valor Paytech’s countertop POS offerings. These systems are designed to handle various forms of payment, such as EMV chip cards, contactless payments, and mobile wallets, making them versatile for different retail settings.

- Mobile App: Valor Paytech also offers a mobile application that enables merchants to manage transactions and customer data efficiently. This app supports manual credit card transactions and integrates with devices like the RCKT Mobile POS via Bluetooth, facilitating smooth and quick payment processes.

- Android POS: Android-based solutions like the VL500 and VP500 are designed to bring the familiar functionality of smartphones to the POS experience. These systems support various payment options and aim to enhance user interaction with their smart, intuitive interfaces.

- Virtual Terminal: This versatile solution offers a suite of essential functions for contemporary businesses, including tokenization, recurring payments, and cash discounting and surcharging capabilities. It supports level 2 and level 3 payment processing, improving businesses’ transaction handling.

- The Vault: Developed by Valor Paytech, the Vault is a secure payment system that stores and accesses customer card information. It offers enhanced security features and works on multiple platforms. This system makes it easier to manage payment methods while ensuring compliance and protection of sensitive data.

- Valor Shield: This security tool is dedicated to stopping unauthorized transactions. It provides options to block international card transactions and counter phishing efforts. Valor Shield lets merchants set transaction limits, including maximum amounts per transaction and thresholds for daily and monthly volumes.

- Valor Updater: This service ensures that customer payment details are up-to-date, which is especially beneficial for recurring transactions. It helps decrease card declines and supports customer retention by maintaining accurate card information.

- QR Code Payment: Valor Paytech’s QR code payment system is a contactless method that allows customers to pay using their mobile devices. It supports the quick sharing of payment links through various channels, facilitating instant payments.

What Makes Valor PayTech a Good Option to Consider?

Valor Paytech Solutions provides a diverse set of benefits to improve the efficiency and security of payment processing for businesses:

- Tokenization: Valor Paytech enhances transaction security through advanced tokenization techniques. This approach substitutes sensitive cardholder data with unique identifiers, significantly lowering the risk of data breaches and fraud.

- Cash Discount & BIN-Based Surcharging: Valor Paytech enables businesses to manage payment processing expenses better. It supports dual pricing strategies, allowing businesses to show transparent pricing for card and cash transactions at the point of sale, which can assist in covering transaction costs.

- Omnichannel Solutions: Valor Paytech’s platform supports payment acceptance on various devices and platforms, enabling businesses to provide consistent payment experiences, whether in-person, online, or via mobile. This capability is facilitated by integrated solutions that link different payment systems and devices, increasing adaptability to meet varied customer demands.

- Innovative Payment Technology: Valor Paytech incorporates the latest technologies to simplify payment procedures. This includes various POS systems that accommodate multiple payment methods, such as EMV, contactless payments, and mobile wallets, allowing businesses to meet consumer demands for quick and secure payment options.

- Security and Reliability: Valor Paytech is committed to securing transactions. The company continually invests in advanced security measures and adheres to industry standards to defend against new threats. Their focus on security is evident in robust offerings like The Vault for secure data storage and Valor Shield for enhanced transaction security.

- Variety of Processors: The systems at Valor Paytech are compatible with numerous major processors, allowing businesses to choose optimal processing solutions tailored to their needs. This compatibility aids in streamlining operations and can lead to cost savings.

A Look at the Different Product Offerings From Valor PayTech

Countertop POS Devices

1. VL100

The Valor VL100 is designed as a comprehensive solution suitable for various types of businesses. It features an auto-connection failback system to maintain connectivity, ensuring no sales are missed. Ideal for use in restaurants, convenience stores, or farmers market booths, the VL100 enhances operational efficiency with its 3.5” touchscreen display. It supports functionalities like bill splitting, on-screen signature, and sending and storing digital receipts.

The device allows configuration with two merchant IDs (MIDs), supports cash discounting, and includes a customer feedback system for real-time reviews during transactions. It offers multiple payment options, including contactless payments via eWallets like Apple Pay, Samsung Pay, Google Pay, and Android Pay, as well as EMV PIN and traditional swipe transactions.

Key Features:

- Electronic signature and thermal receipt printing

- Cash Discounting Capabilities

- Compatible with cash discount and surcharge programs

- Bill Splitting Functionality

- Operates on FD and TSYS platforms

- Text & Store Digital Receipts

2. VL300

The VL300 from Valor Paytech is an advanced customer-facing PIN pad when paired with your Valor terminal. It boasts a 3.5” color LCD screen and a robust microprocessor to facilitate quicker transactions in retail or dining settings. Sharing capabilities with the VL100 and VL500, the VL300 manages on-screen signature captures and features a customer rating system.

Enabled with smart tipping, the VL300 allows customers to add tips effortlessly with a simple button press. Like other Valor terminals, it supports contactless payments through eWallets like Apple Pay, Samsung Pay, Google Pay, and Android Pay and processes both EMV PIN and traditional swipe transactions.

Key Features:

- PCI-PTS 5.0 Certified PinPad

- Signature Capture Feature

- Smart Tipping Function

- Connectivity via Ethernet, USB, and Serial

- Large Scale Touch Screen Display

- Built-In Customer Rating System

3. VP100

The VP100 is a cutting-edge countertop payment solution with a spacious touchscreen for an enhanced user experience. This system features digital signature capture and offers versatile receipt options, including printing, SMS, or email. It also simplifies group payments with its efficient bill-splitting function, improving service convenience.

Equipped with advanced EMV card technology, the VP100 supports various payment methods, including swipe, tap, and dip, and is compatible with EBT-enabled devices, addressing a broad spectrum of customer needs. The device supports dual merchant IDs (MIDs), offers robust connectivity options through Ethernet and Wi-Fi, and maintains consistent service with an auto-connection failback system for reliable operation.

Key Features:

- Supports dual merchant IDs

- Includes options for cash discounting, dual pricing, and surcharging

- Ethernet and Wi-Fi connectivity for stable and secure connections

- Auto-connection failback to ensure continuous operation

- Digital signature capability with flexible receipt options via SMS and email

- Regular automatic software updates

- EBT compatibility

- SMS and email marketing capabilities with the Engage My Customer™ feature

4. VP300

The Valor VP300 is a high-performance retail payment terminal designed for versatility and robust security, suitable for various business needs. It runs on a proprietary system that allows for secure and efficient transactions. The terminal has a 32-bit secure processor, essential for fast processing speeds, especially during busy periods, to keep customer satisfaction high.

The unit includes a 2.4-inch TFT full-color LCD, providing clear visuals and user-friendly operation for staff and customers. It accommodates different payment technologies such as magnetic, EMV smart cards, and contactless EMV cards, enhancing its flexibility with payment options. Its connectivity features include RS232 and USB ports, improving its integration with different systems.

Additional features of the VP300 include a buzzer, alphanumeric keypad, function keys, and audio options, all of which add to a thorough user experience. It holds several important certifications, such as PCI PTS 5.x and EMV levels, ensuring it meets current security protocols.

Key Features:

- PCI-PTS 5.0 Certified PinPad

- Capability for signature capture

- Smart tipping function

- Ethernet, USB, and serial communication options

- Large-scale touchscreen display

- Built-in customer rating system

Wireless POS Devices

5. VL110

The Valor VL110 is a hand-held, wireless POS terminal offering a range of connectivity options, such as 4G, Bluetooth, Ethernet, and WiFi. It boasts a 3.5-inch touchscreen display that simplifies interactions by clearly showing transaction details and enabling straightforward navigation. The device accepts various payment methods, including EMV chip, contactless payments, and mobile payment platforms like Apple Pay, Google Pay, and Samsung Pay.

Powered by a 32-bit secure microprocessor and a Linux-based operating system, the VL110 ensures steady performance. It features a long-lasting battery, making it ideal for mobile businesses. The terminal is designed to handle key tasks like digital signature collection and sending receipts through text or email to improve customer service.

Additional features include smart tipping, which prompts customers with up to four gratuity options, and an auto-connection failback to maintain connectivity during transactions. Due to its pay-at-table functionality, the VL110 is well-suited for diverse business environments such as restaurants, beauty salons, and retail stores.

Key Features:

- Bill Splitting

- GPRS / 4G and Wi-Fi Connectivity

- Large Scale Touch Screen Display

- Signature Capture and Pay At The Table

- Smart Tipping

Android POS Devices

6. VL500

Valor PayTech’s VL500 combines the functionality of an Android tablet with a robust POS payment terminal in a compact and sleek design. It features a high-definition 5.5-inch touch color display and a built-in 2-megapixel camera with LED flash. The VL500 is designed to provide an optimal viewing and user experience in various settings. It includes a thermal printer powered by a high-capacity battery, supporting continuous daily use.

The VL500 enhances the checkout experience with features such as Wi-Fi, 4G LTE/3G connectivity, a microphone, Bluetooth, barcode scanning, dual cameras (front and rear), a fingerprint reader, a base, and a stylus. Recognized as a leading wireless terminal in the industry, the VL500 boasts significant processing capabilities, enabling Valor to develop customized applications that boost business efficiency and success.

Key Features:

- Android Point-of-Sale Operating System

- High-Speed Quad-Core Processor

- 8GB Flash Memory / 1GB RAM

- Dual Pricing and Dual MID Capabilities

- Pay at the Table Functionality

- Cash-Discount Handling

- Contactless Payment Options

7. VP500

The VP500 utilizes the Android platform to provide a point-of-sale (POS) terminal that incorporates the ease of use of a smartphone with sophisticated payment processing technologies. This device enhances customer interactions and streamlines business operations, encouraging the adoption of more contemporary, efficient methods. The VP500 features a user-friendly interface and a 5.5-inch touchscreen, facilitating easier transactions in diverse business environments.

It offers a comprehensive range of capabilities, including support for various payment methods and connectivity options, which ensures its reliability and adaptability for different business needs.

Key Features:

- 5.5-inch Touch Screen Display

- Android Operating System

- Lite POS & Inventory Management

- Menu Management

- Screen Signature Capture

- WLAN, 4G LTE/3G/GPRS, and Bluetooth Connectivity

- Option for paper or digital text/email receipts

- Automatic software updates

- Auto-connection failback procedure

- EMV for contact and contactless transactions

- Option for tip adjustment

- Pay-at-table capability

- Dual-Mid Cash Discounting and Interchange+

- Bill splitting feature

Mobile Solutions

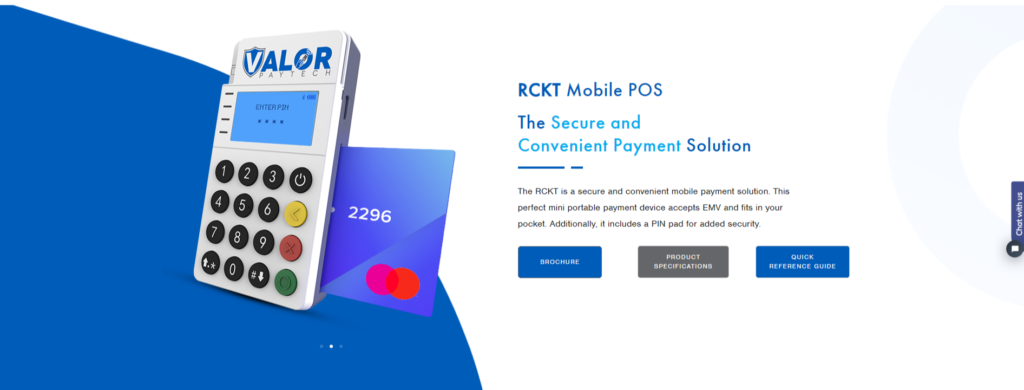

8. RCKT Mobile POS and Mobile App

The Valor PayTech mobile app is designed to handle mobile payments and business transactions efficiently. This app allows merchants to access transaction data in real-time, manage customer information, and manually process credit card transactions. It connects with the RCKT Mobile POS device using Bluetooth, enabling smooth transaction processing. The RCKT Mobile POS is a small, flexible payment device ensuring secure and effective payment processing. It accepts various payment forms such as EMV chip, swipe, and contactless payments, which is beneficial for mobile businesses. The device also has dual pricing display capabilities, which allow merchants to show pricing differences between card and cash payments on the POS terminal.

Furthermore, the app provides features for managing refunds and settling transaction batches through an intuitive interface. It is tailored to improve the operational efficiency of businesses from various sectors by providing tools for managing transactions and engaging customers. Important functionalities include adding tips, selecting receipt delivery methods, and confirming transactions easily.

Customer Support of Valor PayTech

Valor PayTech provides round-the-clock technical support and seeks to respond to support queries efficiently and promptly. If you need assistance, you can contact their customer support team by emailing sales@valorpaytech.com or at 1-800-615-8755. Additionally, you can explore their Partner Resource Center or Knowledge Base for further information.

Pricing of Valor PayTech

Valor PayTech provides several pricing options for its payment gateway, tailored to a business’s specific needs and chosen services. Costs may differ depending on additional features, support or training, and customization requests. The website does not explicitly list the prices for various services. For detailed pricing information, it is recommended that Valor PayTech be contacted directly.

Conclusion

Valor PayTech stands out in the fintech sector with its processor-independent, omnichannel payment solutions. Since its inception in 2019, the company has catered to diverse business needs with a comprehensive range of products and services, from countertop and wireless POS systems to advanced e-commerce and mobile payment solutions.

Valor PayTech’s dedication to innovation and customer satisfaction is evident in its robust, secure offerings, which include advanced features like tokenization, cash discounting, and QR code payments. With over 100,000 devices in use by 2023, Valor PayTech has demonstrated significant growth and reliability, making it a viable option for businesses seeking versatile and secure payment processing solutions. For businesses in retail, restaurants, or mobile settings, Valor PayTech offers a solid platform that enhances efficiency, security, and customer satisfaction.