Omnichannel POS Evolution: Global Payments’ “Genius” Platform for Enterprises

Posted: November 25, 2025 | Updated:

There’s a skinny line between in-store and online shopping today – it has virtually disappeared in today’s retail and hospitality market. Customers expect to order, pay, and interact with a brand seamlessly, whether at a physical counter, on a website, or via a mobile app.

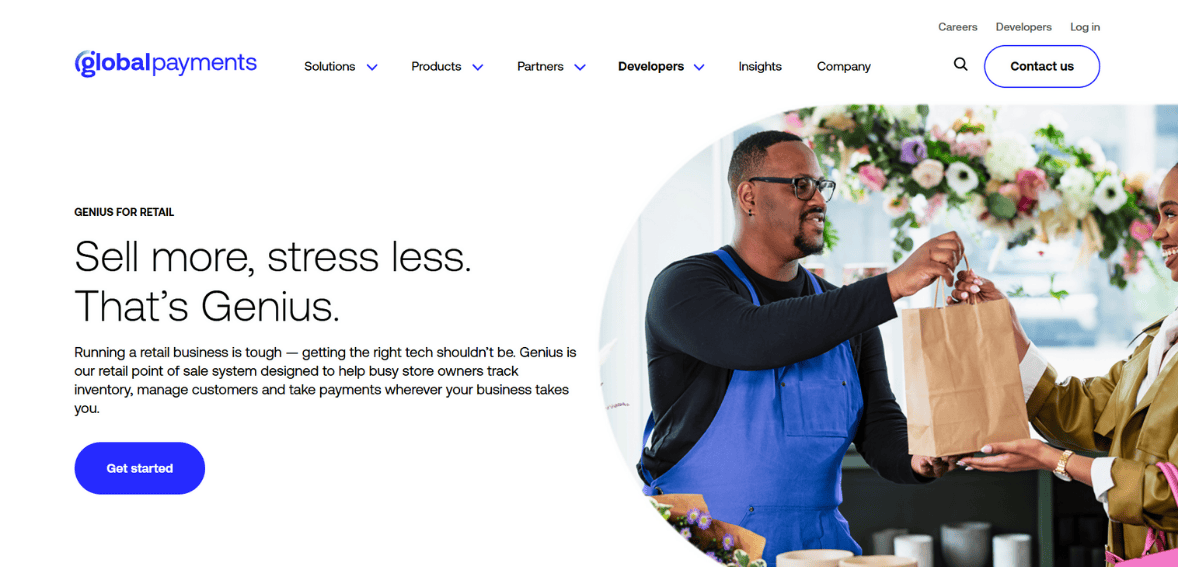

To meet this demand, merchants are seeking unified, “omnichannel” point-of-sale (POS) systems that tie together all sales channels. Payment technology providers are answering the call by rolling out integrated commerce platforms. A notable example is Global Payments’ platform Genius for enterprise businesses. Genius is a modern, modular commerce solution designed for high-volume operators, including large quick-service restaurant (QSR) chains, stadium concessions, corporate cafeterias, and entertainment venues.

It brings together everything a large-scale foodservice or retail operation needs – registers, kitchen displays, self-service kiosks, digital menu boards, back-office reporting, loyalty, and more – all within one system and with fully integrated payment processing. In this blog, we explore why all-in-one POS platforms like Genius are gaining traction, how they can improve both merchant and customer experiences, and what they suggest about the future of enterprise payment technology.

The Need for Unified Commerce Platforms

Large merchants today often operate across many environments. A fast-food chain may have dine-in counters, drive-thrus, mobile ordering, kiosks, and catering or online delivery. A sports arena might have concession stands, team stores, online merchandise sales, and premium lounge services.

In the past, each of these channels might have used separate technology systems: different software for ordering, a single cash register system in the store, another app for online sales, and maybe even a third-party vendor for parking payments or vending. This patchwork approach creates several headaches:

- Data Silos: Inventory, sales, and customer information remain trapped in channel-specific silos. A burger sold through the mobile app may not be reflected in the restaurant’s in-store inventory immediately, leading to inconsistencies. Reports have to be manually combined to get an accurate picture of revenue or stock levels, which delays insights and decision-making.

- Fragmented Customer Experience: Without integration, a customer’s profile (including loyalty status and past orders) can’t follow them across channels. For example, a loyalty reward earned in the restaurant might not be recognized in the mobile app, leading to frustration.

- Operational Complexity: Staff may have to learn and juggle multiple systems (one for the drive-thru, one for table service, another for kiosk orders, etc.), slowing down service. Each system also needs its own support, updates, and vendor relationships.

- Payment Inconsistencies: Separate checkout systems can mean different payment processes or security standards. This increases compliance burdens (such as EMV chip requirements or PCI standards) and can lead to slower transactions when using specific payment methods.

To overcome these issues, businesses are adopting omnichannel POS or unified commerce platforms. Such systems synchronize all channels in real time. Inventory changes immediately when a sale happens anywhere; pricing and menus are updated from a single dashboard; customer data and loyalty points live in one place; and payment processing is built in.

This means a customer could start an order on a mobile phone, finish it at a self-service kiosk, and pay with any preferred method, credit card, mobile wallet, gift card, or even a financing option, without any friction. Likewise, managers get one dashboard that shows total sales and operations across all outlets and channels.

Global Payments’ Genius platform is an example of this trend toward unified commerce. Launched in 2025, Genius consolidates the company’s various POS products under one brand. For enterprise clients, Genius for Enterprise is tailored to the most demanding, high-volume environments.

Instead of having separate systems for POS, kitchen displays, or payment terminals, Genius provides all of these as modules on one backbone. This allows prominent foodservice and retail operations to replace their fragmented setups with a single, cohesive system. The remaining sections will break down what Genius offers and why this approach matters for merchants and customers alike.

Global Payments’ Genius Platform: A Unified Commerce Solution

Image source

Global Payments is a Fortune-500 payment technology company that processes billions of transactions annually. In recent years, the company has invested heavily in software solutions and has become known for acquiring or building advanced POS and software offerings. In mid-2025, Global Payments formally unveiled Genius as its new unified commerce platform.

The initial rollouts included Genius for Restaurants and Genius for Retail, aimed at small and mid-sized businesses. By the fall of 2025, the company announced Genius for Enterprise, an edition specifically targeting large chains, stadiums, universities, and other high-traffic venues.

The core idea behind Genius is to provide an all-in-one commerce enablement platform: one solution that handles every aspect of a merchant’s customer-facing and back-office operations. It is described as a modern, modular system, meaning it is built on contemporary cloud-based technology and consists of interchangeable components (modules) that can be turned on or off as needed.

This modularity is necessary for enterprise customers, since different businesses have different needs. A stadium might use the kiosk and digital signage modules heavily, while a corporate cafeteria might rely more on integrated account billing. Genius allows each enterprise to configure the platform to its workflow.

Genius is cloud-native and hardware-agnostic. Global Payments envisions Genius terminals running on a variety of devices (traditional countertop registers, tablets, mobile handhelds, etc.) and operating systems, all syncing back to a central cloud service. This means a restaurant chain could use different types of checkout hardware across regions while still maintaining a consistent system overall. The cloud foundation also enables real-time updates and analytics, as well as remote management of menus, prices, and content across the network.

At the payment level, Genius comes with a fully integrated payments stack. Instead of dealing with a separate payment terminal or gateway integration, payments are built into the POS software. This integration supports multiple tender types (swipe, chip, contactless NFC, digital wallets, gift cards, etc.) in a single workflow. It handles security, such as EMV chip processing and tokenization, in the background. For large enterprises, this means faster, more streamlined checkout processes and consistent security standards without juggling multiple payment setups.

Key Features of Genius for Enterprise

Image source

Global Payments has highlighted that Genius for Enterprise includes all the pieces a large-scale foodservice organization needs in a unified platform. The main components and capabilities include:

- Point of Sale (POS) Terminals:

Genius provides hardware-agnostic POS software for both countertop and mobile/handheld devices. Registers run on tablets, terminals, or bespoke hardware, but deliver the same software experience. They offer real-time data syncing, so orders from any POS device are updated in the cloud immediately.

Features include conversational menu navigation, offline mode (transactions continue even if connectivity drops), and centralized configuration (settings apply across all terminals). For example, a QSR chain could update a menu item in the head office and have it propagate to every store’s POS system instantly.

- Integrated Payments:

The payment processing engine is tightly built into the platform. Transactions are fast and secure, fully supporting EMV chip cards, contactless payments (like Apple Pay or tap-to-pay credit cards), mobile wallets, and newer payment options such as buy now, pay later (BNPL) or cryptocurrency, if enabled.

Because payments are not an afterthought, businesses benefit from one-touch checkout flows and a unified settlement process. PCI compliance (handling card data securely) is managed at the platform level, relieving merchants of the need for separate PCI scopes.

- Kitchen Management System (KMS):

To streamline high-volume food prep, Genius includes a robust kitchen display and order routing module. Orders taken at the POS or kiosks are automatically sent to kitchen screens (often called KDS, or Kitchen Display Systems).

The system supports features like order bumping (sending only a few items at a time as they’re ready), order claiming by specific stations, and even customized routing (for example, sending salads to one station and drinks to another). This automation helps large kitchens move orders quickly and reduces mistakes, which is crucial when serving thousands of customers per day.

- Digital Menu Boards:

For enterprises with digital signage (common in stadiums and fast-food chains), Genius offers a menu board system. Managers can update menus, prices, or promotions in real time and push those updates to electronic display screens both indoors and outdoors.

This ensures consistency (no manual rewrites) and allows dynamic pricing or limited-time offers to go live at exact times. Digital signs can also show upsell suggestions or nutritional information in sync with what appears on the POS screens.

- Self-Service Kiosks:

In addition to staffed registers, Genius supports modern kiosk hardware. These are customer-facing touchscreens installed in stores where guests can browse the menu, place orders, and pay without interacting with a cashier. Kiosks run the same interface and payment integration as the POS, and they can be customized to feature the brand’s look and feel.

Because they link to the same back end, inventory and pricing remain in sync with registers. Kiosks often speed up service and can even increase average order size through targeted upsells displayed on screen.

- Drive-Thru Automation:

Many QSR enterprises rely heavily on drive-thrus. Genius includes drive-thru-specific technology; for example, it can interface with vehicle loop detectors and integrated cameras so that order-taking starts automatically when a car arrives.

It can also manage drive-thru-specific display units and even incorporate a vision system to ensure orders are confirmed and properly tracked (some modern drive-thru setups use image recognition to help verify orders). This level of automation helps drive-thru lanes move cars faster and with fewer errors.

- Back-Office and Reporting:

At the corporate office level, Genius provides centralized management and reporting tools. All sales data, inventory counts, labor statistics, and financials from every location and channel roll up into a comprehensive dashboard. Managers can pull reports on sales trends, inventory shrinkage, labor costs, and more, all in one place.

These analytics can be broken down by store, region, or channel (e.g., in-store vs online) to guide strategic decisions. Having back-office functions built into the POS platform means insights are available immediately and require no manual data stitching.

Together, these features mean that a large enterprise user of Genius can handle virtually all front- and back-end commerce tasks within a single connected ecosystem. Instead of buying separate POS, payment terminals, kitchen screens, and reporting tools (often from multiple vendors), a business gets one tightly integrated suite.

Enhancing the Merchant Experience

All-in-one omnichannel POS platforms like Genius offer tangible, long-term benefits for businesses by unifying operations across all channels. With a single platform, companies simplify their tech stack: there’s one vendor for support, one software for staff to learn, and one upgrade cycle to manage. This reduces time spent on complex integrations or fixing mismatched systems and makes changes, such as adding a new payment type (such as a mobile wallet), quick and consistent across all touchpoints.

Centralized management lets corporate or franchise leaders control menus, pricing, promotions, and employee permissions from one place so that a nationwide promotion can be configured once in Genius and automatically appear on every POS, kiosk, and menu board—no more manually reprogramming dozens of registers. Because all transactions run through one system, operators also gain real-time data and analytics. They can immediately see which items are performing well, adjust inventory or marketing on the fly, and even reroute supplies to specific locations, using data-driven insights to boost efficiency and profitability.

This unified design is inherently scalable and flexible. A modular, cloud-based platform like Genius can support ten stores or ten thousand, with new terminals or kiosks coming online simply by connecting to the network and downloading the latest software, no complex on-site installation required. As businesses enter new markets, the system can support additional countries, currencies, or tax rules through software updates rather than hardware changes.

Integrated payments further streamline operations by removing the need for separate payment terminals or gateways, helping ensure every transaction complies with EMV and PCI standards while avoiding unexpected integration fees or compatibility issues. Over time, consolidating onto one platform can significantly reduce the total cost of ownership, replacing multiple legacy systems and cutting training and maintenance costs because teams only need to master one set of workflows.

Merchants using Genius have highlighted its ability to handle enterprise-scale demands. A large restaurant chain quickly scaled to over a thousand locations thanks to the platform’s unified configuration and responsive support. Regional chains can also deploy Genius across diverse environments, from cafeterias to stadium concessions, with minimal retraining, since the underlying interface and workflows remain consistent wherever it’s used.

Elevating the Customer Experience

Not only do merchants benefit, but customers themselves enjoy smoother, more consistent experiences when businesses use an omnichannel POS system. The integrated nature of Genius translates into several perks for end users:

- Seamless Omnichannel Ordering:

Customers can place and pay for orders using any channel and expect continuity. A mobile app order can be picked up in-store without reordering or re-entering payment details.

Curbside pickup, drive-thru, in-store dining, and online shopping all share the same catalog and loyalty programs. This convenience means customers spend less time on administrative tasks and more on the purchase itself.

- Faster, Flexible Payments:

With integrated payments on every device, checkout is quicker. Cashiers or kiosks accept any major card, contactless pay, or digital wallet in one tap. Customers can also take advantage of new payment options like pay-later services or digital coupons directly at checkout because the POS already knows the loyalty or financing rules.

There’s no need for the merchant to set up a separate BNPL terminal or for the customer to jump through hoops; everything is just part of the same checkout flow.

- Consistency and Accuracy:

Customers see the same menus, prices, and promotions whether they’re ordering on a website, a kiosk, or from a cashier. This reduces confusion or disputes (“Why is it cheaper online than in-store?”). It also means less wait time and fewer mistakes.

If a menu item goes out of stock, it can be removed immediately from all channels so a frustrated customer never orders something unavailable.

- Customized Offers and Loyalty Rewards:

Because Genius can tie together customer data, shoppers can benefit from personalized experiences. A loyalty program is easier to manage and apply, points earned at any touchpoint automatically go into the customer’s profile.

The system can recognize repeat customers (if they log in or give loyalty info) and automatically suggest favorite items, apply discounts, or give targeted upsell recommendations based on past behavior.

- Modern Service Options:

The platform enables modern conveniences that today’s consumers expect. Self-service kiosks let impatient guests order without queuing at a counter. Digital menu boards quickly showcase combos or limited-time deals.

Mobile POS allows staff to take orders and payments tableside or at events. These innovations improve the overall shopping or dining experience. For example, at a sports arena, fans might use a handheld app to order food to their seat and skip concession lines entirely.

- Reliability and Smooth Service:

Since Genius is cloud-based with offline modes, outages are rare and don’t interrupt service. A customer’s transaction will still go through even if the internet briefly fails, with data syncing later.

This reliability means fewer abandoned purchases and less frustration when using technology at checkout.

The Future of Enterprise Payment Technology

The launch of systems like Global Payments’ Genius illustrates broader trends that are shaping the future of payment and POS technology for large merchants. Several key directions include:

Cloud-Native and API-Driven Platforms

Enterprise POS solutions are moving to the cloud, with open APIs that allow easy integration of new services. This means businesses can add novel features (like an AI-based recommendation engine, a new payment method, or a third-party delivery service) by plugging into the POS platform rather than building from scratch.

Cloud systems also enable continuous deployment of updates, so merchants always have the latest security and features without downtime.

Rich Data and AI Integration

With all data centralized, companies can leverage machine learning to optimize operations. For example, predictive analytics might forecast which items will sell out during a game so that a stadium can pre-stock accordingly.

AI could power dynamic pricing or menu personalization (offering a discount on a popular item to a lapsed customer). The expectation is that the next generation of POS platforms will include innovative tools that automatically analyze the unified data pool.

Expanded Payment Options

Consumer payment preferences keep evolving. Unified commerce platforms are well-positioned to incorporate new tender types. Big POS providers are already experimenting with integrating digital wallets (Apple/Google Pay), installment plans, and even cryptocurrencies at checkout.

A solution like Genius could allow a soccer fan to pay for a jersey at the stadium with a stablecoin or to finance a large order via a buy-now-pay-later option – all handled seamlessly. By supporting multiple payment methods under one roof, merchants can cater to customer preferences and stay competitive.

Security and Compliance as Built-In Services

As data breaches and fraud concerns grow, robust security is paramount. Future enterprise POS systems will likely bundle advanced security (end-to-end encryption, tokenization, fraud detection) as standard.

A unified platform means that updates for compliance (such as new PCI requirements) can be rolled out automatically, relieving merchants of manual patching. For large organizations, having this expertise centralized at the platform level reduces risk.

Personalization and Customer Engagement

Look for commerce platforms to integrate more tightly with marketing tools. In the future, an omnichannel POS could automatically sync with email marketing, CRM, or social media. Hence, a promotion posted on Instagram is reflected on the menu board immediately, and vice versa.

Customers might receive personalized discounts or loyalty offers triggered by live data (e.g., a flash deal when an item is overstocked). The goal is a frictionless journey where commerce and engagement are one continuous cycle.

Hardware Abstraction and Flexibility

While traditional cash registers still exist, future POS approaches treat hardware more as a widget. Genius, for example, allows the same software to run on counters, tablets, smartphones, or kiosks.

We can expect more flexibility in the future, where employees might use personal devices as secure POS, or new form factors could emerge (like bright checkout counters with integrated scales or RFID readers). The software-centric focus means that updating the customer interface or adding new hardware types is simplified.

Global and Multilingual Support

Large enterprises often operate internationally or serve diverse audiences. Next-generation platforms will further support multiple currencies, languages, tax regimes, and compliance rules within one system. This helps brands expand globally without rebuilding their POS infrastructure.

Enterprise payment technology is heading toward platformization. Instead of a disparate ecosystem of peripherals and apps, merchants will adopt broad, extensible platforms that handle everything from checkout to data analytics.

The Genius platform is a prime example: it bundles the cash register, payment gateway, kitchen printer, and reporting engine into a single orchestrated system. As we advance, we can expect other principal payment and software companies to follow a similar path, and merchants will increasingly demand these full-stack solutions.

Conclusion

The evolution of POS systems reflects the broader shifts in commerce: customers want convenience and consistency across all touchpoints, and businesses need operational efficiency and agility. Omnichannel platforms like Global Payments’ Genius represent a pivotal step in that direction for enterprise merchants.

By combining registers, kitchen management, kiosks, digital signage, and payments into a single modular system, Genius simplifies deployment at scale and provides businesses with a unified view of their operations. For merchants, this means streamlined workflows, easier management of multiple locations, and the ability to adapt to new trends rapidly. For customers, it delivers a smoother, faster, and more personalized shopping or dining experience.

Looking ahead, the principles embodied by Genius – integration, flexibility, cloud architecture, and a focus on data – point toward how all enterprise payment technology will likely work. We can expect future systems to be even more data-driven and customer-centric, incorporating AI insights, novel payment methods, and ever-greater connectivity between devices.

In such an ecosystem, the “POS” is no longer just a cash register; it is the connective tissue of the entire commerce experience. Global Payments’ new platform shows that the future of enterprise POS is a unified, omnichannel commerce engine powering seamless transactions for both merchants and consumers.