PayPal Seller Fees – Ultimate Guide for Small Business in USA

Posted: July 15, 2025 | Updated:

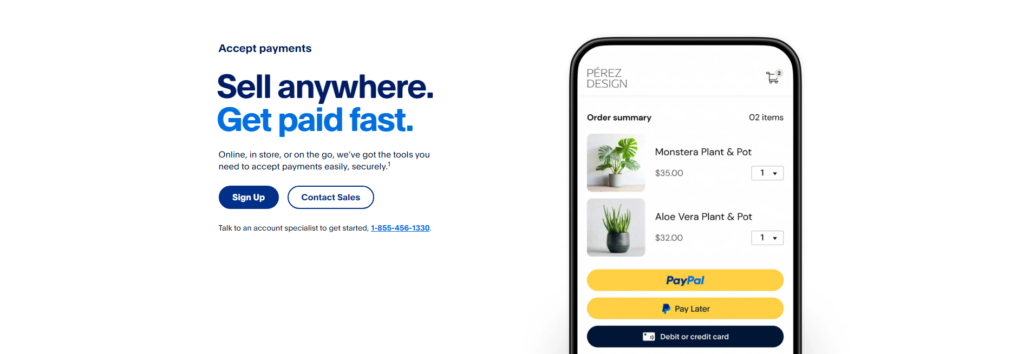

You won’t find a simpler and more convenient online payment option than PayPal. The app is incredible in meeting the needs of small businesses and freelancers. Therefore, it is essential to understand the PayPal seller fees in 2025 to stay updated.

With PayPal, customers can complete transactions with one click on a shopping cart page. Adding PayPal to payment options will facilitate firms and customers simultaneously, with simple PayPal seller fees in 2025. It’s crucial to know upfront PayPal fees, mainly if your business and customers use the app for transactions.

What Are the PayPal Fees for Sellers?

PayPal offers different seller fees on the app to businesses depending on the service package, international vs. domestic transactions, currency received, and payment type.

Commercial transaction fees are PayPal’s principal charges to businesses. These charges include a predetermined fee other than a percentage of the transferred amount. The fixed seller fee ranges from $0.05 to $0.49 per transaction, which is added on top of a percentage of the transferred amount ranging between 1.90 and 3.49 percent. PayPal Fees as a seller may vary depending on your nation’s currency.

For its standard plan, PayPal doesn’t charge merchants extra money for customer care, account maintenance, or account closure. The platform’s advanced payments feature also addresses security issues like PCI compliance. These fees cover most of PayPal’s transaction fees and operating expenses.

Different Types of Paypal Seller Fees in 2025

The entry hurdle to using PayPal is minimal for new businesses. You won’t have to pay anything to open a PayPal Business account. It requires little time to set up, doesn’t require a credit check, and has no cancellation or monthly fees. You can collect payments using various methods and from almost anywhere globally. Additionally, e-commerce companies can quickly integrate PayPal with their websites.

1. Transaction Fees

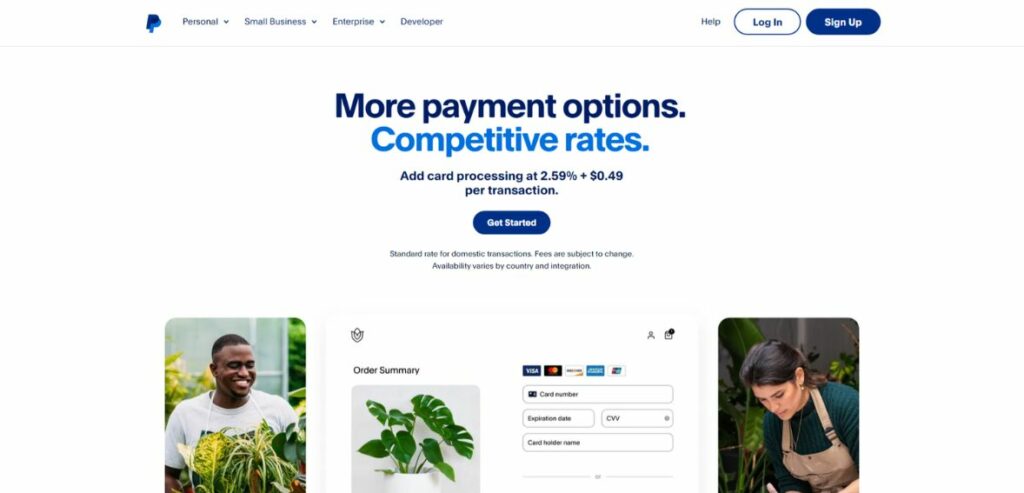

When you join PayPal, your default rate will be 2.99 percent plus a transaction fee of $0.49. This includes all the standard checkout page choices, such as PayPal, credit/debit cards, options for deferred payment, and others. It also includes seller protection on qualified transactions, although chargeback protection is excluded. Additionally, when using the “Pay with Venmo” option for transactions, the fee charged is 3.49 percent of the transaction amount plus an additional $0.49.

By selecting PayPal’s advanced payment program, you may access services like chargeback protection and cut your per-transaction rate to 2.59 percent with a $0.49 fixed rate. However, some features come with extra prices, so carefully weigh the benefits of these features against any additional expenditures. Remember that NGOs and businesses with significant volume can apply for even better pricing.

2. Fees on Payment Received

You can withdraw funds from PayPal deposits free of charge to a linked bank account. However, there is a 1.50 percent fee for instant withdrawals and transfers, up to $10 per withdrawal. There are withdrawal limits and other restrictions that should be mentioned. Remember that typical withdrawal times from PayPal are 3-5 business days.

3. Fees for International Transactions

One of PayPal’s appeals is its ability to accept payments in 96 countries and 24 currencies. PayPal charges a cross-border fee and a fixed currency conversion fee that total between 3.4 percent and 4.8 percent of the transaction amount.

A 1.5 percent international payment fee would be added to the standard rate for US businesses that accept online payments from foreign clients or cards. Currency conversion charges are exclusive to international payment fees.

If PayPal needs to change the currency before depositing the money into your account, you will pay an additional 3.0 percent charge on top of any other costs. Whether the customer’s bank handles the currency conversion on their end will determine whether they must pay the conversion cost. Having your client pay in local currency is one approach to get around this.

4. Fees on Balance Transferred

If the account is already connected to your PayPal account, balance transfers up to $750 monthly are free. This would apply to authorized banks, credit card accounts, and other PayPal accounts. Otherwise, fixed fees and ordinary transfer rates are applicable.

5. Micropayment Fee

PayPal has tailored a micropayment fee structure for sellers handling frequent, low-value transactions, typically under $10. This pricing model is especially beneficial for small businesses involved in digital goods, microservices, and online subscriptions. In 2025, the cost for each micropayment will be 5 percent plus $0.05 per transaction.

This reduced fee structure is designed to help sellers lower their transaction expenses and boost profitability in sectors where small, frequent sales are common.

6. Online Checkout Fees

When customers complete a purchase directly through a website’s checkout system using PayPal—without being redirected to an external PayPal payment page—PayPal charges 3.49 percent of the total transaction amount plus a fixed fee of $0.49 per transaction. This fee structure is specific to the direct checkout process that PayPal integrates within the merchant’s website.

7. Fees on Virtual Terminal

A PayPal Payments Pro account comes with a virtual terminal for a $30 monthly subscription. However, if you only care a little about the other Pro features, PayPal provides the virtual terminal on its own for the same $30 monthly fee.

8. Fees for PayPal Card Reader

PayPal Zettle is a point-of-sale system that has replaced PayPal’s prior POS product, PayPal Here. This Paypal system for stores allows you to accept payments, handle inventory, monitor sales, get reports, and send invoices without paying fees; you are only required to pay the fee when clients execute the transaction.

The fees for card-present transactions are 2.29 percent plus $0.09. Your initial card reader will cost you $29, and each additional one will cost you $79 after that. You won’t pay anything besides the transactions unless there is a chargeback.

9. Fees on Returns and Chargeback

When a user files a chargeback or dispute through PayPal, a dispute fee may be charged to the merchant handling the transaction, regardless of whether the user used Guest Checkout or their PayPal account. The standard dispute fee is typically $15 per dispute. However, if a merchant experiences a high volume of disputes—defined as having a dispute rate of 1.5 percent or higher over the previous three months with more than 100 sales transactions—the fee increases to $30 per dispute.

This fee applies to all eligible transactions except those handled through PayPal Pro or Advanced credit and debit card processing, sometimes called “unbranded” transactions. Disputes resolved amicably or categorized as unauthorized transactions may be exempt from this fee. However, the fee is non-refundable for merchants categorized under the high-volume dispute rate, even if the dispute is resolved in the merchant’s favor.

However, you don’t have to worry about the chargeback fee if you have Chargeback Protection. Those who choose PayPal’s advanced payment option can get chargeback protection. When a customer reverses or rejects a card charge, this function exempts them from the $20 chargeback fee. Regular chargeback protection costs an extra $0.40 for each transaction and necessitates producing documentation proving the delivery of the goods or services. The $0.60 per transaction Effortless Chargeback Protection offered by PayPal does not need you to produce proof unless the customers didn’t receive the delivery. Chargeback protection is beneficial for merchants with high-risk PayPal accounts. PayPal retains the set cost of $0.49 as a refund fee.

10. Payflow Fees

Payflow, PayPal’s payment gateway service, allows merchants to create customized checkout experiences. For transactions processed through Payflow, PayPal charges a fee of $0.10 per transaction.

Monthly Fees for Payflow:

- Payflow Pro: $25 per month

- Fraud Protection Services: Additional fraud protection services can be added for $10 monthly.

Payflow Link offers a simpler setup with no monthly fees but includes the same per-transaction charge as Payflow Pro. These fees help cover the cost of maintaining the services and providing support such as fraud protection and recurring billing options, which can benefit businesses that require these services for their operations.

11. Fees on Monthly Service

The majority of PayPal’s services are included in their transaction costs. However, there are several extras you may purchase for an additional monthly price. Some of their pricing schemes are listed below:

- Advanced Fraud Protection Services costs $10 per month + $0.05 per transaction; however, it does not cover payments made through PayPal and Express Checkout.

- Recurring payments cost $10 monthly and are great for selling monthly subscriptions. Vendors are increasingly using recurring payments.

- PayPal Payments Pro adds some additional conveniences and protections for retailers, including a virtual terminal that enables them to accept payments over the phone for a monthly fee of $30.

- PayPal Payments Advanced enables visitors to check out directly from your website rather than being taken to PayPal to finish the transaction. This payment option costs $5 a month. This option will lift the strain of credit card credentials traveling through your servers for PCI compliance.

In addition to providing a simple, one-click checkout process, PayPal provides working cash, marketing services, and business loans. These are for loans ranging from $1,000 to $500,000. Some of these choices, like chargeback protection, may help you save money, while others, like advanced fraud protection, are likely more for your peace of mind, particularly if you work in a high-risk sector. You should ensure that any add-ons or protections are appropriate for your company because fees can quickly pile up.

12. eCheck Fees

A transaction fee is charged when you receive a payment through an eCheck on PayPal. This fee adheres to the standard rates set in your PayPal agreement and is capped based on the currency of the transaction. For instance, the fee cap for payments in US dollars is USD 45, while for Australian dollars, it might be capped at 50 AUD. To ensure you have the most current details on eCheque fees, it’s recommended to review PayPal’s User Agreement or check the fee schedule on their website.

13. Other fees

Many business owners might wonder if there are any other charges in seller fees PayPal that they should know. If you are thinking the same, then check these extra charges. For accounts inactive for more than a year with funds, PayPal charges an “inactivity” fee. A fixed transaction fee of 3.5 percent exists if you accept American Express. Additionally, there are extra fees for card-not-present (CNP) purchases. Transactions where you don’t have a card have a higher rate than CNP transactions.

Methods to Reduce Seller Fees PayPal

All image source

There are occasions when paying PayPal seller fees is unavoidable. You can still take a few steps to lower the chances of getting into this situation.

- Use a PayPal Business Account: Switching to a business account can unlock lower fees for certain types of transactions. For example, PayPal Business Payments can charge as low as $0.50 per transaction when invoicing through specific platforms.

- Invoice Less Frequently: If you can consolidate payments into larger sums less frequently, you’ll minimize the fixed fee component of PayPal’s charges. For example, invoicing bi-weekly or monthly instead of weekly can reduce the total fees paid.

- Request Payments as “Friends and Family”: While this method can avoid fees, it’s risky if used for business transactions, as it violates PayPal’s terms of service and lacks purchase protection.

- Use Alternative Payment Methods: Consider accepting payments via ACH transfers or direct deposits, often with lower fees than PayPal.

- Pass Fees to Clients: Some businesses add a processing fee to invoices to cover PayPal charges. While this is a common practice, it is important to be transparent with clients about these fees.

- Apply for Reduced Rates: If your business processes many transactions, you may qualify for reduced PayPal fees. These fees typically require consistent monthly transactions exceeding $3,000.

- Deduct PayPal Fees on Taxes: PayPal fees can be written off as a business expense, reducing your taxable income.

- Avoid International Transactions Where Possible: PayPal charges extra fees for cross-border transactions and currency conversions. If you frequently deal with international clients, try to limit these transactions or use alternative methods like TransferWise (now Wise) to minimize costs associated with currency conversion.

- Bill in Your Customer’s Currency: Consider billing clients in their local currency to avoid currency conversion fees. This can help avoid the additional percentage PayPal charges when converting currencies.

- Batch Transactions: Instead of processing multiple small transactions, batch them into fewer larger ones. This reduces the number of times PayPal’s fixed fee is applied, saving you money over time.

- Use an Invoice Generator: Employing a professional invoice generator can help organize transactions, minimizing errors and potential disputes that could lead to refunds or additional fees. Efficient financial management can reduce unnecessary costs.

By opening a business account, you can also reduce your selling fees. All PayPal fees sellers on purchases made using the account will be waived if you follow the above instructions.

Comparing PayPal Fees with Stripe and Square

PayPal’s seller fees are generally higher than other payment gateways, particularly online transactions. However, the platform offers strong brand recognition and ease of use, which can justify the higher costs for some businesses.

For online payments, PayPal charges 2.99 percent + $0.49 per transaction for credit and debit cards and 3.49 percent + $0.49 for payment products like PayPal Checkout. These rates are higher than Stripe and Square, which charge 2.9 percent + $0.30 per transaction. Regarding in-person payments, PayPal’s fees through their Zettle card reader are more competitive at 2.29 percent + $0.09. This is lower than Square’s 2.6 percent + $0.10 but slightly higher than Stripe’s 2.7 percent + $0.05.

PayPal’s international fees are higher, often reaching 4.4 percent + a fixed fee, compared to Stripe’s 2.9 percent + $0.30 plus a small additional percentage for currency conversion. PayPal also imposes additional fees for certain features, such as recurring billing at $10 per month and virtual terminals at $30 per month. In contrast, Stripe includes many features without extra monthly fees, although it charges 0.5 percent for recurring billing.

PayPal tends to be the most expensive option for online transactions, but it offers the advantage of widespread consumer trust and the ability to accept PayPal and Venmo payments, which can be a significant benefit for some businesses.

Conclusion

In 2025, PayPal offers a convenient and widely accepted payment option, particularly for small businesses and freelancers. However, the variety of seller fees associated with PayPal can significantly impact your profit margins. Understanding these costs upfront and assessing whether PayPal aligns with your business needs is essential. While PayPal provides ease of use and brand trust, it may not always be the most cost-effective solution, especially for businesses with high transaction volumes or international clients.

Exploring alternatives, such as Host Merchant Services, which offers dedicated account management and competitive rates, could be beneficial. Consider your specific business requirements, customer preferences, and available reviews before choosing a payment service provider. Reducing expenses can make a significant difference in maintaining a healthy bottom line for your business.

Frequently Asked Questions

-

How can I minimize PayPal fees as a seller?

To minimize PayPal fees, increase your sales volume to qualify for lower rates, apply for micropayment pricing for transactions under $10, and consider alternative payment platforms. Negotiating a custom fee structure with PayPal is also an option for high-volume sellers.

-

What are PayPal’s cross-border fees, and how do they impact international transactions?

PayPal’s cross-border fees and a fixed currency conversion fee range from 3.4 percent to 4.8 percent of the transaction amount. These fees can significantly increase the cost of international sales, so it’s important to factor them into your pricing.

-

Are there specific fees for low-value transactions on PayPal?

Yes, PayPal offers a micropayment fee of 5 percent plus $0.05 per transaction for sales under $10. This structure is ideal for businesses that handle small transactions, reducing the impact of fixed fees.

-

What additional fees should I know when using PayPal for my business?

Additional fees include $30 per month for advanced services like PayPal Payments Pro, a 1.5 percent fee for instant transfers to your bank, and chargeback fees exceeding $20. These costs should be considered in your payment processing strategy.