Appliance Retailer Pirch Files Bankruptcy, Plans to Liquidate

Posted: September 18, 2024 | Updated:

Pirch, a company in San Diego County known for manufacturing high-end appliances, has declared Chapter 7 bankruptcy. Documents filed with the US Bankruptcy Court for the Southern District of California show that Pirch lists between 1,000 and 5,000 creditors, with debts ranging from $100 million to $500 million. The company’s assets are estimated to be between $10 million and $50 million.

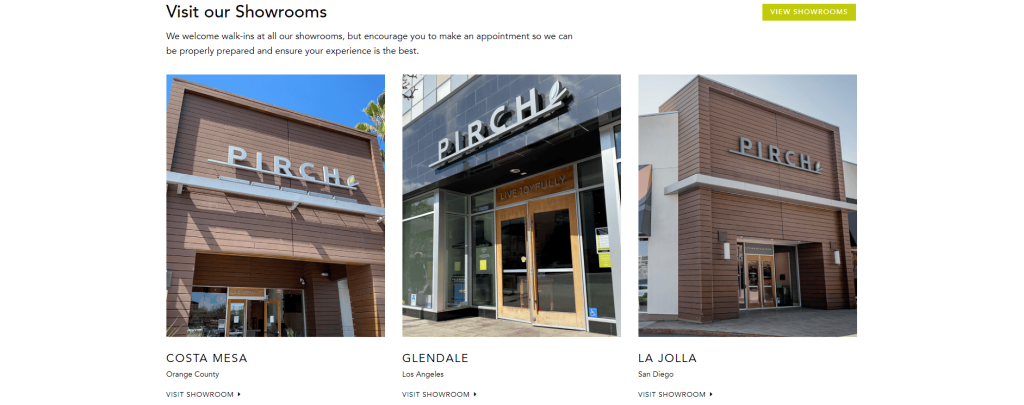

Previously operating several showrooms across Southern California, including Solana Beach and La Jolla locations, Pirch announced on its website that it ceased showroom operations on March 20. The closure was described as a temporary halt to allow the company’s management to develop a plan for the future.

Key Takeaways

- Bankruptcy Filing and Liquidation: Pirch, a high-end appliance retailer, has filed for Chapter 7 bankruptcy, indicating a liquidation process. The company has significant financial liabilities, ranging from $100 million to $500 million, and assets estimated between $10 million and $50 million.

- Store Closures and Operational Halt: Pirch has permanently closed its six Southern California stores in La Jolla and Solana Beach. This decision follows a temporary halt in operations announced earlier, meant to reassess the company’s strategy.

- Financial Impact on Stakeholders: The bankruptcy has caused widespread disruption, affecting interior designers, vendors, and customers. Many are left with unresolved orders and economic losses, including substantial claims against Pirch from suppliers and service providers.

- Legal and Financial Complications: The bankruptcy proceedings involve numerous creditors, major appliance suppliers, and payment processors like American Express. The latter has sued for significant chargeback issues, highlighting broader concerns about potential fraud and unresolved financial disputes.

High-End Appliance Retailer Pirch Files for Chapter 7 Bankruptcy Amidst Closure of Southern California Stores

Pirch, a high-end appliance retailer based in San Diego County, has filed for Chapter 7 bankruptcy, as indicated by records in the US Bankruptcy Court. The filing occurred on Friday, shortly after the company informed its employees that it would permanently close its approximately six stores in Southern California, with locations including La Jolla and Solana Beach.

Image source

The bankruptcy documents reveal that Pirch has between 1,000 and 5,000 creditors, with liabilities totaling $100 million to $500 million and assets valued between $10 million and $50 million.

Several years ago, Pirch shifted its strategy away from expanding its physical store presence and refocused on its core market in California, aiming to fortify partnerships with interior designers, architects, builders, and other intermediaries.

However, these relationships appear to be under strain. Several interior designers, frustrated by undelivered orders and caught off guard by the abrupt closure of showrooms, have united to seek legal counsel, especially as Pirch has remained quiet about its plans.

Whitney Solomon, who owns Whit at Home, described the situation as a horror story unlike anything she has ever encountered. With a decade of experience in interior design, Solomon frequently sourced a variety of remodeling essentials from Pirch, ranging from kitchen appliances to bathroom fixtures and lighting.

Solomon shared that obtaining estimated delivery times for items she had been waiting on for months was becoming increasingly difficult, and she began to suspect something was amiss. She visited a Pirch showroom to resolve these issues, but her client faced additional complications even after the items arrived.

She estimated the financial impact on her business to be around $25,000, which included the cost of a range they were waiting on and additional expenses incurred while trying to resolve the delays.

Furthermore, Solomon highlighted that the aftermath of Pirch’s issues extends beyond her losses. She knows many industry colleagues also dealing with significant unresolved orders for their clients, ranging from $50,000 to $150,000, leading to a frantic search for solutions.

Investigations involving vendors, former employees, customers, and court documents suggest that the creditor’s list may include a diverse group, such as individual customers, landlords, vendors, business partners, and various unresolved financial liabilities accrued during operations.

The notification list for the bankruptcy includes a wide array of entities: several plumbing services, Direct TV, AT&T, Amazon.com, numerous architectural and construction firms, a coffee supplier, and many individual names. Prominent appliance suppliers like Caliber Range, Whirlpool, and Sub-Zero Wolf—the latter having filed a lawsuit against Pirch for outstanding payments—are also mentioned. Additionally, payment processors Worldpay and American Express, which recently filed a $33 million lawsuit against Pirch, are listed as creditors.

American Express claims that Pirch’s actions are causing a significant increase in customer disputes. According to American Express, Pirch has failed to provide transaction data and other information that it is contractually required to share, leaving American Express to deal with over $5 million in chargebacks already processed and potentially up to $33 million more in pending chargeback requests from Pirch’s customers. These are for transactions where Pirch has already received the funds.

Adding fuel to the fire, Pirch has not communicated with American Express, leaving the company uncertain about Pirch’s ability to fulfill customer orders, manage disputes, or even if it plans to address these issues. There are also concerns about potential fraudulent activities by Pirch that require investigation. This situation underscores the urgency for protective measures and the relief American Express seeks to safeguard the public’s and its stakeholders’ interests.

Investment groups, US Bank National Association, at least one real estate firm that pursued legal action for unpaid rent, the city of Glendale’s water and power services, the California Department of Tax and Fee Administration, and the Nevada Department of Taxation are also implicated.

According to the court filings, the company ceased operations in late March, leading to a situation in which customers did not receive their orders, landlords and vendors were left with unpaid dues, and various other stakeholders were affected financially.

Filing for Chapter 7 Bankruptcy entails a complete liquidation of assets to repay creditors. Now, repayment follows a specific order, with taxes given the highest priority. This recent bankruptcy declaration halts any ongoing litigation against the company, including existing lawsuits from landlords, creditors, and customers, effectively pausing all such legal actions.

About Pirch

Pirch is a retail innovator offering high-end lifestyle products for homes. It stands out with its experiential shopping model, allowing customers to interact with home appliances and bathroom fixtures in a setting similar to their homes. Shoppers can test products directly, such as experiencing a variety of 34 shower heads in a dedicated room, all while receiving expert advice from well-trained sales consultants.

The concept originated from the personal shopping frustrations experienced by co-founders Jeffery Sears and James Stuart, who came from the construction industry. Established in 2010, Pirch is based in Oceanside, California.

Conclusion

Pirch’s bankruptcy filing marks a significant turning point for the company and its stakeholders. As Pirch enters Chapter 7 liquidation, the once-prominent high-end appliance retailer faces immense financial challenges, with substantial liabilities and a stark contrast between its debts and assets. The closure of its Southern California stores and the subsequent operational halt have left numerous creditors, including customers, vendors, and suppliers, grappling with unresolved issues and financial losses.

The situation’s complexity is further compounded by ongoing legal disputes and concerns over potential fraudulent activities. Moving forward, the focus will be on managing the fallout of the bankruptcy, addressing the needs of affected parties, and seeking resolution in the face of a challenging retail environment.