Real-Time Payments: What’s Next in 2024?

Posted: September 27, 2024 | Updated:

Real-time payments (RTP) enable consumers to execute direct, bank-to-bank transactions within seconds, avoiding the slower and more involved methods typical of traditional card payments and wire transfers. RTP networks simplify the payment process for consumers and accelerate revenue access for businesses.

Globally, instant, real-time payments are increasingly common, although in some regions, like the US, they are less developed compared to markets such as the United Kingdom and the European Union. However, this is changing as major US payment market players like banks, key card networks, and the Federal Reserve are working to extend faster payment options more widely.

What advantages does RTP offer, what can we learn from more established markets about potential uses in the U.S., and how are leading entities working to expand RTP’s reach?

What Are Real-Time Payments?

Real-time payments, also referred to as immediate or instant payments, are transfers where funds immediately appear in the recipient’s account and are correspondingly deducted from the sender’s account. These payments are operational around the clock, every day of the year, enabling transactions to occur at any moment, including during weekends, holidays, and times when banks are closed. The transaction limit for RTP is $1,000,000.

Are ACH transfers, wire transfers, and mobile payments considered real-time payments?

No, they are not. Although ACH transfers, wire transfers, and mobile payments are widely used for transactions among businesses, consumers, and private individuals, they differ from real-time payments due to the networks they use, the parties involved, and the time it takes to process these transactions.

Source: Aci Worldwide

For example, ACH transfers are not immediate; they can take up to five business days to clear, and even same-day ACH transfers need several hours to reflect in the recipient’s account. Wire transfers, which occur directly between banks and not via a real-time payment network, can take up to two days to reach the recipient’s account.

Mobile payments, meanwhile, also involve a settlement period; funds transferred to a merchant using digital wallets like Google Pay, Apple Pay, or Samsung Pay are not immediately available in the merchant’s account.

Source: Mage A

It’s important to note that once a real-time payment is made, it is final and irreversible, eliminating the possibility for either the sender or the recipient to cancel the transaction once initiated.

Examples of RTP Networks and Platforms Around the World

Real-time payment systems are changing how financial transactions work by enabling instant fund transfers at any time. These systems are increasingly important in the modern digital economy, where speed, convenience, and flexibility are crucial.

Key Real-Time Payment Systems:

- United States: Created by The Clearing House, the RTP Network allows for immediate settlement of transactions between U.S. financial institutions.

- United Kingdom: The Faster Payments Service (FPS) has enabled quick transactions since 2008.

- India: The Unified Payments Interface (UPI) processes over 9 billion transactions monthly as of 2023, driving real-time payments in India.

Examples of global real-time payment products:

- SWIFT: Originally for international transfers, SWIFT now offers real-time payment capabilities.

- PayPal: Facilitates instant payments for both personal and business users across its global network.

- FedNow: Launched by the Federal Reserve, this service provides instant payments for U.S. financial institutions, supporting a range of transaction types such as transfers and bill payments.

- Faster Payments (UK): Allows fast online, mobile, and phone-based transactions between UK banks.

- Zelle (US): Enables quick transfers between U.S. bank accounts.

- Paytm (India): Offers services like direct merchant payments, bill payments, and peer-to-peer transfers.

- Alipay and WeChat Pay (China): Dominating China’s digital payments market, these platforms offer instant transactions for various consumer needs.

These systems not only speed up payments but also improve security by using technologies like tokenization to protect sensitive data. Their 24/7 availability allows users to manage finances without being constrained by banking hours.

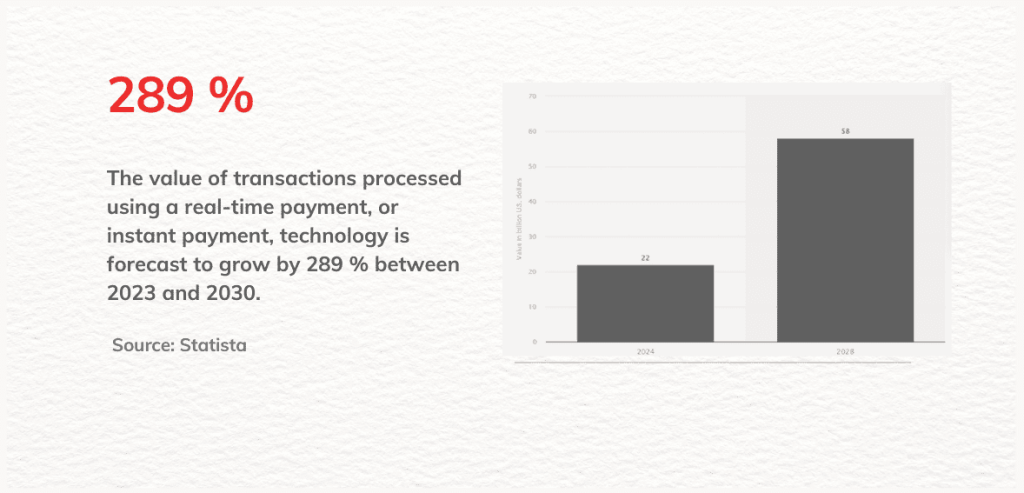

Source: Statista

However, each system has unique benefits and challenges that reflect specific market demands and regulations. For example, FedNow and RTP are U.S.-focused with higher transaction limits, while Paytm and Alipay serve large user bases with a broader range of transaction sizes.

Which Banks in the United States Provide RTP?

Over 460 banks are currently involved with the RTP payment system. The complete list of these banks is available on The Clearing House website. The RTP system is expanding, similar to FedNow, as more financial institutions join. Presently, about 70% of financial institutions, including several well-known ones, are part of RTP. These include:

- Bank of America

- JD Bank

- American National Bank

- Navy Federal Credit Union

- Century Bank

- Citizens National Bank

- Citibank

- Signature Bank

- PNC Bank

- Fifth Third Bank

In addition to these, many local credit unions and banks also support RTP bank transfers, such as State Bank of NW Missouri, Jacksonville Firemen’s Credit Union, and Indiana University Credit Union.

Key Trends Shaping the Growth of Real-Time Payments in 2024

In 2024, real-time payments (RTP) are expected to see significant growth due to rising demand, technological improvements, and broader global use. As these payments increasingly become a part of consumer and business transactions, certain trends are poised to influence the market.

The US is set to catch up with countries like India and Brazil in adopting real-time payments, driven by the expansion of services such as FedNow, which recently surpassed over 900 bank partnerships. Alongside The Clearing House’s RTP network, FedNow is anticipated to accelerate the adoption of instant payments across various sectors.

The use of real-time payments is extending beyond consumer transactions to include business-to-business and cross-border payments. Industries such as insurance, hospitality, and logistics are adopting real-time payments to enhance cash flow and move away from traditional payment methods like checks and ACH. There’s also a growing interest in using real-time payments for international transactions, aiming to streamline and expedite global payments.

Regulatory changes and technological innovations are also shaping the RTP environment. In Europe, updates to the PSD2 and PSD3 directives are influencing the landscape, while schemes like SCT Inst and new global payment networks are facilitating the widespread use of instant payments. Furthermore, advancements in payment orchestration technology are improving the efficiency of transactions by enabling better coordination among various payment methods.

For sectors such as hospitality and the gig economy, real-time payments are becoming a strategic advantage in attracting and retaining talent. For instance, restaurants and service industries are increasingly offering real-time wage payouts to appeal to prospective employees, highlighting the competitive edge that instant payments can provide.

Does Faster Payment Processing Increase the Risk of Fraud Detection Failures?

Yes, with the speed of real-time transactions, there is less time to identify and prevent fraud. Since these transactions are completed within seconds, traditional methods of fraud detection—like batch processing or manual checks—are often inadequate.

Real-time payment systems are particularly vulnerable to types of fraud such as authorized push payment (APP) fraud. In APP fraud, scammers deceive individuals into making payments to accounts they control. Given the irreversible nature of these payments, it becomes challenging to retrieve the funds once lost, unless there are strong preventative mechanisms in place.

However, progress in fraud detection technology, including the use of machine learning and behavioral analytics, has enhanced the ability of financial institutions to detect anomalies instantly. These technologies help in quickly spotting suspicious patterns and potentially stopping fraudulent transactions in their tracks.

Regulatory efforts are also aiding in this fight against fraud. For instance, in the UK, the Confirmation of Payee system verifies the account holder’s name against the details provided before processing a payment, which helps prevent APP fraud. Furthermore, the Mule Insights Tactical Solution (MITS) is used to identify and halt accounts involved in money laundering, helping curb the flow of fraudulent funds.

Will RTP Adoption Mean the End of Checks?

Real-time payments (RTP) are rapidly gaining traction in the U.S., but they are unlikely to eliminate the use of checks soon. However, the use of checks has been in steep decline, dropping by 80% between 1991 and 2021, as RTP offers many advantages over traditional paper checks, particularly in terms of speed, cost, and efficiency. RTP allows transactions to be processed instantly, 24/7, which contrasts with checks, which can take several days to clear and come with higher processing costs.

Business-to-business (B2B) transactions, where checks still account for more than 50% of total payment value, could greatly benefit from real-time payments. These transactions often involve significant amounts and complex payment cycles, and checks are handled inefficiently due to processing delays. Deloitte estimates that RTP could replace trillions in check-based B2B payments by 2028, reducing inefficiencies in supply chains and improving cash flow for businesses. Moreover, RTP provides enhanced transparency and reduces manual reconciliation, addressing some of the biggest pain points in B2B payments.

Conclusion

Real-time payments (RTP) are poised for significant growth in 2024, driven by technological advancements and increasing global adoption. RTP offers clear advantages in speed, efficiency, and transparency, benefiting consumers and businesses alike.

While it won’t fully replace traditional methods like checks and ACH in the near future, RTP is reshaping the financial landscape, particularly in sectors like B2B, hospitality, and cross-border transactions. As the U.S. market continues to evolve, regulatory efforts and improvements in fraud detection will play a key role in ensuring the safe and widespread use of RTP.