Zoho Enters U.S. Payments Market with Launch of Zoho Payments

Posted: June 04, 2025 | Updated:

Zoho Corporation made several announcements at its annual user conference, Zoholics US, in Houston, with the launch of Zoho Payments in the United States being the highlight.

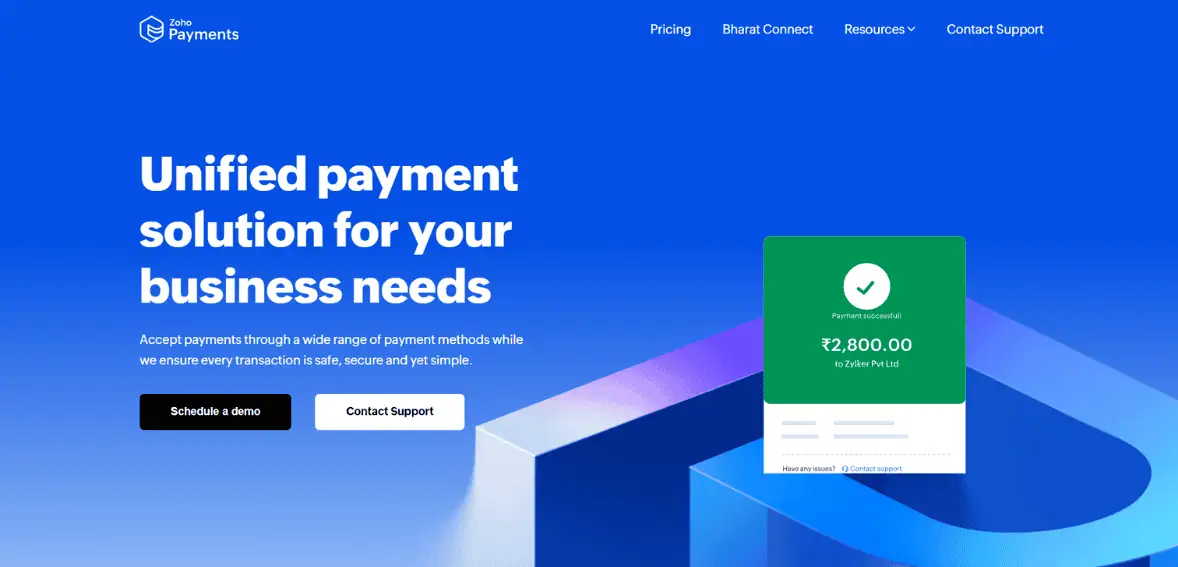

After its successful debut in India last August, Zoho Payments is now buckled up to transform how businesses in the U.S. process payments. This unified platform delivers a secure, seamless, and scalable solution, enabling businesses to accept payments online via ACH, cards, and more, all from one trusted ecosystem.

Key Takeaways

- Zoho Payments offers businesses a single gateway to accept ACH, card, and digital payments directly within Zoho’s finance and operational tools, reducing the need for third-party integrations and improving accounting efficiency.

- Domestic card transactions are charged at a standard 2.9% + $0.30, aligning with major U.S. payment providers. However, international transactions carry a higher cost due to an added 1.5% fee and a 1% currency conversion charge.

- With built-in fraud protection, compliance with global security standards, and automated reconciliation, Zoho Payments aims to reduce manual work, minimize errors, and improve cash flow visibility for finance teams.

- Businesses can collect payments via invoices, hosted pages, checkout buttons, or direct links, with support for over 135 currencies. An open API also allows integration with external platforms, making it suitable for diverse use cases.

Zoho Payments to Streamline Digital Transactions and Simplify Accounting for Businesses

Zoho Corporation has rolled out Zoho Payments, a single hub for collecting money through cards, ACH transfers, and other digital methods. Because the system sits inside Zoho’s finance apps, accounting teams can handle billing, tracking, and reporting in one place.

Raju Vegesna, Chief Evangelist at Zoho, noted that online payments have become the norm for shopping and subscriptions. He said companies now need a payment system that links directly to day-to-day accounting tasks. According to Vegesna, Zoho Payments boosts authorization rates, strengthens fraud protection, automates reconciliation, and helps cut chargeback losses as payment volume rises.

The shift to cash-free spending is clear, as nearly 87% of transactions no longer involve paper money, and 81% of U.S. shoppers prefer paying by card. When businesses juggle separate payment providers, they often deal with delays and bookkeeping mistakes. Zoho Payments solves this by putting every payment channel under one secure roof.

James Martin, founder and CEO of Keystone Transport Services, explained that using other payment portals created bottlenecks because of extra logins and poor integrations. Since the company already relied on Zoho Books, adopting Zoho Payments was the obvious choice. Its automation features have trimmed manual work to almost nothing, so one employee can now cover tasks that once required a full team.

If we look at the pricing of domestic card payments, Zoho charges 2.9% of the transaction amount plus $0.30, which is standard and in line with what most U.S. payment processors charge (e.g., Stripe, PayPal), making it a familiar and expected rate structure. This rate covers Visa, American Express, Mastercard, JCB, Discover, Diners Club, and UnionPay. Charges made on cards issued outside the United States add another 1.5% on top of the standard domestic fee.

The payment processing charges on international cards are on the higher side (at 4.4% + $0.30 + 1% FX fee), especially when compared to Stripe or PayPal, which typically charge around 3.9%–4.4% for international cards (including FX fees). While ACH Direct Debit charges at 0.80%, capped at $5, is reasonable and competitive, particularly for high-ticket transactions, due to the capped fee. However, the $1 instant bank validation charge may be viewed as a small friction point.

A Look at the Core Capabilities

Zoho Payments now lets companies process card transactions in more than 135 currencies and handle ACH transfers inside the United States. Because the gateway sits inside every major Zoho suite—finance, operations, sales, marketing, low-code, and collaboration—teams can turn it on without extra plug-ins. An open API also routes payments from non-Zoho systems to the same back end.

Image source

Companies can collect money in several ways: they can add a pay button to an invoice, drop a quick link in email or chat, publish a hosted page for one-off or subscription charges, or connect a shopping cart. These options shorten settlement times and support custom payout calendars.

Security is baked in. The platform runs full KYC checks, verifies identity, screens for money-laundering risks, and scans global sanction lists. It aligns with card-network rules and central-bank mandates and holds PCI-DSS tier one status. The broader Zoho stack adds SSL encryption, multifactor login, PSD2, GDPR, 3-D Secure, and SCA as well.

Higher approval rates lift revenue while real-time fraud filters cut chargebacks. Automated reconciliation removes repetitive work, slashing mistakes and freeing accountants for tasks that need judgment. Dashboards surface transactions, payouts, refunds, declines, and account summaries, giving clear insight into cash flow and bottlenecks. The infrastructure scales easily as volume climbs.

Zoho has long linked products such as Commerce, Invoice, and Books to outside processors; those links remain, yet the new in-house gateway arrives at a price aimed at cost-conscious users and delivers tighter control of financial workflows.

Out-of-the-box support already covers Inventory, Commerce, Books, Invoice, Checkout, Billing, Sign, Backstage, People, SalesIQ, Creator, and Bookings. Whether the need is invoice links, hosted pages, or checkout buttons, online payments now reach accounts sooner and strengthen cash positions.

About Zoho

Zoho Corporation, originally founded as AdventNet in 1996 by Sridhar Vembu and Tony Thomas, is an Indian multinational tech firm with its main office in Chennai and global base in Austin, Texas. Renamed as Zoho in 2009, the company serves over 100 million users globally as of late 2024. Known for its wide range of cloud-based tools like Zoho CRM, Zoho Books, and Zoho One, the company mainly caters to small and medium-sized businesses.

Privately owned and fully bootstrapped, Zoho follows a customer-first philosophy with zero reliance on external funding. It reported revenues of ₹8,703 crore (USD$1.05 billion) and net profits of over ₹2,800 crore (USD$338 million) in FY23. Led by Sridhar Vembu and CEO Shailesh Kumar Davey, Zoho promotes rural development, employee wellbeing, and strict data privacy. It is widely recognised as a strong alternative to global players like Salesforce and Microsoft.

Conclusion

With the launch of Zoho Payments in the U.S., Zoho has taken a decisive step toward becoming a full-stack financial platform. By bringing payments, accounting, and business operations under one roof, the company offers a streamlined, integrated solution tailored to small and medium-sized businesses. The platform’s tight security, API access, and broad currency support make it suitable for both domestic and international operations. While pricing for global cards leans toward the premium side, the benefits of automation, faster settlements, and seamless reporting help justify the cost. As Zoho continues to deepen its presence in the U.S. market, its long-standing focus on product integration and customer value could prove to be a serious differentiator against more fragmented legacy systems