DOGE Has Terminated 300,000 Federal Credit Cards Following the Implementation of Spending Limits

Posted: May 30, 2025 | Updated:

DOGE, or the Department of Government Efficiency, is in full action, taking significant steps to streamline operations by restricting or fully deactivating Federal credit cards designated for travel and procurement purposes across multiple agencies.

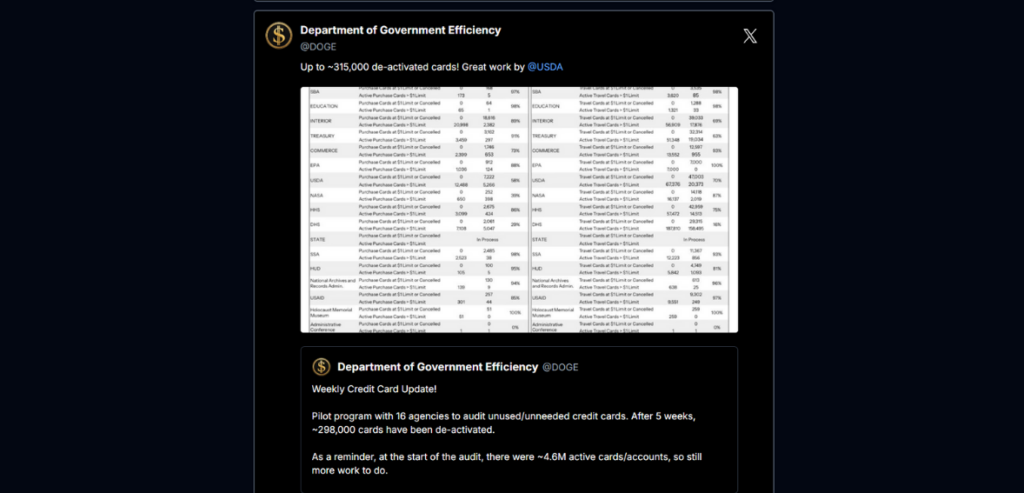

As of last week, DOGE reported (via X) that 298,903 credit cards had either been reduced to a $1 limit or entirely disabled. These include 35,493 procurement-related cards and 263,410 travel-related cards.

The restrictions have impacted numerous independent agencies, such as the Office of Personnel Management, General Services Administration, Environmental Protection Agency, Small Business Administration, NASA, and Social Security Administration. Several Cabinet-level departments have been affected, including Homeland Security, Labor, Agriculture, Interior, Education, Treasury, Commerce, State, Health and Human Services, and Housing and Urban Development.

To date, DOGE has completed audits on 55,587 purchase cards and 501,798 travel cards, with the current restrictions affecting more than half of the audited cards. However, this is only the initial phase of DOGE’s ongoing initiative, as the department ultimately plans to audit approximately 4.6 million federal credit cards spanning various agencies and departments.

Key Takeaways

- DOGE has disabled or severely restricted approximately 300,000 federal credit cards (263,410 travel and 35,493 purchase cards) to curb unnecessary government spending.

- Affected agencies include NASA, the Environmental Protection Agency, and various Cabinet-level departments such as Agriculture, Interior, Health and Human Services, and Homeland Security, prompting them to reassess internal spending practices.

- DOGE has audited over 550,000 credit cards to date, with the current limitations impacting over half of these audited cards. The department plans further audits across nearly 4.6 million government-issued credit cards.

- Supporters see this initiative as crucial for fiscal accountability, while critics express concerns over potential disruptions to agency operations and essential public services. The exact savings for taxpayers are not yet known.

DOGE Deactivates 300,000 Government Credit Cards in Federal Spending Crackdown

In a decisive move to curb federal expenditures, the Elon Musk-backed DOGE has deactivated approximately 300,000 government-issued credit cards. This action aligns with the administration’s broader strategy to enforce stringent spending limits across federal agencies.

Image source

DOGE’s recent initiative targeted purchase and travel cards across multiple federal agencies. Specifically, over 263,000 travel cards and more than 35,000 purchase cards were either canceled or had their spending limits reduced to $1. This measure is part of a pilot program involving 16 agencies to audit and eliminate unused or unnecessary credit cards.

The primary objective of this mass deactivation is to identify and eliminate wasteful spending within the federal government. By scrutinizing and reducing the number of active government credit cards, DOGE aims to enhance fiscal responsibility and ensure that taxpayer dollars are utilized effectively. Elon Musk emphasized that such audits are just the beginning of a comprehensive effort to streamline government operations and reduce unnecessary expenditures.

As mentioned, deactivating these credit cards has significant implications for various federal agencies. For instance, the Department of the Interior saw 18,636 purchase cards affected, while the Department of Agriculture had 47,003 travel cards canceled or limited. Similarly, the Departments of Health and Human Services and the Department of the Interior experienced limitations on 42,959 and 39,213 travel cards, respectively.

These changes have prompted agencies to reassess their spending practices and implement more stringent expenditure controls. While the immediate effect may be increased administrative adjustments, the long-term goal is encouraging accountability and efficiency within federal operations.

The initiative has garnered mixed reactions from various stakeholders. Supporters argue that it is a necessary step toward reducing government waste and promoting fiscal discipline. They believe that such measures will lead to more transparent and responsible use of public funds.

Conversely, critics contend that the abrupt deactivation of a large number of credit cards could hinder the daily operations of federal agencies. They express concerns about potential disruptions in procurement processes and delays in essential services. Additionally, some view this move as part of a broader pattern of aggressive cost-cutting measures that may overlook the nuanced needs of various government departments.

The exact savings to taxpayers resulting from these cancellations remain uncertain. According to DOGE, approximately 4.6 million government-issued credit cards were involved in 90 million individual transactions, amounting to roughly $40 billion in expenditures during fiscal year 2024.

This action by DOGE is part of a series of measures to overhaul government spending practices. The administration has previously implemented spending freezes and imposed stringent limits on government-issued credit cards. Furthermore, the administration has sought to centralize payment systems and increase transparency in government expenditures. An executive order mandated federal agencies to establish centralized systems to record and justify all payments, aiming to enhance accountability and reduce opportunities for waste and fraud.

Last month, Elon Musk spoke at former President Donald Trump’s inaugural Cabinet meeting, highlighting DOGE’s goal to identify $1 trillion in savings to reduce America’s nearly $36.5 trillion national debt significantly.

Musk specifically criticized the approximately $2 trillion annual deficit, warning that the United States “simply cannot sustain” such massive borrowing levels.

Musk cautioned, “If this trend continues, the country risks becoming effectively bankrupt.” He emphasized that DOGE was not merely an optional measure but a crucial element for meaningful economic reform.

Over the weekend, DOGE revealed a concerning discovery involving millions in questionable loans. The agency found that nearly 5,600 loans, totaling about $312 million, were issued by the Small Business Administration (SBA) to recipients whose sole listed owner was 11 years old or younger at the time. These loans, distributed during 2020 and 2021 amidst the COVID-19 pandemic, raise serious questions regarding their legitimacy and intended purpose.

About DOGE

The Department of Government Efficiency (DOGE) is a federal initiative established by President Donald Trump through Executive Order 14158 on January 20, 2025. This department was created to implement the President’s agenda of modernizing federal technology and software to maximize governmental efficiency and productivity. Elon Musk, appointed to lead DOGE, has been instrumental in driving its mission to streamline government operations and reduce unnecessary expenditures.

DOGE’s approach involves embedding specialized teams within federal agencies to audit and optimize operations. These teams, known as “DOGE Teams,” consist of professionals such as engineers, human resources specialists, and attorneys. They are tasked with reviewing existing contracts, grants, and internal processes to identify areas where spending can be reduced or reallocated to promote efficiency. This initiative reflects a commitment to enhancing transparency and accountability in government spending, ensuring that taxpayer dollars are utilized effectively.

Conclusion

The DOGE’s large-scale deactivation of nearly 300,000 federal credit cards marks a significant step in its effort to curb unnecessary government spending. DOGE aims to promote fiscal responsibility and enhance transparency in federal operations by limiting or disabling travel and procurement cards across multiple agencies.

While the initiative has already impacted many agencies, it is only the beginning of a broader campaign to audit and streamline the government’s financial practices. With plans to review millions of federal credit cards, DOGE is positioned to reshape spending protocols further and enforce stricter financial controls.

Though the long-term savings and operational impacts remain, this move signals a firm commitment to reducing waste and ensuring more accountable use of taxpayer dollars.