CardFlight Receives Major Investment: What This Means for Mobile Payments

Posted: November 04, 2024 | Updated:

CardFlight, a SaaS payment technology company headquartered in New York City, secured a growth investment from WestView Capital Partners. The financial transaction details were not revealed.

The company plans to invest in advancing its payment solutions, improving its software offerings, and increasing its service reach to more small businesses and merchant partners throughout the United States. CardFlight, led by CEO and Founder Derek Webster, provides services to over 125,000 small businesses nationwide.

Key Takeaways

- Strategic Investment for Expansion: CardFlight’s new minority investment from WestView Capital Partners is intended to drive growth in the SMB payment solutions market, where the company aims to strengthen its competitive position.

- Increased Market Reach with SwipeSimple: CardFlight already serves over 125,000 SMBs through its product SwipeSimple, processing more than $12 billion annually. The investment will support further expansion of SwipeSimple’s reach via an enhanced reseller network.

- Enhanced Product Development: The partnership enables CardFlight to accelerate product enhancements and introduce new features tailored for SMBs, especially as demand rises for flexible, digital payment methods.

- Alignment with Fintech Trends: This investment mirrors the broader trend of fintech funding focusing on specialized, tech-driven payment solutions for SMBs, positioning CardFlight to stay competitive in a rapidly evolving digital economy.

CardFlight Secures Minority Investment from WestView Capital to Expand SMB Payment Solutions

CardFlight, a New York-based SaaS company focused on mobile payment technology, recently received a significant minority investment from WestView Capital Partners. This investment in mobile payments positions CardFlight for broader expansion in the highly competitive payment solutions market, mainly targeting small and medium-sized businesses (SMBs).

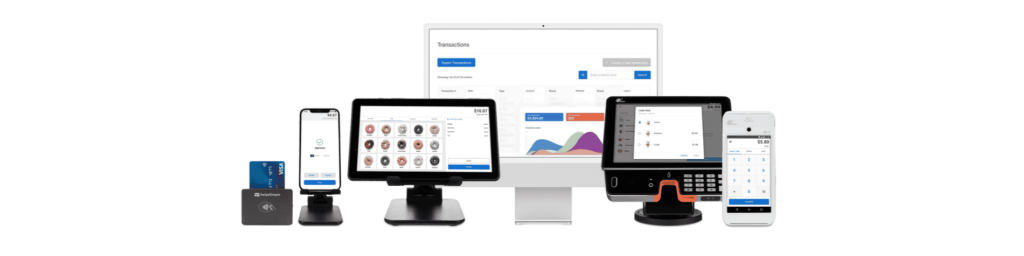

Founded in 2013, CardFlight has built a strong reputation with products like SwipeSimple, which enables over 125,000 SMBs to streamline payment processing with more than $12 billion processed annually across the U.S. This software has been especially appealing for its easy setup and comprehensive payment management features, addressing the needs of small business owners by simplifying payment processing across various channels.

Derek Webster, Founder and CEO of CardFlight, stated that the payment technology sector is experiencing substantial changes. At CardFlight, they continually assess the requirements of small businesses and create new solutions to meet these needs. This approach prepares them well for upcoming industry shifts. Webster and his leadership team are enthusiastic about having WestView Capital Partners on board for their next growth phase. WestView’s considerable experience and strategic insight align with the principles of the company, its employees, and its shareholders.

WestView’s financial backing brings both capital and strategic support. This partnership will facilitate CardFlight’s ability to enhance existing services and launch additional features aimed at SMBs and merchant acquirers. CardFlight investment in mobile payments is pivotal as SMBs increasingly seek digital payment solutions to support diverse payment methods and improve their business operations.

The funding will also support CardFlight’s expansion goals by strengthening its reseller network, which already includes over 100 partners distributing SwipeSimple to thousands of new businesses monthly. Furthermore, Kevin Twomey from WestView will join CardFlight’s board, bringing expertise that aligns with the firm’s growth strategies and its aim to lead in the SMB payment sector.

CardFlight’s unique approach leverages a software-first model, providing embedded payment solutions that integrate easily with business operations—a trend gaining traction among SMBs that need more flexible and tailored payment solutions than traditional methods offer.

WestView’s investment could allow CardFlight to stay competitive in the shifting mobile payments landscape. Demand for digital solutions has accelerated due to changes in consumer behavior and the evolving digital economy. For merchants, especially SMBs, this development promises access to advanced tools without larger payment processors’ high costs or complexities.

Kevin Twomey, a Principal at WestView Capital Partners, noted a shift in how merchants, especially those in the small to medium business (SMB) category, approach payments. CardFlight’s software-driven embedded payments solution addresses the specific needs and preferences of today’s SMB merchants, helping them better understand and develop their businesses. Twomey added that Derek and his team have consistently led innovation in this area and are precisely the leaders WestView seeks to support and partner with. Twomey will join the CardFlight Board of Directors as part of the partnership.

This partnership reflects a broader trend in fintech, where private equity and growth capital are increasingly directed towards tech-driven payment platforms that cater to smaller, niche markets. The anticipated result is that CardFlight will now be better equipped to introduce more robust features and expand its market reach, aiming to simplify the payment process for more SMBs across the U.S., supporting the company’s goal of reshaping mobile payments through practical, SMB-focused solutions.

William Blair and Goodwin Procter LLP provided legal representation for CardFlight, while Latham & Watkins LLP provided WestView. The financial details of the transaction have not been disclosed.

About CardFlight

Image source

CardFlight, established in 2013 and based in New York, provides mobile and in-person payment solutions that simplify transactions for small businesses throughout the United States. Their main product, SwipeSimple, is utilized by over 125,000 small merchants and offers versatile payment options for in-store, mobile, and online transactions. The SwipeSimple platform features EMV and NFC contactless card readers, mobile apps for iOS and Android, a virtual terminal, and a dashboard for business insights. These tools allow small businesses to efficiently manage sales, monitor transactions, and gather customer data from a single interface, accommodating various commerce needs in multiple settings.

CardFlight has earned a strong reputation by adapting quickly to industry changes, such as the shift to chip-card technology in the U.S., and by enhancing its offerings with new features like the EMV Quick Chip for quicker transactions. Their innovative strategies and partnerships with leading payment acquirers have fueled their rapid expansion, consistently earning them a spot on lists of the fastest-growing private companies in the U.S. CardFlight’s dedication to secure, accessible payment options has established them as a reliable resource for both small businesses and major merchant acquirers, further validated by their PCI Level 1 compliance.

About WestView

Image source

WestView, located in Boston, is a growth equity firm concentrating on middle-market growth companies, managing $2.7 billion across five funds. The firm collaborates with current management teams to support minority and majority recapitalizations, provide growth capital, and facilitate consolidation transactions in various sectors such as IT services, business services, software, healthcare technology and outsourcing, and growth industrial sectors.

Westview aims to invest between $20 and $100 million in companies that generate at least $10 million in revenue and have operating profits ranging from $3 to $25 million.

Conclusion

With WestView Capital Partners’ minority investment, CardFlight is set to strengthen its position in the SMB payment solutions market, expanding its services and enhancing its product offerings to meet evolving merchant needs. This funding aligns with broader fintech trends toward specialized, tech-driven solutions for small businesses and supports CardFlight’s commitment to accessible, efficient payment processing.

As demand for digital payment options continues to grow, CardFlight investment mobile payments and software-first approach, in combination with WestView’s strategic guidance, positions the company for continued innovation and growth in a competitive market.