How Long Does It Take For An ACH Transfer To Complete?

Posted: November 03, 2023 | Updated:

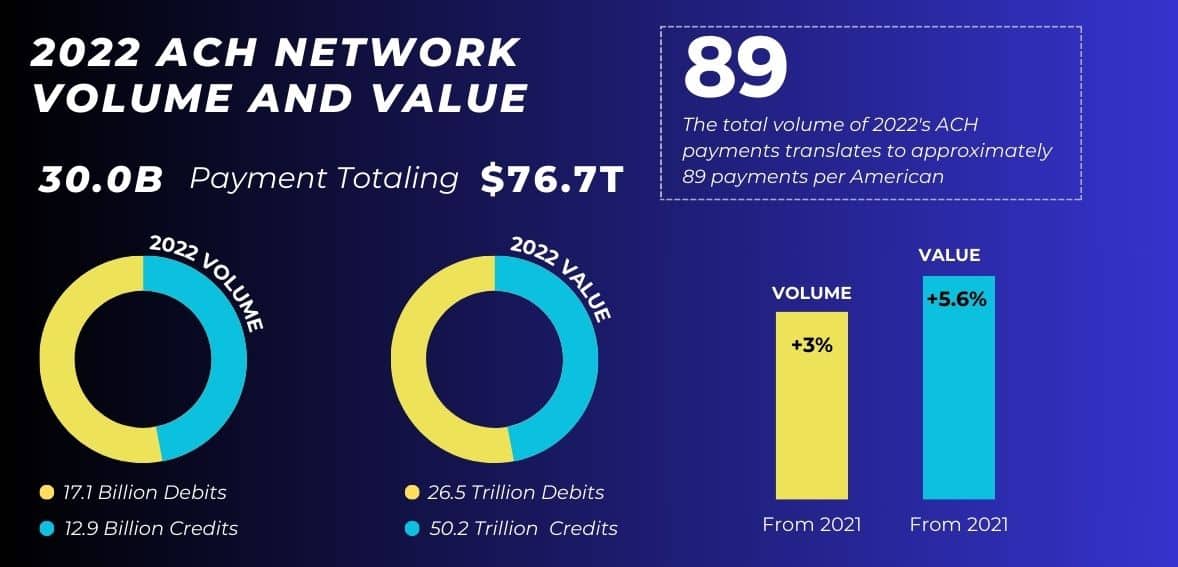

ACH network in the US facilitated the movement of over $72 trillion in 2022. It showed an increase of more than 5% compared to the previous year. ACH transfers have gained prominence as a reliable method for moving various types of funds, including social security benefits and paychecks. A significant reason for this is the secure nature of ACH transfers. Moreover, recent advancements such as same-day ACH have enhanced the accessibility and convenience of the ACH system. So, how much is the ACH transfer time? How long does it take for an ACH transfer to complete? Let us find out.

The time it takes for ACH transfers to go through can differ depending on the bank. Some banks process payments within 1 to 2 business days, while others may take 3 to 6 business days. While it would be great to have transfers, ACH transactions require monitoring because of the different steps involved in the process.

Source: NACHA

Whether you’re waiting for a fund transfer or want to learn more about ACH transfer times, we have all the information below!

What Are ACH Transfers?

The automated clearing house (ACH) is an online network that handles electronic payments between various banks. NACHA oversees the ACH transfer network. It operates as a not-for-profit association, maintaining connections with around 11,000 diverse financial institutions across the US.

An ACH transaction includes a wide range of transactions, including:

- Payroll

- Online bill payments

- Unemployment disbursements

- Social security benefits

- Tax refunds or payments

ACH money transfers come in two varieties:

- ACH debits involve requests for the ACH network to withdraw money from an account not controlled by the requester, often used for auto-bill payments.

- ACH credits entail requests to transfer funds from the requester’s account, typically employed for payroll or government benefit programs, commonly known as “direct deposits.”

How Do ACH Transactions Work?

Consider ACH transfers as digital messages sent in bulk, resembling a streamlined version of sending mail. Each transfer is bundled within a batch of outgoing requests by the initiating bank, known as the ODFI. Subsequently, the ACH network consolidates these messages into batches and dispatches them to the receiving bank, also known as the RDFI. This routine unfolds at fixed intervals throughout the day, precisely at 6:00 am, at 12:00 pm, at 4:00 pm, at 5:30 pm, at 10:00 pm, and at 11:30 pm.

Several factors influence this process:

- The nature of the request, whether it’s an ACH debit or credit.

- The specific processing partner utilized by the initiating party.

- The utilization of either same-day or next-day ACH services by the requester.

- The occurrence of any of the listed return codes in the request.

ACH Transfer Time: What Is The Average Time For An ACH Transfer To Complete?

The duration of ACH transfers can differ depending on the nature of the transfer and the banks involved. Usually, standard ACH transfers take around three to six days, whereas next-day transfers may be slightly quicker but often come with a fee. It’s important to note that these timelines primarily apply to ACH debit transfers. In contrast, ACH credit transfers typically take about one to two days for processing.

Having an understanding of how ACH debit transfers work can bring clarity. Here’s how it works:

- Day 1: You provide your bank with an ACH file containing the recipient’s bank account number and routing number. Your bank then processes and forwards this file to the ACH Network.

- Day 2: The receiving bank (RDFI) gains access to the file, and the funds are credited accordingly.

- Day 3: In the event of any issues, the RDFI must inform the ACH Network within 48 hours of the transaction.

- Day 4: If a problem arises, your bank may contact you after receiving a notification from the ACH Network. However, if everything goes smoothly, the funds are debited from the originating bank (ODFI).

Errors in ACH transactions commonly lead to delays, typically lasting around 1 to 2 days. In an effort to minimize these issues, NACHA introduced new regulations in 2021. These regulations stipulate that those initiating transactions must ensure that the recipient’s account is open, valid, and capable of receiving ACH transfers before initiating any online ACH debit.

The process can become complex because the system mainly focuses on pointing out transaction failures without confirming transactions. Any transaction, even if it was initially processed successfully, may be reversed on. If a transaction fails, the receiving bank (RDFI) has a 48-hour window to report the problem.

Furthermore, there are cases where a transaction that has already been completed might be reversed if the RDFI reports it as a failed transaction at a time. Consumers also have the right to dispute any ACH debit transaction within 60 days from the date of the statement that includes that transaction. They can address their concerns directly with NACHA.

How Much ACH Transactions Costs?

The cost of an ACH transfer typically depends on various factors and can vary. According to the NACHA, the average processing fee for an ACH payment hovers around 11 cents. However, this cost can fluctuate based on different considerations.

Transaction volume plays a significant role in determining the expense, with higher transaction volumes generally resulting in lower fees per transaction. The main cost you’ll encounter with ACH transactions will be the network fees, and these are typically quite small – just a fraction of a penny, really. However, many people do use third-party processors who often add a set fee for each transaction. This generally falls somewhere between 15 cents and a dollar fifty. Sometimes, if you’re dealing with a particularly large transaction, you may end up being charged an extra small percentage. This typically ranges from half a percent to one and a half percent, but it usually never exceeds five dollars.

Lately, a lot of people have started to favor ACH over credit cards and checks. The main reason? It’s usually cheaper. Just as an example, let’s say you’re making a $1,000 debit transaction. With ACH, you might end up paying a couple of bucks at most. But with a credit card, they might slap you with a fee of 2% to 3%, which could mean shelling out $20 to $30 instead. In nearly all scenarios, ACH proves to be notably more economical than credit or debit card solutions.

It’s essential to note that some institutions may impose transfer limits on ACH transfers from savings accounts. In contrast, others might apply fees for exceeding a certain number of transfers or withdrawals per month.

Benefits of ACH Transfers

ACH provides advantages for businesses when it comes to making payments and transfers. Let’s explore some of these benefits;

- When it comes to convenience, ACH surpasses the method of writing checks. With ACH, there’s no need to handle checks, store them in file cabinets, or even sign them with a pen. ACH payments are processed faster, ensuring that vendors have access to funds. Although checks are still commonly used in sectors, an increasing number of vendors prefer ACH as their mode of payment.

- While credit systems offer convenience, they often come with costs, especially for businesses managing recurring payments. Credit card fees can amount to 2.5% of the transaction value in addition to flat-rate processing fees. On the other hand, ACH transactions typically range between 20 cents and $1.50 per transaction. For businesses handling a volume of transactions, choosing ACH can lead to savings.

- ACH payments can facilitate international money transfers, cutting down on processing time compared to physical checks, which can take days or even weeks. Although there isn’t a universal global ACH system, many countries operate their systems that connect with ACH.

- The integration of the bank with electronic funds transfer simplifies accounting processes, eliminating the need for manually updating separate records, as one would do when balancing a checkbook. This integration also allows for seamless compatibility with various accounting tools and software services that offer comprehensive transaction histories through the ACH system.

What Are The Limitations Of ACH Transactions?

While ACH transfers offer efficiency, security, and affordability, they may not be the optimal choice for every transaction. In scenarios where time is of the essence or for high-value payments, businesses might opt for alternative methods. Moreover, it’s important to note that the ACH network does not facilitate international transfers.

- Processing times can be a consideration. As ACH transfers are processed in batches, it typically takes one to three business days for direct ACH payments to reflect in the recipient’s account. This duration is longer compared to the processing times for wire transfers, credit card transactions, and ATM transactions.

- It’s crucial to recognize that ACH payments can only be deposited into bank accounts based in the United States. For international money transfers, one would need to resort to wire transfers or other suitable payment methods.

- Additionally, some banks may impose limitations on ACH transfers, including daily, weekly, monthly, or per-transaction limits on the transfer amount. It’s advisable to consult your bank to ensure that their policies align with the specific transfer requirements necessary to support your business operations.

Conclusion

ACH transfers have become a fundamental element of the US financial landscape, offering a secure and efficient means of electronic payment. While processing times can vary, advancements such as same-day ACH have significantly improved the accessibility and convenience of the ACH network, bolstering its position as a preferred method for handling various types of financial transactions.

Frequently Asked Questions

Why is my ACH transfer in the pending status?

If you’ve noticed that your bank account has a hold on an ACH deposit or deduction, it means that the transaction is currently being processed until the funds are cleared. Although the bank has acknowledged the transaction, it will take a period for the funds to be fully processed.

How long does it usually take for international ACH transfers to be completed?

Typically, international ACH transfers take around 1 to 5 business days with a processing time of 3 days. This timeframe primarily depends on the batch processing method employed by banks. Consequently, it might take hours for a payment to be processed and reflected in the system.

What is involved in ACH payment processing?

ACH payment processing entails electronically transferring funds between the payer’s and payees’ bank accounts through the ACH network of U.S. Institutions. This secure and efficient method enables bank transfers for financial transactions while being regulated by NACHA.