WorldPay vs. Host Merchant Services: A Review of WorldPay and Why HMS Is the Superior Choice in 2025

Posted: February 10, 2025 | Updated:

Selecting the right payment processor is vital for businesses prioritizing secure and uninterrupted transactions. Since 1989, WorldPay has been a major player in the industry, offering merchant services and other payment solutions. But, not-so-transparent pricing, a high number of complaints by the merchants, and contracts with “loopholes,” among other things, have pushed merchants to seek better alternatives. One such alternative is Host Merchant Services.

With a strong foothold in the market due to its transparent pricing, clear and flexible contracts, and reliable 24/7 support, Host Merchant Services is a strong contender to consider.

To help you make the right decision, in this review, we will look at WorldPay vs. Host Merchant Services and compare the key factors of each, like features, pros and cons, pricing, contract flexibility, customer service, and overall value.

WorldPay vs Host Merchant Services: A Complete Review

Overview of WorldPay

Image source

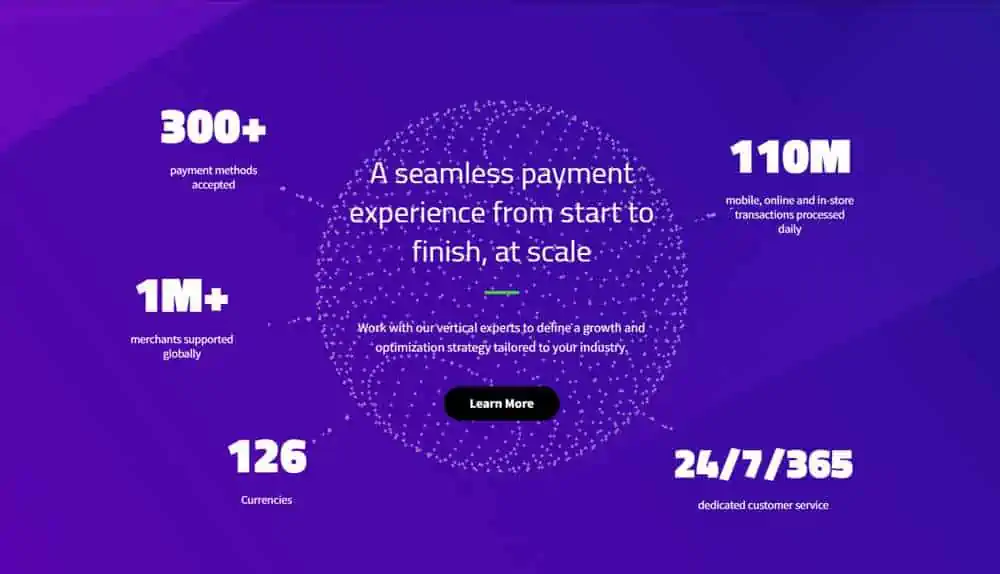

Worldpay is a prominent American multinational financial technology company specializing in payment processing services for merchants and financial institutions worldwide. Established in 1971 as Midwest Payment Systems by Fifth Third Bank, it has evolved through various acquisitions and rebranding efforts to become a payment industry leader.

Worldpay has expanded its capabilities throughout its history by acquiring several companies, including Element Payment Services, Litle & Co., and Mercury Payment Systems. In 2017, it merged with Vantiv, adopting the Worldpay name, and in 2019, it was acquired by Fidelity National Information Services (FIS). In February 2024, Worldpay separated from FIS to become an independent company again, co-owned by GTCR (55%) and FIS (45%).

As of 2023, Worldpay processes approximately 40 billion transactions annually across 146 countries and 135 currencies, generating $4.9 billion in revenue. The company employs around 8,500 people and is headquartered in Cincinnati, Ohio, with international operations in London.

Worldpay offers a comprehensive portfolio of payment solutions, including credit and debit card processing, ATM services, merchant services, rewards programs, and fraud prevention tools. In May 2024, the company introduced a tap-to-pay feature on the iPhone, enabling merchants to accept contactless payments, including those made via Apple Pay and other digital wallets.

The company’s client base spans various sectors, such as retail, restaurants, government, e-commerce, supermarkets, and business-to-business services. Additionally, Worldpay collaborates with over 1,400 financial institutions, including over 700 credit unions in the US, supporting over 33 million debit cards and processing more than 15.7 billion transactions annually.

Pros and Cons of WorldPay

Pros:

- Supports an extensive range of payment methods and currencies, accommodating global transactions.

- Offers numerous POS system integrations, enhancing compatibility and operational flexibility.

- Provides 24/7 phone support, ensuring immediate assistance at any time.

Cons:

- Has transparency issues, making it difficult for clients to obtain clear and straightforward information.

Overview of Host Merchant Services

Image source

Host Merchant Services, established in 2009 and based in Newark, Delaware, is a registered Independent Sales Organization (ISO) with Visa US and MasterCard International, with bank sponsorship provided by Wells Fargo Bank. HMS offers a comprehensive suite of payment processing solutions tailored to various business needs, including retail, restaurant, e-commerce, and mobile processing.

In addition to payment processing, HMS assists businesses in setting up point-of-sale systems and offers tools such as websites and loyalty programs to enhance customer engagement.

HMS serves both high-risk and non-high-risk industries. High-risk sectors they work with include debt collection and recovery, e-cigarettes and vape shops, airlines, timeshares, gambling and casinos, and real estate. Non-high-risk industries they support encompass automotive, retail, restaurants, hospitality, and more.

The company emphasizes transparent pricing with no cancellation fees, aiming to build long-term client relationships. They also provide 24/7 customer service to ensure continuous support for businesses.

Lou Honick, the CEO of Host Merchant Services, founded the company in 2010. Before this, he established HostMySite.com and received numerous accolades, including SBA Young Entrepreneur of the Year and listings on Inc Magazine’s 30 under 30 and the Inc 500. A strong commitment to outstanding customer service and support characterizes his ventures.

Pros and Cons of Host Merchant Services

Pros:

- Host Merchant Services collaborates closely with clients to develop customized solutions tailored to business needs.

- This includes affordable point-of-sale systems, potentially free equipment, and competitive rates.

- Unlike many companies that cater to high-risk businesses, Host Merchant Services does not lock clients into long-term contracts.

- They offer services without requiring commitments and do not charge PCI compliance or closure fees, making them a flexible business option.

- Customer reviews on the site frequently highlight the quality of service, describing it as “outstanding” and praising the availability and expertise of the support staff.

- The company ensures customer service availability 24/7/365, ready to assist whenever needed.

Cons:

- The cost of processing with Host Merchant Services may be high for smaller businesses.

- While Host Merchant Services’ focus on high-risk sectors is advantageous for those specific businesses, it offers little benefit to companies outside these industries, potentially leading non-high-risk enterprises to seek more generalized providers.

Features of WorldPay

Worldpay delivers a full range of payment processing services tailored to suit the needs of different businesses. Here’s a simple rundown of what they offer:

- Global Reach: Worldpay helps businesses go global, operating in over 125 markets and supporting hundreds of payment types. This vast network allows companies to serve a worldwide customer base effectively.

- Credit Card Processing: As a direct processor, Worldpay handles all payments securely in-house, bypassing third-party services. This setup leads to faster and safer transactions. They support a range of countertop terminals that work with EMV chip cards and NFC-based payments, making in-person transactions smooth.

- Online Payment Gateway: Worldpay offers a seamless online and in-person transaction platform, perfect for businesses looking to strengthen their online presence. Their system supports “smart terminals” with features like larger touchscreens and integration capabilities that streamline business operations.

- Fraud and Risk Management: With sophisticated fraud prevention tools and risk management strategies, Worldpay keeps transactions safe, protecting businesses and customers from security threats.

- OmniFlex Virtual Terminal: The OmniFlex virtual terminal by Worldpay is a versatile payment solution that works across in-store, online, and mobile channels. It’s designed to integrate with existing sales systems or function independently. This terminal supports a variety of payment methods and comes with added features like inventory tracking and easy refunds, all while ensuring top-notch security and compliance.

- Card Machines and Hardware: Worldpay offers a variety of card machines under their “SmartPay” series, including models like the Carbon 8, Carbon 10, and Pax A920. These “smart terminals” blend traditional payment processing with advanced features like inventory management to help boost business efficiency.

- Developer Resources: Worldpay’s Developer Hub provides tools and resources for businesses of all sizes to integrate payment solutions seamlessly into their platforms, catering to startups, SMBs, and large enterprises alike.

- Financial Program: Worldpay’s OmniShield Assure provides robust security features to safeguard your transactions and defend against fraud, including EMV assurance, end-to-end encryption, PCI compliance support, and data breach insurance. This insurance compensates up to $100,000 per merchant site and $500,000 per multi-location event, plus up to $25,000 for preventive hardware and software upgrades after a breach. It is unclear if these features are standard or require additional fees.

Features of Host Merchant Services

Host Merchant Services offers a broad range of services tailored to meet the needs of both standard and high-risk businesses, enhancing operational efficiency and security. Here are the improved details of their key offerings:

- Payment Processing: HMS delivers versatile payment processing solutions for brick-and-mortar and online businesses. They support various payment methods, including credit and debit cards, EMV chip cards, and NFC payments. With no-term commitments, their services include access to over 100 payment gateways, virtual terminals, and advanced online shopping cart features, ensuring adherence to EMV and PCI compliance standards for security.

- Point-of-Sale (POS) Systems: HMS provides a variety of POS system choices, such as Clover, Vital, Bonsai, and SwipeSimple, each tailored to different business requirements. These systems are equipped with features supporting transaction processing and advanced inventory management, significantly boosting operational efficiency.

- Mobile Solutions: Catering to mobile businesses like food trucks or field services, HMS offers robust mobile processing solutions. These include portable card readers and applications that support EMV chip and NFC/contactless payments, facilitating secure transactions on the go.

- E-commerce Solutions: HMS integrates with leading e-commerce platforms, including Magento, WooCommerce, and BigCommerce. This integration aids in the efficient management of online transactions and enhances shopping cart functionality, streamlining the e-commerce process.

- Cash Advances and Financial Programs: HMS provides merchant cash advances of up to $500,000 to support businesses requiring rapid funding. They also offer financial programs such as cash discounts, encouraging cash transactions, and aiding in better cash flow management.

- Gift and Loyalty Programs: HMS helps boost customer engagement and retention through customizable gift and loyalty card programs. These programs fully integrate with their payment systems, simplifying sales tracking and balance management.

- Security and Compliance: Security is a top priority for HMS. They offer PCI compliance assistance, end-to-end encryption, and data breach insurance to protect against cyber threats, ensuring that customer and transaction data are secure.

Pricing of WorldPay

FIS Worldpay’s pricing structure is notably opaque, as specific rates and fees are not readily disclosed on their website, making it challenging for businesses to anticipate processing costs accurately. Typically, contracts span three years and employ interchange-plus or tiered processing models. However, details such as pricing initiation points, account setup fees, transaction fees for card-present, e-commerce, keyed-in transactions, and equipment costs remain undisclosed.

Additional costs include an early termination fee ranging from $295 to $495, a PCI compliance fee of $5 per month, a next-day funding fee of $9.95 per month, and a chargeback fee of £20 per disputed transaction. While FIS Worldpay has previously provided some pricing information, the current version of the company’s website primarily offers price quotes for UK customers. These advertised rates often represent the lowest possible fees, a common marketing tactic associated with tiered pricing models. For instance, UK rates start at 2.75% for online transactions and decrease to 1.5% for in-person sales.

Given the variability and potential for undisclosed fees, businesses must engage directly with a Worldpay sales representative to obtain a comprehensive and customized quote. Negotiating for an interchange-plus pricing plan can lead to more transparency and potentially lower rates. Additionally, businesses should monitor their statements, as there have been unexpected rate increases and additional fees.

Pricing of Host Merchant Services

Host Merchant Services offers transparent interchange-plus pricing to all clients, with rates guaranteed for the lifetime of the merchant account. The standard plan starts at $14.99 per month, while a cash discount plan is available at $0 per month for merchants processing over $5,000 monthly and $20 per month for those processing less.

Contracts are on a month-to-month basis, providing flexibility without long-term commitments. For card-present transactions, fees are interchange plus 0.20 — 0.25% plus $0.09–$0.10 per transaction, and for e-commerce transactions, fees are interchange plus 0.35% plus $0.10 per transaction. Equipment costs vary, with some provided at no additional charge.

Notably, there are no monthly minimums, and HMS customizes rate packages for lower-volume accounts, with starting rates around 0.50–0.55% plus $0.10 for volumes under $10,000. Additional fees include a $5.00 monthly gateway fee (optional), $0.75 per voice authorization, $0.20 per batch processing, $15.00 per chargeback, and a $24.00 annual 1099 reporting fee. HMS is transparent about its fees, ensuring merchants know all costs associated with their accounts, allowing businesses to manage expenses effectively and avoid unexpected charges. The company operates on a month-to-month contract basis with no early termination fees, providing flexibility for merchants.

Additionally, HMS guarantees to pay up to $250 in owed early termination fees for referred clients and $500 if that referral client processes over $50,000 per month. This offer may apply specifically in referral situations, but it’s advisable for merchants facing early termination fees with another provider to inquire about this benefit.

Customer Services Offered by WorldPay

Worldpay provides 24/7 merchant support through various channels. Merchants can reach assistance by calling 1-866-622-2390 or by emailing wpsupport@merchantpartners.com.

Additionally, Worldpay offers an online “Contact Us” form for inquiries. Despite these support options, customer feedback indicates mixed experiences with Worldpay’s customer service. On Sitejabber, Worldpay has a rating of 1.0 out of 5 stars based on 54 reviews, with many customers expressing dissatisfaction with customer service and billing issues. Similarly, on the Better Business Bureau (BBB) platform, Worldpay has received 168 complaints over the past three years, with common issues including billing problems and difficulties in obtaining refunds.

Likewise, on Trustpilot, Worldpay holds a rating of 4.6 out of 5 stars based on over 6,000 reviews. Approximately 64% are 5-star reviews praising customer service and payment processing efficiency. However, it’s noteworthy that 29% of the reviews are 1-star, highlighting concerns about service reliability and support responsiveness.

Customer Services Offered by Host Merchant Services

Host Merchant Services prioritizes superior customer service and robust client technical support. The company ensures round-the-clock telephone support, available 24/7/365, by contacting (877) 517-4678.

HMS enhances its support offerings with a live chat option available during business hours for immediate assistance. Support during off-hours is provided through partnerships with third-party technicians, such as TSYS tech support, with HMS overseeing all interactions to uphold their high service standards.

Additionally, HMS furnishes many self-help tools, such as a comprehensive knowledge base, help centers, instructional videos, tutorials, an informative blog, and active engagement on social media platforms. These resources aim to equip merchants with the tools to resolve issues independently and keep abreast of the latest industry developments.

For merchants within a 150-mile radius of its offices in Newark, Delaware, and Naples, Florida, HMS offers in-person support to address terminal issues, benefiting businesses across New England and Florida and enhancing overall customer satisfaction.

Feedback from customers underscores HMS’s commitment to quality service. The company boasts an A+ rating and accreditation from the Better Business Bureau (BBB) since March 2011, with minimal complaints over the past three years, including none in the recent year. On Trustpilot, HMS has earned a stellar 4.9 out of 5-star rating from 48 reviews, 96% of which are five stars.

Reviews often praise HMS for its exceptional customer support, competitive rates, lack of a long-term contract policy, and transparent interchange-plus pricing model that offers flexibility and freedom from penalties upon service cancellation.

Conclusion

Businesses need reliability, transparency, and strong customer support when choosing a payment processor. While WorldPay has a long-standing presence in the industry and offers a broad range of services, concerns about pricing transparency, contract terms, and customer service have led many merchants to seek alternatives.

Host Merchant Services is a strong competitor with its straightforward pricing, month-to-month contracts, and 24/7 customer support. Unlike WorldPay, HMS provides clear cost structures and does not impose long-term commitments or hidden fees. Positive customer feedback further reinforces its reputation for reliable service and responsive support.

For businesses looking for a payment processor that prioritizes transparency, flexibility, and customer satisfaction, HMS presents a more dependable choice in 2025.