How to Get An EIN Number for Your Business?

Posted: October 11, 2023 | Updated:

As a business owner, chances are you’ll need to get an EIN number, or Employer Identification Number, at some point. An EIN, often referred to as a tax identification number for your business consists of nine numbers and is allocated to your business by the IRS. It plays a crucial role when it comes to filing your company’s income tax returns or employee payroll returns. While an EIN is necessary for a few businesses, it’s optional for others.

In general, independent contractors and small business proprietors benefit a lot from EIN. Understanding who should apply for one and recognizing the advantages it brings can provide a significant boost to your business. Beyond ensuring compliance with tax and employment regulations, this number unlocks various essential business functions.

These include the ability to open a business bank account and obtain the necessary permits or licenses. To make the process of applying for the EIN seamless, we will walk you through the steps of getting one for your company.

What Is The EIN Number?

EINs play a crucial role in identifying businesses in the US, much like how Social Security is used for identifying residents. As previously mentioned, EINs consist of distinctive nine-digit combinations structured as **-*******. The IRS issues these unique identifiers and encompasses information regarding the location of the company in which it was established first. The IRS utilizes EINs to pinpoint taxpayers obligated to file for many business-related tax returns.

As a business owner, You are required to have the EIN if you have employees, file specific tax returns, operate as a corporation or partnership, or withhold taxes from income sources apart from wages. Businesses must initiate the EIN application process via fax, phone, mail, or online before establishing their operations.

It’s worth noting that all types of businesses, regardless of their size or structure, can apply and get the EIN. The IRS does not make distinctions based on company size. This means that even businesses with just one employee are eligible for an EIN, making it accessible and applicable across a broad range of enterprises, from small-scale operations to multinational corporations.

Who Needs The EIN?

Here are the businesses (not limited to) that are required to have the EIN:

- Sole proprietorships

- NPOs

- Government agencies

- S corporations

- Partnerships

- Estates

- Trusts

- LLCs

Sole proprietorships, in most cases, are not obligated to get the EIN. However, there are specific situations where an EIN becomes necessary:

- If you currently have employees or are considering hiring them, you will need to obtain the EIN.

- Before you can offer a Keogh or solo 401(K) retirement plan, you must establish an EIN.

- If you are acquiring or inheriting a sole proprietorship, or if you’re thinking about purchasing one, you will need to have the EIN.

- If bankruptcy becomes a necessity, you will need an EIN to navigate the process.

Additionally, the IRS mandates EINs for trusts created by estate funds and representatives overseeing an estate that continues to operate a business following the owner’s passing.

Independent contractors, individuals operating SMEs, freelancers, and those participating in the gig economy through side jobs are typically not required to get an EIN. Nonetheless, there are numerous practical reasons why they may find it advantageous to do so.

How Can You Apply For The EIN?

To simplify the process, we have broken it down into three easy steps. Each step will give you detailed instructions about getting an EIN.

1. Understanding the Eligibility Criteria for EIN

Before applying for the EIN, it’s essential to determine whether you meet the basic eligibility requirements. To qualify for an EIN, you must satisfy two fundamental criteria:

- Your primary business activities must be based in the United States or its territories.

- The individual applying for the EIN should have an authentic taxpayer’s ID number, like an SSN.

Determining your main business involves identifying the primary income you earn from (e.g., an engineer, a consultant, or a doctor) and the location of your place of business. It’s worth noting that conducting services outside the United States doesn’t automatically disqualify you from meeting eligibility criteria. Up until your main or focused business operations are centered in the US, you remain an eligible candidate for the EIN.

It’s important to note that the individual who is submitting the EIN application doesn’t have to be exclusively the owner of the entity. That person can also be an officer (like a President or Vice President) or a partner of the company. The IRS extends the privilege of applying to a responsible party who knows about the company’s assets and financials, among other things. Additionally, a personal assistant or a secretary is also liable to undertake the application process only if the interested person signs the SS4 form and completes the designated section for third-party designees.

Step 2: Gathering the Important Information

To commence the process smoothly, it’s crucial to assemble all the required information before filling out Form SS4. Here’s how you can make sure you have everything you need:

- Start by reviewing the PDF version of Form SS4 to familiarize yourself with its requirements and structure. Then, figure out what category your business falls under. If it’s a corporation, make sure you’re ready to specify the country or state where your business was incorporated. For LLCs, remember to have the count of your employees handy.

- Keep in mind that if you plan to apply, you’ll only have 15 minutes to finish the form online before your session times out. Having all the necessary details readily available will help prevent this from happening.

To complete your form, you will need the following information readily available:

- Your business’s legal and trade names (if they differ).

- The physical and mailing addresses of your business.

- The legal classification of your business.

- A brief overview of your business’s products and services.

- The reason behind your application for the EIN.

- The date your business was initiated or acquired.

- The closing month (it is typically December in the US) of your business’s accounting year.

- Information about the assigned responsible party, including their Social Security or their tax ID.

- Confirmation of whether you have previously applied for the EIN.

- An estimate of the number of employees you anticipate having in the next year.

- An indication of whether your annual payroll is projected to exceed $1,000.

Step 3: Applying for the EIN: Options and Methods

When it comes to obtaining an EIN, the IRS provides several application options, catering to different preferences and circumstances. These options include applying online, via fax, or through traditional mail.

Additionally, applicants currently residing overseas with intentions of establishing business operations in the United States can opt for a phone application. For those based in the US, the application online is the most convenient and best choice.

Let’s see some specifics:

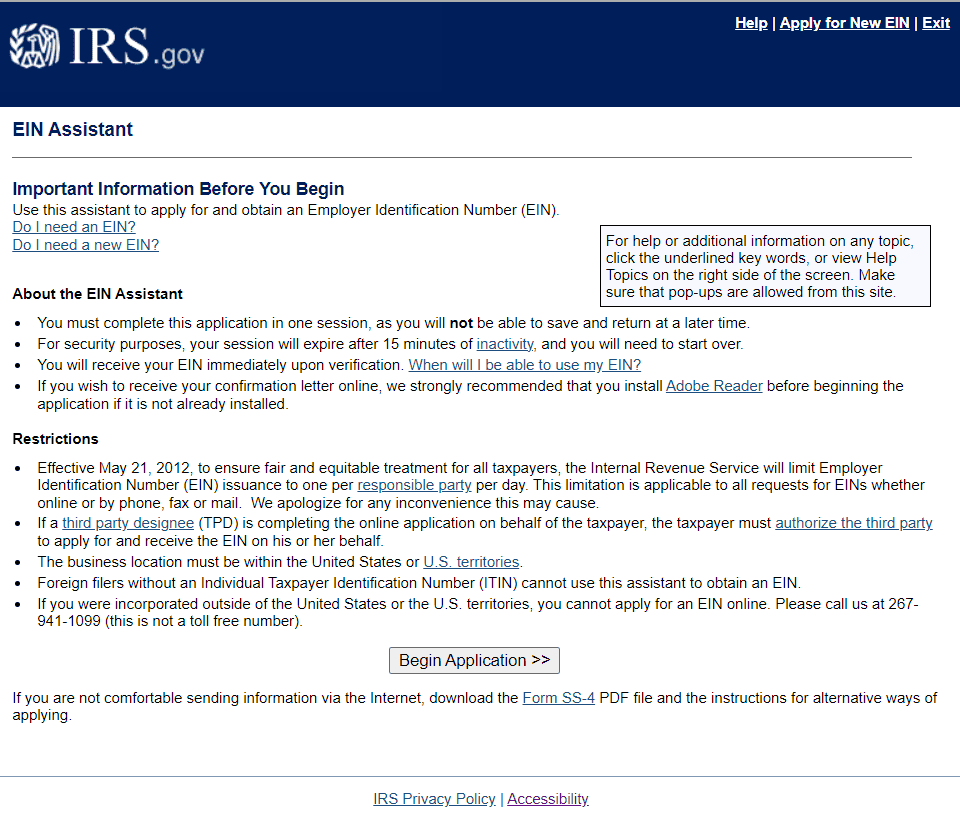

Online Form:

The IRS offers an efficient EIN assistant online, guiding you through the application process easily. This application is accessible for four weekdays, and the timing is 7 AM to 10 PM (Eastern Standard Timezone). The assistant not only simplifies the process but also gives you links to valuable resources and additional information. It’s important to note that, for security reasons, the system will log you out automatically in 15 minutes, and each party is limited to one EIN application per day. If you choose this method, you’ll get your EIN immediately upon submission.

Source IRS

Fax Application

Opting for the fax application route entails a processing time of approximately four days.

Mail Application

Traditional mail applications require patience, as they typically take about four weeks to process.

Regardless of the method you select, whether by mail or fax, you must submit Form SS4 as part of the application process.

Benefits Of Having The EIN

In many ways, the EIN remains one of the best-kept secrets within the business. Astonishingly, not every entrepreneur prioritizes getting one, even though it offers a multitude of advantages. Here’s why having an EIN can significantly benefit your business:

- Essential for Employee Hiring: If your business intends to hire employees, an EIN becomes an absolute necessity. Furthermore, establishing a functional payroll system hinges on having this unique identifier.

- Ensures Tax Compliance: Compliance with tax regulations is non-negotiable. Failure to obtain the required EIN before tax filing can expose you to various tax penalties and complications.

- Enhances Credibility: An EIN carries more than just practical utility; it also bestows credibility upon your business. It signifies your commitment and responsibility as a severe business operator.

- Facilitates Business Licensing: In numerous states, acquiring the EIN is required to get a business license. It serves as a fundamental step in ensuring compliance with local regulations.

- Enables Business Banking: Many banks stipulate the necessity of the EIN to open a business bank account. Additionally, it often complements the requirement for an appropriate business license, demonstrating your authorization to operate within your designated area.

- Simplifies Loan Application: For a bank loan, most financial institutions will condition you to have a business account and, by extension, an EIN. This essential number lays the groundwork for your financial interactions.

Conclusion

Understanding how to get the EIN for your company goes beyond complying with regulations. It also opens up growth possibilities. Having an EIN empowers you to take strides forward, such as starting the process of opening bank accounts, applying for loans, obtaining necessary permits, and much more.

Frequently Asked Questions

Q: What are the responsibilities of employers related to EIN?

When you obtain an EIN for your company, you have obligations that you need to fulfill. Having an EIN means that you are officially registered with the government. Therefore, it is crucial to file your tax returns and meet tax payment deadlines to maintain standing. These responsibilities include collecting and submitting FICA (Medicare), FUTA, payroll, and income taxes.

Furthermore, employers with an EIN are also required to verify their employee’s identity and eligibility to work in the US. Businesses holding an EIN must retain a copy of Form I9 for each employee they hire.

Q: What should I do if I lose my EIN?

Suppose you happen to misplace or lose your EIN; there are several ways to recover it. First, check for the EIN on a notice sent by the IRS back when it was initially issued. You should also take the chance to retrieve it by contacting the bank where you may have submitted it.

Q: Why Can’t I Use The Social Security Instead Of EIN?

When the IRS mandates an EIN, you don’t have a choice. However, there’s a compelling reason to opt for an EIN for your business, even when not obligatory: safeguarding against identity theft.

An EIN helps maintain a clear separation between your personal and business finances.

Q: How Long Does Till I Get EIN?

If you apply through the online portal, you will be issued immediately. If you opt to fax your EIN application to the IRS, it can take 4-10 days for processing.