CFOs Using Working Capital to Fuel Growth

Posted: October 09, 2023 | Updated:

Working capital is a critical factor in the finance world, particularly for businesses. The significance of working capital extends beyond simply covering day-to-day expenses. It can also be leveraged strategically to fuel growth and meet market demands. For instance, it can be allocated towards settling supplier payments, purchasing inventory, and optimizing various operational aspects.

Today, we will get into the roots of the crucial role that CFOs play in managing working capital and also how they are using working capital to fuel growth.

The Connection Between Working Capital and Growth

When a company has sufficient working capital, it possesses the ability to consistently compensate its employees, fulfill supplier obligations, and manage other financial responsibilities. These financial responsibilities can include interest payments and taxes. With working capital in hand, they can easily tackle temporary challenges of low cash flow.

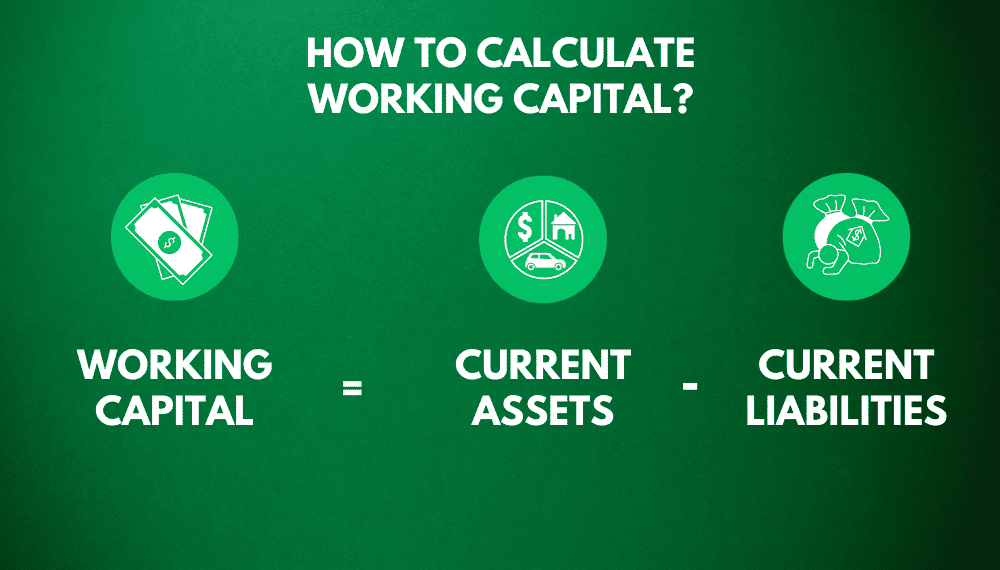

How to calculate working capital?

Working capital can serve as a means to finance business expansion without the need for incurring additional debt. Furthermore, businesses that are good in forecasting and managing their cash flow can seize advantageous pricing and early supplying opportunities and negotiate discounts through early payment arrangements.

For instance, as the shift towards EVs gains momentum, CFOs in the fleet industry play a vital role in adapting to these changing dynamics. They oversee traditional fuel-powered operations and the evolving new sustainable EVs’ tech-related developments. A CFO can use various financial tools, including virtual cards, working capital loans, and lines of credit.

Given the current global economic environment, CFOs are prioritizing the swiftness of working capital – the ability to borrow it quickly, repay it promptly, and make instant decisions and purchases. This is the crucial aspect that CFOs are currently focusing on to drive growth. It ensures an increase in operating profits and gives the company competitive leverage.

Strategies for CFOs to Optimize Working Capital More Effectively

Business Analysis

Before getting into financial complications, it’s essential to undertake a comprehensive business analysis to identify key value drivers. This analysis merges business strategy and financial assessments, offering a clear view of the company’s core elements.

- Business Strategy Analysis: This step involves scrutinizing the industry in which the company operates and evaluating its strategic approach. The goal is to create a sustainable competitive advantage by identifying key value drivers and assessing potential business risks.

- Financial Analysis: Financial analysis comes into play, focusing on two critical facets:

- Ratio Analysis: This aspect involves evaluating financial ratios that gauge the product market performance and financial policies. Key ratios include ROE. This further separates into asset turnover, financial leverage, and net profit margin. Short-term asset turnover and working capital aspects are of particular interest in investment management.

- Cash Flow Analysis: Complementing ratio analysis, cash flow analysis centers on assessing a firm’s investment management, financial risks, and operating activities.

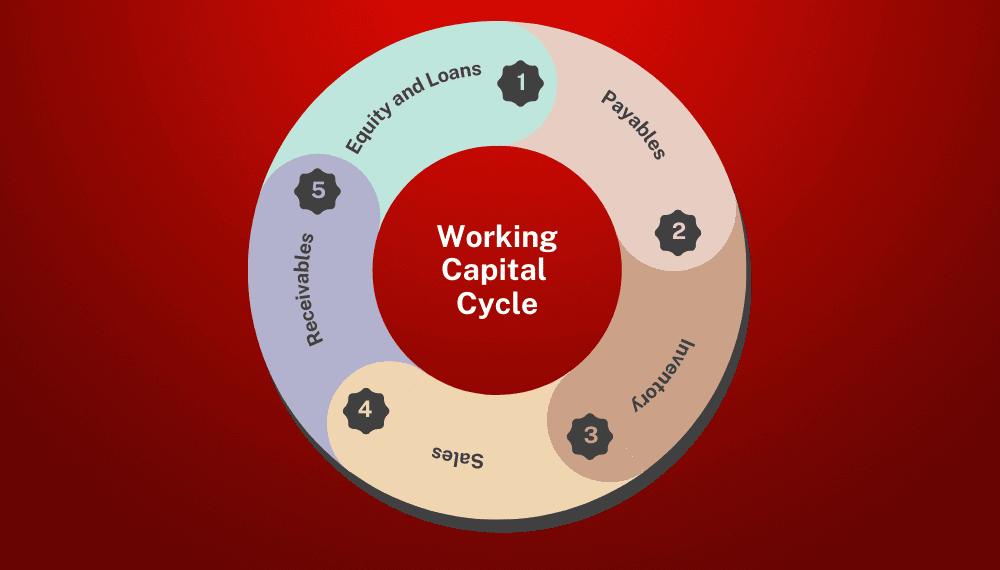

- Interconnectivity: In the execution of Working Capital Management, it’s vital to remember that breaking the cycle into smaller processes can help the CFOs. The interconnectivity between different aspects of the business, such as purchasing and production, can significantly impact overall efficiency and profitability.

- Benchmarking for Insights: Comparing financial ratios with industry peers offers valuable insights into working capital management. While it doesn’t mean strict replication, it can highlight opportunities to develop a more cost-effective working capital management strategy, potentially giving your company a competitive edge.

Optimizing Working Capital

When it comes to optimizing working capital, there are several crucial factors to consider. After conducting a thorough business analysis to identify key value drivers and investment management opportunities, the CFO faces the challenging task of optimizing both. This involves choosing from various options within the physical and financial value chain.

- Balancing Act: One of the primary challenges is to get a perfect balance between different forces, both internal and external, to the company. The CFO must carefully weigh these forces and their impact on the organization.

- Optimizing Value Chains for Success: Optimization is the key to success – The CFO must align the critical drivers in both the physical and financial value chains to ensure that investment management and shareholder value are mutually satisfying.

- The Cost-Benefit Equation: Another critical aspect is managing the relative costs of implementation versus expected benefits. This enables consideration of financial performance indicators and less tangible effects on client and supplier relationships, organizational structure, and culture. These aspects are intricately interconnected.

- Breaking Down the Financial Value Chain: When a CFO works on the financial value chain, it is important to break it down into separate working capital cycles. This might include purchase-to-pay, production and stock, and order-to-collect cycles. Together, these cycles make up the cash conversion cycle, each presenting unique challenges and implementation solutions.

- Purchase-to-Pay Cycle: For the purchase-to-pay cycle, extending the payment period often incurs additional costs, such as lower rebates or higher credit interest. Centralizing functions like purchasing, accounts payable, and accounts receivable can provide economies of scale, enhancing bargaining power. However, setting up incentives for subsidiaries is crucial. They need to see the benefits of relinquishing some authority in favor of a centralized approach, perhaps tying performance metrics to working capital ratios.

- Production and Stock Cycle: In the production and stock cycle, the goals are to shorten production processes and reduce raw material and intermediate product stocks. However, challenges like maintaining production levels, ensuring quality, and adapting to demand fluctuations must be addressed.

- Order-to-Collect Cycle: In the order-to-collect cycle, embracing technology like e-billing can significantly reduce the order-to-collect time. Yet, it relies on client cooperation, which isn’t always guaranteed.

Case Study – Working Capital Channels into Growth Opportunities

Recent research indicates that an increasing number of corporations are turning to working capital solutions to support their strategic growth initiatives and anticipated shortfalls rather than merely using them to address unexpected cash flow gaps.

Dive deeper into this trend, especially concerning Growth corporations, which include companies with annual revenues ranging from $50 million all the way up to $1 billion. We’ll explore the distinct division between strategic and tactical applications of working capital within this group.

Strategic Use of Working Capital

The data reveals a noteworthy pattern among Growth Corporate CFOs, with a significant majority opting for external working capital solutions to fuel strategic growth initiatives.

Additionally, 34% of these CFOs employ such solutions to manage expected cyclical shortfalls and seasonal gaps proactively. Furthermore, there’s a fascinating breakdown of how various industry verticals leverage working capital to their advantage.

Enhanced Business Metrics

An astonishing 70% of all users report improvements in key business metrics. These metrics include lower days payable outstanding (DPO), higher working capital ratios, and reduced cash conversion cycles. These indicators serve as critical measures of a company’s liquidity and operational efficiency, directly reflecting its capacity to meet payment obligations.

Impact on DPO

Accessing working capital solutions for strategic growth purposes has a substantial impact on DPO. It’s associated with a remarkable 33% increase in the probability of achieving improved DPO, as compared to using these solutions solely to cover unexpected cash flow shortfalls.

Remarkably, the top performers in this index boast an average DPO of just 46 days, surpassing both the average sample (50 days) and the lower-performing group (51 days).

Industry Insights

Certain industry sectors exhibit distinct proficiency in using external working capital for strategic and growth-related purposes. Fleet and mobility companies, in particular, stand out in this regard. These companies often rely on virtual credit cards and working capital loans to bolster their strategic business needs.

Strategic vs. Tactical Working Capital Use

Approximately 3 in almost 10 firms did not tap into any external working capital resources over the past 12 months.

This phenomenon is more common in Central Europe, the Middle East, North America, and Africa in the healthcare industry. Surprisingly, 70% of the CFOs from these firms do not need such “solutions,” indicating a perception that using working capital was indicative of an inefficiently run business.

Emerging Trends

Notably, marketplace firms are leading the charge in utilizing third-party credit facilities, a trend prominently observed in North America.

Conclusion

During the COVID-19 pandemic from 2020 to 2021, CFOs who leveraged their balance sheets to establish a robust liquidity foundation outperformed competitors with less capital. These CFOs paved the way for their companies to gain market share and emerge from the pandemic with stronger, growth-focused profit and loss statements and healthier balance sheets.

In the years 2022-2023, businesses have grappled with a challenging macroeconomic environment marked by inflation, rising interest rates, and supply chain disruptions. In many cases, this has led to fluctuations in customer demand and margins, adding pressure to short-term operational outcomes. Consequently, downstream effects on the balance sheet include delayed customer payments, extended vendor terms, increased capital costs, and more stringent borrowing conditions.

Effective finance leaders take proactive steps to prioritize and manage liquidity in the face of operational challenges. Vigilant management of working capital helps mitigate the impact and represents a proactive response to market disruptions. Embracing working capital to fule growth is viewed positively by capital markets and provides CFOs with the flexibility to execute a balance sheet recapitalization.