Fiserv Ventures into High-End Restaurants

Posted: June 03, 2025 | Updated:

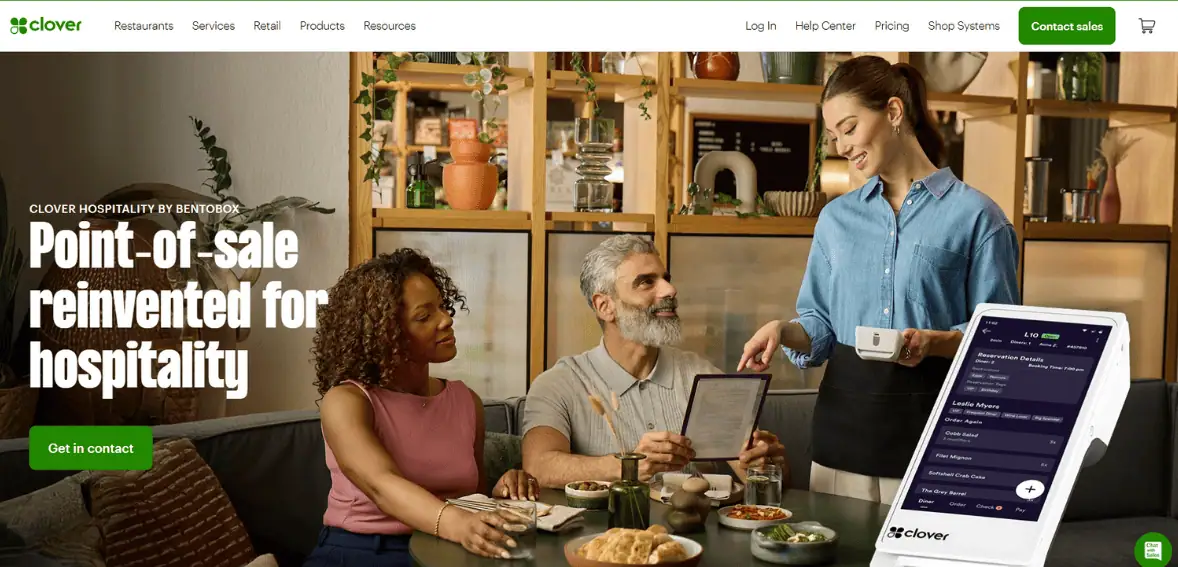

Fiserv Targets Restaurant Industry with Bold Clover Hospitality Launch

Fiserv is making an aggressive move into the restaurant space with the upcoming launch of Clover Hospitality, a new high-end point-of-sale solution tailored for the hospitality sector. The product is set to debut next month, with Brooklyn’s renowned Italian restaurant Lilia as its first client.

“This is a premium solution built specifically for restaurants,” said newly appointed CEO Michael Lyons during the company’s Q1 earnings call. Lyons, formerly president of PNC Financial, takes over from Frank Bisignano, who was appointed by President Trump to lead the Social Security Administration.

The restaurant tech space is crowded, but Fiserv is betting big on Clover’s strong track record. Already a standout performer in Fiserv’s merchant-services division, Clover is now poised to push deeper into one of the most competitive verticals in payments.

Key Takeaways

- Fiserv is launching Clover Hospitality, a point-of-sale solution designed specifically for fine-dining restaurants. This marks its first major move into the high-end hospitality segment, with Brooklyn’s Lilia as its inaugural client.

- Developed in collaboration with Union Square Hospitality Group, the new Checkless Payments feature lets guests pay using a card saved at reservation, eliminating the wait for the check and improving table turnover.

- Clover Hospitality integrates front- and back-of-house tools, customer profiles, marketing, and loyalty programs—building on Fiserv’s 2021 BentoBox acquisition to deliver an all-in-one system tailored for upscale venues.

- Fiserv is banking on features like mesh networking, encrypted payments, and partnerships with firms like Verifone, Klarna, and ADP to compete in a crowded market led by players such as Toast, Square, and Stripe.

Fiserv Targets Fine Dining with Clover Hospitality Launch at NRA Show

Nowadays, every industry is getting inundated with technology, and fine-dining establishments are not behind in the race. These establishments seek technologies that complement their haute cuisine and personalized service. To that end, Fiserv, Inc.—a Fortune 500 leader in payments and financial technology – has announced the launch of Clover Hospitality, a point-of-sale (POS) solution specifically tailored for upper-market restaurants.

The new offering debuts at the 2025 National Restaurant Association (NRA) Show on May 17 in Chicago, marking Fiserv’s first major push into high-end dining.

The full-service restaurant sector is transforming, with 64 percent of diners placing a higher value on experience over price, according to the National Restaurant Association’s 2025 State of the Restaurant Industry report. Meanwhile, rising costs—restaurant expenses have climbed 26 percent since 2021—and tightening labor markets are increasing operational pressures on restaurateurs. These trends underscore the need for integrated technology solutions that streamline both front‐ and back‐of‐house operations while enhancing the guest journey.

Clover Hospitality is designed to meet the nuanced requirements of fine‐dining venues, integrating intuitive hardware, advanced software, and seamless payment processing into a single package. At its core, the system provides real‐time table management, guest intelligence, and resiliency features such as localized mesh networking, promising in‐service continuity even during Wi-Fi outages. And by extending the functionality of Clover through technology acquired from BentoBox in 2021, Fiserv is looking to offer an “omnibranded” toolkit: reservations, online ordering, marketing, loyalty, and now POS all under one roof.

A cornerstone of the Clover Hospitality launch is Checkless Payments, developed in collaboration with Union Square Hospitality Group (USHG) and inspired by conversations between USHG founder Danny Meyer and former Fiserv chairman Frank Bisignano. This feature allows guests to pay using the card saved at reservation time, avoiding the traditional “waiting for the check” ritual and reducing service friction. Pilot tests at USHG’s Manhatta restaurant have shown promising results, with guests completing their payments seamlessly and departing without ceremony.

During Fiserv’s Q1 earnings call in April, incoming CEO Michael Lyons revealed that Lilia, a renowned Italian eatery in Brooklyn, will be the inaugural client of Clover Hospitality. Lyons described the new product as “a high-end solution for restaurants,” which shows its focus on the premium segment. Securing Lilia as a launch partner lends credibility and visibility to Fiserv’s upmarket ambitions.

At the NRA Show, Fiserv showcased Checkless Payments in action, highlighting its implementation at Manhatta—USHG’s sky-high, fine-dining destination. Danny Meyer emphasized that Checkless Payments addresses “the least hospitable part of the dining experience: waiting for the check,” and positions technology as an enabler of genuine hospitality rather than a barrier. With plans to roll out across USHG’s portfolio and subsequently to all Clover Hospitality customers, Fiserv is setting a new standard for frictionless payment in premium dining.

Beyond checkless dining, Clover Hospitality offers an array of high-touch features like:

- Digital Waitlists & Ticketing: Streamlines guest flow with visual dashboards for front-of-house teams.

- Customer Profiles: Builds loyalty by tracking order history, dietary preferences, and payment methods.

- Back-of-House Integration: Unifies front- and back-of-house tasks, from inventory management to staff notifications.

- Omnichannel Marketing Tools: Leverages BentoBox’s platform to power websites, reservations, and promotional campaigns.

These capabilities are developed in consultation with restaurant managers to ensure data-driven insights support operational growth and guest satisfaction.

Through streamlined operations and faster table turnover, upscale restaurants can uphold their premium price points while boosting both seating capacity and revenue earned per cover. Integrated guest analytics enable personalized service, anticipating preferences and enhancing the emotional connection between staff and diners. Automated check processing not only elevates the experience but can free up staff to focus on service, driving higher labor productivity and reducing error rates. Collectively, these improvements position Clover Hospitality as a profit multiplier rather than a mere cost center.

The restaurant POS market is fiercely contested. Major players such as Toast, Square, Lightspeed, Shift4 Payments, PayPal, Block, and Stripe have all introduced or enhanced solutions targeting hospitality venues. According to AFM Consulting principal Aaron McPherson, this proliferation of tailored offerings highlights the need for vertical-specific innovation and exceptional service. Fiserv tries to differentiate through deep industry partnerships (e.g., USHG), integrated commerce capabilities, and a broad distribution network of over 1,000 partner banks.

Additionally, Clover Hospitality leverages cutting-edge infrastructure and security:

- Localized Mesh Networking: Ensures POS terminals and tablets stay in sync, even during connectivity disruptions.

- Point-to-Point Encryption (P2PE): Through partnerships with Bluefin and Verifone, merchants can reduce PCI scope by up to 90 percent while maintaining robust security.

- Integrated Finance and Payroll: Recent additions include Klarna for flexible guest payments and ADP payroll integration for streamlined labor management.

- Data-Driven Insights: Real-time dashboards track gross payment volume—in Q1, Clover processed $296 billion with revenue growth of 27 percent year-over-year.

These innovations position Fiserv to support both operational resilience and guest-centric experiences in premium hospitality.

Fiserv has already introduced Clover in 13 countries and continues to expand its international footprint. With a revenue target of $3.5 billion for Clover in 2025 and capital expenditures of $1.4–$1.5 billion allocated for product development, Fiserv is committing substantial resources to sustain growth. Retail analysts at William Blair emphasize that the small-business POS market, particularly food and beverage, represents a $3.1 trillion annual volume opportunity, underscoring the strategic rationale for Fiserv’s upmarket pivot.

About Fiserv

Fiserv, Inc. is an American multinational financial technology company founded in 1984 and headquartered in Milwaukee, Wisconsin, U.S.. It is publicly traded on the New York Stock Exchange under the ticker symbol FI and is a member of the S&P 500® Index. The company provides technology solutions and services for banking, merchant acquiring, global commerce, billing and payments, and point-of-sale platforms, serving clients such as banks, credit unions, securities broker-dealers, mortgage providers, insurance firms, and retailers worldwide. As of 2024, Fiserv employs approximately 38,000 people globally.

For the fiscal year ended December 31, 2024, Fiserv reported GAAP revenue of $20.46 billion, representing a 7% increase year-over-year. The company recorded operating income of $5.88 billion and net income of $3.13 billion, with total assets of $77.2 billion and total equity of $27.1 billion as of year-end 2024. Under the leadership of President and CEO Frank Bisignano, Fiserv has pursued strategic growth through acquisitions, including the transformative $22 billion acquisition of First Data in 2019, followed by recent deals such as Payfare in March 2025 and Australian payment facilitator Pinch Payments in April 2025 . Looking ahead, Fiserv projects organic revenue growth of 10% to 12% for 2025.

Conclusion

Fiserv’s entry into high-end hospitality with Clover Hospitality signals a calculated expansion into a competitive but lucrative market. By targeting fine-dining restaurants with purpose-built tools like Checkless Payments, real-time table management, and integrated marketing capabilities, Fiserv is positioning Clover as more than a payment solution—it’s a full-service operational platform.

Backed by strong industry partnerships and a proven track record in merchant services, Fiserv is aiming to deliver tangible value where efficiency, service quality, and guest expectations intersect. As the premium dining sector looks for ways to balance cost pressures with elevated experiences, Clover Hospitality arrives at a pivotal moment—with the potential to become a key player in shaping how technology supports hospitality at the top end of the market.