Get the payment processing solution that fits your business

NetSuite Integration for Seamless Processing with Cybersource + Host Merchant Services

A connected approach to payments that supports growth and reduces complexity

Centralized Payments, Reconciliation, and Security – All in One Place

Centralized Payments, Reconciliation, and Security – All in One Place

Run payments at the same level as the rest of your NetSuite stack. Host Merchant Services connects NetSuite to Cybersource, giving you enterprise-grade payment processing, advanced fraud tools, and transparent pricing – without adding complexity for your finance or IT teams.

With NetSuite already powering more than 43,000 customers worldwide, your ERP becomes even more powerful when payments, reconciliation, and risk management are all unified through one integration.

Why NetSuite Merchants Choose Host Merchant Services

Built for NetSuite + Cybersource –

Integration designed specifically for NetSuite’s SuitePayments framework and Cybersource’s payment platform, so you get a native feel instead of a “bolted-on” gateway.

One Omnichannel Payment Stack –

In-store, online, mobile, and recurring payments all run through the same platform, giving you unified reporting and settlement across every channel.

Transparent, Competitive Pricing –

Interchange-plus style pricing, no long-term contracts, no termination fees, and no hidden surcharges. You stay because the solution works, not because you’re locked in.

Advanced Fraud and Security by Default –

Cybersource brings Level 1 PCI DSS compliance, tokenization, Decision Manager fraud tools, and EMV 3-D Secure into your NetSuite environment.

Merchant-First Support –

Dedicated integration specialists and 24/7/365 support that understands NetSuite, Cybersource, and day-to-day merchant operations.

Why NetSuite Merchants Choose Host Merchant Services

Powered by NetSuite And Cybersource

Powered by NetSuite And Cybersource

Together with Host Merchant Services, you get a single integration that links these capabilities directly to your NetSuite workflows, order to cash, subscriptions, invoicing, and beyond.

ERP Backbone:

NetSuite connects ERP, CRM, and commerce in one cloud platform for tens of thousands of organizations worldwide.

Payment Engine:

Cybersource is a Visa solution with global acquiring connections, advanced fraud management, and a full suite of payment security services.

Fraud Intelligence:

Decision Manager uses machine learning trained on insights from more than 141 billion VisaNet transactions each year to evaluate risk in real time.

Omnichannel Commerce Inside NetSuite

Buy Online, Pick Up In-Store (BOPIS)

Create seamless BOPIS experiences without building separate systems. Orders placed through your website flow into NetSuite, while payments and pickup are handled through the same Cybersource integration, keeping inventory, revenue, and risk controls aligned.

In-Store, Online, Mobile, and Recurring

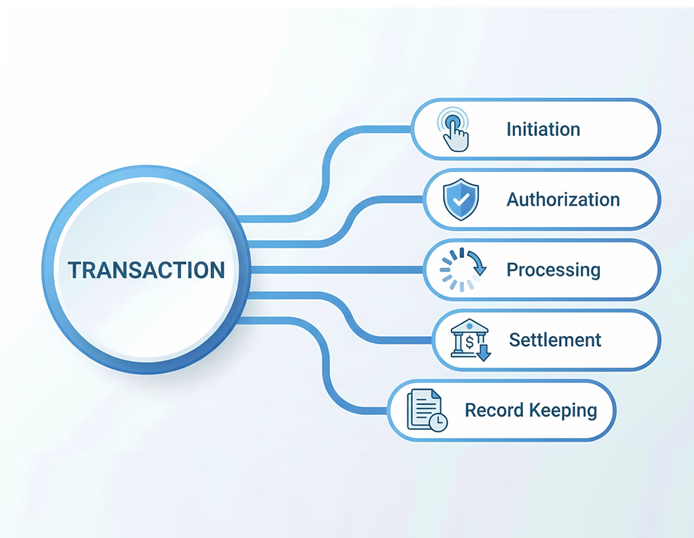

Process payments from your point-of-sale terminals, e-commerce checkout, mobile devices, or recurring billing schedules through one payment platform. NetSuite becomes the command center, while Cybersource and HMS handle authorization, settlement, and reporting.

Secure Stored Payment Details

Let returning customers and account-based buyers check out quickly using stored credentials. Card data is vaulted by Cybersource and represented in NetSuite as tokens, so you speed up checkout while keeping sensitive data off your own systems.

Loyalty, Subscriptions, and Repeat Business

Launch loyalty programs, subscriptions, and renewal-based offerings backed by tokenization and recurring billing. With NetSuite as the system of record, you’ll see complete lifetime value and renewal performance by customer, product, and channel.

Omnichannel Commerce Inside NetSuite

Results NetSuite Teams Can Expect with HMS Payment Integration

Streamlined Payment Processing

HMS delivers a unified payment experience across:

In-Store POS –

Take card-present payments with EMV and contactless support tied directly into NetSuite orders and invoices.

E-commerce and Customer Portals –

Connect shopping carts and self-service portals through Cybersource’s gateway and APIs.

Mobile and Field Payments –

Let sales and service teams accept payments on tablets or phones while keeping the transaction data in sync with NetSuite.

All channels post into consistent NetSuite records and roll up into centralized reporting.

Streamlined Payment Processing

Competitive Pricing

Competitive, Transparent Commercials

NetSuite merchants choose Host Merchant Services because the pricing model is straightforward and easy to understand.

There are no long-term contracts, no early termination penalties, and no hidden charges tucked into the fine print. You see exactly what you pay and where you save compared to your current setup.

E-commerce and Gateway Integration

Through the Cybersource gateway, you gain global card acceptance, support across multiple channels, and advanced tools for payment security, device fingerprinting, and strong customer authentication.

You also maintain consistent, branded checkout experiences that support customer trust and reduce friction during the buying process.

E-commerce and Gateway Integration

Advanced Security and Fraud Protection

Advanced Security and Fraud Protection

PCI DSS Compliance Built-In

Cybersource is a certified Level 1 PCI Service Provider, which means cardholder data is captured and stored in secure Visa data centers—not on your local network. This reduces your PCI DSS scope and simplifies annual validation.

Token Management Service

Card numbers are replaced with non-reversible tokens during transactions. Tokens can be reused for future orders, subscriptions, and refunds while the underlying card data stays encrypted and inaccessible to your systems.

Decision Manager Fraud Detection

Cybersource’s Decision Manager uses AI and machine learning to score and route transactions based on risk, drawing on insights from over 141 billion global VisaNet transactions each year. You get highly tuned, real-time decisions that reduce manual review and protect revenue.

EMV 3-D Secure and PSD2 SCA

Add an extra layer of authentication for online payments with EMV 3-D Secure. This helps minimize fraudulent transactions, shifts much of the chargeback liability to the card issuer, and supports Europe’s PSD2 Strong Customer Authentication requirements—while keeping customer friction as low as possible.

Service, Expertise, and Merchant-Focused Support

NetSuite implementations often combine virtual terminals, card-present hardware, e-commerce gateways, and custom workflows. HMS helps you design the right combination, then stands behind it with:

- Highly Trained NetSuite + Cybersource Specialists – A team that works with SuitePayments and Cybersource every day.

- 24/7/365 Support – Real people who understand payments and NetSuite, not generic call centers.

- Relationship-Driven Approach – We focus on long-term partnerships and continuous optimization, not one-time installs.

Host Merchant Services gives NetSuite merchants a payment integration that is reliable, secure, and easy for both finance and operations teams to live with.

Service, Expertise, and Merchant-Focused Support

How Implementation Works

How Implementation Works

Discovery and Design

We review your current NetSuite environment, payment flows, chargeback history, and reporting needs. Together we define target use cases and success metrics.

Configuration and Integration

Our team configures Cybersource, maps payment methods and currencies, sets up Decision Manager rules, and connects everything through SuitePayments into your NetSuite account.

Testing, Training, and Go-Live

We run test transactions across all channels, confirm settlement and reporting, and train your staff so that day-to-day use feels seamless.

Ongoing Optimization

After go-live we monitor performance, adjust fraud rules, and help you roll out new channels, regions, or business models as you grow.

Unlock Better Pricing, Better Security, and Better Support

Transform your NetSuite payment experience with an integration that combines Cybersource’s enterprise-grade platform with Host Merchant Services’ transparent pricing and merchant-first support.