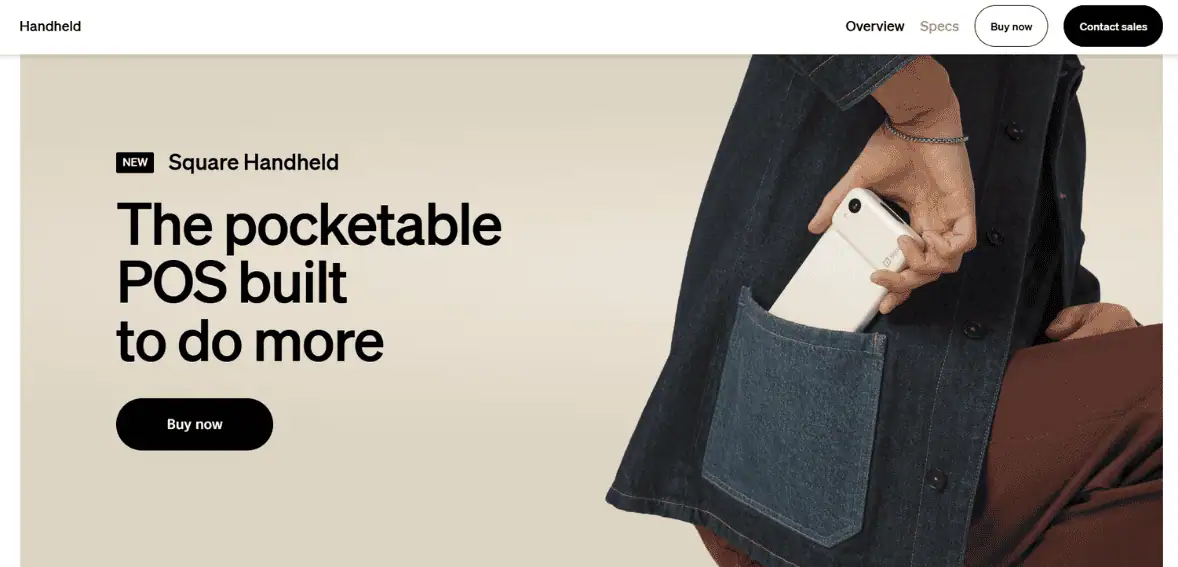

Square Launches Handheld POS Device

Posted: May 29, 2025 | Updated:

Square is betting big on mobile-native consumers and small-business owners with the launch of its powerful new Square Handheld POS – a sleek, all-in-one point-of-sale device built for speed, simplicity, and control. Designed to feel as intuitive as a smartphone, the Square Handheld device, restaurants and retailers will be able to run their entire business operation – from payments to back-of-house functions – right from the palm of their hand.

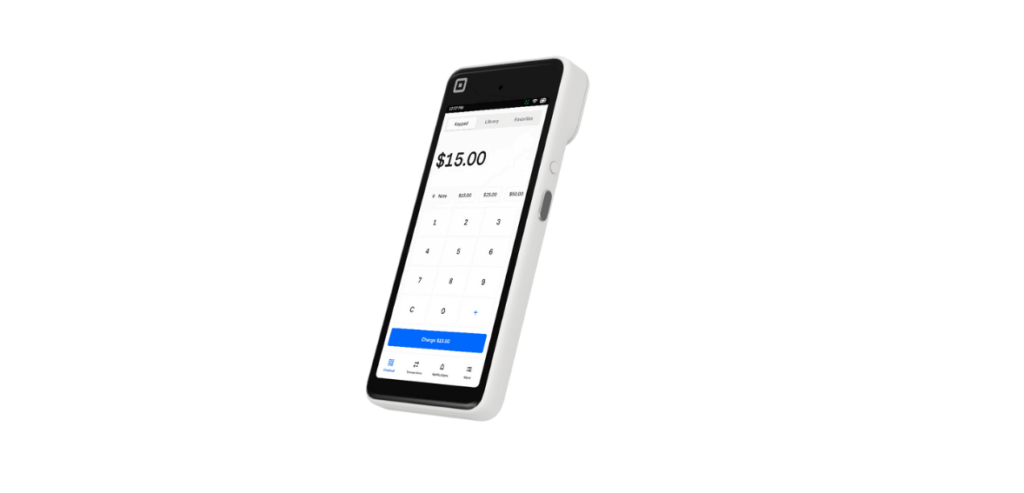

Backed by Square’s new unified Point of Sale app, this device is more than just a payment terminal. It’s a full-scale business command center. Businesses can accept tap or dip payments, scan QR codes and barcodes, and even capture high-resolution product images with the built-in 16-megapixel camera to instantly update their item library.

Compact, connected, and completely versatile, the Square Handheld is built to streamline operations and elevate the way modern businesses work.

Key Takeaways

- Square Handheld is a lightweight, portable device designed for restaurants and retailers, combining payment acceptance, barcode scanning, and high-resolution product imaging into a single tool.

- The device runs Square’s new unified Point of Sale app, replacing four separate apps with one flexible system that supports various business types and can be adjusted on the fly.

- Features like tableside ordering and digital receipts help businesses reduce labor bottlenecks and cut costs, including a reported 25% drop in paper-receipt expenses from early users.

- Priced at $399 or $37 per month interest-free, Square Handheld undercuts rivals and is supported by a new twice-yearly “Square Releases” update cycle, aligning hardware and software improvements for ongoing innovation.

Square Handheld POS: A Compact, Powerful POS Designed for Restaurants and Retailers

On 13 May 2025, Square (the merchant-services arm of Block Inc.) quietly dropped a hardware bombshell: Square Handheld, a fully integrated point-of-sale (POS) computer that weighs just 11 oz, measures under an inch thick, and slips into an apron pocket. Square says the device is its “most powerful, portable POS ever,” built for restaurants and retailers that cannot afford checkout choke-points or inventory blind spots. The debut arrived as the opening act of “Square Releases,” a new twice-a-year cadence for shipping hardware and software in synchrony.

Square Handheld looks and feels like a ruggedised smartphone with its 6.2-inch Corning Gorilla Glass touchscreen, IP54 ingress protection against dust and splashes, and a chassis slim enough to ride in a jeans pocket yet sturdy enough to survive a double shift. Under the glass sits an all-day battery – Square’s lab tests show two complete service shifts on one charge. The 16-megapixel rear camera doubles as a documenter of new SKUs, while a laser barcode reader on the top edge speeds price checks and gift-card scans. At 11 oz the unit is lighter than a Toast Go 2 (≈18 oz) and markedly trimmer than a Clover Flex (1.13 lb).

Payments functionality is table-stakes in 2025, but Square squeezes its entire stack – tap, dip, and NFC wallet acceptance – into the handheld with no dongles required. That means sellers can start, split, and close checks at the table or in the store aisle, then send a digital receipt via SMS or email in seconds. The antenna array leverages the same encryption and tokenization services that protect transactions on Square Register, preserving compliance without extra certifications for merchants.

Hardware grabs headlines, yet the bigger strategic move is inside – Square’s unified Point of Sale app now ships pre-loaded on every Handheld unit. The single code-base consolidates what used to be four separate apps (Restaurants, Retail, Appointments, Invoices) into seven “modes” that can be toggled on the fly – Quick Service, Bar, Retail, and more.

Push-notification APIs warn staff when an order backs up; quick-settings tiles let managers change floor plans or item availability without diving through sub-menus. In effect, Square is turning each device into a context-aware node on a cloud POS fabric.

Thomas Templeton, Square’s hardware lead, suggests that on-device AI is planned for the future, such as automatically identifying unlabelled SKUs or recommending menu options based on the weather. The Snapdragon-level processor inside Handheld is reportedly more powerful than needed for current tasks, providing capacity to run AI models locally. This could reduce API response times and lower cellular data costs.

How Square Handheld Can Help Restaurants and Retailers Streamline Operations and Cut Costs?

Restaurants drove 50% of Square’s 2024 gross payment volume; they are also the vertical where labour shortages hit hardest. Tableside order-and-pay with Handheld compresses the order-to-fire cycle to seconds, while managers can flip a “Bar Mode” on busy nights to turn every server into a mobile tab station. Early pilot users such as La Mediterranee in Berkeley report a 25% drop in paper-receipt costs and the end of mid-shift charging rituals.

On shop floors, the same camera that photographs latte art can capture UPC-A, QR, or DataMatrix codes in low light, pushing updates straight to Square’s item catalogues. Garden-centre staff can check out customers at the greenhouse gate; apparel associates can start a sale on Handheld and finish at a staffed register if the shopper wants gift-wrapping. With Digital Receipts enabled by default, businesses can eliminate on-counter printers entirely – something not possible on Clover Flex, whose integrated printer adds bulk and cost.

The launch lands in a crowded field. Toast Go 2, released in 2023 and refreshed this spring, emphasises 24-hour battery life and deep kitchen-display integration, but it remains restaurant-only and requires a monthly SaaS plan that often tops $75. Clover Flex hits a broader SMB audience and packs a built-in printer, yet its $749 entry price and proprietary app store deter micro-merchants. Stripe’s Terminal S700 is slick, but it assumes the merchant already codes against the Stripe API. Square’s Handheld therefore, threads a gap: undercutting competitors on device cost, selling exclusively through first-party channels, and offering an à-la-carte software menu that scales from pop-ups to multi-unit enterprises.

Pricing, Financing, and the Accessory Upsell

Square undercut its two closest rivals on day one. Handheld lists at $399 or $37 per month for 12 months, versus Clover Flex at $749 or $40 over 36 months. There is no built-in receipt printer (a choice that shaves weight), but Square teamed with Belkin on a $39 silicone case line in seven colours – reminiscent of the strategy Apple used to build margin on iPhone accessories.

At $399, a café can deploy three Handhelds and a Wi-Fi mesh for less than the price of a single Clover Flex kit. Square’s flat 2.6% + $0.10 card-present fee matches its other hardware, simplifying forecasting. The only consumable is optional receipt paper if merchants pair Handhelds with countertop printers; digital-only shops eliminate that line item entirely. Financing at $37 per month is interest-free, a tactic Square has used since 2018 to accelerate the uptake of Square Terminal.

Operational Caveats and Potential Friction Points

- Square Handheld is Wi-Fi-only; there is no LTE SKU at launch. Operators with spotty networks will need mesh extenders or fallback Registers.

- The camera, while 16 MP, lacks optical image stabilisation, so UPC scans can fail in dim storerooms.

- And bigger chains on Oracle or NCR Aloha stacks may balk at migrating because Handheld currently plugs only into Square’s own back office.

Hardware Drag on Gross Profit, Software Lift on ARPU

Hardware margins are thin – Square historically grosses single-digit percentage points on devices – but each deployed Handheld multiplies annualised revenue per unit (ARPU) via SaaS modules and incremental payment volume.

The company disclosed that restaurants and retail together already account for half of 2024 GPV; converting even 10% of that cohort to Handheld would put millions of devices in the field and raise service-based revenue far faster than Block’s Bitcoin-linked bets.

Square Releases: Why the Cadence Shift Matters?

Square historically dripped out features at random; “Square Releases” formalises a biannual versioning rhythm akin to Apple’s WWDC or Tesla’s OTA updates. Launching Handheld inside that umbrella signals that future hardware, perhaps a next-gen Register or self-order kiosk, will drop alongside major firmware pushes, ensuring that the physical and digital stacks evolve together. That matters for CTOs who need predictable change windows, and for investors tracking Block’s cap-ex cycles.

About Square

Square, founded in 2009 by Jack Dorsey and Jim McKelvey and headquartered in San Francisco, is a pioneering financial technology company whose mission is to empower businesses of all sizes with easy-to-use, affordable payment and commerce solutions. Its flagship offering, the Square Reader, revolutionized point-of-sale by turning smartphones and tablets into full-featured payment terminals. Building on that success, Square has developed a comprehensive suite of hardware and software products—including Square Stand, Square Terminal, Square Register, and the Square Point of Sale app—that seamlessly integrate payments, inventory management, invoicing, and analytics. Through the Square Developer Platform, third-party apps can tap into its APIs to extend functionality.

Since its IPO in 2015, Square has rapidly expanded both its product ecosystem and its global footprint, serving millions of sellers across the United States, Canada, Japan, Australia, and the U.K. Beyond core payment processing, Square has broadened its services to include Square Capital (business loans), Square Online (e-commerce storefronts), Square Appointments (booking and scheduling), and Square Payroll. By combining financial services, software tools, and powerful data insights, Square helps entrepreneurs streamline operations, deepen customer relationships, and grow revenue.

Conclusion

Square Handheld represents a significant step for Square in meeting the evolving needs of small businesses. By combining powerful hardware with a unified software platform, it offers restaurants and retailers a flexible, efficient tool to manage payments, inventory, and operations all in one device.

While some challenges remain, such as Wi-Fi dependency and integration limits with larger legacy systems, the Handheld’s competitive pricing and thoughtful design position it well against rivals. The introduction of a regular release cycle also suggests Square is committed to ongoing innovation, supporting merchants with timely updates and new features. Overall, Square Handheld aims to simplify daily workflows while providing room to grow alongside modern business demands.