Large Chip vs. Small Chip Cards: EMV Chip Card FAQ

Posted: October 23, 2023 | Updated:

EMV represents the worldwide standard of all the cards integrated with computerized chips and specialized technology designed to verify chip-based card transactions. Given the surge in the rise in counterfeit card fraud and data breaches, card issuers in the US are embracing this modernized technology to safeguard consumers and diminish the costs associated with fraudulent activities. EMV chip cards play a crucial role in safeguarding consumers and this article will answer some important FAQs about the differences between large chip vs small chip cards.

These updated cards are implemented to enhance security in transactions, making it notably more challenging for “scammers” to counterfeit cards successfully.

For financial institutions and merchants, the shift to EMV requires incorporating new internal processing set-ups and in-store functionalities, along with compliance with fresh liability regulations. For consumers like us, it involves adapting to new payments and activating fresh card procedures. Above all, it ensures enhanced protection against fraudulent activities.

What Does EMV Stand For?

EMV represents (Europay cards, Mastercard cards, and Visa) the key credit card companies that led the way in developing and promoting this chip technology.

What Is EMV Chip?

EMV is an advanced payment technology that employs a compact yet powerful chip integrated into debit and credit cards, enhancing the security of card transactions. Initially conceptualized in the midst of the 1990s, it has now become the standard for ensuring secure card payments.

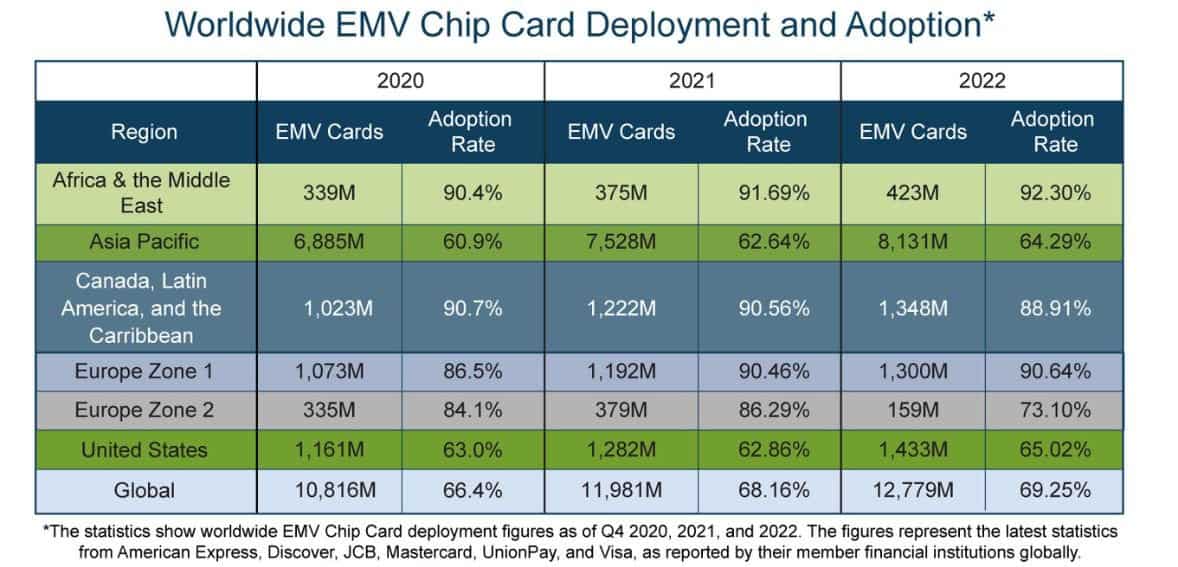

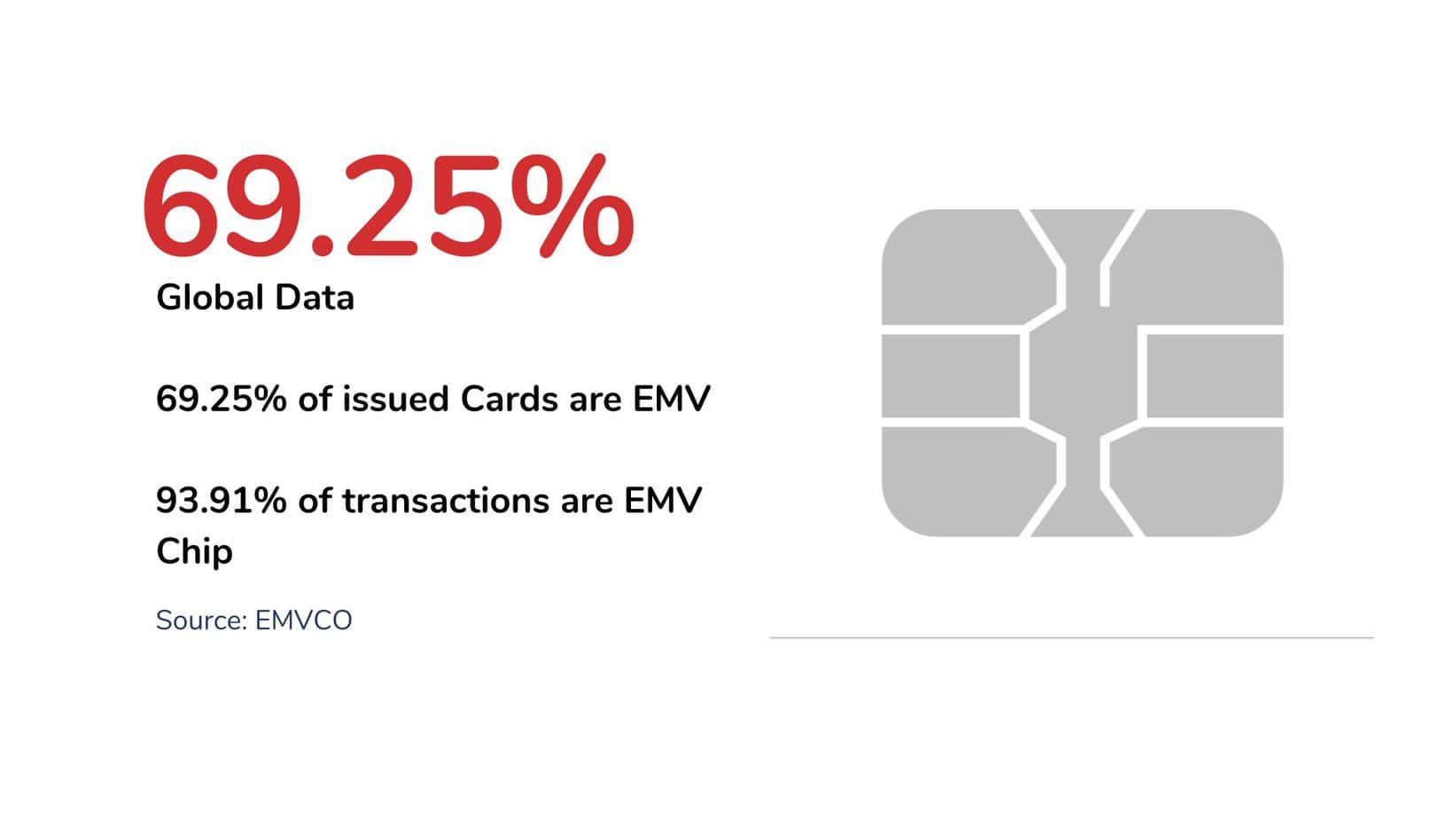

Source: EMVCO

The oversight of EMV technology falls under the purview of EMVCo. This organization includes major credit card companies such as Visa, Mastercard, Discover, American Express, UnionPay, and JCB among its members.

How Do EMV Chip Cards Work?

EMV chips function similarly to magnetic strips, transmitting data for payment. However, the way payment terminals process EMV chips differs from how they handle magnetic strips. For EMV chip card transactions, the card is inserted into the payment terminal slot, which reads and authenticates the chip’s data, requiring authorization before completing the purchase. This method is known as “dipping.”

In contrast, swiping a magnetic strip card through a reader is referred to as “swiping,” enabling data transmission for purchase authorization. While swiped transactions are faster, they are less secure than EMV transactions.

A notable advantage of EMV cards is their production of a unique code for each transaction, enhancing security and making it difficult for fraudsters to create counterfeit cards. Consequently, merchants and card issuers favor EMV transactions despite their more intricate nature compared to magnetic strip transactions.

In the U.S., most cards utilize chip-and-signature technology, requiring cardholders to provide a signature for transaction validation. Conversely, chip-and-PIN transactions, where a cardholder enters a four-digit PIN, are more common internationally and are considered more secure than chip-and-signature transactions.

Additionally, EMV cards can be utilized for contactless payments by tapping or waving the card near a payment terminal, eliminating the need for a PIN. Understanding these aspects of EMV chip cards can help ensure secure and convenient transactions for both merchants and customers alike.

What Are the Types of EMV Chip Cards?

EMV chip cards come in two main types:

- Chip-and-PIN: These cards offer heightened security, necessitating the creation and entry of a personal identification number (PIN) at the point of sale to validate the transaction. Without the correct PIN, the payment cannot be processed.

- Chip-and-signature: These cards require the cardholder to provide a signature for each transaction, serving as a means of identity verification.

Initially, both types of EMV chip cards mandated the cardholder’s signature for every transaction, but over time, this practice has become less prevalent. While some businesses still request customer signatures, credit card companies have implemented additional fraud protection measures, diminishing the significance of this step.

The widespread adoption of EMV technology may make it seem like an established concept, yet its integration is relatively recent. Although it became standard across Europe before gaining popularity in the US around 2011, the momentum for US adoption surged in 2015.

This was prompted by newly introduced fraud liability regulations that held merchants and card issuers accountable for losses resulting from fraud if they failed to transition to EMV technology. This underscores the crucial role that EMV technology plays in mitigating fraud and safeguarding consumers.

What Are Large Chip Cards?

When it comes to an understanding of small chip vs large chip. Large chip cards, as the name implies, feature a considerably larger chip on the card’s front. This chip is readily distinguishable by its size when compared to the standard version. It tends to be more square or evenly shaped. In cases where there are numbers on the front of the card, they are typically positioned very close to the top of the numbers.

What Are Small Chip Cards?

Conversely, small chip cards are more compact and rectangular, appearing slightly wider than they are tall. When numbers are present on the card’s front, there is a noticeable gap between the chip and the numbers. Well-known cards like Chime Card and cards from Cash App, among various major banks, utilize this type. Many financial institutions employ both large chip and small chip variants, making it crucial to consult this guide for proper identification.

What Is The Main Difference Between Large Chip Vs Small Chip Cards?

- Large chip cards have visibly larger, square chips placed near the top of the numbers, while small chip debit cards are more compact and have a noticeable gap between the chip and the numbers.

- EMV chips include 6-contact and 8-contact variants. The latter has two inactive bottom pins reserved for potential future use. Both types serve the same purpose and can be accepted by businesses with EMV card readers.

What Are The Types of EMV Chips?

Regarding EMV chips, two main physical chip types can be found on EMV-enabled credit or debit cards: 6-contact and 8-contact chips. Despite their differences, both chips serve the same fundamental purpose. In the case of 8-contact chip cards, the bottom two pins are currently inactive and reserved for potential future use. Here is an overview of the functions of each pin structure:

8-Pin Structure:

| Name | Description |

| VCC | +3.3v or 5v DC |

| Reset | Option of Card Reset |

| CLOCK | A Card Clock |

| AS | (1) Application Specific option |

| GND | Ground |

| VPP | Programming of NC or+21v DC |

| IO | (Data) In-Out |

| AS | (2) Application Specific option |

6-Pin Structure:

| Name | Description |

| VCC | +3.3v or 5v DC |

| Reset | Option of Card Reset |

| CLOCK | A Card Clock Option |

| GND | Ground |

| VPP | Programming of NC or+21v DC |

| IO | (Data) In-Out |

Despite the variations in pin structures, they possess similar attributes. These distinctions between large chip vs small chip credit card do not impact how small businesses accept these cards. With an EMV card reader, businesses can accept payments from either card configuration. Additionally, for customers, the card’s pin structure does not affect their experience. What matters most is leveraging EMV technology to ensure more secure transactions.

What Is An EMV Chip Credit Card?

An EMV credit card refers to a worldwide standard adopted by Mastercard, Visa, and Europay. It involves the integration of computer chips in cards and the associated technology utilized for authenticating chip-based card transactions.

Following a series of extensive data infringements and a surge in counterfeit frauds related to cards, card issuers in the U.S. shifted to this advanced technology to safeguard consumers and minimize the expenses incurred due to fraudulent activities.

Are EMV Cards More Secure Than The Traditional Cards?

The distinctive feature that sets the new generation of cards apart is the small square of metal- the computer chip. Unlike the magnetic stripes on traditional cards, which contain all the data, the computer chip on EMV cards generates a unique transaction code every time the card is used for payment. This innovative feature significantly enhances security.

For traditional cards, unauthorized access to the data embedded in the magnetic stripe provides all the necessary cardholder information and sensitive cards to conduct fraudulent transactions. Consequently, forgers use these cards as easy targets, turning card information they steal into cash.

However, with EMV cards, the story changes. Even if a fraudster manages to steal the information of the chip from a specific POS, any attempt to duplicate cards would be futile. This is because the number created during that instance would be rendered unusable for any future transaction, resulting in the card being denied.

While EMV technology cannot completely prevent data infringements, it makes it exceedingly difficult for fraudsters to profit from the data they steal. This added security layer is a significant step forward in safeguarding sensitive financial information.

How Do The EMV Chip Cards Work?

Using an EMV chip card for in-person transactions is a quick and straightforward process. Here’s a breakdown of how it works:

- Insert or tap the card: When making a purchase, simply insert your EMV chip card into the card reader with the chip facing up, or tap it against an NFC-enabled card reader if the option is available.

- Enter PIN if required: Some EMV chip cards may necessitate the entry of a PIN number to verify and authorize the transaction. While the trend is shifting towards PIN usage instead of signatures for added security, not all cards currently require a PIN.

- Provide a signature: Although it’s less common nowadays, some businesses may still request customer signatures on card transactions for additional security against potential fraud.

- Remove the card when prompted: Most card readers or point-of-sale (POS) terminals will indicate when the transaction is complete, allowing you to remove your card safely.

It’s important to note that EMV chips are not utilized for online purchases, as these transactions are classified as card-not-present (CNP) and therefore do not involve the physical component of the card. This serves as an additional layer of security for online transactions.

Conclusion

The nationwide transition to EMV chip cards signifies a critical step forward in enhancing payment security. These cards, with their advanced chip technology, are designed to thwart counterfeit card fraud and protect consumers. For merchants, it involves adapting to new technology and regulations, while for consumers, it means adjusting to new payment methods. The main distinction between large and small EMV chip size lies in the size and position of the chip on the card.

The choice between chip-and-PIN or chip-and-signature further adds to the versatility of EMV cards. Ultimately, EMV technology stands as a powerful shield against fraud and a significant advancement in securing financial transactions.